What Income Disqualifies You From Unemployment

Even if you have earned enough money to qualify it must be in covered employment. The following circumstances may disqualify you from collecting unemployment benefits.

Expert Q A About The Unemployment Provisions Of The American Rescue Plan

Expert Q A About The Unemployment Provisions Of The American Rescue Plan

The name of the income is less important than how why or from whom the payment is made.

What income disqualifies you from unemployment. Refusing quitting or being fired from a job. Disqualifying income consists of investment income such as taxable and tax-exempt interest dividends pensions and annuities net income from rents and royalties net capital gains and net. If you quit or are fired from your job you may not qualify for unemployment benefits.

The employee earned at least 900 in the highest-paid quarter of the base period and at least 125 times the employees earnings in the highest paid quarter in the entire base period. Return to Top Wages Earned While Requesting Unemployment Benefits. Or foreign national residing during the fiscal year.

If you draw upon your retirement plans like a 401k that too is subject to deduction based on those amounts the weekly benefit amount payable to you could drop to zero thus disqualifying you. Eligibility for unemployment disqualifications factors disqualifying individuals from receiving unemployment compensation benefits can occur for a variety of reasons from having been terminated from employment for a cause to classification as an independent contractor when you thought you were an employee. The other requirements you would have to satisfy to claim unemployment insurance include.

If you are collecting UI it means you had a job where you were getting a W-2 and you were laid off. If you start to day-trade your income from all that would be taxed as short-term capital gains I believe. Specifically excluded from this definition is any unemployment compensation you.

If you receive certain types of Temporary Income Benefits TIB Supplemental Income Benefits SIB or Lifetime Income Benefits LIB we cannot pay you unemployment benefits. You are not working to make that money. If you dont report your income you may be disqualified from getting any benefits at all.

You are simply Unemployed which you are if you do not employ yourself. Youll receive a Form 1099-G after the end of the year reporting in Box 1 how much in the way of benefits you received. Your states unemployment agency can explain what types of income must be reported.

There is no need to declare an occupation on your 1040 form. You may even have to repay your benefits or go to jail for fraud. Well determine your continued eligibility by sending you a questionnaire for you to complete.

If you dont report income or a new job you are disqualified from receiving benefits. The IRS defines earned income as the compensation you receive from employment and self-employment. If you are self-employed or a 1099 then you likely cannot use your PPP funds to pay yourself and continue to collect unemploymentbecause the payment you make to yourself counts as income which in most cases will disqualify you from continuing to receive unemployment.

For example some states may require you to report barter commissions from direct selling products like Avon or. Meeting all the reporting requirements. Eligibility for unemployment depends on your earnings during a designated base period which is typically the past year.

The 100000 a year from investment income is separate from your job compensation. If youre getting severance pay from your employer then you are receiving income and this may disqualify you from getting unemployment insurance benefits. Unemployment insurance benefits including Pandemic Unemployment Assistance and Federal Pandemic Unemployment Compensation are considered unearned income.

Types of income include but are not limited to. Unemployment benefits are income just like money you would have earned in a paycheck. 2 Insufficient earnings or length of employment.

To qualify for the EITC you must have earned income and if you have no children you must have worked or operated a farm or business and earned less than 20430 in 2016. Your company could technically refute the unemployment benefit claim upon realizing you earn six figures in interest income. That money is now working for you.

The IRS will receive a copy as well. Individuals may also be disqualified from unemployment benefits while. This also means you usually have to have worked for your employer for at least a year.

Severance notice or retention pay and any other payments made because of separation from employment Sick pay and holiday pay.

States Are Telling Some People To Pay Back Unemployment Benefits Marketplace

States Are Telling Some People To Pay Back Unemployment Benefits Marketplace

The Investing Financial Advice To Follow Should Fit On A Note Card Financial Education Financial Advice Words Of Wisdom

The Investing Financial Advice To Follow Should Fit On A Note Card Financial Education Financial Advice Words Of Wisdom

Littman Krooks Attorney Marion Walsh Named Advocate Of The Year Education Advocacy Advocate Education

Littman Krooks Attorney Marion Walsh Named Advocate Of The Year Education Advocacy Advocate Education

How To Claim Unemployment And The Reasons You Qualify Glassdoor

How To Claim Unemployment And The Reasons You Qualify Glassdoor

Should You Use Your Unemployment Benefits To Start An Llc Incfile

Should You Use Your Unemployment Benefits To Start An Llc Incfile

Unemployed Here S What To Do If You Suddenly Lose Your Job Zerxza Lost Job Lost My Job Job

Unemployed Here S What To Do If You Suddenly Lose Your Job Zerxza Lost Job Lost My Job Job

Should You Use Your Unemployment Benefits To Start An Llc Incfile

Should You Use Your Unemployment Benefits To Start An Llc Incfile

Unemployment Insurance Benefits Can You Turn Down Your Work

Unemployment Insurance Benefits Can You Turn Down Your Work

Des Covid 19 Information For Individuals

Des Covid 19 Information For Individuals

Am I Eligible For Unemployment Alan Lescht

Am I Eligible For Unemployment Alan Lescht

What You Should Know About Unemployment Compensation

Self Employment Income Statement Template Fresh Self Employment Profit And Loss Statement Line Marketing Income Statement Statement Template Self Employment

Self Employment Income Statement Template Fresh Self Employment Profit And Loss Statement Line Marketing Income Statement Statement Template Self Employment

Best Job Search Tips For 2020 Job Search Tips Job Search Motivation Job Interview Tips

Best Job Search Tips For 2020 Job Search Tips Job Search Motivation Job Interview Tips

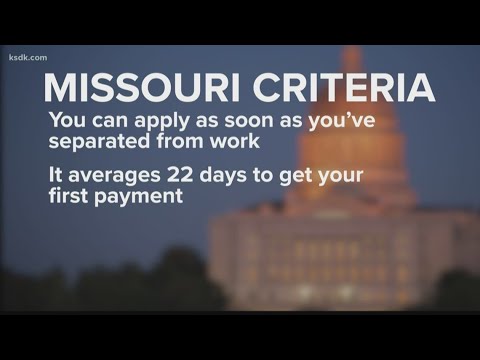

What You Need To Know About Unemployment Benefits And Coronavirus Youtube

What You Need To Know About Unemployment Benefits And Coronavirus Youtube

Ppp Loans Vs Unemployment Benefits How To Choose Bench Accounting

Ppp Loans Vs Unemployment Benefits How To Choose Bench Accounting

What Happens If Unemployment Is Denied Khou Com

What Happens If Unemployment Is Denied Khou Com

Post a Comment for "What Income Disqualifies You From Unemployment"