Unemployment Tax Rate Florida 2020

Here is a list of the non-construction new employer tax. The minimum tax rate for 2021 increased from the prior year.

Did You Collect Unemployment Benefits In 2020 Act Now To Avoid A Tax Day Surprise Dollars And Sense Abc10 Com

Did You Collect Unemployment Benefits In 2020 Act Now To Avoid A Tax Day Surprise Dollars And Sense Abc10 Com

Unemployment Tax Rates Minimum Tax Rate 2020 10 2021 29 2022 115 forecasted.

Unemployment tax rate florida 2020. 45 on 327263 and over of taxable income for married joint filers and 163632 and over for single filers. If you earned more than 10200 in unemployment benefits last year the IRS has good news for you. 10200 in unemployment benefits wont be taxed leading to confusion amid tax-filing season.

1 2020 unemployment tax rates are to range from 01 to 54 unchanged from 2019. 0029 29 or 2030 per employee. Thats why different states have different income tax rates and some like Florida dont charge income tax at all.

For more information about the tax rate review the Reemployment Tax Rate. Generally if you paid wages subject to state unemployment tax you may receive a credit of up to 54 of FUTA taxable wages when you file your Form 940. For 2020 the FUTA tax rate is projected to be 6 per the IRS.

You can view your tax rate by logging in to the Departments Reemployment Tax file and pay website. Pay FUTA Unemployment Tax. The maximum rate paid by relatively few large businesses with a greater propensity for layoffs will remain 54 for the first 7000 in wages or 378 per employee the chamber said.

0540 54 or 378 per employee. The Florida Department of Revenue FDOR will increase the unemployment tax rate in January for the vast majority of the states employers according to a Florida Chamber of Commerce news release. In the past 12 years the highest the minimum tax rate increased to was 00151 151 in 2012.

The minimum tax rate for 2020 is 0001 01 and will increase to 00029 029 in 2021. 52 rows SUI tax rate by state. The initial tax rate for new employers is 0270 27 which is applied to the first 7000 in wages paid to each employee during a calendar year.

The FUTA tax applies to the first 7000 in wages you pay an employee throughout the calendar year. If you pay state unemployment taxes you are eligible for a tax credit of up to 54. The minimum and maximum tax rates effective January 1 2021 are as follows based on annual wages up to 7000 per employee.

The form 49T is a courtesy form providing claimants with a receipt of repayment that provides the amount paid to a Reemployment Assistance overpayment in a specific tax year. Colorado for example charges a tax rate. Its worth noting that youll also need to pay SUTA taxes thanks to the State Unemployment Tax Act for your employees as well.

You wont have to pay taxes on that money thanks. Under the American Rescue Plan those who received federal unemployment benefits in 2020 will receive a 10200 tax break when they file a federal income tax return this year. You might be alright if you arranged to have income tax withheld from your benefits but federal law caps withholding on benefits at 10.

Unemployment tax credit. You as the employer will pay 6 of each employees first 7000 of taxable income. Tax Rate Information webpage.

Due to the COVID-19 pandemic the 49T form will not be provided for the 2020 tax year. Starting in 2021 Proposition. This means that employers who previously only needed to pay the minimum rate of 7 per employee will soon need to pay 2030 per employee.

Floridas unemployment tax rates are to be unchanged for 2020 a spokesman for the state Department of Revenue said Dec. The federal tax rate applied to your benefits depends on your total income heres a quick reminder of the tax rates and income ranges to which they apply for calendar year 2020. This 7000 is known as the taxable wage base.

Employees are not responsible for paying the FUTA tax. If youre entitled to the maximum 54 credit the FUTA tax rate after credit is 06. From 2016 to 2020 the minimum tax rate was 0001 001.

10 That extra 600 is also taxable after the first 10200. By Irina Ivanova March 19 2021 708 AM MoneyWatch. Any amount over 7000 for the year is excess wages and is not subject to tax.

However given the COVID-19 pandemic and the mass unemployment crisis in Florida the Florida Chamber of Commerce has announced that the minimum unemployment tax rate will now be 29 effective Jan. It provided an additional 600 per week in unemployment compensation per recipient through July 2020.

Alvarez Marsal Tax Internship Summer 2020 In 2020 Capital Gains Tax Income Tax Tax Forms

Alvarez Marsal Tax Internship Summer 2020 In 2020 Capital Gains Tax Income Tax Tax Forms

Payroll Tax What It Is How To Calculate It Bench Accounting

Payroll Tax What It Is How To Calculate It Bench Accounting

2020 Tax Changes Affecting Family Child Care Providers Tom Copeland S Taking Care Of Business

2020 Tax Changes Affecting Family Child Care Providers Tom Copeland S Taking Care Of Business

How Severely Will Covid 19 Impact Sui Tax Rates

How Severely Will Covid 19 Impact Sui Tax Rates

Preparing Tax Returns For Inmates The Cpa Journal

Preparing Tax Returns For Inmates The Cpa Journal

2020 New Jersey Payroll Tax Rates Abacus Payroll

2020 New Jersey Payroll Tax Rates Abacus Payroll

Oregon Retirement Tax Friendliness Smartasset

Oregon Retirement Tax Friendliness Smartasset

The States Where People Are Burdened With The Highest Taxes Zippia

The States Where People Are Burdened With The Highest Taxes Zippia

States With Highest And Lowest Sales Tax Rates

States With Highest And Lowest Sales Tax Rates

Are You Thinking Of Moving To Clermont Here Are My Top 10 Reasons Why You Should Click The Link In Bio To Subscribe To My R In 2020 Clermont Moving To Florida Moving

