South Carolina Unemployment Insurance Tax Registration

Employers determined to be liable under the Employment Security Law Chapter 96 of the North Carolina General Statutes are required to prominently display the Certificate of Coverage and Notice to Workersposter in their workplace. South Carolina Unemployment Registration South Carolina Unemployment Insurance Be sure to use your correct mailing address when filing you will be receiving necessary documentation and claimant information.

Sc Dew Announces 3 Programs To Expand Unemployment Benefits Wpde

Sc Dew Announces 3 Programs To Expand Unemployment Benefits Wpde

State Tax Forms and Instructions Find forms and instructions for state taxes.

South carolina unemployment insurance tax registration. Click here if you have paid wages under covered employment or if you have an existing agent account. Most employers with the exception of agricultural and domestic employers and non-profit organizations are considered liable under the SC Employment Security Law if the following requirements are met. All newly established businesses are required to register with the Reemployment Assistance Tax Unit.

This number is typically six digits. Unauthorized use of the information system is prohibited and subject to criminal and civil penalties. Please keep this time frame in mind when planning your first South.

We offer services including assistance finding qualified workers instructions on how to pay your unemployment tax information about qualifying for a tax credit and more. The South Carolina Department of Employment and Workforce DEW oversees the registration and collection of the Unemployment Insurance Tax for South Carolina. Employers must register for the appropriate accounts in order to hire employees to process payroll and to file tax.

Use of the information system indicates consent to monitoring. Welcome To South Carolina State Unemployment Insurance Tax System Select who you are Employers. South Carolina Department of Employment and Workforce - unemployment tax.

Here are the basic rules for South Carolinas UI tax. If youve run payroll in South Carolina in the past you can find your Employer Account Number on the Employer Package Liability Letter and Employer Quarterly Contribution and Wages Report Form UCE-120 received from the South Carolina Department of Employment and Workforce. The DEW has also provided video tutorials for this and other registrations.

Securely file pay and register most South Carolina taxes using the SCDORs free online tax portal MyDORWAY. South Carolina Department of Revenue Registration PO Box 125 Columbia SC 29214-0850 Phone. Unemployment Insurance Tax - See Reemployment Assistance Tax.

Register with the South Carolina Department of Employment and Workforce. Department of Revenue Withholding Number. Department of Employment and Workforce is here to help you with your business needs.

9 digits 99999999-9 To find an existing account number call. Welcome to The Unemployment Insurance System Users are accessing a US. You should receive your SC Withholding File Number and tax deposit schedule within 24 hours after registering online or 3 weeks if registering by mail.

Register your company at the SC Department of Revenue online. Register for employer identification accounts. New South Carolina Employer.

The South Carolina Department of Employment and Workforce continues to improve employers wage reporting experience with the State Unemployment Insurance System SUITS through automation for out of state taxable wage credit calculation. Depending on the type of business where youre doing business and other specific regulations that may apply there may be multiple government agencies that you must contact in order to get a South Carolina Unemployment Insurance Tax Registration. South Carolina requires employers to register with the Department of Revenue and Department of Employment Workforce.

Register With the Department of Employment and Workforce. A South Carolina Unemployment Insurance Tax Registration can only be obtained through an authorized government agency. Learn about unemployment tax for employers.

Tax Unit South Dakota Department of Labor and Regulation. Information system usage may be monitored recorded and subject to audit. Registering for South Carolina Payroll Tax Account Numbers.

Go to our State Unemployment Insurance Tax System SUITS and click Employers under Register for an Account. Different states have different rules and rates for UI taxes. Click here if you have paid wages under covered employment or if you have an existing employer account.

Harbor Compliance provides payroll tax registration services in every state to help your company hire employees and process payroll on time. If the mail does not reach you your SC benefits can be delayed andor eligibility may change. As a South Carolina employer your small business must establish an employer account with the state and then have South Carolinas Department of Employment of Workforce DEW determine if you are liable for UI taxes.

In most states the two payroll taxes are withholding and unemployment insurance aka unemployment tax and unemployment compensation. Reemployment Assistance Tax Employer Registration.

