What Is The Federal Unemployment Tax Rate For 2020

It is not deducted from the employees wages. This discounted FUTA rate can be used if.

What Is The Futa Tax 2021 Tax Rates And Info Onpay

The standard FUTA tax rate is 60 on the first 7000 of taxable wages per employee which means that the maximum tax that you as an employer have to.

What is the federal unemployment tax rate for 2020. FUTA tax rate. According to the IRS the FUTA tax rate is projected to be 6 for 2020. FUTA Tax Rates and Taxable Wage Base Limit for 2021 The FUTA tax rate protection for 2021 is 6 as per the IRS standards.

If it is. This 7000 is known as the taxable wage base. Illinois generally fully taxes unemployment compensation.

Relief bill waives 10200 in unemployment benefits from 2020 tax returns. According to the IRS unemployment compensation is taxable and must be reported on a 2020 federal income tax return That includes all state unemployment benefits as well as. This image is for informational purposes only.

Department of Labors Contacts for State UI Tax Information and Assistance. 13 states are not offering the federal tax break on 2020 returns. Unemployment tax breakIRS tax refunds to start in May for 10200 unemployment tax break.

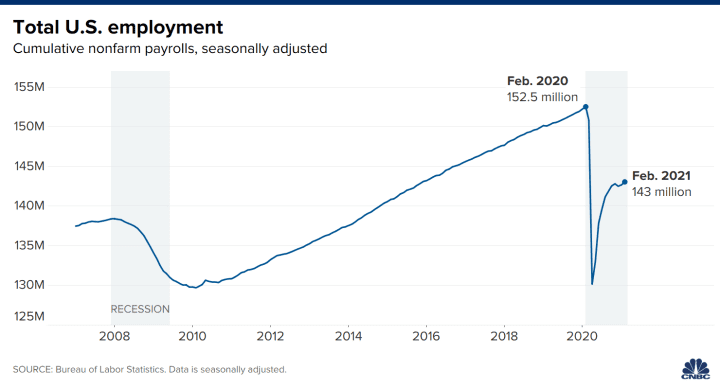

Your state wage base may be different based on the respective states rules. Supplemental Tax Rates Federal Unemployment Tax Act FUTA Social Security taxable earnings 137700 increased from 2019 Social Security maximum paid by employee 853740 increased from 2019 Medicare tax rate first 200000 in employee wages 145 unchanged Medicare tax rate after 200000 in employee wages 235 unchanged. Unemployment rate peaked in April 2020 to 148a level not seen since data collection began in 1948before declining to a still-high 67 in December to close out the year.

For a list of state unemployment tax agencies visit the US. The 54 tax credit is reduced if the businesss state or territory fails to repay the federal government for money borrowed to pay unemployment benefits. By the quantity of money being held back the employees are able to claim income tax return credit scores.

For more information refer to the Instructions for Form 940. The employer has no out-of-state employees. SUI tax rate by state.

2020 FUTA Tax Rate. Where you enter your unemployment compensation on your Schedule 1. However the state has adopted the the 10200 federal tax exemption for 2020 unemployment benefits.

The FUTA tax is 6 0060 on the first 7000 of income for each employee. Most employers receive a maximum credit of up to 54 0054 against this FUTA tax for allowable state unemployment tax. That represents a lot of Americans who will find themselves grappling with taxes on their unemployment benefits when the filing season rolls around in 2021 for 2020 tax returns.

