Unemployment Tax Refund Amendment

The American Rescue Plan a 19 trillion Covid relief bill waived. If their adjusted gross income was less than 150000 they could exclude up to 10200 of unemployment compensation from their taxable income.

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

The IRS says dont file an amended tax return if the new Covid bill changed your refund The new Covid relief package waives taxes on up to 10200 of unemployment.

Unemployment tax refund amendment. 1 day agoThe IRS urged taxpayers to wait and not file an amended return if they missed claiming the unemployment exclusion on their tax return. After that point unemployment benefits are taxable income. 10200 unemployment tax break The American Rescue Plan waived federal tax on up to 10200 of unemployment benefits per person received in.

However a recent law change allows some recipients to not pay tax on some 2020 unemployment compensation. Recently the IRS announced that early filers can expect to. Thirteen states arent offering a tax break on unemployment benefits received last year according to data from HR Block.

On March 31 2021 the IRS announced that refunds will be sent out during the spring and summer of 2021 to taxpayers who filed their tax return reporting unemployment compensation on or before March 15 2021. The legislation allows taxpayers who earned less than 150000 in adjusted gross income to exclude unemployment compensation up to 20400 if. 2 days agoExpecting another refund after the IRS calculates the 10200 unemployment tax break.

As a result you do NOT have to file an amendment to only claim the additional tax refund as a result of the UCE. The American Rescue Plan. If you are married each spouse receiving unemployment compensation doesnt have to pay tax on.

If your modified adjusted gross income AGI is less than 150000 the American Rescue Plan enacted on March 11 2021 excludes from income up to 10200 of unemployment compensation paid in 2020 which means you dont have to pay tax on unemployment compensation of up to 10200. COVID Tax Tip 2021-46 April 8 2021 Normally any unemployment compensation someone receives is taxable. The IRS will start issuing tax refunds in May to Americans who filed their returns without claiming a new break on unemployment benefits the federal agency said Wednesday.

You might want to do more than just wait Last Updated. The unemployment benefits that many taxpayers received for months are tax-free up to 10200. 2 days ago2021 TAX FILING.

The American Rescue Plan which was signed into law by President Joe Biden on March 11 made the first 10200 of unemployment income tax. The latest stimulus bill passed March 11 a month into tax season and after millions of Americans had already filed and included relief for taxpayers who received unemployment compensation in 2020. That represents a lot of Americans who will find themselves grappling with taxes on their unemployment benefits when the filing season rolls around in 2021 for 2020 tax returns.

Anyone who received jobless benefits during 2020 may now be eligible for the earned income. The legislation signed on March 11 allows taxpayers who earned less than 150000 in modified adjusted gross income to exclude unemployment compensation up to 20400 if married filing jointly and 10200 for all other eligible taxpayers. The IRS will automatically refund money to eligible people who filed their tax return reporting unemployment compensation before the recent changes made by the American.

The Internal Revenue Service will automatically issue tax refunds next month to Americans who already filed their returns but are eligible to take advantage of a new break on unemployment benefits. 1 day agoUnemployment tax refund could put thousands back in your pocket For the millions of Americans who filed for unemployment last year federal support came with a price tag. How and who has to file an Amended Return to get the 10200 IRS unemployment tax break.

The legislation excludes only 2020 unemployment benefits from taxes. 1 day agoThe Internal Revenue Service is telling people not to file amended returns after the recent stimulus packages tax break on the first 10200 of unemployment benefits.

Many Waiting Weeks For Tax Refunds As Irs Deals With Backlog Prepares For Stimulus Checks Wreg Com

Many Waiting Weeks For Tax Refunds As Irs Deals With Backlog Prepares For Stimulus Checks Wreg Com