Sc Dew Announces 3 Programs To Expand Unemployment Benefits Wpde

Sc Dew Announces 3 Programs To Expand Unemployment Benefits Wpde

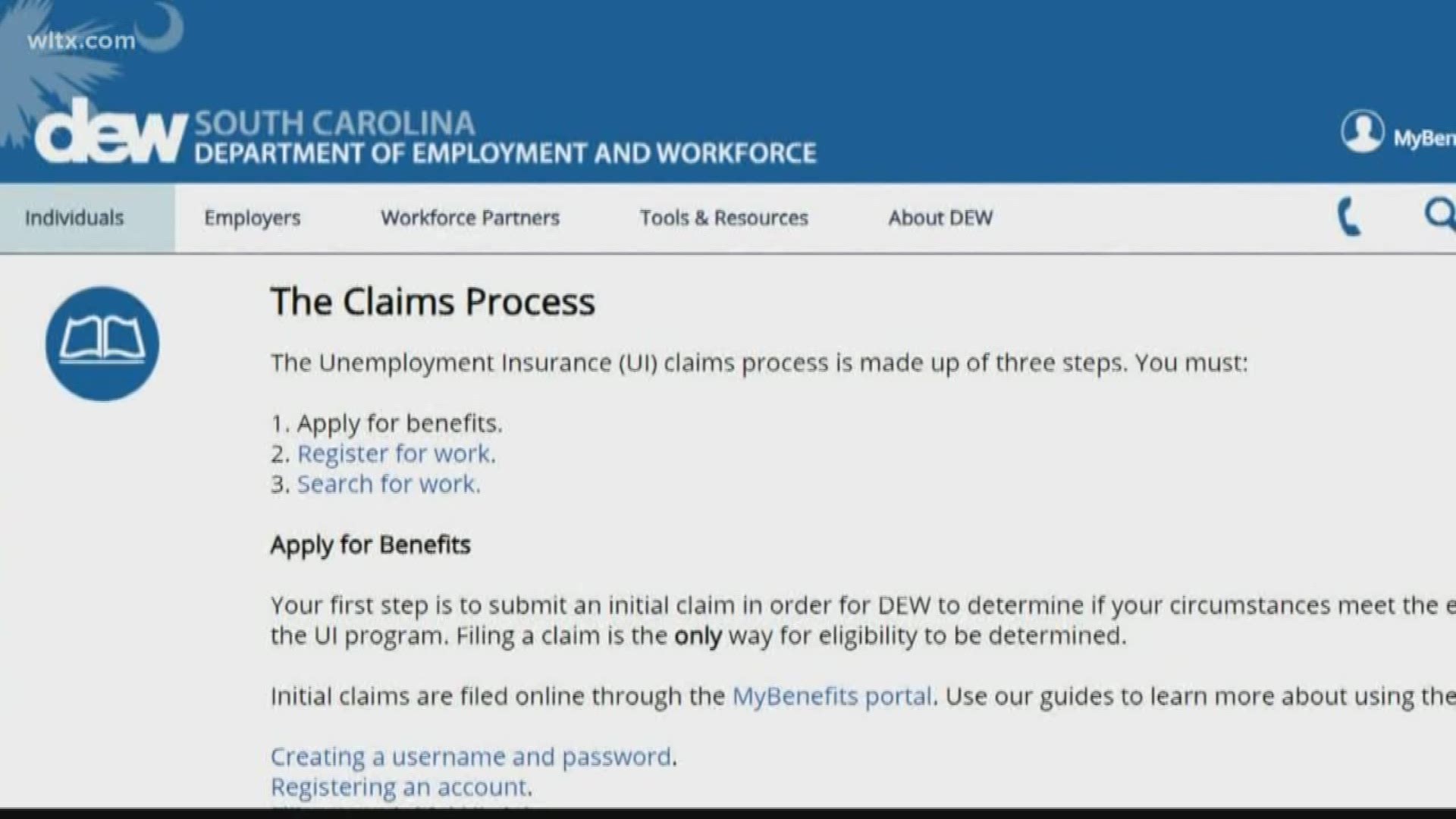

High Volume Of Sc Unemployment Insurance Applications Delays State Website Wltx Com

High Volume Of Sc Unemployment Insurance Applications Delays State Website Wltx Com

