How To Enter Annual Income On Unemployment

You will be required to substantiate that income if requested by the EDD. When entering their yearly income consumers should consider how much they have earned so far this year add any severance pay plus unemployment including the extra 600 per week and include what might be earned if and when they return to work later this year.

Unemployment Verification Letter Sample Awesome 9 10 Letter Unemployment Verification Dannybarrantes Temp Letter Templates Letter Of Employment Letter Sample

Unemployment Verification Letter Sample Awesome 9 10 Letter Unemployment Verification Dannybarrantes Temp Letter Templates Letter Of Employment Letter Sample

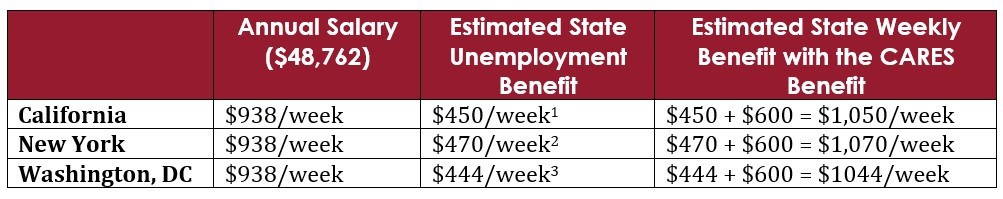

This includes any additional federal unemployment income provided through the CARES Act.

How to enter annual income on unemployment. The amount will be carried to the main Form 1040. That assumes you meet the income restrictions and youre entitled to the full 10200 and your spouse doesnt also have unemployment. For description type UCE10200.

How to make an estimate of your expected income Step 1. Unemployment benefits are affected by certain kinds of payments. Unemployment compensation has its own line Line 7 on Schedule 1 which accompanies your 1040 tax return.

Back To Main Menu Close. If expenses exceed the 3 rule enter only the amount over the 3. 240 hours x 750 1800 1840 hours x 800 14720 Annual Income 16520 See Appendix 8 for an explanation of the correct approach to rounding numbers C.

If you work or earn any wages while receiving Unemployment Insurance UI benefits you must report these wages when you certify for benefits. Start with your households adjusted gross income AGI from your most recent federal income tax return. If you have farming or fishing income enter it as either farming or fishing income or self-employment but not both.

If you are eligible to claim the Property Tax Fairness Credit andor the Sales Tax Fairness Credit line 25d andor line 25e follow these instructions for completing Schedule PTFCSTFC. Include both taxable and non-taxable Social Security income. When certifying for UI benefits report your work and gross wages wages earned before any deductions during the actual.

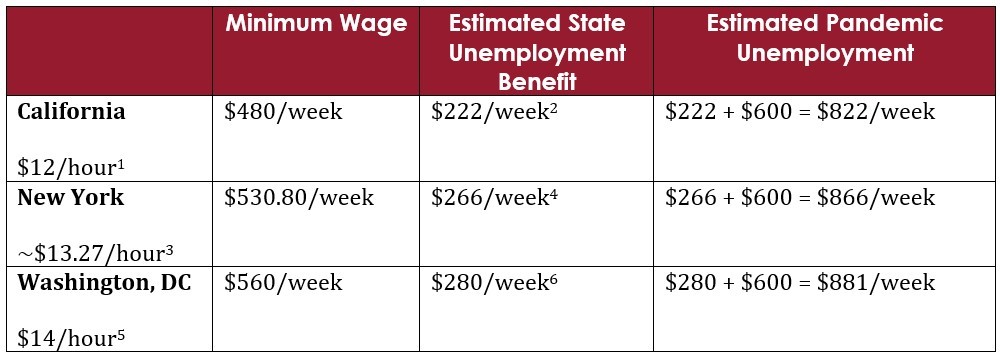

When entering your yearly income consider how much you have earned so far this year add any severance pay plus unemployment including the extra 600 per week and include what might be earned if and when you return to work later this year. It will go on line 8 of Schedule 1 as a deduction -. Annual Income is calculated as follows.

If you received unemployment compensation during the year you should receive Form 1099-G which is a report of income received from a government source showing the amount you were paid. Some circumstances present more than the usual challenges to estimating anticipated income. Gathering the Necessary Information Before you can get started youll need some basic information.

