Unemployment Ohio Tax Break

If you got unemployment income last year and your state isnt offering a tax break on your first 10200 of benefits you may need to gear up for a tax bill when you. Ohio Income Tax Update.

Did You Receive A 1099 G From The Ohio Department Of Taxation Or The Ohio Department Of Job And Family Services Department Of Taxation

Did You Receive A 1099 G From The Ohio Department Of Taxation Or The Ohio Department Of Job And Family Services Department Of Taxation

Posted on 012621 by Zach Schiller in Revenue Budget.

Unemployment ohio tax break. You might want to do more than just wait Last Updated. 2 days agoExpecting another refund after the IRS calculates the 10200 unemployment tax break. The new tax break is an exclusion workers exclude up to 10200 in.

A balanced well-designed tax system makes sure we all do our part to sustain our communities while caring for people going through hard times. It is included in your federal adjusted gross income FAGI on your federal 1040. Right now many Ohioans are going through hard times but our state tax code hasnt been designed to help them especially.

Its great that Americans wont have to pay taxes on 10200 of unemployment income. Specifically federal tax changes related. However 13 states are not waiving taxes on unemployment benefits for 2020.

On March 31 2021 Governor DeWine signed into law Sub. The American Rescue Plan a 19 trillion Covid relief bill waived. Three others Arizona Ohio and Vermont didnt officially adopt the federal standard but their tax forms do allow eligible residents.

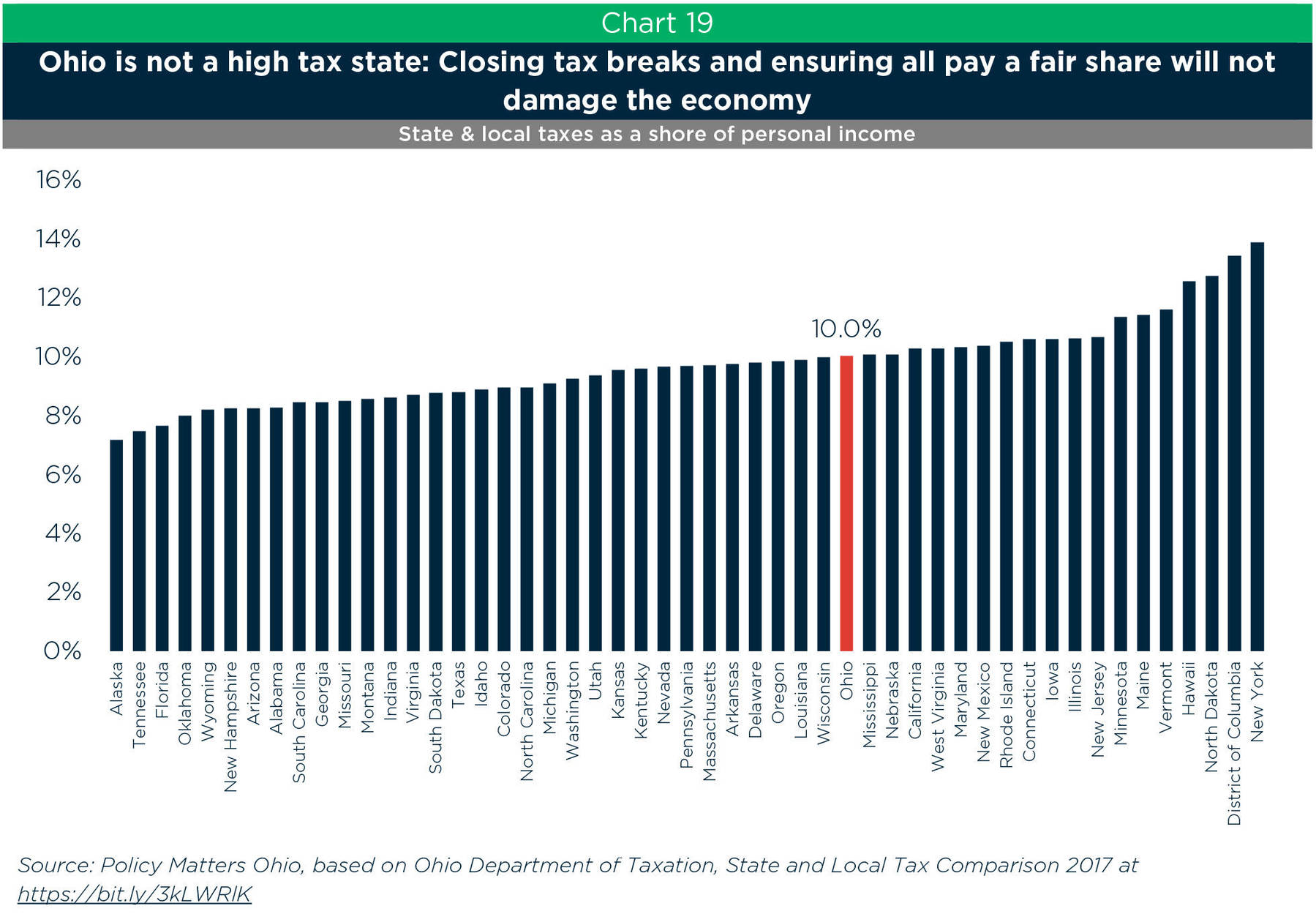

Additionally if you live in a traditional tax base school district your unemployment compensation is. Residents with 150000 in taxable income pay a marginal state tax rate of 825 percent. Under the American Rescue Plan those who received federal unemployment benefits in 2020 will receive a 10200 tax break when they file a federal income tax return this year.

