Does Receiving Unemployment Affect Your Taxes

Receiving any income that exceeds 12200 for a single filer must be filed. How does unemployment affect my taxes.

Pin On Personal Money Management

Pin On Personal Money Management

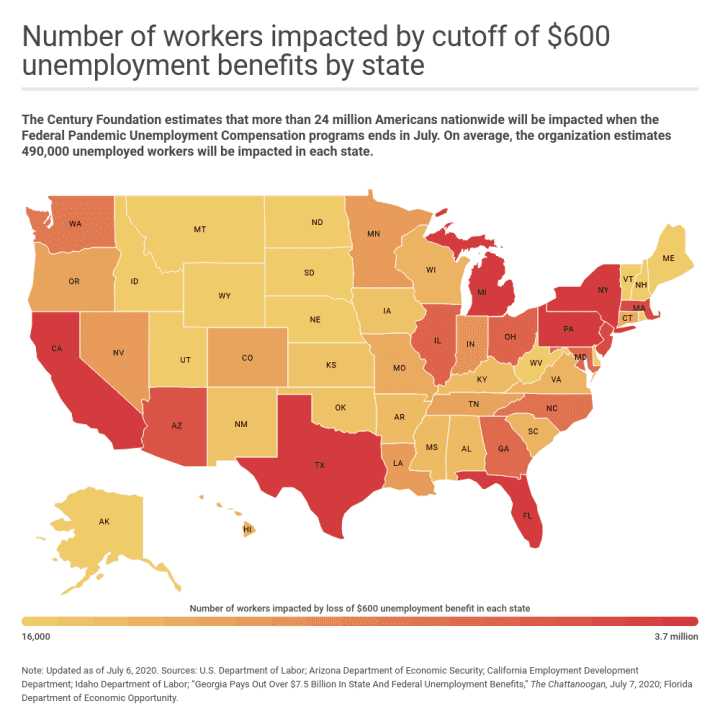

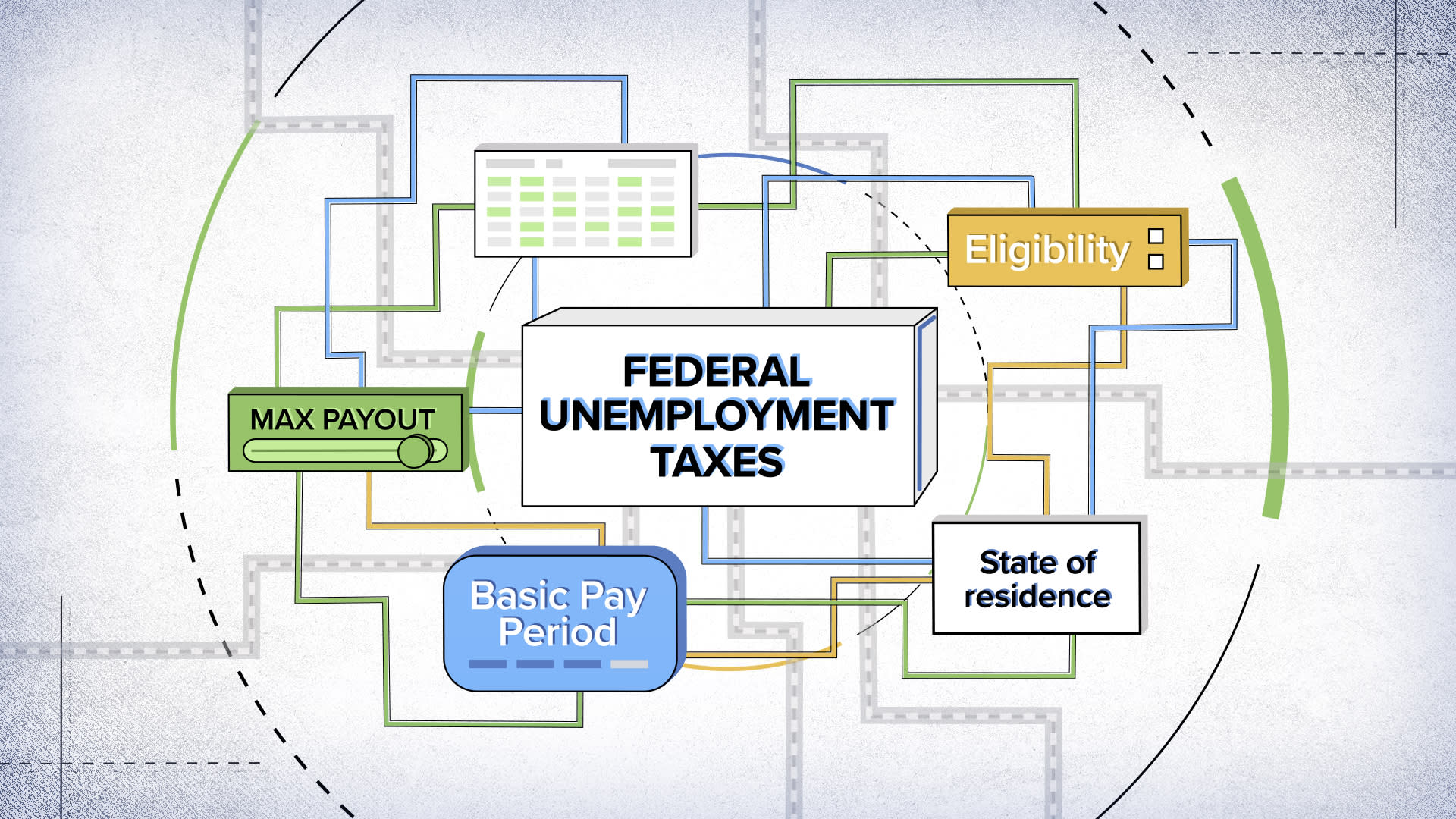

Many states cap their highest unemployment insurance UI payment at half the states average weekly wage and some have even lower benefit caps.

Does receiving unemployment affect your taxes. Otherwise the IRS can and likely will implement penalties. Ortega said if you dont have the money still. That means that your state might not impose an income tax on the compensation you received this year.

Long ago unemployment benefits were exempt from income tax. If you are receiving unemployment benefits check with your state about voluntary withholding to help cover your income taxes when you file your tax return. If you earned 18240 and received the extra 600 in COVID unemployment benefits for six months 3600 it will be subject to federal income tax but it will not reduce your Social Security.

Workers are not required to have federal taxes withheld from their benefit payments. Normally unemployment benefits are fully taxable by the IRS and must be reported on your federal tax return. To help at tax time consider withholding taxes from your unemployment.

Quarterly estimated tax payments are still due on April 15 2021. Check to see if your state is following the new federal guidelines. The next thing to remember is that state unemployment benefits are taxable.

Receiving unemployment benefits doesnt mean youre automatically ineligible for the Earned Income Credit but there are other requirements youll also need to satisfy to claim the EIC. If taxes havent been taken from your payments Ortega suggests setting aside 10 percent of the total amount of unemployment benefits received. While unemployment benefits are taxable they arent considered earned income.

