Unemployment Tax Break New Mexico

American Rescue Plan Act that excludes up to 10200 of unemployment compensation from 2020 federal gross income. 2 days agoThere are 12 states that tax unemployment payments that have yet not followed the federal lead to extend a waiver to the first 10200 in unemployment benefits claimed in 2020 according to.

Its also important to keep in mind that not everyone will get a federal tax break on 10200 in unemployment income.

Unemployment tax break new mexico. The exclusion is available for taxpayers with an adjusted gross income under 150000. You will be taxed at the regular rate for any federal unemployment benefits above 10200. You might want to do more than just wait Last Updated.

More than a dozen states arent offering a new tax break on unemployment benefits. President Bidens 19 coronavirus relief package offered a major tax break for millions of Americans who collected unemployment aid last year but more than a dozen states arent following suit. 1 day agoA good problem to fix.

That provision only applies to tax. Its great that Americans wont have to pay taxes on 10200 of unemployment income. And the IRS just announced that those who qualify for this break will start to receive a second tax refund.

Trumps first public address since COVID-19 diagnosis had hallmarks of a campaign event at the White House. You can take the tax break if you have an adjusted gross. The New Mexico Department of Workforce Solutions is a World-Class market-driven workforce delivery system that prepares New Mexico job seekers to meet current and emerging needs of New Mexico businesses.

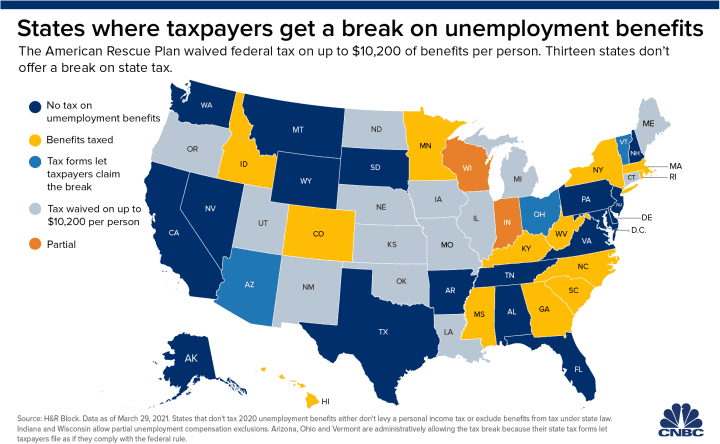

And insures that every New Mexico citizen who needs a job will have one. The American Rescue Plan waived federal tax on up to 10200 of jobless aid per person collected in 2020. As of March 29 13 states have not conformed with the federal unemployment tax break according to recent data from HR Block.

Thirteen states arent offering a tax break on unemployment benefits received last year according to data from HR Block. As a result any unemployment compensation received in 2020 up to 10200 exempt from federal income tax is also exempt from New Mexico income tax. Some states wont allow taxpayers to collect Bidens 10200 unemployment break The American Rescue Plan waives federal income taxes on up to 10200 in 2020 unemployment.

What we know and dont know about Hunter Bidens alleged laptop. Because New Mexico Personal Income Tax is calculated using federal adjusted gross. 2 days agoExpecting another refund after the IRS calculates the 10200 unemployment tax break.

It includes a tax break on up to 10200 of unemployment benefits earned in 2020. The American Rescue Plan waived federal tax on up to 10200 of jobless. And insures that every New Mexico citizen who needs a job will have one.

That will be the case if a new tax break on up to 10200 of unemployment benefits makes them newly eligible for income-dependent tax credits and deductions like the earned income tax. That means taxpayers will need to pay state tax on benefits they received last year absent any forthcoming changes to state law. The American Rescue Plan a 19 trillion Covid relief bill waived.

And every business who needs an employee will find one with the necessary skills and work readiness to allow New. These states are requiring residents to pay taxes on unemployment. Ljubaphoto E Getty Images More than a dozen states arent offering a new tax break on unemployment benefits.

The New Mexico Department of Workforce Solutions is a World-Class market-driven workforce delivery system that prepares New Mexico job seekers to meet current and emerging needs of New Mexico businesses. And every business who needs an employee will find one with the necessary skills and work readiness to allow New. However as part of the stimulus package the federal government is forgiving taxes on up to 10200 of unemployment benefits earned in 2020 for individuals earning less than 150000.

