Ohio Unemployment Wage Rate

If you file your application during 2021 you must have an average weekly wage of at least 280 before taxes or other deductions. The Taxable Wage Base is the amount of an employees wages upon which the employer is required to pay unemployment taxes each year.

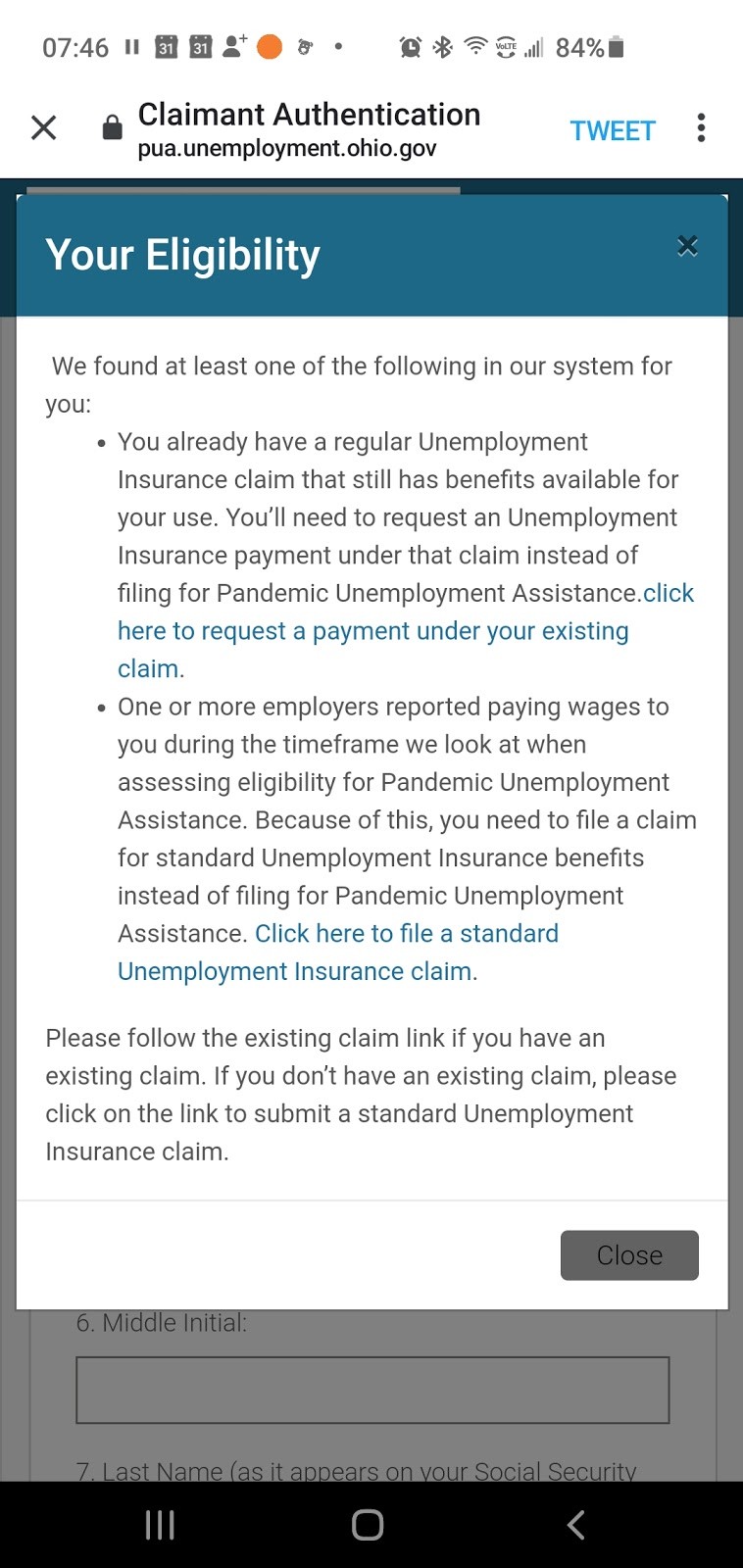

Ohio Oh Department Of Job And Family Services Odjfs Extra 300 Fpuc Peuc Pua And Eb 2021 Unemployment Benefit Extensions News And Updates Aving To Invest

Ohio Oh Department Of Job And Family Services Odjfs Extra 300 Fpuc Peuc Pua And Eb 2021 Unemployment Benefit Extensions News And Updates Aving To Invest

Quarterly Census of Employment and Wages.

Ohio unemployment wage rate. And no matter what you are looking for were confident. Ohios nonagricultural wage and salary employment decreased 11500 over the month from a revised 5253200 in November to 5241700 in December 2020. The taxable wage base may change from year to year.

