State Of Ohio Unemployment Laws

The Ohio Department of. You must be able to work and are not disabled.

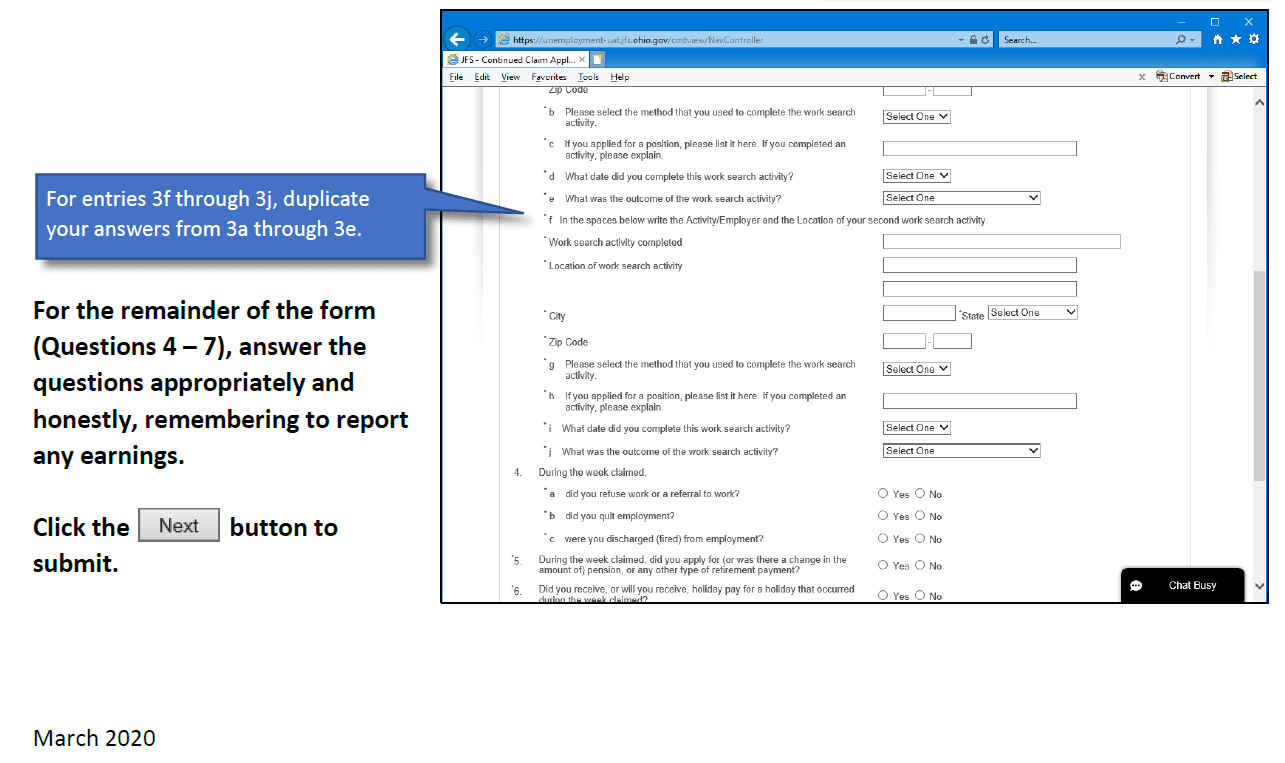

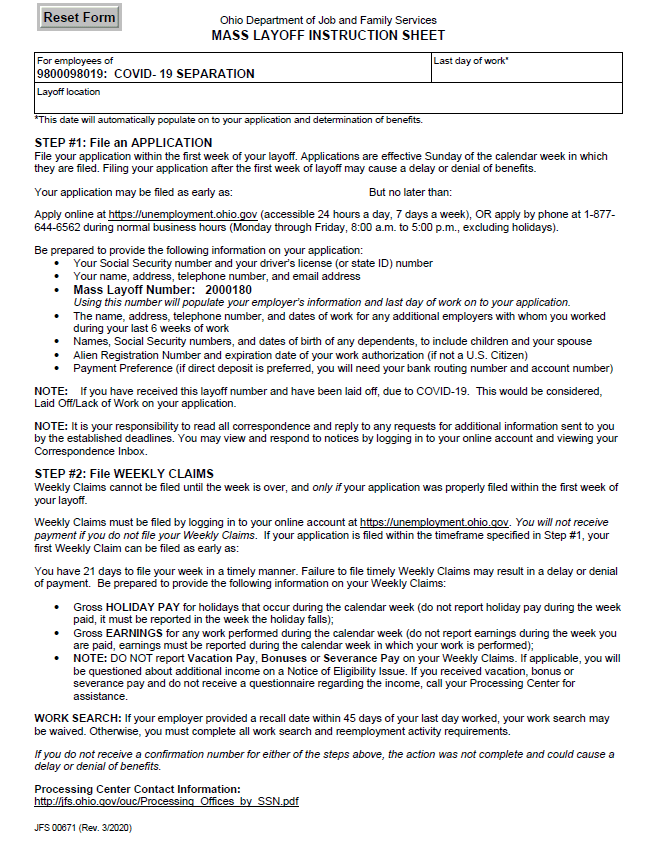

Https Unemployment Ohio Gov Pdf New Workers Self Service User Guide Pdf

You must file a weekly certification.

State of ohio unemployment laws. What is Base Period or Base Year. You must be actively looking for a job and keeping a record of your job search. Employment Age Certification.

1 day agoDuring the last unemployment crisis Ohio borrowed about 34 billion to pay unemployment benefits to workers. COLUMBUS Ohio AP Around 48000 Ohioans have been notified they received an overpayment of unemployment benefits during the coronavirus pandemic the state. Fair Labor Standards Act FLSA FamilyMedical Leave FMLA Health and Safety OSHA Labor Laws NLRA Leave Laws.

All hours worked from the 1 st to the 15 th. Ohio taxes unemployment compensation to the same extent it is taxed under federal law. Coronavirus and Unemployment Benefits Frequently Asked Questions and answers for claimants and employers can be found here.

Emergency and extended unemployment could extend this. To see if you are eligible apply at unemploymentohiogov or call 877 644-6562. Work for such an employer is covered employment.

1 day agoCOLUMBUS OhioBoth new and ongoing unemployment claims filed in Ohio hit a two-month low last week thanks at least in part to the steadily decreasing number of. The Ohio Department of Taxation offered guidance regarding recently enacted legislation that aligned the state with federal tax changes included in the American Rescue Plan Act of 2021 PL. Mass Layoffs WARN Meals and Breaks.

State Labor Offices. 117-2 that affected the calculation of adjusted gross income for taxpayers who received unemployment. Your benefit year begins the day you file for unemployment.

In Ohio you may be eligible for unemployment even if you quit your last job. Minimum Wage for Tipped Employees. Unemployment benefits provide short-term income to unemployed workers who lose their jobs through no fault of their own and who are actively seeking work.