That means taxpayers will need to pay state tax on benefits they received last year absent any forthcoming changes to state law. That tax break will put a lot of extra.

Well Isn T This Depressing Minimum Wage Wage Christian Nation

Well Isn T This Depressing Minimum Wage Wage Christian Nation

Valley Lights By Dominic Silva Via 500px Beautiful Las Cruces New Mexico Where I Grew Up Las Cruces Pinterest Las Cruces

Valley Lights By Dominic Silva Via 500px Beautiful Las Cruces New Mexico Where I Grew Up Las Cruces Pinterest Las Cruces

Can You Collect Minnesota Unemployment If You Live In Another State In 2020 Debt Debt Settlement Debt Settlement Companies

Can You Collect Minnesota Unemployment If You Live In Another State In 2020 Debt Debt Settlement Debt Settlement Companies

Pin On Information Visualized Infographics

Pin On Information Visualized Infographics

This Table Shows Standard And Poor S Credit Ratings For Each Of The States From 2004 To July 2017 These Ratings Range From Credit Rating Credits States

This Table Shows Standard And Poor S Credit Ratings For Each Of The States From 2004 To July 2017 These Ratings Range From Credit Rating Credits States

10 200 Unemployment Tax Break 13 States Aren T Giving The Waiver

10 200 Unemployment Tax Break 13 States Aren T Giving The Waiver

Embedded Image Permalink Country Interesting Information Visualisation

Embedded Image Permalink Country Interesting Information Visualisation

Form 14 Where To File 14 Things That Happen When You Are In Form 14 Where To File Outrageous Ideas Irs Forms Outrageous

Form 14 Where To File 14 Things That Happen When You Are In Form 14 Where To File Outrageous Ideas Irs Forms Outrageous

What Is The Benefit Of Tax Deferred Growth Great American Insurance

What Is The Benefit Of Tax Deferred Growth Great American Insurance

Pin By Erik Aalbers On Economic Charts Global Economy Economy Global

Pin By Erik Aalbers On Economic Charts Global Economy Economy Global

11 Places In New Mexico That Are Off The Beaten Path But Worth The Trip New Mexico History New Mexico Las Vegas Trip

11 Places In New Mexico That Are Off The Beaten Path But Worth The Trip New Mexico History New Mexico Las Vegas Trip

Thecpataxproblemsolver Asks For Everyone 2 Share This Information About Recovering From A Disaster Like Hurricanemic Financial Advice Irs Taxes Sba Loans

Thecpataxproblemsolver Asks For Everyone 2 Share This Information About Recovering From A Disaster Like Hurricanemic Financial Advice Irs Taxes Sba Loans

State Provides Guidance On How To Take Advantage Of New Mexico Pandemic Tax Breaks Kob 4

State Provides Guidance On How To Take Advantage Of New Mexico Pandemic Tax Breaks Kob 4

10 200 Unemployment Tax Break 13 States Aren T Giving The Waiver

10 200 Unemployment Tax Break 13 States Aren T Giving The Waiver

Payroll Journal Entries Payroll Journal Entries Bookkeeping

Payroll Journal Entries Payroll Journal Entries Bookkeeping

Prisoners Rake In Millions From Tax Fraud Prison Fraud Tax

Prisoners Rake In Millions From Tax Fraud Prison Fraud Tax

Economonitor Ed Dolan S Econ Blog What Quantitative Easing Did Not Do Three Revealing Charts 2 Qe Did Not Cause Inflation Chart Teaching Resources Blog

Economonitor Ed Dolan S Econ Blog What Quantitative Easing Did Not Do Three Revealing Charts 2 Qe Did Not Cause Inflation Chart Teaching Resources Blog

Pin By Xenophon Hendrix On Social Data Social Data Chase Bank Account Credit Cards Accepted

Pin By Xenophon Hendrix On Social Data Social Data Chase Bank Account Credit Cards Accepted

Post a Comment for "Unemployment Tax Break New Mexico"