Unemployment Tax Break Claim

After that point unemployment benefits are taxable income. The 19 trillion Covid relief bill gives a federal tax break on up to 10200 of unemployment benefits.

2020 Unemployment Tax Break H R Block

2020 Unemployment Tax Break H R Block

Americans who received unemployment benefits last year can claim a special new tax break included in the 19 trillion American Rescue Plan Act recently signed by President Biden.

Unemployment tax break claim. The unemployment benefits that many taxpayers received for months are tax-free up to 10200. On Wednesday the IRS confirmed concrete steps it will take to automatically refund money for Americans who filed their tax returns before being. 2 days agoExpecting another refund after the IRS calculates the 10200 unemployment tax break.

If your modified adjusted gross income AGI is less than 150000 the American Rescue Plan enacted on March 11 2021 excludes from income up to 10200 of unemployment compensation paid in 2020 which means you dont have to pay tax on unemployment compensation of up to 10200. The IRS plans to automatically process refunds for people who paid taxes on unemployment income before the American Rescue Plan made a portion tax-free. The break is 20400 for two workers.

President Joe Biden signed a 19 trillion Covid relief bill Thursday that waives federal tax on up to 10200 of unemployment benefits an individual received in 2020. That unemployment tax break doubles for married couples who file taxes jointly. The IRS will start issuing tax refunds in May to Americans who filed their returns without claiming a new break on unemployment benefits the federal.

The 19 trillion Covid relief measure limits. What exactly is the tax break for those who received unemployment compensation in 2020. The Unemployment Tax Waiver Could Save You Thousands of Dollars This tax break could provide a tax savings of thousands of dollars depending on your tax situation.

But the strategy may have backfired this year as early filers who paid taxes on their federal unemployment benefits missed out on an important. The American Rescue Plan waived federal tax on up to 10200 of jobless aid per person collected in 2020. The new stimulus package called the American Rescue Plan Act of 2021 makes tax-free a big chunk of unemployment benefits people received last.

That represents a lot of Americans who will find themselves grappling with taxes on their unemployment benefits when the filing season rolls around in 2021 for 2020 tax returns. Up to 10200 of. All filers need to have modified adjusted gross income below 150000 to get.

In addition to extending federal 300 unemployment benefits through September the American Rescue Plan allows tax exemptions for up to 10200 in unemployment benefits paid in. You might want to do more than just wait Last Updated. The 19 trillion American Rescue Plan allows those who received unemployment benefits to deduct 10200 in.

Uncle Sam taxes unemployment benefits as if they were wages although up to 10200 of unemployment compensation received in 2020 is exempt from. Even though jobless benefits count as income for tax purposes the newly-signed 19 trillion American Rescue Plan will not impose federal income. The IRS told Americans to wait to file an.

Serino Supermajority Fails New Yorkers By Declining To Offer Tax Break On Unemployment Benefits Ny State Senate

Serino Supermajority Fails New Yorkers By Declining To Offer Tax Break On Unemployment Benefits Ny State Senate

Unemployment 10 200 Tax Credit Irs Begins Refund In May If You Filed

Unemployment 10 200 Tax Credit Irs Begins Refund In May If You Filed

Unemployment Tax Troubles Wrong 1099 G Amounts Benefits Id Theft Don T Mess With Taxes

Tax Waiver For Unemployment Benefits Leads To Questions Kake

Tax Waiver For Unemployment Benefits Leads To Questions Kake

Are Unemployment Insurance Benefits Taxable A Guide On Ui Taxes

Are Unemployment Insurance Benefits Taxable A Guide On Ui Taxes

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Irs Refund Checks For 10 200 Unemployment Tax Break Coming In May

Irs Refund Checks For 10 200 Unemployment Tax Break Coming In May

Taxes 2021 Everything New Including Deadline Stimulus Payments And Unemployment Cnet

Taxes 2021 Everything New Including Deadline Stimulus Payments And Unemployment Cnet

No 10 200 Unemployment Tax Break In 13 States Could Mean Higher Taxes

No 10 200 Unemployment Tax Break In 13 States Could Mean Higher Taxes

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Here S How The 10 200 Unemployment Tax Break Works

Here S How The 10 200 Unemployment Tax Break Works

2020 Unemployment Tax Break H R Block

2020 Unemployment Tax Break H R Block

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

New Stimulus Bill Offers Tax Break On Unemployment Payments Whec Com

New Stimulus Bill Offers Tax Break On Unemployment Payments Whec Com

Stimulus Bill Unemployment Benefits How A New Tax Break Could Save You Money Cnet

Stimulus Bill Unemployment Benefits How A New Tax Break Could Save You Money Cnet

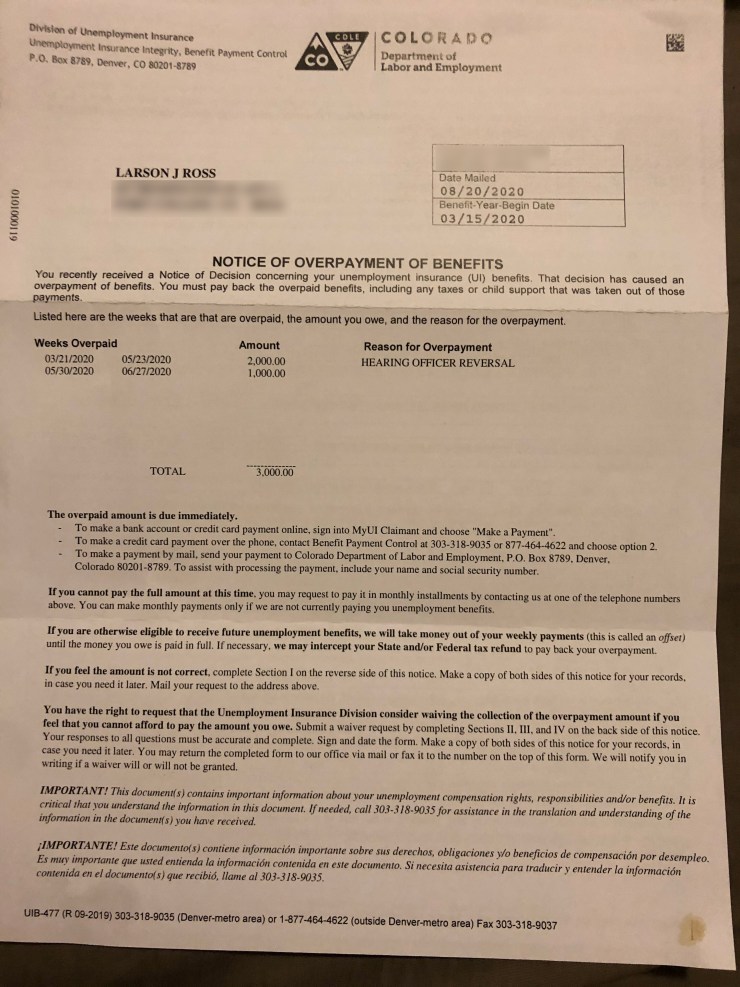

States Are Telling Some People To Pay Back Unemployment Benefits Marketplace

States Are Telling Some People To Pay Back Unemployment Benefits Marketplace

Post a Comment for "Unemployment Tax Break Claim"