Report it by calling toll-free. Per Section 411315 of the Ohio Revised Code an employer must pay employees at least twice per month. However you must show that you had just cause to leave your job.

It is included in your federal adjusted gross income FAGI on your federal 1040. Base period is the first four of the last five completed calendar quarters immediately before the first day of. Additionally if you live in a traditional tax base school district your unemployment compensation is also subject to.

The state gives unemployed workers up to 26 weeks of Ohio unemployment compensation while they search for new work. Unemployment benefits are available to employees when they are no longer working through no fault of. G In accordance with section 303c3 of the Social Security Act and section 3304a17 of the Internal Revenue Code of 1954 for continuing certification of Ohio unemployment compensation laws for administrative grants and for tax credits any interest required to be paid on advances under Title XII of the Social Security Act shall be paid in a timely manner and shall not be paid directly or indirectly by an equivalent reduction in the Ohio unemployment.

As a result any unemployment. Because Ohios income tax begins with federal adjusted gross income your unemployment compensation is also taxable to Ohio on your IT 1040 return. Workers in Ohio who have been laid off fired or forced to leave their jobs might be eligible for unemployment benefits through the Ohio Department of Job and Family Services ODJFS.

During that time Ohio employers were hit. This has been interpreted to mean that you must show that an ordinarily careful person in similar circumstances would have quit. Ohio pays regular unemployment benefits for 26 weeks -- if you collected full benefits every week your regular unemployment would last 26 weeks.

In order to receive unemployment benefits in Ohio you must follow these rules. State Taxes on Unemployment Benefits. The IRS considers unemployment compensation taxable income.

In some cases such as high Ohio unemployment rates the state may allow workers to file for extensions. You have one year -- 52 weeks -- in which to collect benefits. Under Ohio law most employers are required to pay contributions for unemployment insurance.