Ohios prevailing wage laws apply to all public improvements financed in whole or in part by public funds when the total overall project cost is fairly estimated to be more than 250000 for new construction or 75000 for reconstruction enlargement alteration repair remodeling renovation or painting. New employers in the construction industry are to be assessed a rate of 580 in 2021 also unchanged from 2020. Ohios nonagricultural wage and salary employment decreased 8400 over the month from a revised 5304300 in January to 5295900 in February 2021.

Ohios unemployment taxable wage base will remain at 9000 for 2021. The average weekly wage is determined by dividing your total wages earned during the base period from any employer who pays unemployment contributions by the total number of weeks. Whether you are an individual looking to take your career to the next level a business looking for top talent or an educator wanting to shape Ohios future curriculum for the better Ohios Top Jobs can provide you with valuable insights to help guide you along the way.

The number of workers unemployed in Ohio in December was 315000 down from 328000 in November. Instructions for filing certified payroll reports. The taxable wage base for calendar year 2020 and subsequent years is 9000.

780 rows Ohio These occupational employment and wage estimates are calculated. The taxable wage base for calendar years 2018 and 2019 is 9500. The counties with the lowest rates other than Holmes were.

Data Series Back Data Sept 2020 Oct 2020 Nov 2020 Dec 2020 Jan 2021 Feb 2021. Ohio Unemployment Insurance BENEFITS CHART - 2021 If your application for unemployment benefits is allowed your actual weekly benefit amount will be determined after you. If an employers account is not eligible for an experience rate the account will be assigned a standard new employer rate of 27 unless the employer is engaged in the construction industry in which case the 2017 rate is 62 the 2018 rate is 60 the 2019 rate is.

The 2020 SUI taxable wage base reverts to 9000 down from 9500 for 2018 and 2019. Worker Inflow Outflow. Starting in 2021 Proposition 208 approved by.

Geauga and Medina 36. Based on 2017 data these reports can help you understand where workers go for work where they come from and your workforce relationship with other counties. The comparable unemployment rate for Ohio was 56 in February.

45 on 327263 and over of taxable income for married joint filers and 163632 and over for single filers. Ohios unemployment rate was 55 in December 2020 down from 57 in November. Weekly Wage is between.

Five counties had unemployment rates at or above 80 in February. See table on next page Five counties had unemployment rates at or below 40 in February. Ohios unemployment rate was 56 in October 2020 down from a revised 83 in September.

Ohio Labor Market Information LMI website. Monthly forecast of employment growth for Ohio and its eight largest MSAs for the next six months. 460 462 230 230 230 462 464 231 231 231 464 466 232 232 232 466 468 233 233 233 468 470 234 234 234.

Wage Data by Area. Ohios unemployment rate was 50 in February 2021 down from 53 in January. Report it by calling toll-free.

Ohio 2020 SUI tax rates increase taxable wage base decreases. The new-employer tax rate is to be 270 for 2021 unchanged from 2020. Act by December 31 to potentially lower tax rates The Ohio 2020 state unemployment insurance SUI tax rates will range from 03 to 94 up from the 2019 range of 03 to 92.

Ohios nonagricultural wage and salary employment increased 30800 over the month from a revised 5191500 in September to 5222300 in October 2020.

Unemployment Rate In Ohio Ohur Fred St Louis Fed

Unemployment Rate In Ohio Ohur Fred St Louis Fed

Respond To Employer Request For Separation Information Office Of Unemployment Insurance Operations Ohio Department Of Job And Family Services

Respond To Employer Request For Separation Information Office Of Unemployment Insurance Operations Ohio Department Of Job And Family Services

How To Calculate Amount Of Unemployment In Ohio 9 Steps

How To Calculate Amount Of Unemployment In Ohio 9 Steps

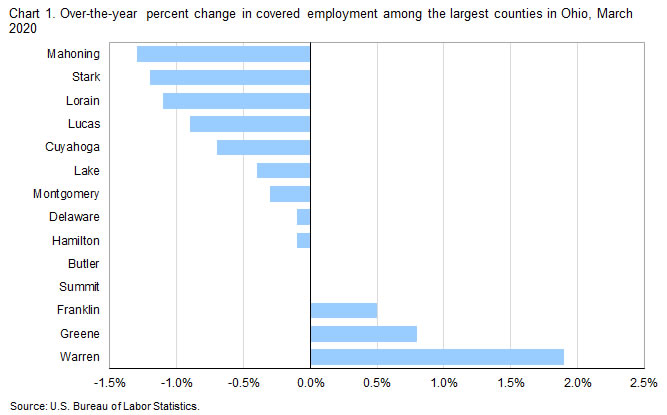

County Employment And Wages In Ohio First Quarter 2020 Midwest Information Office U S Bureau Of Labor Statistics