You may be eligible for more than the minimum weekly benefit amount of 167 if your annual income for 2019 that you report on your PUA application meets a minimum threshold. How to Report Work and Wages. 6 2021 you should be careful to not count this income for the rest of the year in your annual income estimate while using the Shop and Compare Tool or you could lose out on financial help.

Remember to keep all of your forms including any 1099-G form you receive with your tax records. If you earned at or below this amount you will remain at 167 per week. We understand this is a guess.

- On the next screen youll get blanks to enter the amount and a description. For the amount enter with a minus sign. 51 rows Top 50 Highest Paying States for Unemployment Jobs in the US.

You can also enter your monthly income. You should plan on covering a full year of pay stubs. Weve identified 11 states.

On Form 1040ME line 14 enter your federal adjusted gross income from line 11 of the federal return Form 1040 or Form 1040-SR. Annual income 18f enter zero. The State of NJ site may contain optional links information services andor content from other websites operated by third parties that are provided as a convenience such as Google Translate.

Youll transfer the amount in Box 1 of Form 1099-G to Line 7 of Schedule 1 then the withholding amount in Box 4 of the 1099-G if any goes directly onto your 1040 tax return on Line 25b. You must answer all of the questions asked which includes your full name complete address Social Security number current and past employers last day of work how many hours you worked in the last week and how much your gross. You can certify with UI Online SM or by mail using the paper Continued Claim Form DE 4581 PDF.

Because Pandemic Unemployment Compensation payments end Sept. Filing for unemployment can be done online or on the phone depending on your specific state unemployment requirements. Any unemployment compensation received must be included in your income and should be reported in the appropriate sections of your federal and state tax returns.

Medical expense is 5000 3 of annual income is 2000 you would enter 3000. You report your unemployment compensation on Schedule 1 of your federal tax return in the Additional Income section. Division of Unemployment Insurance provides services and benefits to.

In order to calculate gross wages for unemployment benefits you will first need to gather your pay stubs and take note of all deductions that have occurred. If you complete lines 1a through 1e include on line 1e the total unemployment.

Income Tax Task Cards Activity Financial Literacy Math For Kids Filing Taxes

Income Tax Task Cards Activity Financial Literacy Math For Kids Filing Taxes

Median Household Income Essentially Unchanged In July 2015 Median Household Income Household Income Income

Median Household Income Essentially Unchanged In July 2015 Median Household Income Household Income Income

What Is Irs Form 1040 Income Tax Return Tax Return Income Tax

What Is Irs Form 1040 Income Tax Return Tax Return Income Tax

Who Cares Unemployment Benefits For Reduced Hours And Furloughed Employees Steptoe Johnson Llp

Who Cares Unemployment Benefits For Reduced Hours And Furloughed Employees Steptoe Johnson Llp

Best Infographics On Twitter Infographic How To Become Successful Job Security

Best Infographics On Twitter Infographic How To Become Successful Job Security

Covid 19 Unemployment Benefits Hamilton Ryker

Covid 19 Unemployment Benefits Hamilton Ryker

Understanding Your Tax Forms The W 2 Tax Forms W2 Forms Tax Time

Understanding Your Tax Forms The W 2 Tax Forms W2 Forms Tax Time

Labor And Economic Opportunity Can A Person Work Part Time And Still Collect Ui Benefits

Labor And Economic Opportunity Can A Person Work Part Time And Still Collect Ui Benefits

States Are Telling Some People To Pay Back Unemployment Benefits Marketplace

States Are Telling Some People To Pay Back Unemployment Benefits Marketplace

Who Cares Unemployment Benefits For Reduced Hours And Furloughed Employees Steptoe Johnson Llp

Who Cares Unemployment Benefits For Reduced Hours And Furloughed Employees Steptoe Johnson Llp

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Browsegrades Macroeconomics This Or That Questions Fun To Be One

Browsegrades Macroeconomics This Or That Questions Fun To Be One

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Why You Should Consider Trade School Instead Of College The Simple Dollar Trade School Vocational School Online School

Why You Should Consider Trade School Instead Of College The Simple Dollar Trade School Vocational School Online School

Ui Online Reporting Wages And Regular Earnings With Ui Online Youtube

Ui Online Reporting Wages And Regular Earnings With Ui Online Youtube

Post a Comment for "How To Enter Annual Income On Unemployment"