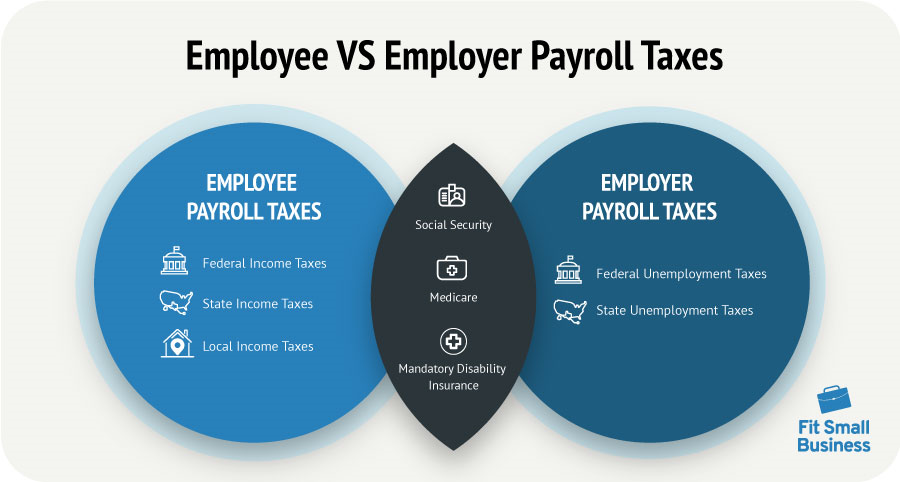

Transmittal of Wage and Tax Statements Form W-3 1. Only the employer pays FUTA tax. Each state has its own tax rate for.

Consequently the effective rate works out to 06 0006. It applies to the first 7000 paid to each employee as wages during the year. Note that some states require employees to contribute state unemployment tax.

Heres what you need to know From stimulus checks to Tax. Federal Unemployment Tax Return Form 940 Wage and Tax Statement Form W-2 and. The 7000 is often referred to as the federal or FUTA wage base.

All UI taxes for 2020 have been paid in full by January 31 2021. After the first 7000 in annual wages employers do not have to. Federal government in which companies subtract tax obligations from their workers pay-roll.

In 2019 the Virgin Islands received. State Taxes on Unemployment Benefits. The tax applies to the first 7000 you paid to each employee as wages during the year.

Here is a list of the non-construction new employer tax rates for each state and Washington DC. The FUTA tax rate is 60. And the state is not a credit reduction state.

Most employers pay both a Federal and a state unemployment tax. The IRS will only tax you on 4800 for the 2020 tax year. IRS Federal Tax Tables 2021 - Federal Withholding Tables 2021 is the procedure needed by the US.

The Federal Unemployment Tax Act FUTA requires the employers to pay the FUTA taxes quarterly and report the same on Form 940 annually.

Simple Steps For The Preparation Of Quickbooks Form 940 Quickbooks Employer Identification Number Getting Things Done

Simple Steps For The Preparation Of Quickbooks Form 940 Quickbooks Employer Identification Number Getting Things Done

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Are Employers Responsible For Paying Unemployment Taxes