Will You Get A Tax Refund Or Owe The Irs 32 Of Americans Don T Know

Will You Get A Tax Refund Or Owe The Irs 32 Of Americans Don T Know

Understanding Your Tax Forms The W 2 Tax Forms W2 Forms Tax Time

Understanding Your Tax Forms The W 2 Tax Forms W2 Forms Tax Time

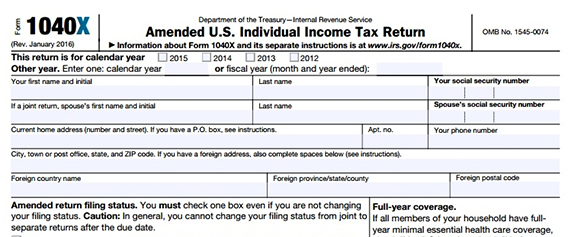

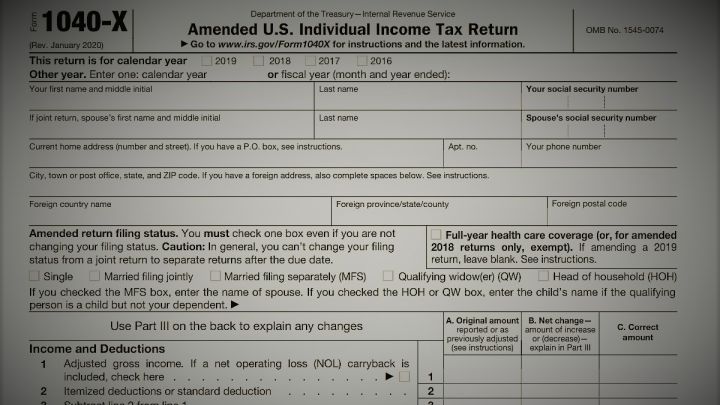

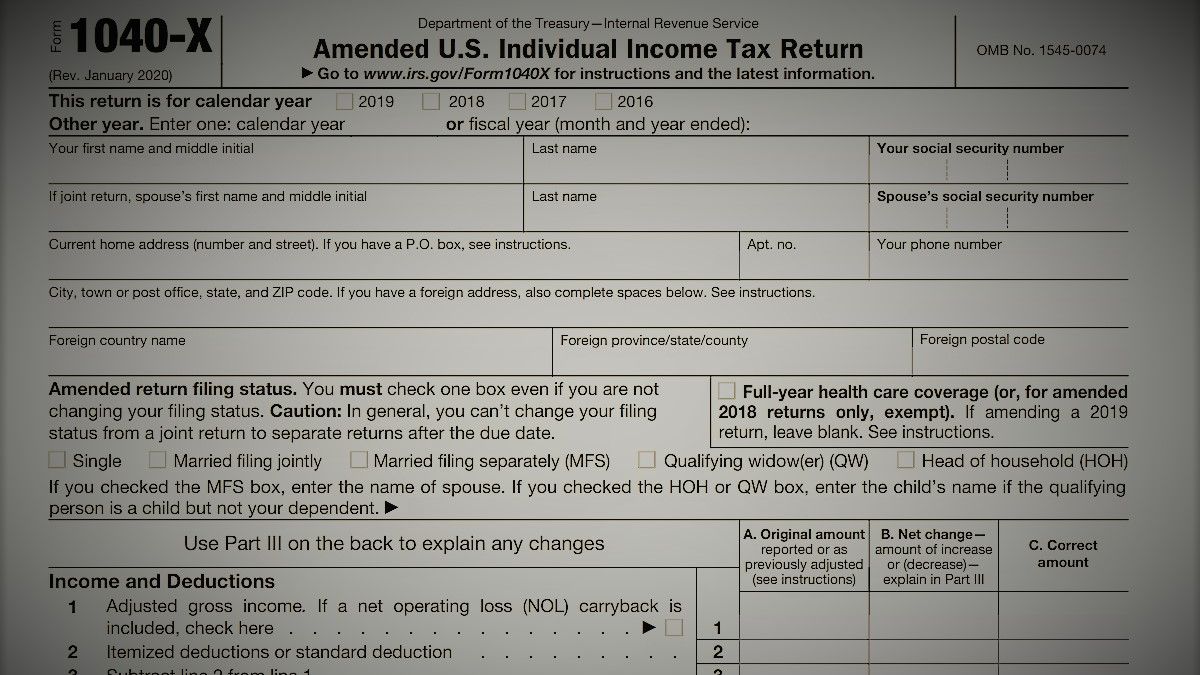

Wondering How To Amend Your Tax Return Picnic S Blog

Wondering How To Amend Your Tax Return Picnic S Blog

Income Tax A Complete Illustrated Guide Income Tax Income Accounting Services

Income Tax A Complete Illustrated Guide Income Tax Income Accounting Services

How To Go About Filing An Amended Tax Return E File Com

How To Go About Filing An Amended Tax Return E File Com

The Irs Is Behind In Processing Nearly 7 Million Tax Returns An Early Warning Sign The Agency Is Under Strain The Washington Post

The Irs Is Behind In Processing Nearly 7 Million Tax Returns An Early Warning Sign The Agency Is Under Strain The Washington Post

Paying Taxes On Unemployment Checks Everything You Need To Know Cnet

Paying Taxes On Unemployment Checks Everything You Need To Know Cnet

Tax Filing 2021 How To File An Amended Tax Return As Com

Tax Filing 2021 How To File An Amended Tax Return As Com

Tax Filing 2021 How To File An Amended Tax Return As Com

Tax Filing 2021 How To File An Amended Tax Return As Com

Stimulus Unemployment Answers To Your Tax Related Questions Fox43 Com

Stimulus Unemployment Answers To Your Tax Related Questions Fox43 Com

What Is Irs Form 1040 Income Tax Return Tax Return Income Tax

What Is Irs Form 1040 Income Tax Return Tax Return Income Tax

Checking The Status Of A Federal Tax Return E File Com

Checking The Status Of A Federal Tax Return E File Com

Do I Need To File A Tax Return Forbes Advisor

Do I Need To File A Tax Return Forbes Advisor

Stretch Your Dollar How Do Amended Tax Returns Work

Stretch Your Dollar How Do Amended Tax Returns Work

2020 Tax Returns Amended By Irs Software And Paper Edits Refund Checks Slashgear

2020 Tax Returns Amended By Irs Software And Paper Edits Refund Checks Slashgear

Post a Comment for "Unemployment Tax Refund Amendment"