Does Not Filing Taxes Affect Unemployment

The legislation signed on March 11 allows taxpayers who earned less than 150000 in modified adjusted gross income to exclude unemployment compensation up to 20400 if married filing. Tax impact of benefits Unemployment benefits are included along with your other income such as wages salaries and bank interest For tax year 2020 the first 10200 of unemployment income are tax free for taxpayers with an AGI of less than 150000.

Paying Taxes On Unemployment Checks Everything You Need To Know Cnet

Paying Taxes On Unemployment Checks Everything You Need To Know Cnet

Colorado for example charges a tax rate of 463 so for 10200 in.

Does not filing taxes affect unemployment. State Taxes on Unemployment Benefits. On March 31 the IRS announced taxpayers who have already filed would not have to resubmit their tax. Californians do not have to pay state income taxes on unemployment benefits.

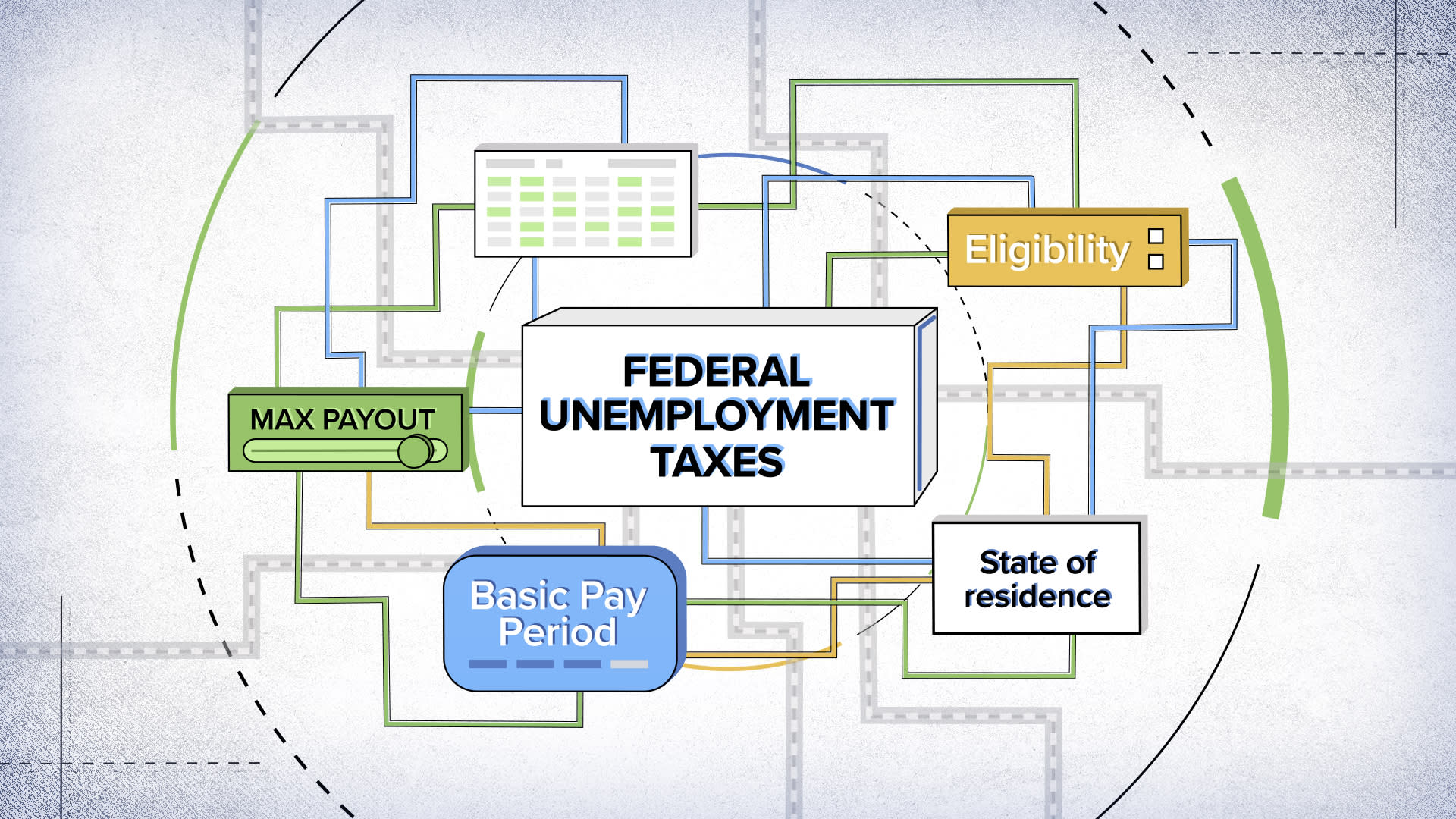

Workers are not required to have federal taxes withheld from their benefit payments. Additionally unemployment benefits are always subject to federal taxes but a handful of states do not tax it. Workers are not required to have federal taxes withheld from their benefit payments.

Of course you could also wait until you file your taxes and pay any tax you owe at that time. You will pay taxes on your unemployment compensation. JACKSONVILLE Fla Some unemployed Floridians who didnt have taxes deducted from their unemployment benefits may have a hefty payment to the government in the coming months.

Youll still pay significantly less in FICA taxes than you would have if youd been working if you collected unemployment through a significant part of the year. If you are receiving unemployment benefits check with your state about voluntary withholding to help cover your income taxes when you file your tax return. Unemployment benefits are taxable income which may surprise some filers.

The legislation signed on March 11 allows taxpayers who earned less than 150000 in modified adjusted gross income to exclude unemployment compensation up to 20400 if married filing. While they are given the option to have it withheld few opt to. You may need to gear up for a tax bill when you file your state income taxes this year.

