Do I Have To Report Uber Income Under 600

If you arent eligible to receive either form you can download an annual summary of earnings. Its only replacing the use of 1099-MISC for reporting independent contractor payments.

Do You Have To File A 1099 Under 600

Do You Have To File A 1099 Under 600

The tax summary provides a detailed breakdown of your annual earnings and business-related expenses that may be deductible.

Do i have to report uber income under 600. Form 1099-NEC is not a replacement for 1099-MISC. Likewise Uber isnt required to provide a 1099-NEC if your non-driving income was less than 600. Even if the client does not issue a Form 1099-MISC the income whatever the amount is still reportable by the taxpayer.

However if you cant the income can be easily manually entered. Business owners who pay nonemployees over 600 are required to file a 1099-NEC on behalf of the freelancer to the IRS. Note that the 600 is a threshold below which a payer is not required to issue a form 1099-MISC but the recipient of.

The IRS rules do not require Uber to issue a 1099-K if you processed fewer than 200 transactions or earned 20000 or less in payments. The official IRS tax document that only applies to driversdeliverers who received more than 600 in. If you earned less than 600 for most apps you wont get a 1099.

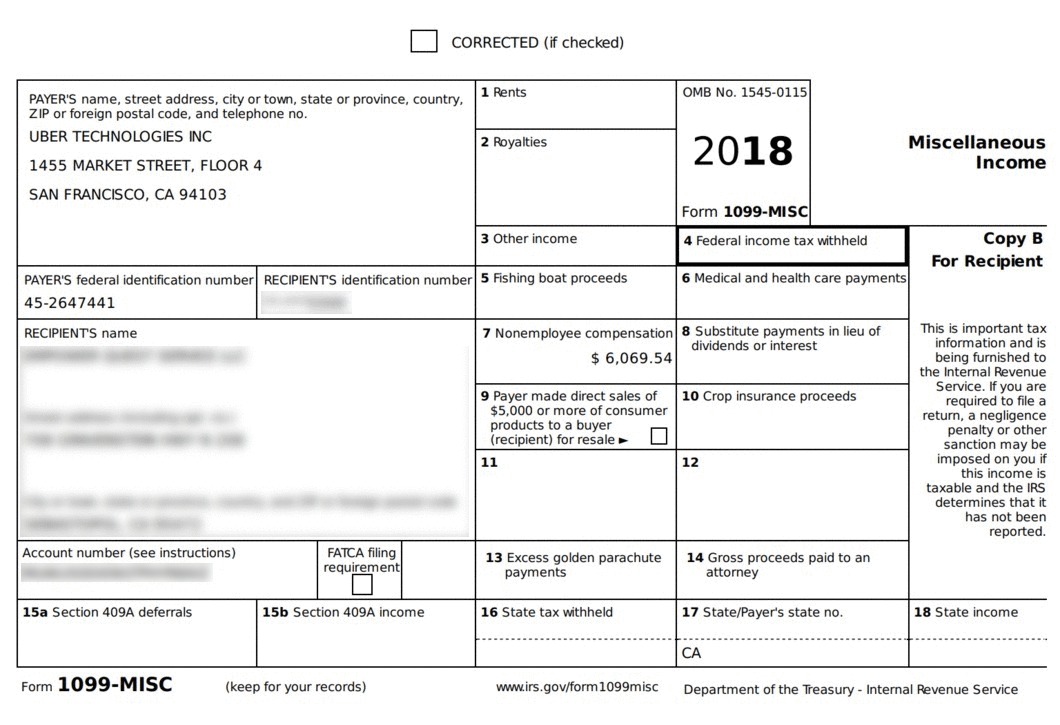

Even if you dont receive a 1099 youre still required to report your ridesharing income to the IRS. In 2018 Uber drivers may receive the following tax documents from Uber for the 2017 tax year. If your net earnings from Uber exceed 400 you must report that income.

The 1099-NEC Nonemployee Compensation is replacing the tax Form 1099-MISC Miscellaneous Income for self employed people starting the tax year 2020. Self-employed taxpayers and those who work as independent contractors typically report their miscellaneous income on Schedule C of IRS Form 1040. Yes if you are required to file a tax return you have to report ALL income whatever the amount including self-employment income under 600.

New city bonuses mentoring referral fees etc. Some confuse this with meaning they dont need to report that income on their taxes. You are required to report and pay taxes on any income you receive.

If youre not required to file an income tax return and your net earnings from Uber are less than 400 you arent required to report your Uber income. Uber drivers fall under the rules for a 1099-K for their driving services and a 1099-MISC for any other payouts eg. You could earn thousands from Uber Eats and not get a 1099 because of how they use the 1099-K.

Well describe them below but you can always learn more about these relief options through the SBA website. The 600 threshold is not related to whether you have to pay taxes. If you are a resident of Vermont Virginia or Massachusetts you will receive Form-1099-K if you earn at least 600 in rides.

Whether you report them as income is something you have to decide. Learn more about Form 1099-MISC at IRSgov. What is the Uber tax summary used for.

Drivers and delivery people who received 600 or more of these types of payments will receive a 1099-NEC. Uber does not have to send you a 1099 if you made under 600 that. They also dont have to send a 1099-MISC to anyone who made under 600 in referrals.

Your coworker is incorrect. Uber income reporting Uber sends Form 1099-K to drivers who earn more than 20000 in rides and give at least 200 rides during the calendar year. If you earn money as an independent contractor or freelancer you probably have heard that your clients dont have to send you a Form 1099-MISC unless you earn 600 or more.

