Unemployment Taxes And Covid

Jobless Americans get a tax waiver of up to 10200 on unemployment benefits. Senate Democrats agreed to lower additional unemployment aid to 300.

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

The legislation excludes only 2020 unemployment benefits from taxes.

Unemployment taxes and covid. Married couples who. Senate Republicans push to exclude 10200 in unemployment benefits from NYS taxable income to ease economic burden caused by COVID-19 shutdowns. Employment Security has resource and service information for workers and businesses in Washington state concerning COVID-19 coronavirus.

If you received unemployment benefits even if they were extra benefits due to coronavirus you will owe income taxes on those benefits just like with any other income. The American Rescue Plan passed last month included a tax relief provision that waives taxes on up to 10200 of unemployment benefits meaning more. Child Tax Credit For tax year 2021 only Expanded to 3000 for those age.

Please visit our COVID-19 web page for more on. Prepare for a state tax bill. For filing tax reports or tax and wage reports online.

COVID-19 stimulus package. You may use either EAMS or ePay to pay your taxes. For paying unemployment taxes.

Unemployment income tax year 2020 The first 10200 of unemployment benefits received can be excluded from 2020 income for households with adjusted gross incomes of less than 150000. 8 hours agoCHARLOTTE NC. The first 10200 of unemployment benefits would be exempt from taxes for the first time to prevent surprise bills for unemployed people at the end of.

Covid bill waives taxes on up to 20400 of unemployment benefits for married couples. Your first step is to prepare your taxes to figure out exactly how much you owe if anything. If you got unemployment income last year and your state isnt offering a tax break on your first 10200 of benefits you may need to gear up for a tax bill when you.

OMara colleagues call for income tax break for unemployed New Yorkers. The American Rescue Plan waives federal tax on up to 10200 of unemployment benefits per person in 2020. The tax break isnt available to those who earned 150000 or more.

The legislation signed on March 11 allows taxpayers who earned less than 150000 in modified adjusted gross income to exclude unemployment compensation up to 20400 if married filing jointly and 10200 for all other eligible taxpayers. To use EAMS or EAMS for Single Filers you will need to be sure to set up your online account in advance. The latest version of the 19 trillion federal coronavirus relief.

Use Employer Account Management Services EAMS or EAMS for Single Filers to file your tax reports or tax and wage reports online. The Senate on Saturday passed a version of the Covid relief package that is slightly different than the one passed by the House.

Paying Taxes On Unemployment Checks Everything You Need To Know Cnet

Paying Taxes On Unemployment Checks Everything You Need To Know Cnet

If You Were On Unemployment Last Year You Ll Probably Get A Tax Break Marketplace

If You Were On Unemployment Last Year You Ll Probably Get A Tax Break Marketplace

Frequently Asked Questions About Unemployment Benefits For The Self Employed Cares Act Nav

Frequently Asked Questions About Unemployment Benefits For The Self Employed Cares Act Nav

Covid Bill Provides Tax Waiver On Up To 10 200 Of Unemployment Benefits

Covid Bill Provides Tax Waiver On Up To 10 200 Of Unemployment Benefits

Taxes 2021 Everything New Including Deadline Stimulus Payments And Unemployment Cnet

Taxes 2021 Everything New Including Deadline Stimulus Payments And Unemployment Cnet

Lawmakers Urge Democratic Leaders To Waive Taxes On Jobless Benefits In Covid Relief Bill

Lawmakers Urge Democratic Leaders To Waive Taxes On Jobless Benefits In Covid Relief Bill

