How To Get Iowa Unemployment Tax Form

Rates vary from 0000 to 9000 on table 1 and from 0000 to 7000 on table 8. Printer Friendly Version Iowa Workforce Development will begin mailing form 1099-G on Jan 21 2020.

Iowa Unemployment 1099 G Online Fill Online Printable Fillable Blank Pdffiller

Iowa Unemployment 1099 G Online Fill Online Printable Fillable Blank Pdffiller

Find a line-by-line breakdown of the IA 1040 tax form here.

How to get iowa unemployment tax form. Contact the IRS at 800-829-1040 to request a copy of your wage and income information. Applying the Rate Table to the Rankings. The 1099-G includes any unemployment insurance benefits issued December 29 2018 through December 30 2019 and any federal andor state taxes that were withheld.

But you dont have to wait for your copy of the form to arrive in the mail. If Iowa-source income is 1000 or more a nonresident isnt. If you would like to request an additional copy of your 1099-G form to be mailed to your address on file please contact 800 244-5631.

State Income Tax Range. The latest stimulus includes a federal tax exemption for up to 10200 in unemployment benefits received in 2020. It contains information about.

033 on up. The Internal Revenue Service and the State Department of Revenue and Finance will also be provided this information. Employers whose benefit ratios place them in Rank 1 are assigned the corresponding Rank 1 rate from the rate table.

1099G form is needed to complete your state and federal tax returns if you received unemployment insurance benefits last year. People filing an original 2020 Iowa tax return should report the unemployment compensation exclusion amount on Form IA 1040 Line 14 using a code of M. Many of the forms are fillable Adobe Reader Version 11 includes a feature that allows a fillable form to be saved.

See form for instructions on how to submit. You can download Form 4506-T at IRSgov or order it from 800-TAX-FORM. Youll transfer the amount in Box 1 of Form 1099-G to Line 7 of Schedule 1 then the withholding amount in Box 4 of the 1099-G if any goes directly onto your 1040 tax return on Line 25b.

You should be able to get an electronic copy if you log into CONNECT and go to My 1099-G and 49Ts in the main menu. You can also use Form 4506-T to request a copy of your previous years 1099-G. Youth and Young Adult Services.

Call the Department for further assistance. All Forms and Publications Forms for Individuals Forms for Employers Iowa Workforce Development Administration Documents Labor Market Information Documents Unemployment Insurance Documents Workforce Services Documents Annual Reports. Heres how to claim it even if youve already filed your 2020 tax return.

Nonresidents must also file an Iowa return if they are subject to Iowa lump-sum tax or Iowa minimum tax even if Iowa-source income is less than 1000. Income from pass-through entities such as partnerships and S-corporations. If you were out of work for some or all of the previous year you arent off the hook with the IRS.

This tax form provides the total amount of money you were paid in benefits from NYS DOL in 2020 as well as any adjustments or tax withholding made to your benefits. Intended for those who would benefit from a more comprehensive set of instructions. IDES mailed paper copies of the 1099-G form in January to all claimants who opted NOT to receive their form electronically.

Unemployment compensation has its own line Line 7 on Schedule 1 which accompanies your 1040 tax return. Those who received unemployment benefits for some or all of the year will need a 1099-G form. Mail the completed form to.

After recently mailing the 1099-G forms IWD discovered the forms may not have included all of the benefits received by claimants in 2020. This means table 1 collects the most UI tax and table 8. Youll also need this form if you received payments as part of a governmental paid family leave program.

Unemployment Insurance Tax Rate Tables. March 20 2021 at 941 am. TaxWatch What to do if you already filed taxes but want to claim the 10200 unemployment tax break Last Updated.

Work Opportunity Tax Credit. The Iowa Department of Revenues ID Number is 42-6004574 The Tax Year shown on the form is the tax year for which you received the refund The Reportable Refund shown is the amount of an Iowa income tax refund you received If you received a refund for more than one tax year you will receive a 1099-G for each year. The Iowa law stipulates that UI taxes may be collected from employers under eight different tax rate tables and each tax rate table has 21 rate brackets or ranks.

Likewise employers in Rank 2 are assigned the. Your Notice of Tax Rate is sent in November of each year for the following tax year. The Statement for Recipients of Certain Government Payments 1099-G tax forms are now available for New Yorkers who received unemployment benefits in calendar year 2020.

If you need a different year from the current filing year select the applicable YEAR from the drop down. There are three options. DES MOINES - Today Iowa Workforce Development announced that it will reissue new 1099-G tax forms to all claimants on Jan 25 2021.

Https Www Iowaworkforcedevelopment Gov Sites Search Iowaworkforcedevelopment Gov Files Documents 2018 2020 2021 20english 20unemployment 20insurance 20claimant 20handbook 20updates Pdf