Are You Thinking Of Moving To Clermont Here Are My Top 10 Reasons Why You Should Click The Link In Bio To Subscribe To My R In 2020 Clermont Moving To Florida Moving

Opinion The Rich Really Do Pay Lower Taxes Than You In 2020 Low Taxes Federal Income Tax Wealth Tax

Opinion The Rich Really Do Pay Lower Taxes Than You In 2020 Low Taxes Federal Income Tax Wealth Tax

Arizona Tax Forms 2020 Printable State Az Form 140 And Az Form 140 Instructions

Arizona Tax Forms 2020 Printable State Az Form 140 And Az Form 140 Instructions

W 4 Employee S Withholding Certificate And Federal Income Tax Withholding For 2020 Sap Blogs

W 4 Employee S Withholding Certificate And Federal Income Tax Withholding For 2020 Sap Blogs

What Is The Gift Tax In 2020 Daveramsey Com

What Is The Gift Tax In 2020 Daveramsey Com

2020 Tax Changes For 1099 Independent Contractors Updated For 2020

2020 Tax Changes For 1099 Independent Contractors Updated For 2020

How Much Does A Small Business Pay In Taxes

How Much Does A Small Business Pay In Taxes

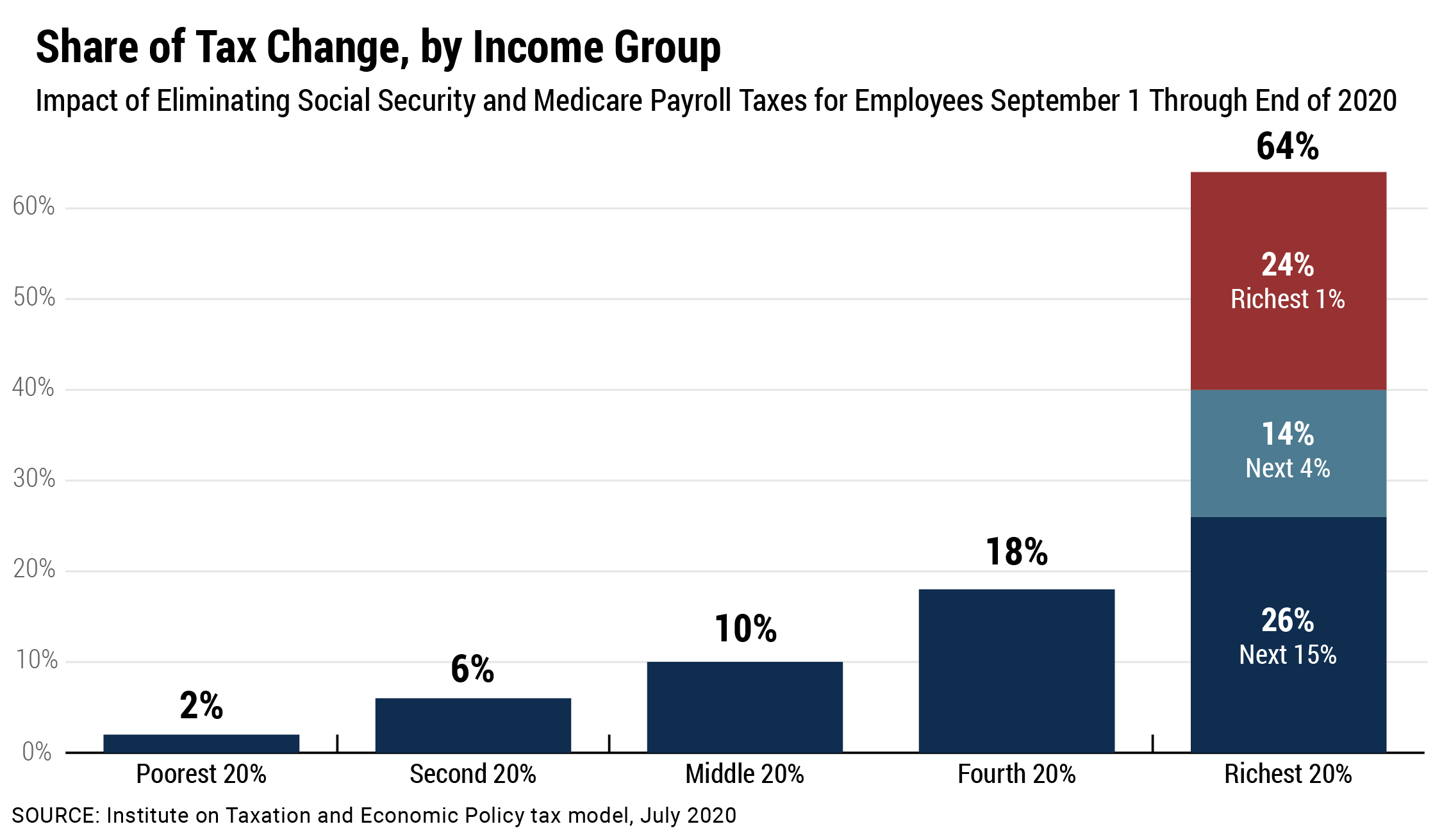

An Updated Analysis Of A Potential Payroll Tax Holiday Itep

An Updated Analysis Of A Potential Payroll Tax Holiday Itep

Paying Taxes On Unemployment Checks Everything You Need To Know Cnet

Paying Taxes On Unemployment Checks Everything You Need To Know Cnet

Post a Comment for "Unemployment Tax Rate Florida 2020"