Can You Collect Unemployment If You Are Self Employed In Texas

However for self-employed individuals without employees whose typical profit and business expenses combined are less than 950 per week the. Registering for work is separate and distinct from submitting an application for Unemployment Benefits.

Your benefit year begins on the Sunday of the week in which you applied for benefits and remains in effect for 52 weeks.

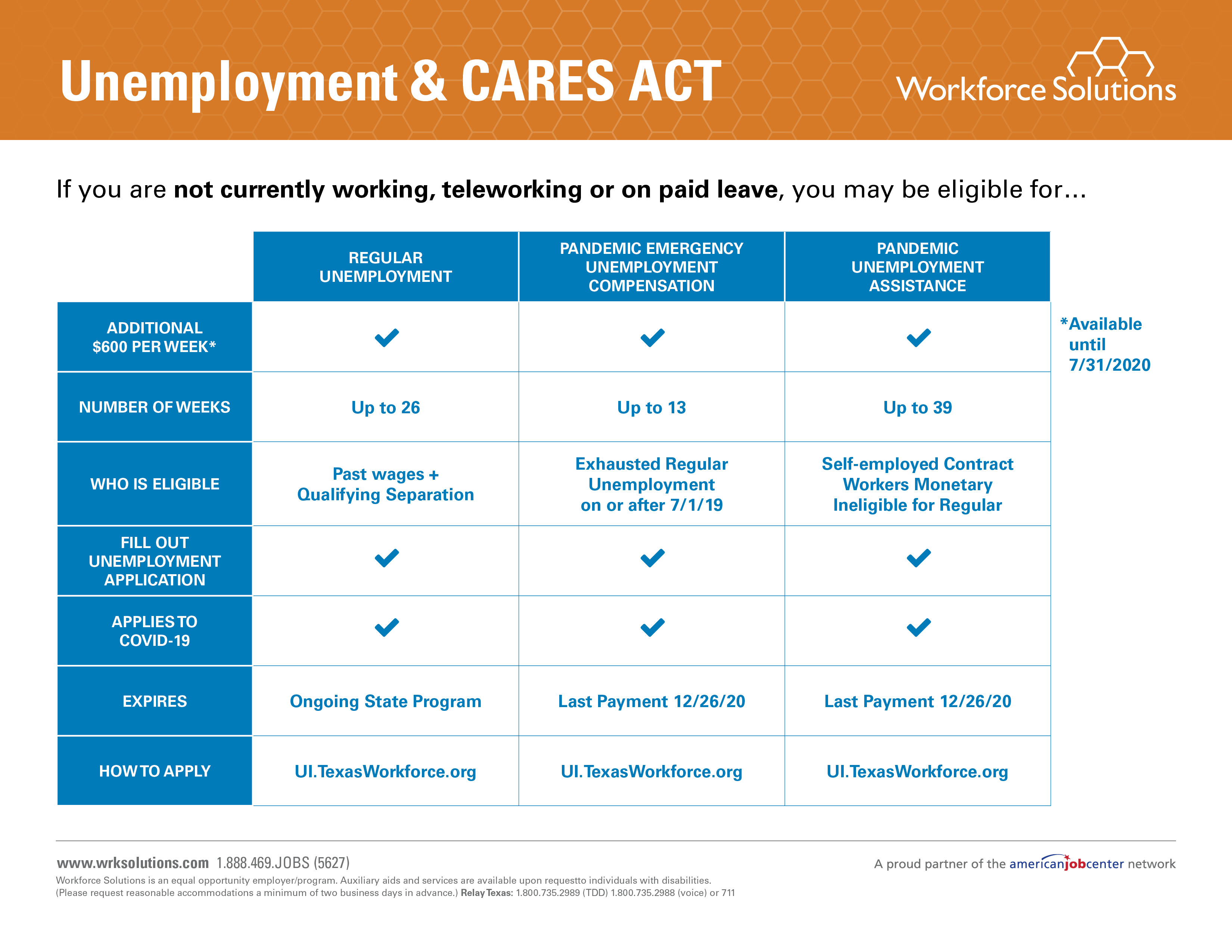

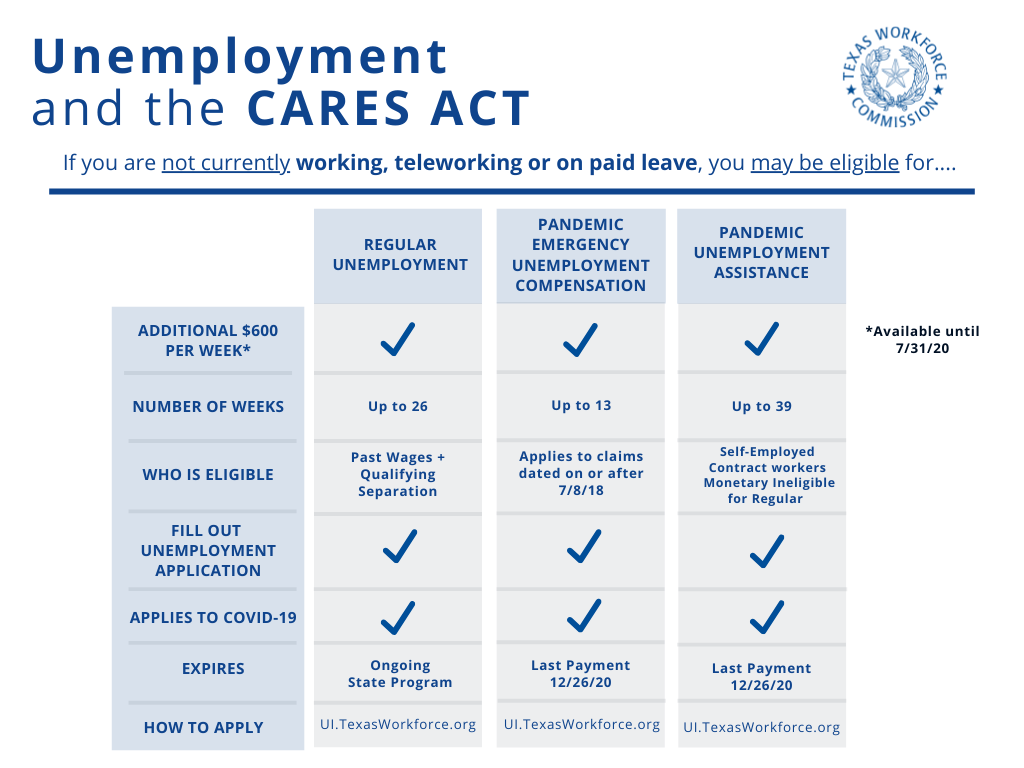

Can you collect unemployment if you are self employed in texas. Pandemic Unemployment Assistance PUA provides unemployment benefits to workers who were not traditionally eligible for benefits including self-employed people. If you are self-employed a contract worker or previously worked in a position that did not report wages you may qualify for unemployment and can apply. See also Stop Your Claim for additional information.

It is possible that if you are self-employed that you did not make unemployment insurance payments and are therefore ineligible for unemployment benefits. To receive benefits you must be totally or partially unemployed and meet the eligibility requirements. Those who are self-employed independent contractors or part-time workers are eligible.

See the Eligibility section for details. If you already applied for unemployment benefits TWC will determine if you qualify for regular unemployment or any pandemic claim programs. You may run out of benefits before your benefit year expires.

People who are self-employed including independent contractors and gig workers and dont qualify for regular unemployment insurance can receive benefits if they are unable to. Under most regular unemployment insurance regulations independent contractors and self-employed workers cant collect unemployment benefits. AUSTIN The Texas Workforce Commission TWC advises self-employed contract and gig workers who have lost work due to the COVID-19 pandemic to apply for Pandemic Unemployment Assistance PUA using Unemployment Benefits Services UBS.

Traditionally self-employed professionals are ineligible for unemployment benefits because they generally do not make contributions to the unemployment taxes that these benefits come from. During the application process when UBS asks non-traditional workers the reason for their job separation they should select reduced. In order for an individual to be eligible either you or an employer had to make contributions in the past 5 to 18 months.

