Unemployment For Independent Contractors In Ohio

Benefits will be retroactive to. The short answer is DEPENDSthe Ohio workers compensation system protects employees who are injured or contract illnesses on the job.

Ohio Unemployment For Independent Contractors Self Employed Worker

Ohio Unemployment For Independent Contractors Self Employed Worker

OHIO Self-employed part-time workers and independent contractors filing 1099 forms for taxes will be able to begin the process to apply for unemployment benefits Friday the Ohio Department of.

Unemployment for independent contractors in ohio. For more information call 866 733-0025 option 3 or visit SharedWork Ohio. In Ohio unemployment benefits are designed to provide workers with temporary income when a worker loses his job through no fault of his own. On July 6th the.

Legitimately actual independent contractors are legally self-employed and as such. Ten states have begun sending unemployment benefits to self-employed workers and independent contractors who are eligible for such payments for the first time under the CARES Act. However there are two ways you could qualify for unemployment benefits.

Because these benefits are provided for by taxes paid by employers only employees and not independent contractors were eligible. You were laid off due to the coronavirus COVID-19 pandemic or. To be excluded employment it must be established by the employer that the contractor is free from direction or control over the service being performed.

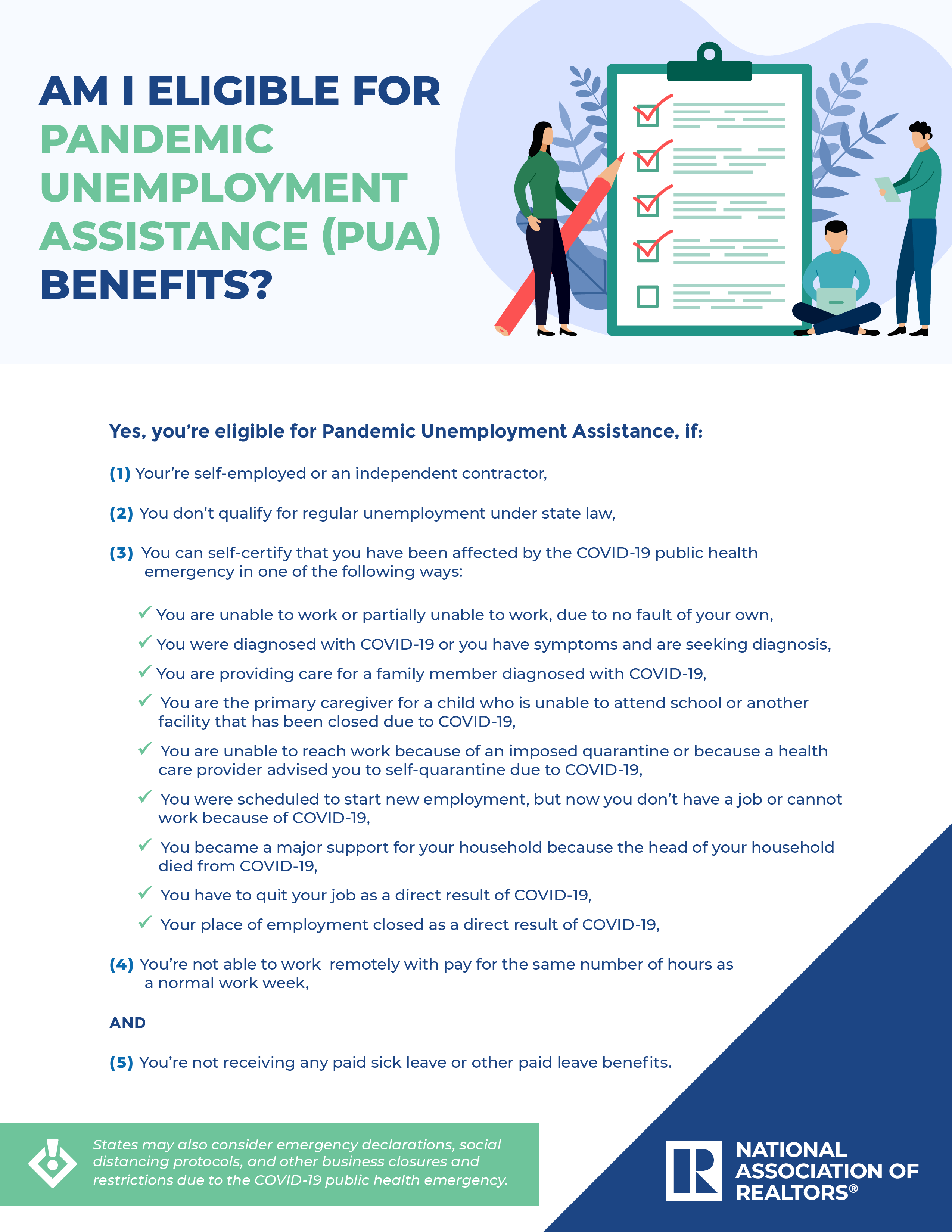

Expanded Eligibility Resource Hub The new federal Pandemic Unemployment Assistance or PUA program provides benefits for many individuals ineligible for state unemployment benefits including self-employed workers 1099 tax filer. Independent contractors gig workers and other self-employed workers will have to wait until the Ohio Department of Job and Family Services. Hair dressers gig drivers landscapers freelancers and other independent contractors who work for themselves normally dont qualify for unemployment benefits.

