Ohio Employer Unemployment Taxes

Under the Federal Unemployment Tax Act FUTA employers are required to pay 06 percent on an employees first 7000 of earnings. The American Rescue Plan of 2021 provides for a one-time exemption of 10200 per person in unemployment benefits to individuals and couples who earned 150000 or less last year.

Https Unemployment Ohio Gov Pdf New Workers Self Service User Guide Pdf

Earnings equal to or less than 20 of a claimants weekly benefit amount will not reduce the amount of benefits paid.

Ohio employer unemployment taxes. Highlighted below are two important pieces of information to help you register your business and begin reporting. Employers state unemployment tax rates are based largely on their experience rating which is a measure of how much they have paid in taxes and been charged in benefits. To receive your Unemployment tax account number and contribution rate.

Under the Ohio Unemployment Law most employers are liable to pay Unemployment taxes and report wages paid to their employees on a quarterly basis. Also used by employers to authorize the Ohio Department of Job and Family Services to furnish information directly to a representative. Find the government information and services you need to live work travel and do business in the state.

Suspect Fraud or Ineligibility. If an individual works for two or more employers both employers are required to pay unemployment taxes on the first 9000 each employer pays to that individual. Any earnings from employment during the week claimed may reduce the amount of benefits paid.

Earnings over 20 of the weekly benefit amount will reduce the. 20 hours agoThe processing of your tax return should not be delayed while your report of unemployment identity theft is under investigation. Used by employers to authorize someone other than the employer to provide information pertaining to Unemployment Taxes.

If an employers account is not eligible for an experience rating it will be assigned a standard new employer rate of 27 percent. Additional state taxes can apply. You must register for a UI tax account as soon as you employ at least one person who is covered by Ohios unemployment compensation law.

Due to the Coronavirus pandemic and resulting historic levels of unemployment Ohios structurally flawed unemployment compensation trust fund was unable to cover the cost of benefits for unemployed Ohioans. Money to fund unemployment benefits comes from employer taxes which means employees dont pay any part of the costs to fund unemployment benefits. JFS-20106 Employers Representative Authorization for Taxes.

By taking action the DeWine administration and the legislature can save Ohio employers an estimated 109 million in payroll taxes in 2022. Once registered youll be issued a Unemployment Compensation UC tax account number. Federal Additional Compensation FAC data for State Programs expired 12312010 The FAC program provided a 25 weekly supplement to the unemployment compensation of eligible claimants.

1 day agoEliminating Ohios unemployment loan balance according to a statement from the Ohio Chamber of Commerce would stave off an employer tax increase in 2022 of more than 100 million and a subsequent 658 million in total tax increases over a. Obtain detailed information regarding your. Ohio income tax update.

Report Suspected Fraud or Ineligibility. In Ohio most employers are required to pay Unemployment Compensation taxes and report wages each quarter. How to Obtain an Employer Account Number.

1 day agoOhio Chamber of Commerce President CEO Andrew Doehrel said in a statement that using the federal money to pay off the unemployment debt will prevent save employers from premium hikes -- which he. As an Ohio employer subject to UI tax your small business must establish a UI tax account with the Ohio Department of Job and Family Services JFS. The Ohio Department of Taxation offered guidance regarding recently enacted legislation that aligned the state with federal tax changes included in the American Rescue Plan Act of 2021 PL.