This program is extended until September 6 2021 and allows individuals receiving benefits to continue collected long as the individual has not reached the maximum number of weeks. You should apply for benefits as soon as you are unemployed or underemployed. For example in New York you can work up to 7 days per week without losing unemployment benefits for that week if you work 30 hours or fewer and earn 504 or less in gross pay excluding earnings from self-employment.

With the recent introduction of new unemployment and relief benefits for self-employed professionals though your eligibility may change. You may still request payment for weeks before you start your job but be sure to report work and earnings if you start work during your payment request period. You may be required to register for work at a state employment service office to remain eligible for Unemployment Benefits.

The Texas Workforce Commission TWC has. This Pandemic Unemployment Assistance or PUA provides up to 39 weeks of benefits to qualifying individuals who are unable to work due to COVID-19. For instance with new plans like disaster relief.

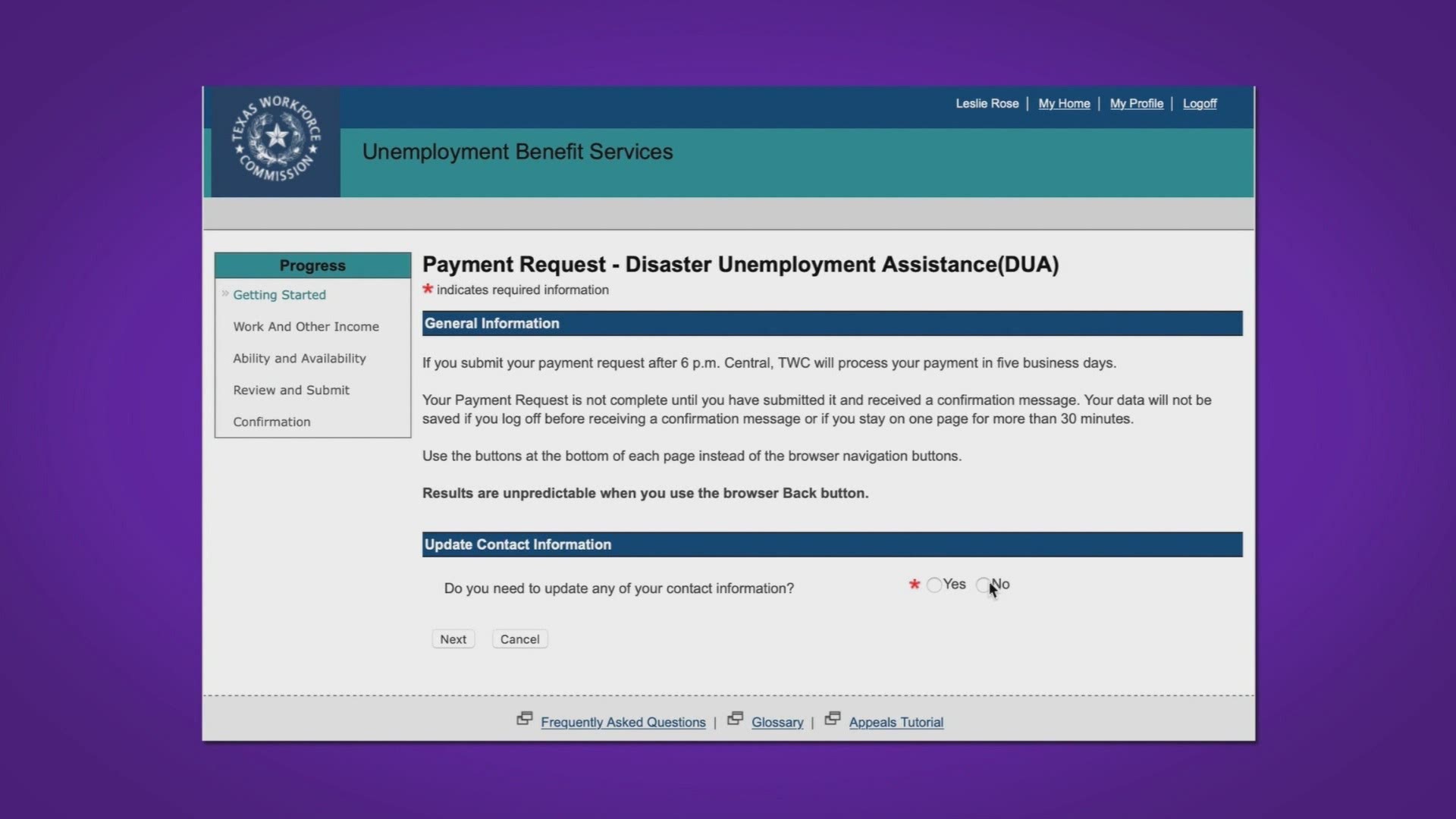

Your benefit year stays in effect for those dates even if TWC disqualifies you or you receive all of your benefits. Disaster Unemployment Assistance DUA provides unemployment benefits for individuals who lost their jobs or self-employment or who are no longer working as a direct result of a major disaster for which a disaster assistance period is declared and who applied but are not eligible for regular unemployment benefits. Self-employed workers independent contractors gig economy workers and people who have not worked long enough to qualify for the other types of unemployment assistance may still qualify for PUA if they are otherwise able to work and available for work within the meaning of the applicable state law and certify that they are unemployed partially unemployed or unable or unavailable to work.

If you work the customary number of full-time hours for your occupation you will not be eligible to receive unemployment benefits. The amount you are earning through part-time employment will usually be subtracted from this figure. Texans who are self-employed or independent workers no longer have to sit on hold with the unemployment office.

Covid 19 Unemployment Benefits And Paid Leave Faqs Lone Star Legal Aid

Covid 19 Unemployment Benefits And Paid Leave Faqs Lone Star Legal Aid