Most states do not withhold taxes from unemployment benefits voluntarily but you can request they withhold taxes. UNEMPLOYMENT Unemployment benefits are taxable income which may surprise some filers. Unemployment benefits are taxable.

Unemployment benefits are generally taxable. You should be mailed a Form 1099-G before January 31 2021 for Tax Year 2020 stating exactly how much in taxable unemployment benefits you received. Unemployment compensation is considered taxable income by the IRS and most states thus you are required to report all unemployment income as reported on Form 1099-G on your income tax return.

While the federal government considers unemployment as taxable income not all states do. Filing late as usual will also subject you to interest charges. You dont have to pay Social Security and Medicare taxes on your unemployment benefits but you do have to report them on your tax return as income.

WASHINGTON With millions of Americans now receiving taxable unemployment compensation many of them for the first time the Internal Revenue Service today reminded people receiving unemployment compensation that they can have tax withheld from their benefits now to help avoid owing taxes on this income when they file their federal income tax return next year. If your income is below 150000 per year you wont be taxed for the first 10200 of unemployment benefits you received in 2020. You should file your taxes even if you are unemployed or furloughed.

Unfortunately thats no longer true. Any unemployment benefits you receive over that threshold or any. Under normal circumstances receiving unemployment would result in a reduction of both credit.

