Unemployment For Reduced Hours In Ohio

PUA Login false Coronavirus and Unemployment Insurance Benefits. Expanded Eligibility Resource Hub The new federal Pandemic Unemployment Assistance or PUA program provides benefits for many individuals ineligible for state unemployment benefits including self-employed workers 1099 tax filer.

Https Ccao Org Wp Content Uploads Sharedwork Ohio Program And Cares Act Program Overview1 Pdf

If you had your hours reduced by 25 or more you qualify for unemployment benefits.

Unemployment for reduced hours in ohio. Report it by calling toll-free. A 25 reduction of the 240 wages earned leaves the employee with 180 in earned wages or 42 less than the weekly benefit amount. The SharedWork Ohio SWO program however allows employers to make a less drastic hours reduction while ensuring their employees still.

Since your weekly benefit amount is a result of your wages during the 18 months before your claim partial unemployment benefits tend to apply to those who lost a full-time job and could only find a replacement with less pay or hours. The participating employee works the reduced hours each week and the Ohio Department of Job and Family Services ODJFS provides eligible individuals an unemployment insurance benefit proportionate to their reduced hours. In California benefits usually last between 12 to 26.

The participating employee works the reduced hours each week and the Ohio Department of Job and Family Services ODJFS provides eligible individuals an unemployment compensation benefit proportionate to their reduced hours. A 50 reduction in working hours for a full-time employee making minimum wage would result in weekly earnings from the employer of 240. As explained above for employees to be eligible for partial unemployment benefits employers generally must cut an employees hours by at least 50.

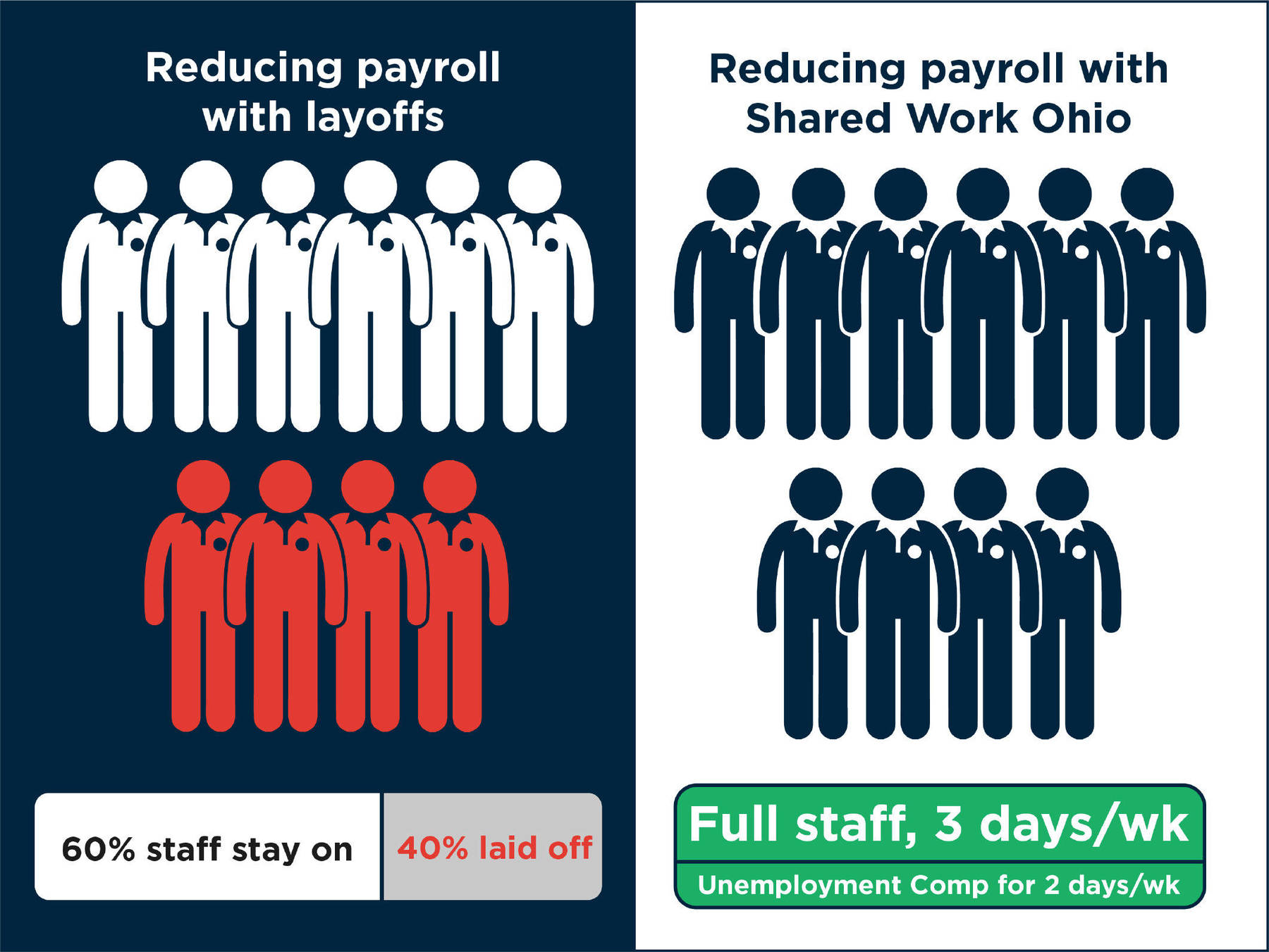

If you worked zero hours for that week you are eligible to receive 50 of your normal weekly salary so 100 dollars. 51 rows Your weekly benefit amount will not be reduced if you earn less than 14 of your weekly. This is a voluntary layoff aversion program that allows workers to remain employed and employers to retain their staff during times of reduced business activity.