Texas Workforce Commission Offers Advice On Filing For Unemployment Benefits Kvue Youtube

Texas Workforce Commission Offers Advice On Filing For Unemployment Benefits Kvue Youtube

Employment Posters California Employment Related Securities Return Temporary Employment Agencies Bolton Contract Template Caregiver Caregiver Resources

Employment Posters California Employment Related Securities Return Temporary Employment Agencies Bolton Contract Template Caregiver Caregiver Resources

Want A Business Loan Pay Attention To These Five Areas Business Loans Loan Financial Institutions

Want A Business Loan Pay Attention To These Five Areas Business Loans Loan Financial Institutions

Frequently Asked Questions About Unemployment Benefits During The Covid 19 Pandemic Texas Riogrande Legal Aid Trla Free Legal Services

![]() Texas Tx Twc Enhanced Unemployment Benefit Extensions To September 2021 300 Fpuc Pandemic Unemployment Assistance Pua And Peuc News And Updates Aving To Invest

Texas Tx Twc Enhanced Unemployment Benefit Extensions To September 2021 300 Fpuc Pandemic Unemployment Assistance Pua And Peuc News And Updates Aving To Invest

Https Irp Cdn Multiscreensite Com 2d521d2c Files Uploaded Unemployment 20information 202020 Pdf

Q A With The Texas Workforce Commission Wfaa Com

Q A With The Texas Workforce Commission Wfaa Com

Unemployment Insurance Flowchart Checklist Texas Afl Cio

Unemployment Insurance Flowchart Checklist Texas Afl Cio

Unemployment Benefits Workforce Solutions

Unemployment Benefits Workforce Solutions

Unemployment Benefits Workforce Solutions

Unemployment Benefits Workforce Solutions

Q A With The Texas Workforce Commission Wfaa Com

Q A With The Texas Workforce Commission Wfaa Com

Texas Winter Storm Resource Disaster Unemployment Lone Star Legal Aid

Texas Winter Storm Resource Disaster Unemployment Lone Star Legal Aid

Texas Workforce Commission Answers Questions About Unemployment Benefits Texas Hotel Lodging Association

Texas Workforce Commission Answers Questions About Unemployment Benefits Texas Hotel Lodging Association

Best Health Insurance Options For The Self Employed In 2020 Best Health Insurance Health Insurance Options Buy Health Insurance

Best Health Insurance Options For The Self Employed In 2020 Best Health Insurance Health Insurance Options Buy Health Insurance

Post a Comment for "Can You Collect Unemployment If You Are Self Employed In Texas"