Changes in how Unemployment Benefits are taxed for Tax Year 2020. Because Ohios income tax begins with federal adjusted gross income your unemployment compensation is also taxable to Ohio on your IT 1040 return. However with the new stimulus bill up to 10200 in last years unemployment payments can be exempt from taxes if your adjusted gross income AGI is less than 150000 according to new.

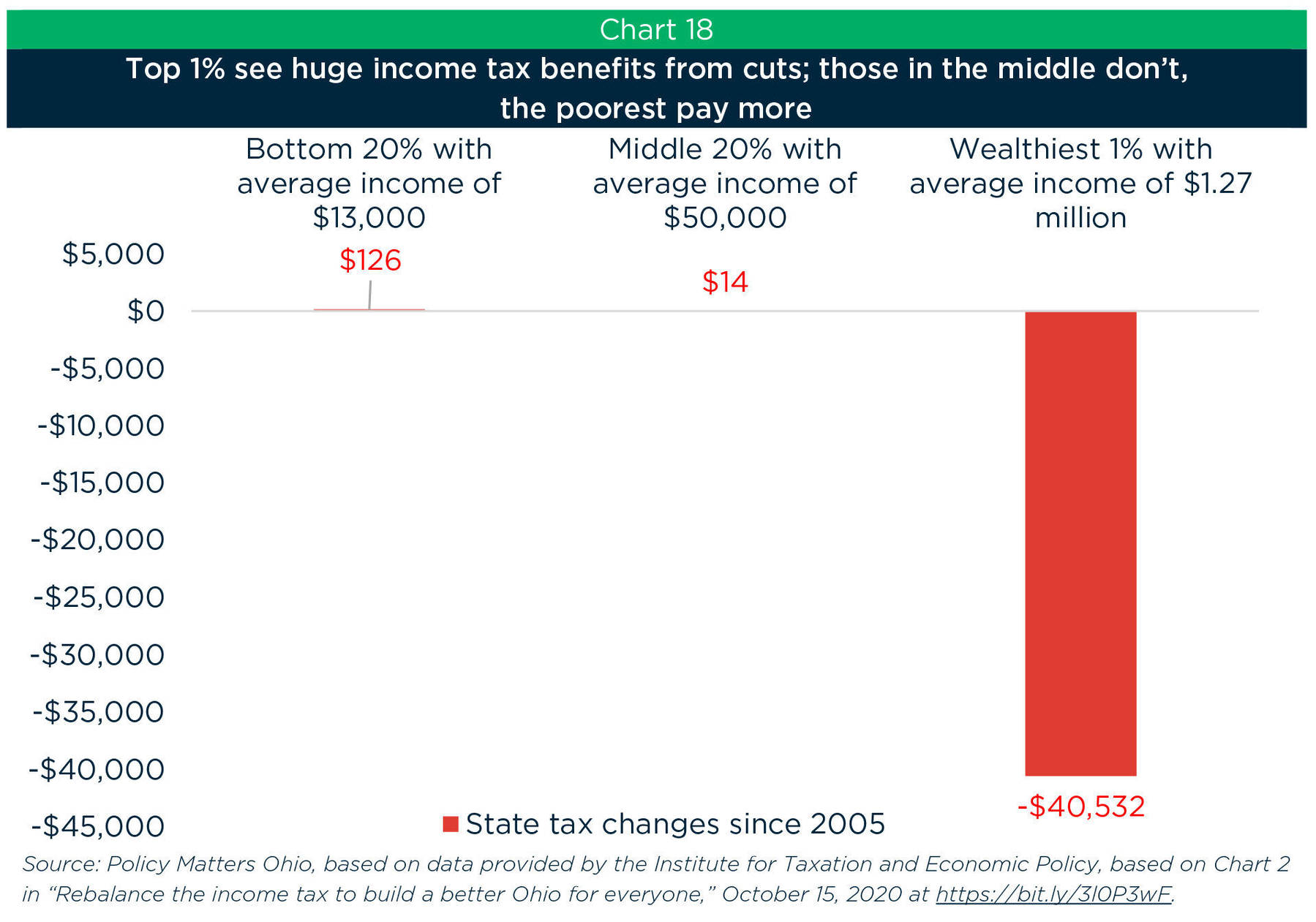

Mike DeWine Wednesday brought Ohio in line with federal tax lawUnder the American Rescue Plan individuals who received unemployment benefits and earned. A tax on unemployment benefits a break for affluent Ohioans. Arizona taxes unemployment compensation to the same extent as it is taxed under federal law.