County Employment And Wages In Ohio First Quarter 2020 Midwest Information Office U S Bureau Of Labor Statistics

Seneca County S Unemployment Rate Increases

Seneca County S Unemployment Rate Increases

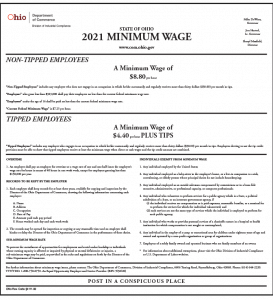

Free Minimum Wage Poster Labor Law Poster 2021

Free Minimum Wage Poster Labor Law Poster 2021

Ohio Unemployment Oh Benefits Eligibility Claims

Ohio Unemployment Oh Benefits Eligibility Claims

Unemployment Benefits Comparison By State Fileunemployment Org

Unemployment Benefits Comparison By State Fileunemployment Org

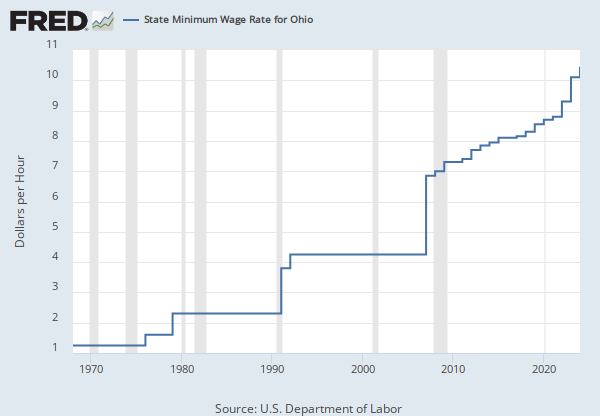

2020 Ohio Minimum Wage Rate Jumps 1 75

2020 Ohio Minimum Wage Rate Jumps 1 75

Unemployment Compensation In Ohio

Extended Unemployment Benefits In Ohio What You Should Know

Extended Unemployment Benefits In Ohio What You Should Know

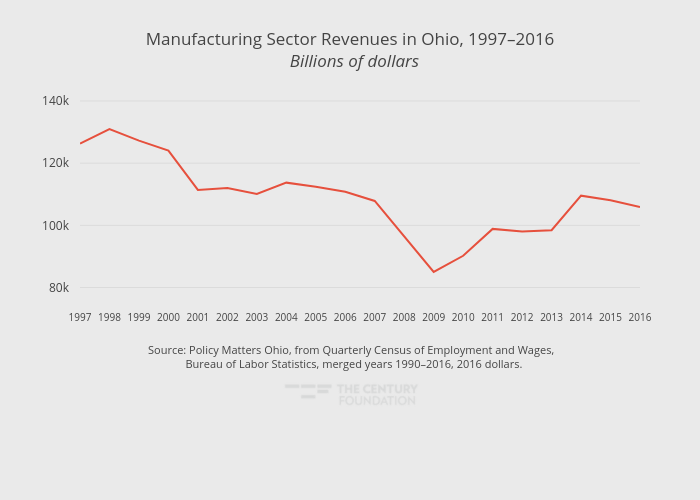

Manufacturing A High Wage Ohio

Manufacturing A High Wage Ohio

How To Calculate Amount Of Unemployment In Ohio 9 Steps

How To Calculate Amount Of Unemployment In Ohio 9 Steps

How To Calculate Amount Of Unemployment In Ohio 9 Steps

How To Calculate Amount Of Unemployment In Ohio 9 Steps

Tens Of Thousands Of Ohioans Told To Repay Unemployment Benefits Scene And Heard Scene S News Blog

Tens Of Thousands Of Ohioans Told To Repay Unemployment Benefits Scene And Heard Scene S News Blog

Ohio Employers It S Time To Update The Ohio 2021 Minimum Wage Posting Has Released Compliance Poster Company

Ohio Employers It S Time To Update The Ohio 2021 Minimum Wage Posting Has Released Compliance Poster Company

Q A Your Most Common Unemployment Questions The Lima News

Q A Your Most Common Unemployment Questions The Lima News

Unemployment Changes In Ohio Due To Covid 19 Equality Ohio

Unemployment Changes In Ohio Due To Covid 19 Equality Ohio

How To Calculate Amount Of Unemployment In Ohio 9 Steps

How To Calculate Amount Of Unemployment In Ohio 9 Steps

Post a Comment for "Ohio Unemployment Wage Rate"