Not only is unemployment compensation taxable but receiving it can affect some tax credits you might be eligible for and are counting on to defray those 2020 taxes due. Something else to consider is if you usually get the Earned Income Credit EIC each year Capelli said. This tax break will be welcome news for.

While they are given the option to have it withheld few opt to. Uncle Sam taxes unemployment benefits as if they were wages although up to 10200 of unemployment compensation received in 2020 is exempt from federal tax. The state notifies the IRS that you are receiving it so failing to declare your income will result in you end up on the IRS audit list and that could mean lots of trouble down the line as an IRS investigating agent asks you detailed questions.

While those on unemployment dont have to pay Social Security or Medicare taxes typically about a combined 765 rate you do have to pay federal income taxes and state taxes in. When you enter your Form 1099-G well determine whether or not you need to pay any state income tax. The federal tax filing deadline for individuals has been extended to May 17 2021.

And if you received unemployment benefits youre going to owe federal and likely state income taxes on those payouts.

Weekly Waterfall Evergreen Financial Tips For Students Families And Seniors Ovlg Financial Tips Paying Taxes Financial

Weekly Waterfall Evergreen Financial Tips For Students Families And Seniors Ovlg Financial Tips Paying Taxes Financial

How Unemployment Can Affect Your Tax Return

How Unemployment Can Affect Your Tax Return

How Unemployment Can Affect Your Tax Return

How Unemployment Can Affect Your Tax Return

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Receiving Unemployment Payments Tax Season Might Cost You Next Year

Receiving Unemployment Payments Tax Season Might Cost You Next Year

057 Music For Massage One Gain Of Massage Is To Guide Your Body S Healing In Your Mind S Eye Chiropractic Care Massage Benefits Craniosacral Therapy

057 Music For Massage One Gain Of Massage Is To Guide Your Body S Healing In Your Mind S Eye Chiropractic Care Massage Benefits Craniosacral Therapy

From Now On No More Calorie Count Diet A Stat By Freeletics Nutrition Shows You Why Training Plan Freeletics Individual Training

From Now On No More Calorie Count Diet A Stat By Freeletics Nutrition Shows You Why Training Plan Freeletics Individual Training

How Unemployment Affects Your Taxes Taxact Blog

How Unemployment Affects Your Taxes Taxact Blog

Congress Wants To Waive Taxes On Unemployment Some States May Not

Congress Wants To Waive Taxes On Unemployment Some States May Not

How Will Unemployment Benefits Impact Your 2020 Taxes Legalzoom Com

How Will Unemployment Benefits Impact Your 2020 Taxes Legalzoom Com

How Unemployment Can Affect Your Tax Return

How Unemployment Can Affect Your Tax Return

Tax Checklists For Individuals Or Bloggers Small Business Tax Checklist Tax Prep Diy Taxes

Tax Checklists For Individuals Or Bloggers Small Business Tax Checklist Tax Prep Diy Taxes

Receiving Unemployment Payments Tax Season Might Cost You Next Year

Receiving Unemployment Payments Tax Season Might Cost You Next Year

Receiving Unemployment Payments Tax Season Might Cost You Next Year

Receiving Unemployment Payments Tax Season Might Cost You Next Year

I Cant Wait Until The Child Support Papers Are Finished Ur Gonna Really Be C Child Support Laws Ideas Of Chil Child Support Laws Child Support Supportive

I Cant Wait Until The Child Support Papers Are Finished Ur Gonna Really Be C Child Support Laws Ideas Of Chil Child Support Laws Child Support Supportive

We Couldn T Process Your Credit Card Vector Free Image By Rawpixel Com Wan

We Couldn T Process Your Credit Card Vector Free Image By Rawpixel Com Wan

Pyrin Child Support Quote Calculate Child Support Payment Between You And Your Ex Husband Chi Childcare Quotes Child Support Quotes Child Support Payments

Pyrin Child Support Quote Calculate Child Support Payment Between You And Your Ex Husband Chi Childcare Quotes Child Support Quotes Child Support Payments

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Is Unemployment Taxed H R Block

Is Unemployment Taxed H R Block

Post a Comment for "Does Receiving Unemployment Affect Your Taxes"