How To File A Weekly Claim Cares Act Updates Iowaworkforcedevelopment Gov Www

How To File A Weekly Claim Cares Act Updates Iowaworkforcedevelopment Gov Www

3 12 154 Unemployment Tax Returns Internal Revenue Service

3 12 154 Unemployment Tax Returns Internal Revenue Service

Fill Free Fillable Forms State Of Iowa Ocio

Fill Free Fillable Forms State Of Iowa Ocio

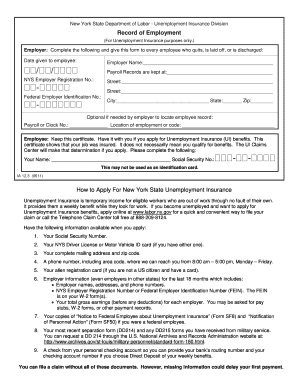

2018 2021 Form Ny Dol Ia 12 3 Fill Online Printable Fillable Blank Pdffiller

2018 2021 Form Ny Dol Ia 12 3 Fill Online Printable Fillable Blank Pdffiller

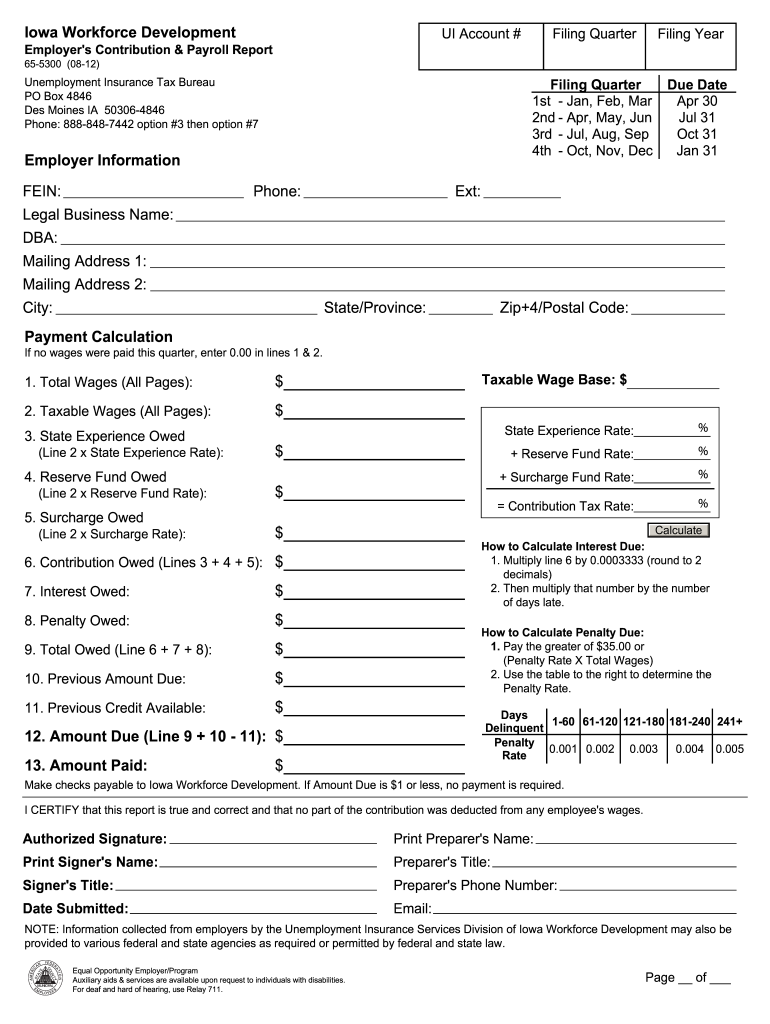

Iowa Form 65 5300 Fill Online Printable Fillable Blank Pdffiller

Iowa Form 65 5300 Fill Online Printable Fillable Blank Pdffiller

Unemployment Fraud Chicago Man Receives Ohio Unemployment Tax Form Despite Never Living There Abc7 Chicago

Unemployment Fraud Chicago Man Receives Ohio Unemployment Tax Form Despite Never Living There Abc7 Chicago

Https Www Iowaworkforcedevelopment Gov Sites Search Iowaworkforcedevelopment Gov Files 60 0111 20employer 27s 20notice 20of 20change Pdf

W 2 1099 Electronic Filing Iowa Department Of Revenue

W 2 1099 Electronic Filing Iowa Department Of Revenue

Unemployment Insurance For Self Employed April 16 2020 Iowaworkforcedevelopment Gov Www

Unemployment Insurance For Self Employed April 16 2020 Iowaworkforcedevelopment Gov Www

Iowa Workforce Iowaworkforce Twitter

Iowa Workforce Iowaworkforce Twitter

Ia 12 3 Record Of Employment Fill Out And Sign Printable Pdf Template Signnow

Ia 12 3 Record Of Employment Fill Out And Sign Printable Pdf Template Signnow

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back Tax Credits For People Who Work

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back Tax Credits For People Who Work

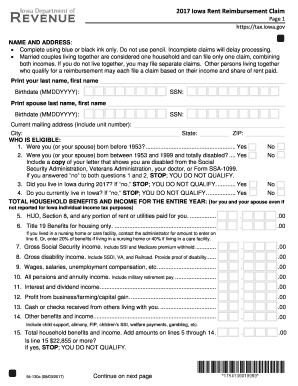

Rent Reimbursement Fill Out And Sign Printable Pdf Template Signnow

Rent Reimbursement Fill Out And Sign Printable Pdf Template Signnow

Fill Free Fillable Forms State Of Iowa Ocio

Fill Free Fillable Forms State Of Iowa Ocio

How To File For Unemployment Benefits If You Re Self Employed Youtube

How To File For Unemployment Benefits If You Re Self Employed Youtube

That Extra 600 A Week In Unemployment Benefits Is Taxable Weareiowa Com

That Extra 600 A Week In Unemployment Benefits Is Taxable Weareiowa Com

Asked And Answered Filing Taxes While On Unemployment

Asked And Answered Filing Taxes While On Unemployment

W 2 And 1099 File Upload Instructions Iowa Dept Of Revenue

W 2 And 1099 File Upload Instructions Iowa Dept Of Revenue

Post a Comment for "How To Get Iowa Unemployment Tax Form"