Applying For Benefits Sc Department Of Employment And Workforce

Applying For Benefits Sc Department Of Employment And Workforce

Applying For Benefits Sc Department Of Employment And Workforce

Applying For Benefits Sc Department Of Employment And Workforce

Sc Works Trident Coronavirus Updates Sc Works Trident

Sc Works Trident Coronavirus Updates Sc Works Trident

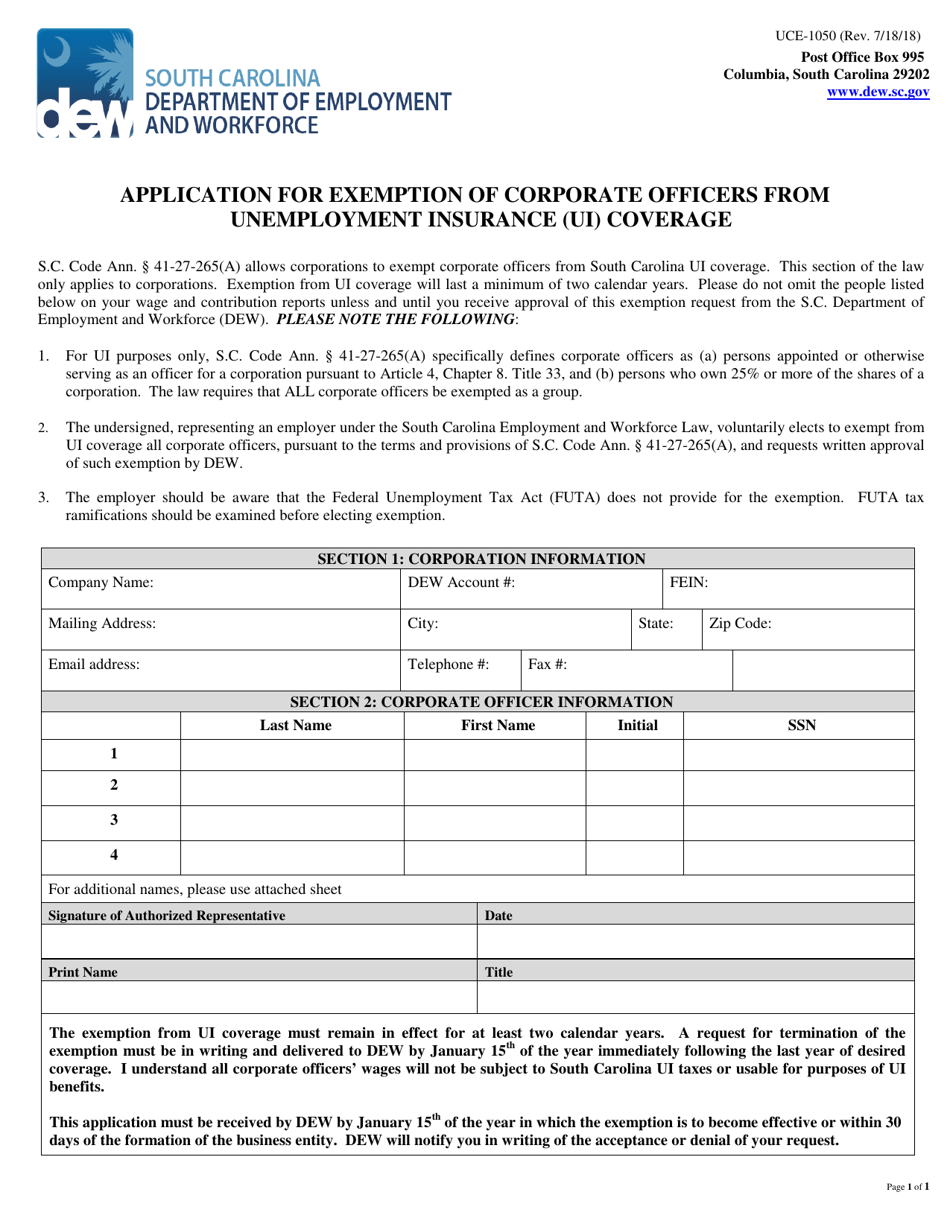

Form Uce 1050 Download Printable Pdf Or Fill Online Application For Exemption Of Corporate Officers From Unemployment Insurance Ui Coverage South Carolina Templateroller

Form Uce 1050 Download Printable Pdf Or Fill Online Application For Exemption Of Corporate Officers From Unemployment Insurance Ui Coverage South Carolina Templateroller