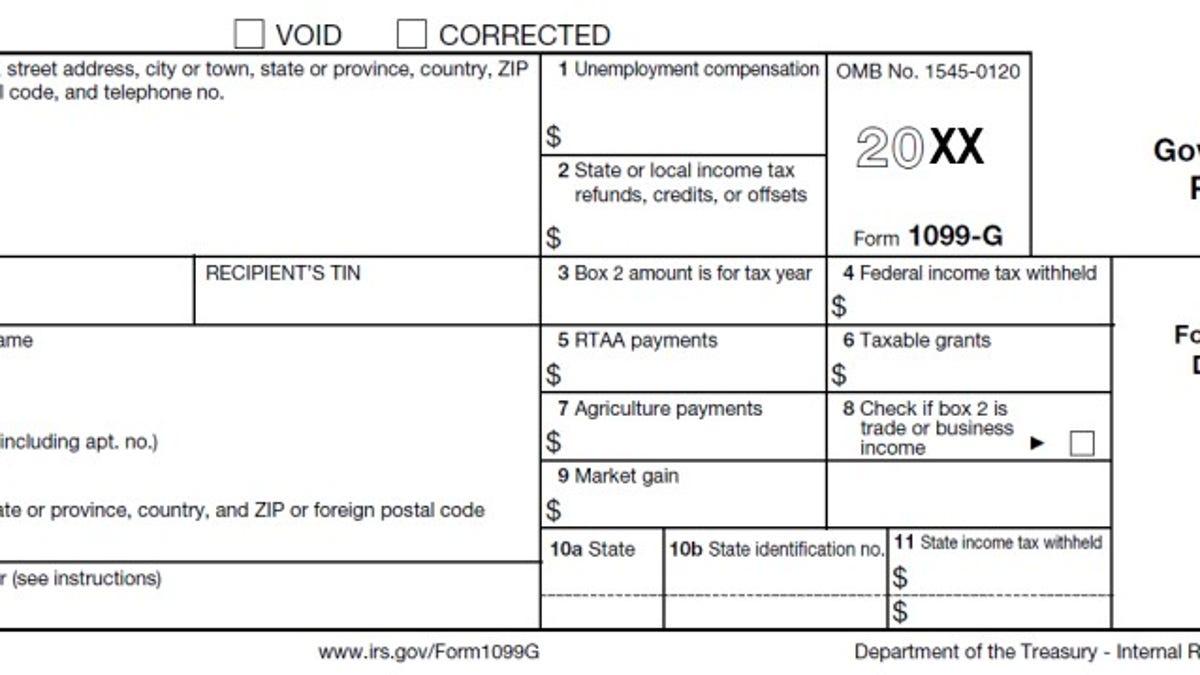

Ohiogov is the official website for the State of Ohio. Report it by calling toll-free. Changes in how unemployment benefits are taxed for tax year 2020 Read More Did you receive a 1099-G.

Unemployment taxes contributions must be paid on the first 9000 of an employees wages per year. If an employers account is not eligible for an experience rate the account will be assigned a standard new employer rate of 27 unless the employer is engaged in the construction industry in which case the 2017 rate is 62 the 2018 rate is 60 the 2019 rate is. 117-2 that affected the calculation of adjusted gross income for taxpayers who received unemployment.

Odjfs Wants Businesses To Report Employees Who Refuse To Return To Work

Odjfs Wants Businesses To Report Employees Who Refuse To Return To Work

Ohio Kentucky Raise Unemployment Insurance Tax Rates On Employers Wkrc

Ohio Kentucky Raise Unemployment Insurance Tax Rates On Employers Wkrc

Https Unemployment Ohio Gov Pdf New Workers Self Service User Guide Pdf

Ohio Kentucky Raise Unemployment Insurance Tax Rates On Employers Wkrc

Ohio Kentucky Raise Unemployment Insurance Tax Rates On Employers Wkrc

Unemployment Fraud Reports Running Rampant In Central Ohio

Unemployment Fraud Reports Running Rampant In Central Ohio

Number Of Ohioans Who Filed For Unemployment Continues To Decline For 8th Straight Week

Number Of Ohioans Who Filed For Unemployment Continues To Decline For 8th Straight Week

Respond To Employer Request For Separation Information Office Of Unemployment Insurance Operations Ohio Department Of Job And Family Services

Respond To Employer Request For Separation Information Office Of Unemployment Insurance Operations Ohio Department Of Job And Family Services

Number Of Ohioans Who Filed For Unemployment Continues To Decline For 8th Straight Week

Number Of Ohioans Who Filed For Unemployment Continues To Decline For 8th Straight Week

Ohio Kentucky Raise Unemployment Insurance Tax Rates On Employers Wkrc

Ohio Kentucky Raise Unemployment Insurance Tax Rates On Employers Wkrc

Ohio Unemployment Help Wkyc Com

Ohio Unemployment Help Wkyc Com

Covid 19 Unemployment Benefits Hamilton Ryker

Covid 19 Unemployment Benefits Hamilton Ryker

Https Unemployment Ohio Gov Pdf New Workers Self Service User Guide Pdf

Respond To Employer Request For Separation Information Office Of Unemployment Insurance Operations Ohio Department Of Job And Family Services

Respond To Employer Request For Separation Information Office Of Unemployment Insurance Operations Ohio Department Of Job And Family Services

Post a Comment for "Ohio Employer Unemployment Taxes"