Will The 600 From Unemployment Be Taxed

It provided an additional 600 per week in unemployment compensation per recipient through July 2020. 9 That extra 600 is also taxable after the first 10200.

What Can And Can T Be Taxed From The 2020 Economic Stimulus Bill Wzzm13 Com

What Can And Can T Be Taxed From The 2020 Economic Stimulus Bill Wzzm13 Com

President Joe Bidens administration said on Wednesday that it will provide 235 million to the Palestinians and restart funding for the United Nations Relief and Works Agency UNRWA which assists 57 million registered Palestinian refugees.

Will the 600 from unemployment be taxed. But withholding is voluntary. 259 on up to 54544 of taxable. Unemployment benefits are generally treated as income for tax purposes.

2 days agoWith the federal government exempting some unemployment benefits from taxes there was a question of whether New York would do the same. Those benefits including the additional weekly 600 of Federal Pandemic Unemployment Compensation and the extra 300 weekly through the Lost Wages Assistance program are considered taxable. House Democrats are proposing to forgive 600 a week in pandemic unemployment benefits from the states income tax.

Unemployment benefits are not. Arizona taxes unemployment compensation to the same extent as it is taxed under federal law. That means if you got 15000 from unemployment during a typical year it would be taxed in the same income tax brackets as it would if youd earned 15000 from a job.

And yes that extra 600 a week will get taxed along with the regular benefits. Announcement that it will renew humanitarian aid marking a break with the Trump era. That is taxable as well The IRS notes unemployment compensation is taxable and must be reported on a 2020 federal income tax return.

State Income Tax Range. The new tax break is an exclusion workers exclude up to 10200 in jobless benefits from their 2020 taxable. Meanwhile Republicans who control the Senate are eyeing a 438 million tax break.

Additionally the Employment Development Department EDD did not withhold taxes from either the 600 federal unemployment booster or the 300. Under the CARES Act the federal government is paying eligible unemployed people an extra 600 a week until July 31. Yes the extra 600 that the unemployed can receive as part of the expanded federal benefits is taxed by the federal government.

2 You might be alright if you arranged to have income tax withheld from your benefits but federal law caps withholding on benefits at 10. Palestinian refugees on Thursday welcomed the US. However that will depend on many factors such as their state of residence the duration of unemployment pay and whether Congress extends the 600-a-week payments past July which seems unlikely.

Unemployment benefits are considered compensation just like income from a job. State Taxes on Unemployment Benefits. The extra 600 in weekly payments works out to 8400 in taxable income if you received the benefit for 14 weeks and remember this money is offered on.

Someone who received 10200 or more in unemployment benefits and is in the 10 tax bracket could save 1200 on federal income taxes assuming. When you are approved for unemployment benefits in New York the state gives you the option of. I know 500-600 extra per week.

They would save more than 600 in state taxes. Unlike the two stimulus checks delivered as part of a broader coronavirus relief measure unemployment benefits are taxable at the federal level and by. But you wouldnt owe payroll taxes ie Social Security and Medicare taxes on your benefits.

