Is Unemployment Unearned Income

To determine if your unemployment is taxable see Are Payments I Receive for Being Unemployed Taxable. Unearned and earned income are taxed differently.

Earned Income Vs Unearned Income What S The Difference Millers On Fire

Earned Income Vs Unearned Income What S The Difference Millers On Fire

While unemployment benefits are taxable they arent considered earned income.

Is unemployment unearned income. Many are just now becoming aware that income from unemployment is taxable and is included in their Adjusted Gross Income for determining other tax benefits. Does the unearned income count towards her own support. The federal tax filing deadline for individuals has been extended to May 17 2021.

If it does then no I did not provided more the 50 oh her support. Working young adults are special Kiddies. It cannot be used in contributions to individual retirement accounts.

Children who are subject to the kiddie tax. If you received unemployment compensation during the year you must include it in gross income. ATX gives me the warning Return is for a child of age 18 and investment income exceeds 2200.

Unearned income includes investment-type income such as taxable interest ordinary dividends and capital gain distributions It also includes unemployment compensation taxable Social Security. Here is some more information about unemployment benefits of which you may be unaware. Unearned income is not limited to investment income such as dividends and interest.

2020 Instructions for IRS Form 8615 Tax for Certain Children Who Have Unearned Income states. Under normal circumstances receiving unemployment would result in a. But what does support mean.

Unearned income differs from earned income which is income gained from employment work or through business activities. Unemployment income is considered unearned income for kiddie tax purposes. Receiving unemployment benefits doesnt mean youre automatically ineligible for the Earned Income Credit but there are other requirements youll also need to satisfy to claim the EIC.

Recent legislation modified the tax rates and brackets used to figure the tax on 2020 unearned income for certain children. CARES and COVID Tax Relief Acts Unemployment Benefits American Rescue Plan Tax-Exempt Portion of Unemployment Bogus Forms 1099-G Kiddie Tax and Unemployment States Taxation of Unemployment With the passage of the CARES Act stimulus package early in 2020. Unemployment income is treated the same as unearned income from investments.

Unearned income in-kind supplied Excluded. You might evaluate if they should file their own return. In-Kind Income is food shelter or both that you get for free or for less than its fair market value.

Yes Eloise will be subject to the kiddie tax because of her unemployment compensation. Unearned income on the other hand is not related to active work. The kiddie tax taxes the childs unearned income at the parents rate.

Normally we think of unearned income as being interest dividends and capital gains but certain other types of income including unemployment benefits are considered to be unearned income. I understand unemployment is unearned income the 14000 and the 1500 she received from her job is earned income. It includes any type of income that isnt earned income including unemployment compensation taxable Social Security benefits alimony some taxable scholarships and more.

Uniform Relocation Assistance Real Property Acquisition Policies Act of 1970 PL 94-646 section 218. Examples of unearned income include pensions social security benefits real estate income unemployment compensation and capital gains. For tax year 2020 dependent children with unearned income above a certain amount are taxed at the parents individual tax rate.

Quarterly estimated tax payments are still due on April 15 2021. If youre collecting unemployment benefits and youre smart the amount youre receiving is an after-tax amount. There are a few places where they ask about earned vs unearned income.

Yes unemployment benefits are a form of unearned income thats taxable and reportable on federal and state returns. Form 8615 may be required if earned income is not more than half their support Obviously the unemployment is unearned income but it is certainly not investment income. Unearned Income is all income that is not earned such as Social Security benefits pensions State disability payments unemployment benefits interest income dividends and cash from friends and relatives.

Unemployment Compensation UC - before deductions.

What Unearned Income Means On A Dependent S Income Tax Return Cpa Practice Advisor

What Unearned Income Means On A Dependent S Income Tax Return Cpa Practice Advisor