Are Employers Responsible For Paying Unemployment Taxes

What Is Fica Tax Contribution Rates Examples

What Is Fica Tax Contribution Rates Examples

What Are Fica And Futa Employers Resource

What Are Fica And Futa Employers Resource

What Is The Futa Tax 2021 Tax Rates And Info Onpay

What Is The Futa Tax 2021 Tax Rates And Info Onpay

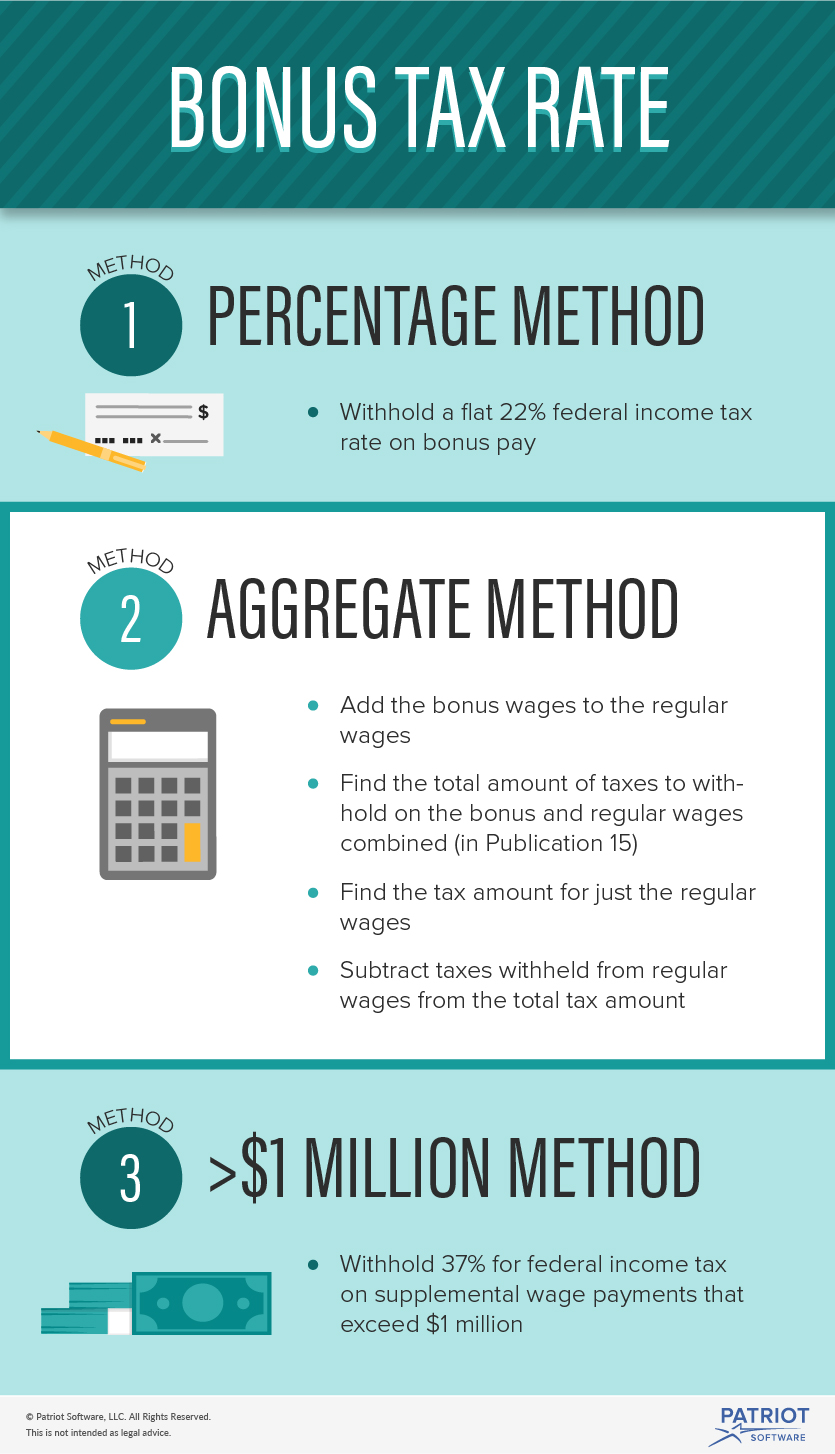

Are Bonuses Taxed At A Higher Rate Bonus Tax Rate Methods

Are Bonuses Taxed At A Higher Rate Bonus Tax Rate Methods

2020 Unemployment Tax Break H R Block

2020 Unemployment Tax Break H R Block

Payroll Taxes And Employers What Employment Taxes Are You Legally Responsible For

Payroll Taxes And Employers What Employment Taxes Are You Legally Responsible For

Pin On Financial Planning Essentials

Pin On Financial Planning Essentials

Pin On Financial Planning Essentials

Pin On Financial Planning Essentials

Futa Tax Learn How To Calculate The Federal Futa Tax

Futa Tax Learn How To Calculate The Federal Futa Tax

Did You Collect Unemployment Benefits In 2020 Act Now To Avoid A Tax Day Surprise Dollars And Sense Abc10 Com

Did You Collect Unemployment Benefits In 2020 Act Now To Avoid A Tax Day Surprise Dollars And Sense Abc10 Com

What Is Futa Tax Rate Due Dates More

What Is Futa Tax Rate Due Dates More

National Level Real Estate Forecast Real Estate Real Estate Information Real Estate News

National Level Real Estate Forecast Real Estate Real Estate Information Real Estate News

Income Tax Task Cards Activity Financial Literacy Math For Kids Filing Taxes

Income Tax Task Cards Activity Financial Literacy Math For Kids Filing Taxes

Bar Chart Showing The Distribution Of Student Loan Borrowers By Balance Student Loan Debt Student Loans Refinancing Student Loans

Bar Chart Showing The Distribution Of Student Loan Borrowers By Balance Student Loan Debt Student Loans Refinancing Student Loans

Payroll Taxes Costs And Benefits Paid By Employers Accountingcoach

Payroll Taxes Costs And Benefits Paid By Employers Accountingcoach

Congress Wants To Waive Taxes On Unemployment Some States May Not

Congress Wants To Waive Taxes On Unemployment Some States May Not

Post a Comment for "What Is The Federal Unemployment Tax Rate For 2020"