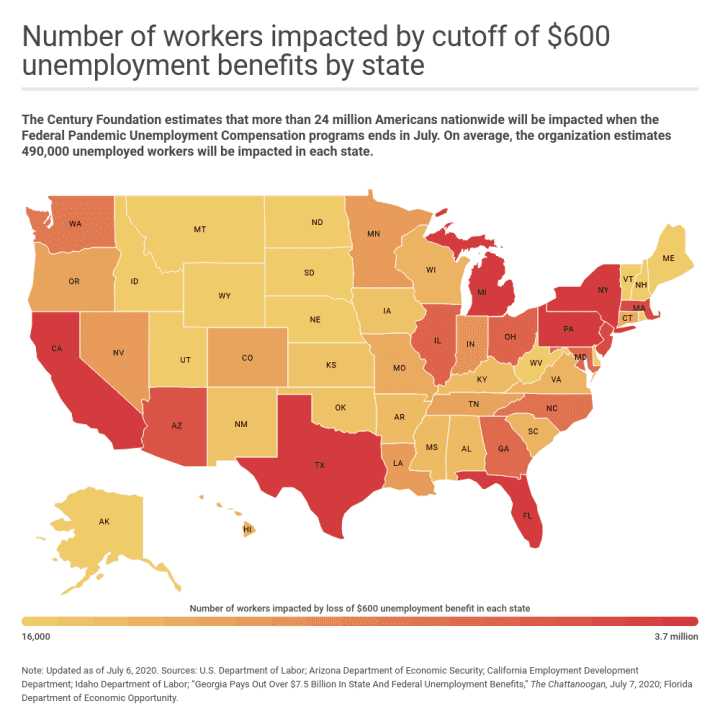

Expiring 600 Unemployment Benefits Are Essential For Some Workers

Expiring 600 Unemployment Benefits Are Essential For Some Workers

Do I Have To Pay Taxes On Unemployment Why Isn T Edd Withholding Dollars And Sense Youtube

Do I Have To Pay Taxes On Unemployment Why Isn T Edd Withholding Dollars And Sense Youtube

Why Stimulus Checks May Appear To Impact Your 2021 Tax Refund Abc11 Raleigh Durham

Why Stimulus Checks May Appear To Impact Your 2021 Tax Refund Abc11 Raleigh Durham