Do not report this income on Form 1040 Line 21 as Other Income. If you have less than 400 in income from Uber but are otherwise required to file a tax return you must still file Schedule C regardless of the amount of your income. You should file a Form 1040 and attach Schedule C and Schedule SE to report your Uber income.

Both Uber and Lyft will report your income on Form 1099-K if you earned at least 20000 over at least 200 rides. Its only that Doordash isnt required to send you a 1099 form if you made less than 600. New COVID relief measures temporarily extends PPP through March 31 2021 and clarifies that businesses will be able to take tax.

Im an Uber Driver. Uber will provide you with a 1099-MISC if you received at least 600 in other income such as prizes or legal settlement. Yes you must report ALL of your income on your tax return.

You may also receive Form 1099-MISC if you earned over 600 from non-driving payments like referrals and bonuses. Independent contractors must report all income as taxable even if it is less than 600. The US Small Business Administration SBA has 2 programs that are new for independent contractors under the CARES Act.

The taxpayer who receives the income is required to report the income regardless of the amount even if the amount is less than 600. There is no ride or delivery threshold to receive this document. Uber actually does not have to send out 1099-Ks to anyone who made under 20000 and received less than 200 payments for driving services.

You made money but not enough to get a 1099.

Don T Pay Creditors A Dime Financial Tips Credit Repair Credit Karma

Don T Pay Creditors A Dime Financial Tips Credit Repair Credit Karma

Pin On Brazen Boss Babes By Elise Mcdowell

Pin On Brazen Boss Babes By Elise Mcdowell

January Online Income Report Blog Income Income Reports Blog Income Report

January Online Income Report Blog Income Income Reports Blog Income Report

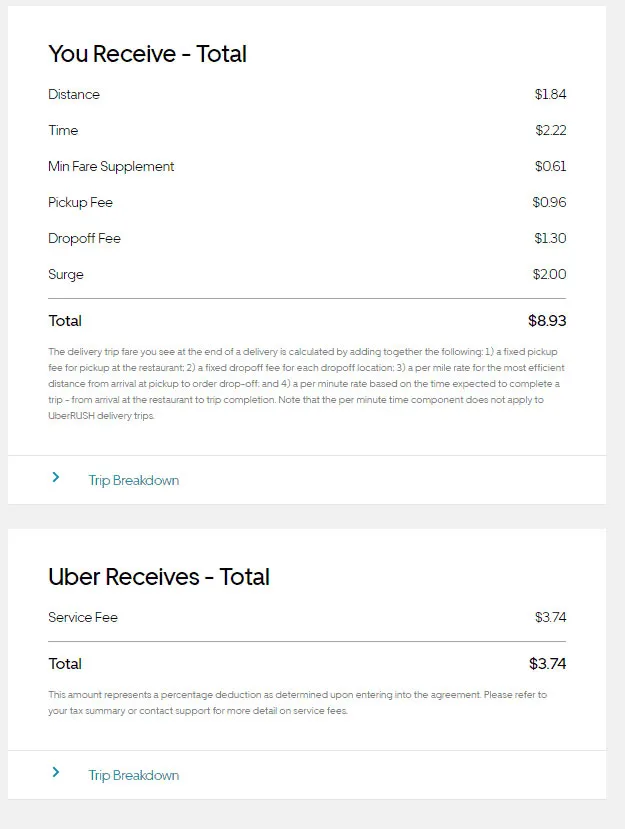

Why Does My Uber Eats 1099 Or Annual Tax Summary Say I Made More Than I Did Entrecourier

Why Does My Uber Eats 1099 Or Annual Tax Summary Say I Made More Than I Did Entrecourier

Turbotax Self Employed Explained How To File Rideshare Taxes Advice Experiences Uber Drivers Forum For Customer Service Tips Experience

Turbotax Self Employed Explained How To File Rideshare Taxes Advice Experiences Uber Drivers Forum For Customer Service Tips Experience

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2021

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2021

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2021

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2021

Tax Tips For Rideshare Drivers Tax Guide For Lyft Uber Drivers

Tax Tips For Rideshare Drivers Tax Guide For Lyft Uber Drivers

Turbotax Self Employed Explained How To File Rideshare Taxes Advice Experiences Uber Drivers Forum For Customer Service Tips Experience

Turbotax Self Employed Explained How To File Rideshare Taxes Advice Experiences Uber Drivers Forum For Customer Service Tips Experience

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2021

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2021

Https Www Ctcresources Com Uploads 3 1 6 2 31622795 Frequently Asked Questions Faqs Re Sharing Economy 2 1 20 Pdf

2015 W2 Form Free Uber Driver Tax Specialist Uber Tax Deductions You Can Claim 1099 Tax Form Fillable Forms Tax Forms

2015 W2 Form Free Uber Driver Tax Specialist Uber Tax Deductions You Can Claim 1099 Tax Form Fillable Forms Tax Forms

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2021

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2021

Top 7 Mistakes That Rideshare Drivers Make At Tax Time Stride Blog Tax Time Rideshare Driver Tax

Top 7 Mistakes That Rideshare Drivers Make At Tax Time Stride Blog Tax Time Rideshare Driver Tax

Why Does My Uber Eats 1099 Or Annual Tax Summary Say I Made More Than I Did Entrecourier

Why Does My Uber Eats 1099 Or Annual Tax Summary Say I Made More Than I Did Entrecourier

Turbotax Self Employed Explained How To File Rideshare Taxes Advice Experiences Uber Drivers Forum For Customer Service Tips Experience

Turbotax Self Employed Explained How To File Rideshare Taxes Advice Experiences Uber Drivers Forum For Customer Service Tips Experience

Post a Comment for "Do I Have To Report Uber Income Under 600"