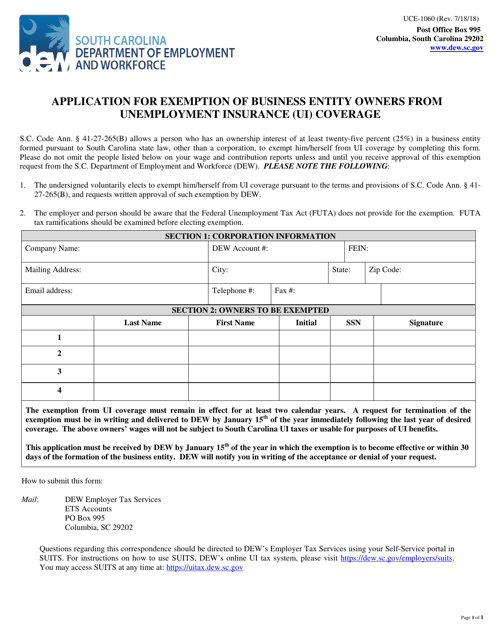

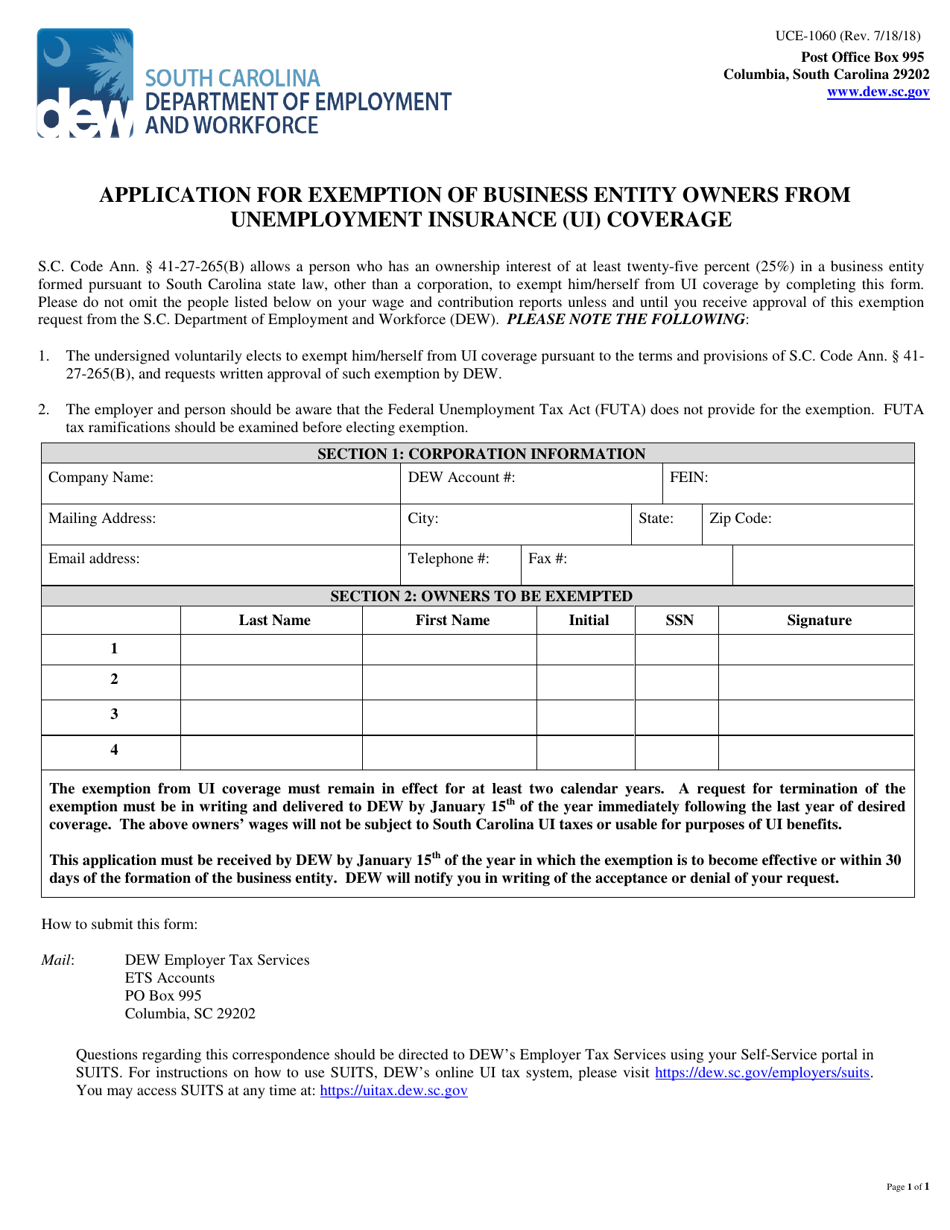

Form Uce 1060 Download Printable Pdf Or Fill Online Application For Exemption Of Business Entity Owners From Unemployment Insurance Ui Coverage South Carolina Templateroller