Earned Income Vs Unearned Income What S The Difference Millers On Fire

Earned Income Vs Unearned Income What S The Difference Millers On Fire

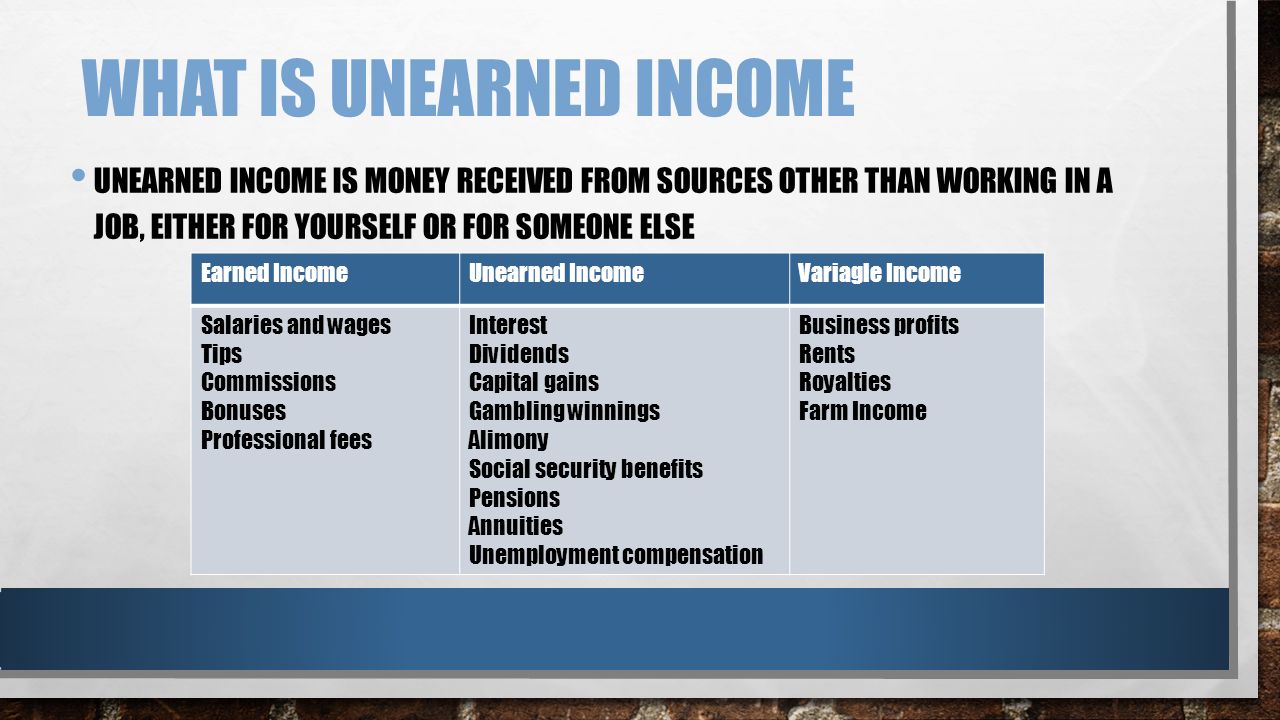

2 2 Unearned Income And Payment Ppt Video Online Download

2 2 Unearned Income And Payment Ppt Video Online Download

Onjuno What Is Unearned Income

Onjuno What Is Unearned Income

Earned Income Vs Unearned Income What S The Difference Millers On Fire

Earned Income Vs Unearned Income What S The Difference Millers On Fire

Wage Verification Form Template Awesome Sample In E Verification Letter 5 Free Documents Letter Templates Doctors Note Template Lettering

Wage Verification Form Template Awesome Sample In E Verification Letter 5 Free Documents Letter Templates Doctors Note Template Lettering

What Is Unearned Income What Does Unearned Income Mean Unearned Income Meaning Explanation Youtube

What Is Unearned Income What Does Unearned Income Mean Unearned Income Meaning Explanation Youtube

Earned Income Vs Unearned Income What S The Difference Millers On Fire

Earned Income Vs Unearned Income What S The Difference Millers On Fire

Paycheck Basics Personal Finance Income Unearned Income An Individual S Income Derived From Sources Other Than Employment Such As Incomesourcesemployment Ppt Download

Paycheck Basics Personal Finance Income Unearned Income An Individual S Income Derived From Sources Other Than Employment Such As Incomesourcesemployment Ppt Download

Of Snap Families With Unearned Income Child Support Comprises Large Share Of It Center On Budget And Policy Priorities

Of Snap Families With Unearned Income Child Support Comprises Large Share Of It Center On Budget And Policy Priorities

What S The Difference Between A Tax Return And A Refund What About Between Earned And Unearned Inc Federal Income Tax Tax Preparation Social Security Benefits

What S The Difference Between A Tax Return And A Refund What About Between Earned And Unearned Inc Federal Income Tax Tax Preparation Social Security Benefits

Chapter 2 Income Benefits And Taxes What Is

Chapter 2 Income Benefits And Taxes What Is

Kiddie Tax On Unearned Income H R Block

Kiddie Tax On Unearned Income H R Block

![]() Unearned Income Icon Of Colored Outline Style Available In Svg Png Eps Ai Icon Fonts

Unearned Income Icon Of Colored Outline Style Available In Svg Png Eps Ai Icon Fonts

5 25 Set Of 3 Vintage Theatre Acting Books Vintage Theatre Book Set Tag Art

5 25 Set Of 3 Vintage Theatre Acting Books Vintage Theatre Book Set Tag Art

Post a Comment for "Is Unemployment Unearned Income"