So lets say you worked partial hours for a week and only made 150 dollars subtract 20 from that 150 totals 120 dollarsyou will not get any money from unemployment because you made more than 100 dollars that week. Ohio has been approved to distribute weekly 300 Lost Wages Assistance LWA payments to eligible individuals who were fully or partially unemployed or working reduced hours under a SharedWork Ohio plan because of COVID-19 for weeks ending August 1 through September 5 2020. To collect through Ohios partial unemployment program you must earn less than your weekly benefit amount and work less than full-time hours.

Under a SharedWork Ohio plan the participating employer reduces affected employees hours in a uniform manner. The participating employee works the reduced hours each week and the Ohio Department of Job and Family Services ODJFS provides eligible individuals an unemployment insurance benefit proportionate to their reduced hours. Under a SharedWork Ohio plan the participating employer reduces affected employees hours in a uniform manner.

Under a SharedWork Ohio plan the participating employer reduces affected employees hours in a uniform manner. These timeframes are sometimes extended during periods of high unemployment including during the coronavirus pandemic In Ohio for example unemployment benefits are usually limited to 20 to 26 weeks. Your earnings before the reduced hours must be below 85000 per year.

The CARES Act can support short-term compensation programs where employers reduce hours instead of laying off and employees receive prorated unemployment benefits. The weekly anticipated unemployment benefit would be 222 see above. If you are being called in for fewer hours you are partially unemployed and should qualify for unemployment benefits unless your weekly earnings were too low less than 269 per week.

Workers who are unemployed temporarily because of COVID-19 and are expected to return to work with their employer within a few weeks or some other defined short period of time. Ohio unemployment insurance provides benefit payments for partial wage replacement to workers that have lost their job or have had their hours of work reduced through no fault of their own. Case in point many of Delta Airline workers had their hours reduced by 25.

The participating employee works a reduced number of hours each week and ODJFS provides eligible people with unemployment insurance benefits proportionate to their reduced hours.

How To Calculate Amount Of Unemployment In Ohio 9 Steps

How To Calculate Amount Of Unemployment In Ohio 9 Steps

Ohio Begins Implementing New Federal Unemployment Programs City Of Mentor Ohio

Ohio Begins Implementing New Federal Unemployment Programs City Of Mentor Ohio

Who In Ohio Is Qualified For Coronavirus Related Jobless Benefit Wfmj Com

Who In Ohio Is Qualified For Coronavirus Related Jobless Benefit Wfmj Com

How To Calculate Amount Of Unemployment In Ohio 9 Steps

How To Calculate Amount Of Unemployment In Ohio 9 Steps

Https Marketing Sedgwick Com Acton Ct 4952 P 023b Bct Ct12 0 1 D Sid Tv2 3abejyl3qts

Https Unemployment Ohio Gov Pdf New Workers Self Service User Guide Pdf

Covid 19 Unemployment Benefits Hamilton Ryker

Covid 19 Unemployment Benefits Hamilton Ryker

Avoid Layoffs With Shared Work Ohio

Avoid Layoffs With Shared Work Ohio

Https Unemployment Ohio Gov Pdf New Workers Self Service User Guide Pdf

How To Calculate Amount Of Unemployment In Ohio 9 Steps

How To Calculate Amount Of Unemployment In Ohio 9 Steps

Employment Benefits In Ohio During Covid 19

Employment Benefits In Ohio During Covid 19

Answers To Qualifying For Unemployment The 300 Payments And Disputed Ohio Claims That S Rich Q A Cleveland Com

Answers To Qualifying For Unemployment The 300 Payments And Disputed Ohio Claims That S Rich Q A Cleveland Com

As Ohio Unemployment Claims Continue State Asks Employers To Report Employees That Do Not Return To Work

As Ohio Unemployment Claims Continue State Asks Employers To Report Employees That Do Not Return To Work

Ohio Unemployment Claims Will Be Backdated Says Husted Wfmj Com

Ohio Unemployment Claims Will Be Backdated Says Husted Wfmj Com

How To Calculate Amount Of Unemployment In Ohio 9 Steps

How To Calculate Amount Of Unemployment In Ohio 9 Steps

In Face Of Coronavirus State Policymakers Can Bolster Unemployment Compensation System

In Face Of Coronavirus State Policymakers Can Bolster Unemployment Compensation System

Covid 19 Unemployment Benefits Hamilton Ryker

Covid 19 Unemployment Benefits Hamilton Ryker

How To Calculate Amount Of Unemployment In Ohio 9 Steps

How To Calculate Amount Of Unemployment In Ohio 9 Steps

Https Jfs Ohio Gov Ocomm Pdf Cares Act Pdf

Post a Comment for "Unemployment For Reduced Hours In Ohio"