Covid 19 Unemployment Benefits Hamilton Ryker

Covid 19 Unemployment Benefits Hamilton Ryker

Https Ohpsych Org Resource Resmgr Files Covid 19 Food Insecurities Questions And Answers Unempl Pdf

Columbus Ohio Unemployment Compensation Livorno Arnett Co Lpa

Columbus Ohio Unemployment Compensation Livorno Arnett Co Lpa

Ohio Updates Pre Registration Process For Pandemic Unemployment Assistance Benefits

Ohio Updates Pre Registration Process For Pandemic Unemployment Assistance Benefits

Unemployment Changes In Ohio Due To Covid 19 Equality Ohio

Unemployment Changes In Ohio Due To Covid 19 Equality Ohio

Free Ohio Minor Labor Laws Labor Law Poster 2021

Free Ohio Minor Labor Laws Labor Law Poster 2021

Covid 19 Unemployment Benefits Hamilton Ryker

Covid 19 Unemployment Benefits Hamilton Ryker

Who In Ohio Is Qualified For Coronavirus Related Jobless Benefit Wfmj Com

Who In Ohio Is Qualified For Coronavirus Related Jobless Benefit Wfmj Com

Coronavirus Covid 19 And Your Employment Everything You Need To Know

Coronavirus Covid 19 And Your Employment Everything You Need To Know

Free Ohio Unemployment Compensation Labor Law Poster 2021

Free Ohio Unemployment Compensation Labor Law Poster 2021

Covid 19 Unemployment Benefits Hamilton Ryker

Covid 19 Unemployment Benefits Hamilton Ryker

Https Unemployment Ohio Gov Pdf New Workers Self Service User Guide Pdf

Covid 19 Unemployment Benefits Hamilton Ryker

Covid 19 Unemployment Benefits Hamilton Ryker

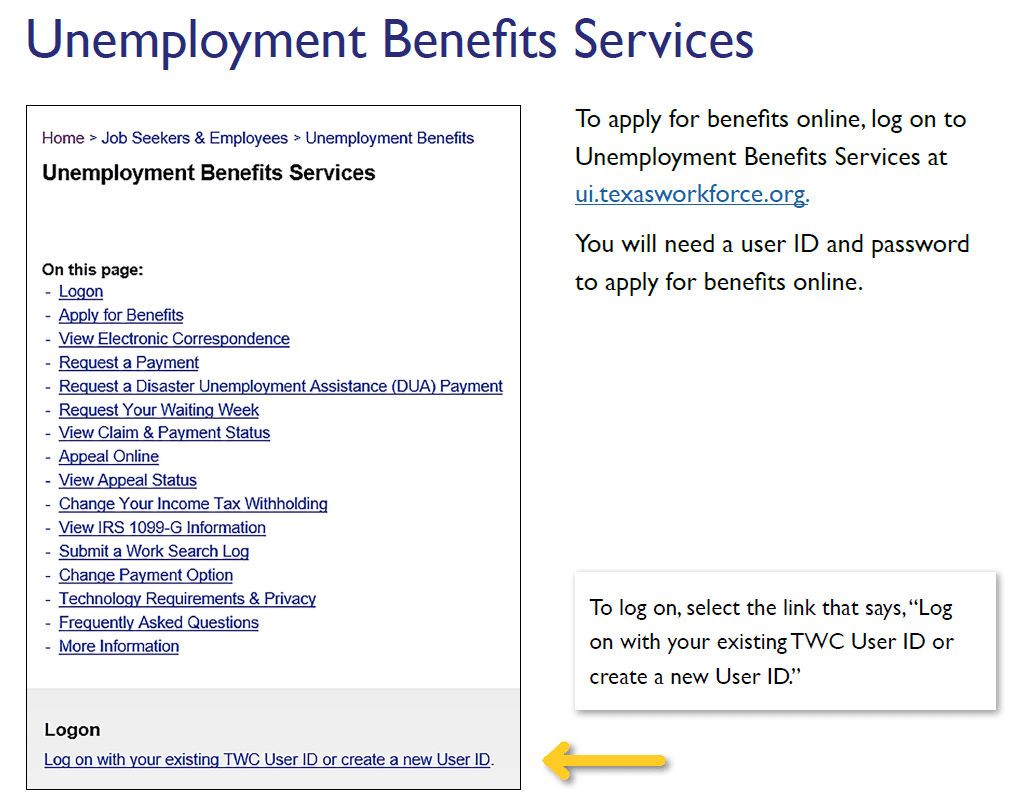

Http Www Olc Org Pdf Internetfilingunemploymentcomp Pdf

Https Unemployment Ohio Gov Pdf New Workers Self Service User Guide Pdf

Unemployment Compensation In Ohio

Https Unemployment Ohio Gov Pdf New Workers Self Service User Guide Pdf

Ohio Unemployment Compensation Benefits Gov

Https Unemployment Ohio Gov Pdf New Workers Self Service User Guide Pdf

Post a Comment for "State Of Ohio Unemployment Laws"