Form Uce 1060 Download Printable Pdf Or Fill Online Application For Exemption Of Business Entity Owners From Unemployment Insurance Ui Coverage South Carolina Templateroller

Sc Works Trident Coronavirus Updates Sc Works Trident

Sc Works Trident Coronavirus Updates Sc Works Trident

Form Uce 1060 Download Printable Pdf Or Fill Online Application For Exemption Of Business Entity Owners From Unemployment Insurance Ui Coverage South Carolina Templateroller

Form Uce 1060 Download Printable Pdf Or Fill Online Application For Exemption Of Business Entity Owners From Unemployment Insurance Ui Coverage South Carolina Templateroller

Accessing Your 1099 G Sc Department Of Employment And Workforce

Accessing Your 1099 G Sc Department Of Employment And Workforce

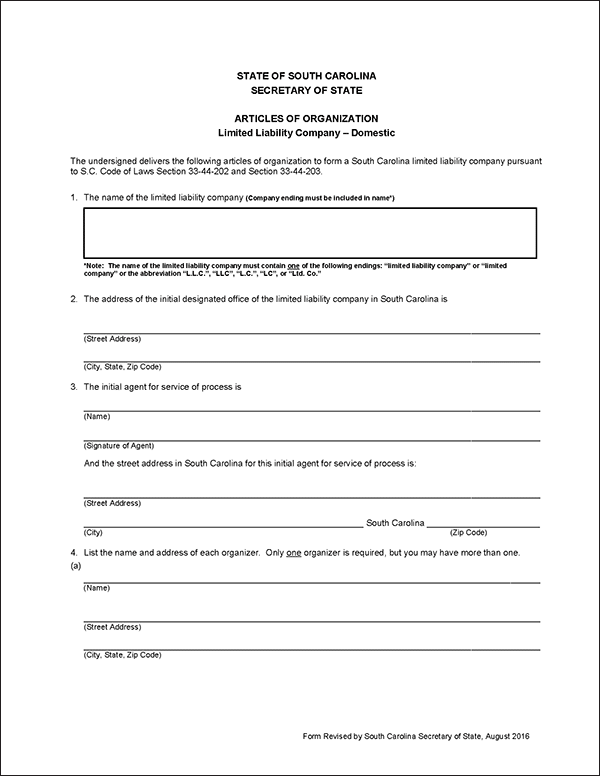

How To Form A South Carolina Llc Startingyourbusiness Com

How To Form A South Carolina Llc Startingyourbusiness Com

Sc Unemployment Agency S New Security Check Hinders Some From Receiving Payments Business Postandcourier Com

Sc Unemployment Agency S New Security Check Hinders Some From Receiving Payments Business Postandcourier Com