Just make sure you file a tax return next year even if you cant afford to pay. The IRS told Americans to wait to file an. 2 days agoUnemployment benefits are taxable income which may surprise some filers.

If you received unemployment benefits in 2020 and youve already filed your tax returns the Internal Revenue Service is saying you dont have. A lot of people did. By signing the plan into law on March 11 Congress removed the federal taxability of 2020 unemployment benefitsup to 10200 for individuals and 20400 for married couples filing.

2 days agoHowever rampant unemployment put some families at risk of missing out or getting a smaller credit as unemployment is not considered earned income in the eyes of the IRS. Most states do not withhold taxes from unemployment benefits voluntarily but you can request they withhold taxes. You can choose to have federal income taxes withheld from your unemployment compensation when you apply for unemployment benefits or you can choose not to do so and just pay estimated taxes each quarter to avoid a tax bill when you file your return.

The failure to file penalty is pretty steep at 5 per month up to 25 of your tax bill. You should be mailed a Form 1099-G before January 31 2021 for Tax Year 2020 stating exactly how much in taxable unemployment benefits you received. For people who have not yet filed their 2020 California income tax.

The 19 trillion Covid relief bill gives a federal tax break on up to 10200 of unemployment benefits. Unemployment tax credit. Unemployment compensation is considered taxable income by the IRS and most states thus you are required to report all unemployment income as reported on Form 1099-G on your income tax return.

Pay them upfront either automatically or. Unemployment compensation is not subject to FICA taxes the flat-percentage Social Security and Medicare taxes that would normally be withheld from your paycheck if you were working. Additionally unemployment benefits are always subject to federal taxes but a handful of states do not tax it.

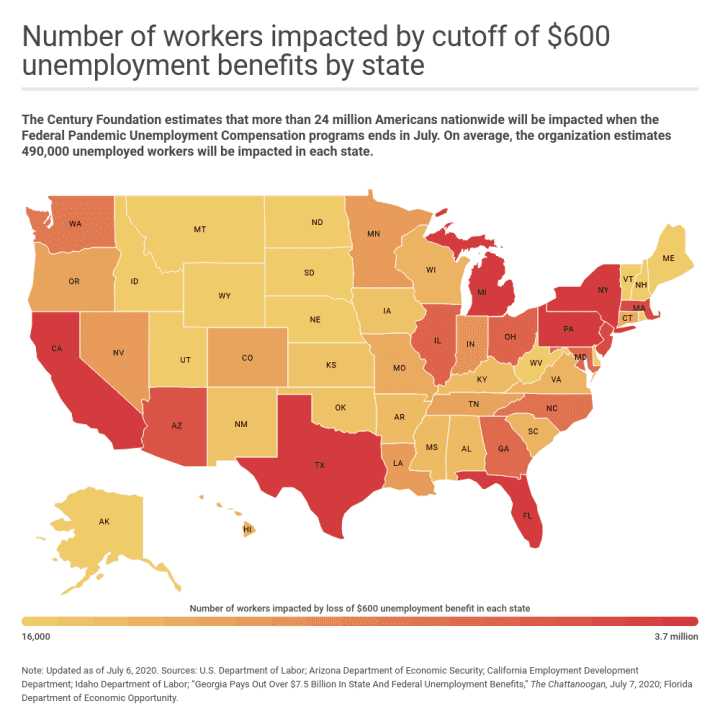

Unemployment benefits are generally taxable. While they are given the option to have it withheld few opt to. According to the IRS more than 23 million Americans filed for unemployment last year.

Taxes 2021 Everything New Including Deadline Stimulus Payments And Unemployment Cnet

Taxes 2021 Everything New Including Deadline Stimulus Payments And Unemployment Cnet

If You Were On Unemployment Last Year You Ll Probably Get A Tax Break Marketplace

If You Were On Unemployment Last Year You Ll Probably Get A Tax Break Marketplace

How Unemployment Benefits Affect Your Tax Return R G Brenner

How Unemployment Benefits Affect Your Tax Return R G Brenner

Top 3 Tax Tips For Unemployment Benefits

Top 3 Tax Tips For Unemployment Benefits

Unemployment Benefits And Taxes Here S What To Do About Incorrect Tax Forms And Other Issues The Denver Post

Unemployment Benefits And Taxes Here S What To Do About Incorrect Tax Forms And Other Issues The Denver Post

2020 Unemployment Tax Break H R Block

2020 Unemployment Tax Break H R Block

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

Do I Need To File A Tax Return Forbes Advisor

Do I Need To File A Tax Return Forbes Advisor

How Unemployment Stimulus Payments Will Affect Your Taxes Abc10 Com

How Unemployment Stimulus Payments Will Affect Your Taxes Abc10 Com

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Faqs Benefits Kansas Department Of Labor

Faqs Benefits Kansas Department Of Labor

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

Is Unemployment Taxed H R Block

Is Unemployment Taxed H R Block

How Unemployment Affects Your Taxes Taxact Blog

How Unemployment Affects Your Taxes Taxact Blog

Receiving Unemployment Payments Tax Season Might Cost You Next Year

Receiving Unemployment Payments Tax Season Might Cost You Next Year

2021 Taxes A Comprehensive Guide To Filing Money

2021 Taxes A Comprehensive Guide To Filing Money

Receiving Unemployment Payments Tax Season Might Cost You Next Year

Receiving Unemployment Payments Tax Season Might Cost You Next Year

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

How Unemployment Can Affect Your Tax Return

How Unemployment Can Affect Your Tax Return

Post a Comment for "Does Not Filing Taxes Affect Unemployment"