IRS delays tax due date to May 17 As Americans file their tax returns for 2020 --. That would translate into incremental state taxes of 841 on 10200 in unemployment. That will be the case if a new tax break on up to 10200 of unemployment benefits makes them newly eligible for income-dependent tax credits and deductions like the earned income tax.

1 day agoA good problem to fix. State Taxes on Unemployment Benefits. Along with the tax break Bidens bill also extended the 300 a week in federal unemployment benefits until September 6.

Prepare for a state tax bill. Unemployment benefits are generally treated as income for tax purposes. The nearly 2 million Ohioans who collected unemployment benefits in 2020 are in line for a big break on their federal taxes under the 19 trillion relief plan.

Thirteen states arent offering a tax break on unemployment benefits received last year according to data from HR Block. The break is the result of a compromise between Democrats and Republicans. The IRS considers unemployment compensation taxable income.

However only 13 states are excluding 10200 of federal unemployment benefits from their residents tax liability for 2020. Unemployment benefits are not subject to municipal income taxes in Ohio so nothing changes there the Regional Income Tax Agency confirmed. 18 which incorporates recent federal tax changes into Ohio law effective immediately.

The change in a bill signed by Gov. That tax break will put a lot of extra.

Irs Sending You More Money Unemployment Refunds Coming 10tv Com

Irs Sending You More Money Unemployment Refunds Coming 10tv Com

The Ohio 2022 2023 State Budget

The Ohio 2022 2023 State Budget

What Is Local Income Tax Income Tax Income Tax

What Is Local Income Tax Income Tax Income Tax

Ohio Urges Victims Of Unemployment Fraud To Act Now To Avoid Tax Troubles Strauss Troy Co Lpa

Ohio Urges Victims Of Unemployment Fraud To Act Now To Avoid Tax Troubles Strauss Troy Co Lpa

Income School District Tax Department Of Taxation

Income School District Tax Department Of Taxation

Did You Receive A 1099 G From The Ohio Department Of Taxation Or The Ohio Department Of Job And Family Services Department Of Taxation

Did You Receive A 1099 G From The Ohio Department Of Taxation Or The Ohio Department Of Job And Family Services Department Of Taxation

The Ohio 2022 2023 State Budget

The Ohio 2022 2023 State Budget

Did You Receive A 1099 G From The Ohio Department Of Taxation Or The Ohio Department Of Job And Family Services Department Of Taxation

Did You Receive A 1099 G From The Ohio Department Of Taxation Or The Ohio Department Of Job And Family Services Department Of Taxation

Did You Receive A 1099 G From The Ohio Department Of Taxation Or The Ohio Department Of Job And Family Services Department Of Taxation

Did You Receive A 1099 G From The Ohio Department Of Taxation Or The Ohio Department Of Job And Family Services Department Of Taxation

Not All Senior Citizens Still Qualify For Ohio Property Tax Discounts Homestead Savings Calculator Cleveland Com

Not All Senior Citizens Still Qualify For Ohio Property Tax Discounts Homestead Savings Calculator Cleveland Com

What You Need More Than An Assistant Sales Coaching Sales And Marketing Assistant

What You Need More Than An Assistant Sales Coaching Sales And Marketing Assistant

Ohio Oh State Tax Refund Ohio Tax Brackets Taxact Blog

Ohio Oh State Tax Refund Ohio Tax Brackets Taxact Blog

Did You Receive A 1099 G From The Ohio Department Of Taxation Or The Ohio Department Of Job And Family Services Department Of Taxation

Did You Receive A 1099 G From The Ohio Department Of Taxation Or The Ohio Department Of Job And Family Services Department Of Taxation

New Ohio Tax Conformity Bill Passes Hw Co Cpas Advisors

New Ohio Tax Conformity Bill Passes Hw Co Cpas Advisors

Ohio Unemployment Help Wkyc Com

Ohio Unemployment Help Wkyc Com

Ohio Postpones Tax Filing Deadline To May 17 Matching The Irs Revised Deadline For Federal Taxes Cleveland Com

Ohio Postpones Tax Filing Deadline To May 17 Matching The Irs Revised Deadline For Federal Taxes Cleveland Com

Did You Receive A 1099 G From The Ohio Department Of Taxation Or The Ohio Department Of Job And Family Services Department Of Taxation

Did You Receive A 1099 G From The Ohio Department Of Taxation Or The Ohio Department Of Job And Family Services Department Of Taxation

Did You Receive A 1099 G From The Ohio Department Of Taxation Or The Ohio Department Of Job And Family Services Department Of Taxation

Did You Receive A 1099 G From The Ohio Department Of Taxation Or The Ohio Department Of Job And Family Services Department Of Taxation

Income 1099 G And 1099 Int From The Department Of Taxation Department Of Taxation

Income 1099 G And 1099 Int From The Department Of Taxation Department Of Taxation

Post a Comment for "Unemployment Ohio Tax Break"