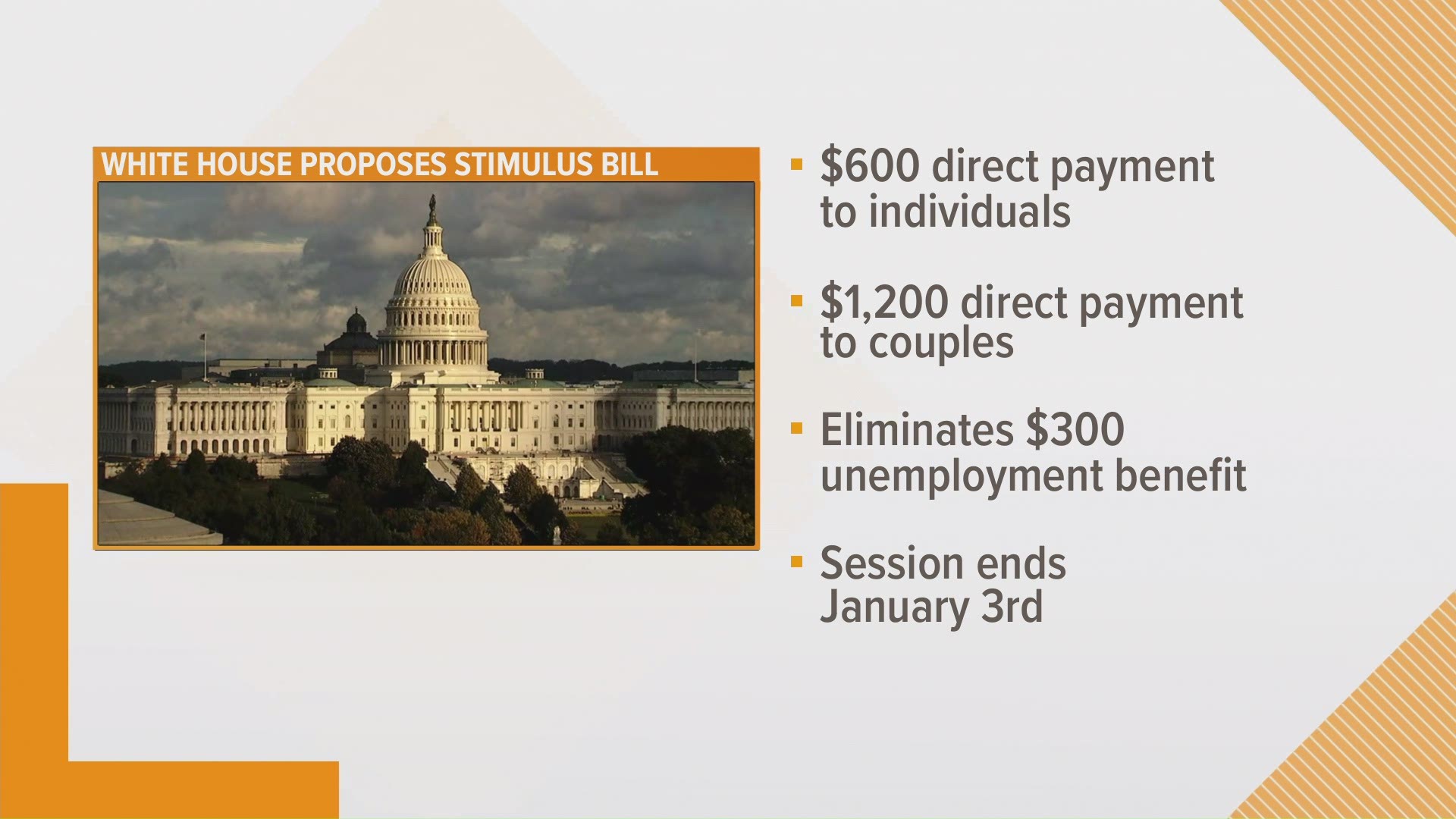

Congress Agrees On Covid Relief Bill With 600 Stimulus Checks

Congress Agrees On Covid Relief Bill With 600 Stimulus Checks

Receiving Unemployment Payments Tax Season Might Cost You Next Year

Receiving Unemployment Payments Tax Season Might Cost You Next Year

Are Your Unemployment Benefits Taxable

Are Your Unemployment Benefits Taxable

Des 600 Federal Unemployment Checks More State Aid Coming This Week

Des 600 Federal Unemployment Checks More State Aid Coming This Week

Extra 300 Fpuc Unemployment Compensation Covid Stimulus Relief Slow Rollout Out By States Aving To Invest

Extra 300 Fpuc Unemployment Compensation Covid Stimulus Relief Slow Rollout Out By States Aving To Invest

Covid 19 Details On Economic Relief For Authors The Authors Guild

Covid 19 Details On Economic Relief For Authors The Authors Guild

Did You Collect Unemployment Benefits In 2020 Act Now To Avoid A Tax Day Surprise Dollars And Sense Abc10 Com

Did You Collect Unemployment Benefits In 2020 Act Now To Avoid A Tax Day Surprise Dollars And Sense Abc10 Com

Extra 300 Fpuc Unemployment Compensation Covid Stimulus Relief Slow Rollout Out By States Aving To Invest

Extra 300 Fpuc Unemployment Compensation Covid Stimulus Relief Slow Rollout Out By States Aving To Invest

Expiring 600 Unemployment Benefits Are Essential For Some Workers

Expiring 600 Unemployment Benefits Are Essential For Some Workers

Texas Workforce Commission On Twitter Important Tax Info For Unemployment Benefits Q How Will I Know How Much In Unemployment Benefits I Received A You Will Receive Form 1099 G From Twc In

Texas Workforce Commission On Twitter Important Tax Info For Unemployment Benefits Q How Will I Know How Much In Unemployment Benefits I Received A You Will Receive Form 1099 G From Twc In

Yes Your Extra 600 In Unemployment Is Taxable Income

Yes Your Extra 600 In Unemployment Is Taxable Income

10 Days Could Mean The Difference Between Retiring Early Or Not The Motley Fool Early Retirement Day The Motley Fool

10 Days Could Mean The Difference Between Retiring Early Or Not The Motley Fool Early Retirement Day The Motley Fool

Are Unemployment Benefits Taxed Yes Claim As Income On Taxes

That Extra 600 A Week In Unemployment Benefits Is Taxable Weareiowa Com

That Extra 600 A Week In Unemployment Benefits Is Taxable Weareiowa Com

Post a Comment for "Will The 600 From Unemployment Be Taxed"