CLEVELAND Ohio -- Ohio is now accepting jobless claims from self-employed workers and independent contractors who pre-registered for a new program that provides assistance to workers who dont. For independent contractors not eligible for Unemployment Compensation benefits impacted by the coronavirus the Disaster Unemployment Assistance DUA program provides unemployment benefits to individuals who have become unemployed as a direct result of a Presidentially declared major disaster. Provides an additional 13 weeks of Unemployment benefits to all recipients.

Ohio employers may apply for a SharedWork Ohio plan if they have at least two affected employees who do not work on a seasonal temporary or intermittent basis. The new program is one way Congress boosted unemployment insurance for 2020 to help ease the economic pain for a record number of out-of-work Americans. If they are current on all unemployment taxes.

PUA will provide up to 39 weeks of unemployment benefits to individuals who are not working as a result of COVID-19 and are self-employed independent contractors gig economy workers and others who otherwise would not qualify for regular UC. An employee under Ohio Workers Compensation law is a term of art and can include persons denominated by employers as independent contractors. Pandemic Emergency Unemployment Compensation.

The FPUC program began on March 29. Does that mean I am not eligible for UI benefits. An independent contractor is someone who is in business for him or herself.

By Kristen M. And if they agree to the program requirements. Unemployment benefits are ordinarily available to employees but not independent contractors.

In particular claims from federal programs created to help people not normally eligible for unemployment aid such as independent contractors and the self-employed have been vulnerable. However on March 27 2020 the federal government passed the Coronavirus Aid. PUA Login false Coronavirus and Unemployment Insurance Benefits.

Unemployment Claims and Independent Contractors. You were misclassified as an independent contractor. I am paid as an independent contractor.

However under Ohio law if you are an independent contractor you are precluded from receiving those benefits. But these arent normal times. Generally employees in Ohio are eligible to receive unemployment benefits if they are laid off from their place of employment.

While it is true that independent contracts are ineligible for UI many employees are incorrectly labeled independent contractors by their employers. Expands eligibility for individuals who are typically ineligible for Unemployment benefits for example independent contractors self-employed and gig workers. The services of an individual that is determined to be an independent contractor under contract to perform a special service for an employer are excluded from covered employment.

The average unemployment benefit in Ohio is currently about 380 a week. Pandemic Unemployment Assistance.

Can Independent Contractors Collect Unemployment

Can Independent Contractors Collect Unemployment

When Independent Contractors Get Unemployment Benefits What It Means For Employers

When Independent Contractors Get Unemployment Benefits What It Means For Employers

Urgent Alert For Independent Contractors Or Self Employed Individuals Who Filed For Pandemic Unemployment Assistance Benefits In Ohio

Urgent Alert For Independent Contractors Or Self Employed Individuals Who Filed For Pandemic Unemployment Assistance Benefits In Ohio

Dwd Explains New Stipulation For The Self Employed Independent Contractors And Small Business Owners Wane 15

Dwd Explains New Stipulation For The Self Employed Independent Contractors And Small Business Owners Wane 15

Hiring Guide For 1099 Independent Contractors Legalities Forms Taxes Exaktime

Hiring Guide For 1099 Independent Contractors Legalities Forms Taxes Exaktime

Pandemic Unemployment Assistance Pua Benefits Checklist

Pandemic Unemployment Assistance Pua Benefits Checklist

Free Ohio Independent Contractor Agreement Pdf Word

Free Ohio Independent Contractor Agreement Pdf Word

Free Independent Contractor Agreement Templates Pdf Word Eforms

Free Independent Contractor Agreement Templates Pdf Word Eforms

Independent Contractors Workers Comp Benefits In Ohio D B Blog

Independent Contractors Workers Comp Benefits In Ohio D B Blog

What Is The Test For Independent Contractor Vs Employee Jan 2019 Who Is My Employee

What Is The Test For Independent Contractor Vs Employee Jan 2019 Who Is My Employee

Why You Need To Understand The Difference Between Independent Contractor Self Employed And Employee Nurse Practitioners In Business

Why You Need To Understand The Difference Between Independent Contractor Self Employed And Employee Nurse Practitioners In Business

Free Ohio Independent Contractor Agreement Word Pdf Eforms

Employee Vs Independent Contractor Which Are You Mansell Law Employment Attorneys

Employee Vs Independent Contractor Which Are You Mansell Law Employment Attorneys

How To Report Misclassification Of Employees Top Class Actions

How To Report Misclassification Of Employees Top Class Actions

Are Your Cleaning Company Workers Employees Or Independent Contractors

Are Your Cleaning Company Workers Employees Or Independent Contractors

Pittsburgh Pa Misclassifying Employee As Independent Contractor Mko Employment Law Llc

Pittsburgh Pa Misclassifying Employee As Independent Contractor Mko Employment Law Llc

Independent Contractors Could Be Waiting Until May For Jobless Benefits The Lima News

Independent Contractors Could Be Waiting Until May For Jobless Benefits The Lima News

Post a Comment for "Unemployment For Independent Contractors In Ohio"