Enhanced Unemployment Benefits During The Coronavirus Crisis Smartasset

Enhanced Unemployment Benefits During The Coronavirus Crisis Smartasset

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

Collecting Unemployment Take These Steps To Avoid A Tax Bill Next Year

Collecting Unemployment Take These Steps To Avoid A Tax Bill Next Year

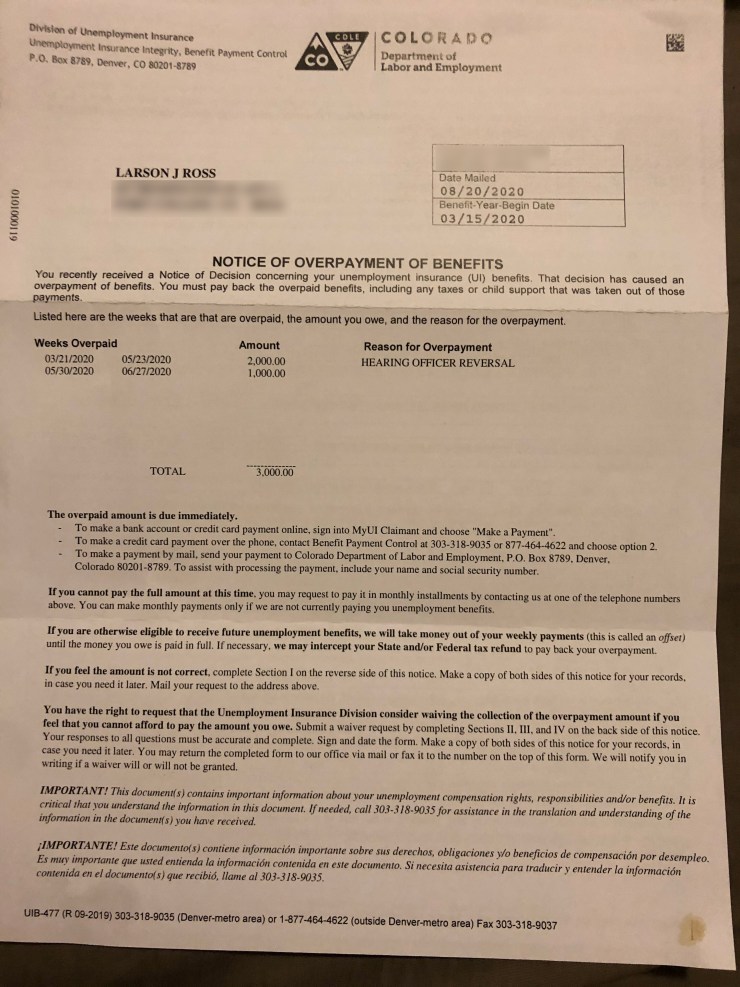

States Are Telling Some People To Pay Back Unemployment Benefits Marketplace

States Are Telling Some People To Pay Back Unemployment Benefits Marketplace

Congress Wants To Waive Taxes On Unemployment Some States May Not

Congress Wants To Waive Taxes On Unemployment Some States May Not

Did You Collect Unemployment Benefits In 2020 Act Now To Avoid A Tax Day Surprise Dollars And Sense Abc10 Com

Did You Collect Unemployment Benefits In 2020 Act Now To Avoid A Tax Day Surprise Dollars And Sense Abc10 Com

Unemployment Stimulus Am I Eligible For The New Unemployment Income Relief The Turbotax Blog

Unemployment Stimulus Am I Eligible For The New Unemployment Income Relief The Turbotax Blog

How To Avoid Tax On Up To 10 200 Of Unemployment Benefits Personal Finance Greensboro Com

How To Avoid Tax On Up To 10 200 Of Unemployment Benefits Personal Finance Greensboro Com

Unemployed About To Owe Taxes On Benefits Need To Start Looking For Work Wral Com

Unemployed About To Owe Taxes On Benefits Need To Start Looking For Work Wral Com

Covid 19 Unemployment Benefits And Your Taxes Taxact Blog

Covid 19 Unemployment Benefits And Your Taxes Taxact Blog

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Tackling Covid 19 Unemployment Work Opportunities And Targeted Support Beat Windfall Bonuses The Heritage Foundation

Tackling Covid 19 Unemployment Work Opportunities And Targeted Support Beat Windfall Bonuses The Heritage Foundation

Post a Comment for "Unemployment Taxes And Covid"