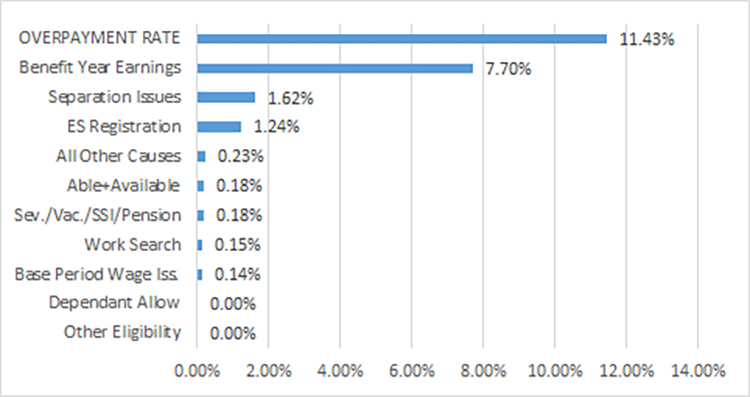

South Carolina U S Department Of Labor

South Carolina U S Department Of Labor

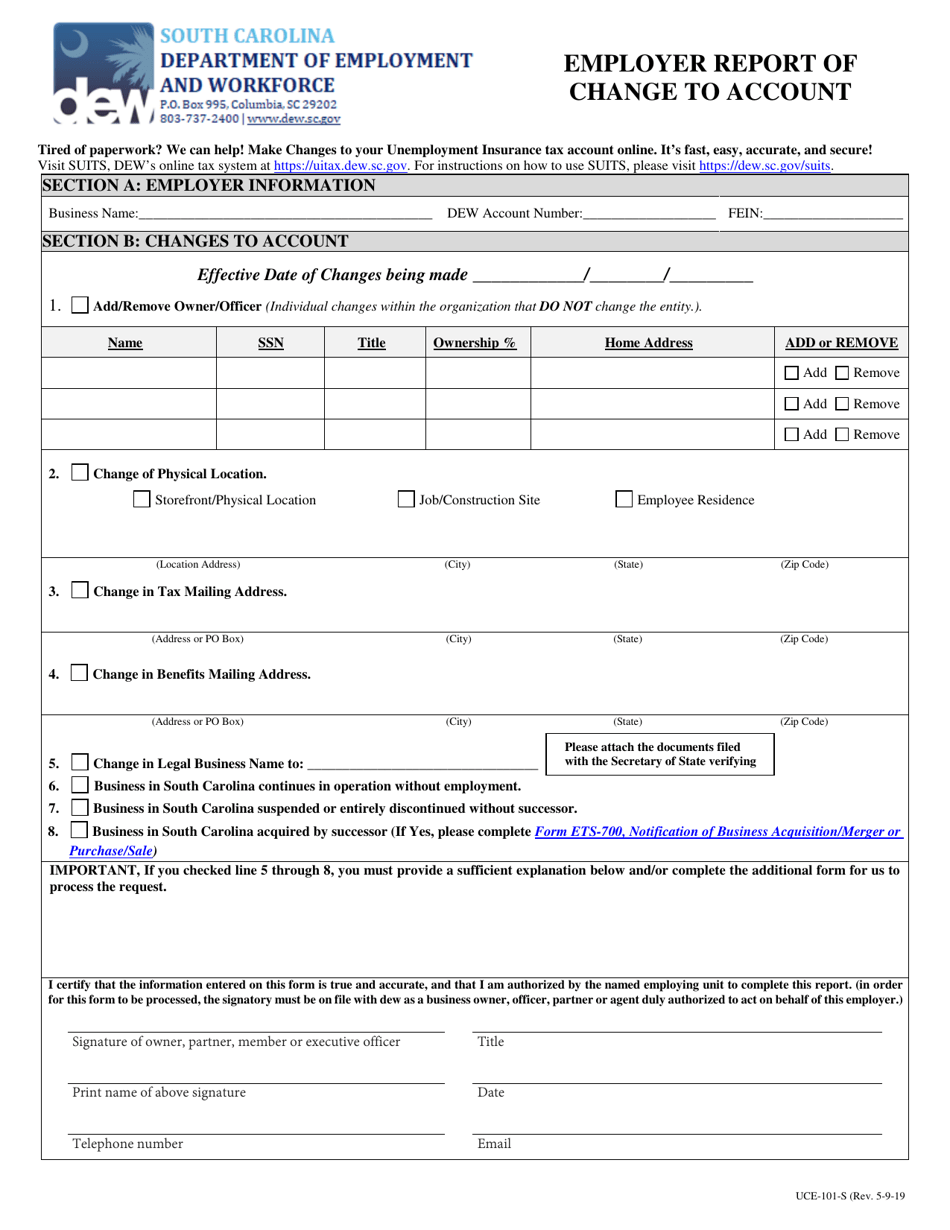

Form Uce 101 S Download Fillable Pdf Or Fill Online Employer Report Of Change To Account South Carolina Templateroller

Form Uce 101 S Download Fillable Pdf Or Fill Online Employer Report Of Change To Account South Carolina Templateroller

![]() Ui Tax Forms Sc Department Of Employment And Workforce

Ui Tax Forms Sc Department Of Employment And Workforce

Applying For Benefits Sc Department Of Employment And Workforce

Applying For Benefits Sc Department Of Employment And Workforce

Llc In Sc How To Form An Llc In South Carolina Truic Guides

Llc In Sc How To Form An Llc In South Carolina Truic Guides

Post a Comment for "South Carolina Unemployment Insurance Tax Registration"