How To File For Unemployment If You Were Self Employed

But if you live in one state and work in one or more other states your home states unemployment agency should be able to guide you on how to file. How do I apply for unemployment benefits if Im self-employed.

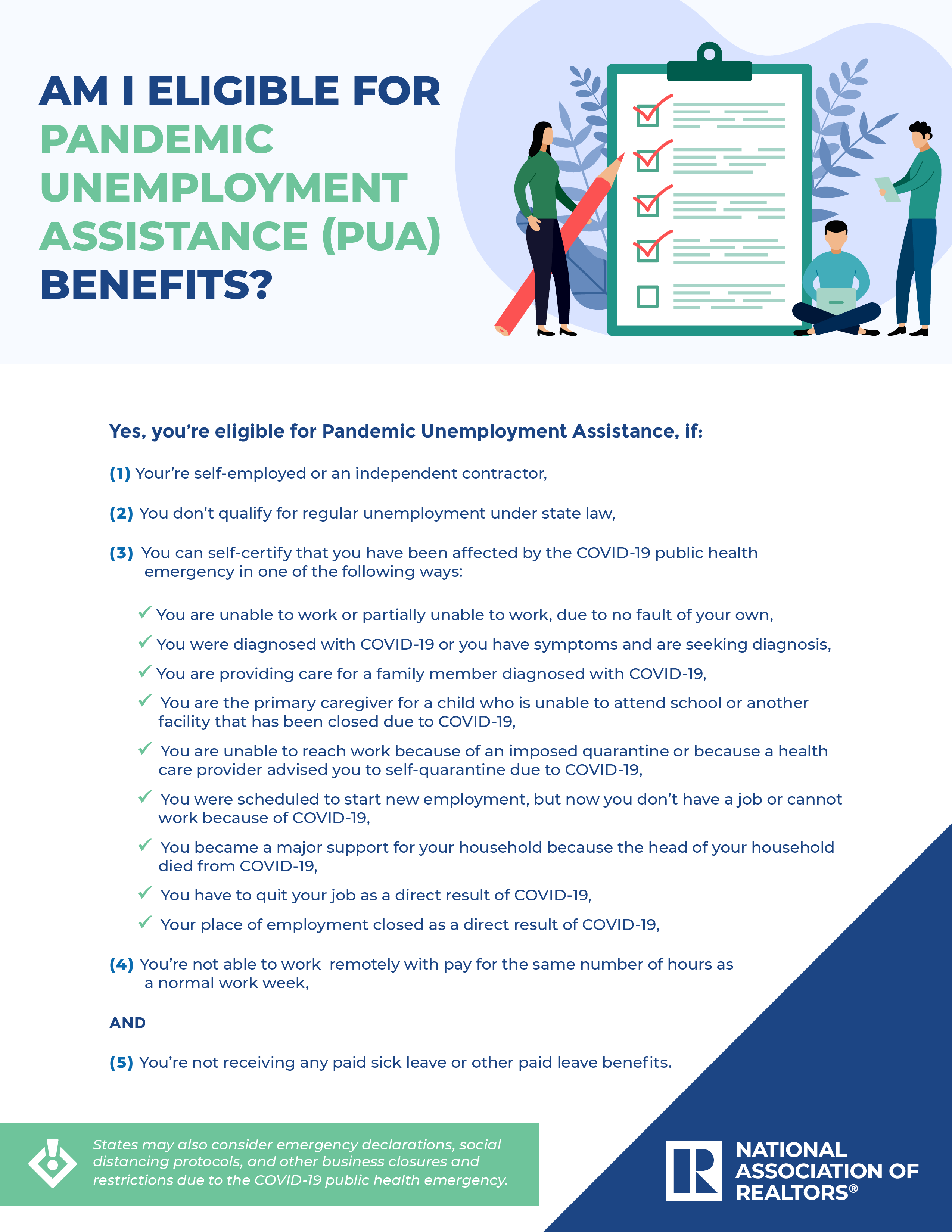

Pandemic Unemployment Assistance Pua Benefits Checklist

Pandemic Unemployment Assistance Pua Benefits Checklist

You can apply for regular unemployment benefits either online or by phone.

How to file for unemployment if you were self employed. According to the United States Department of Labor once you determine your eligibility you can file a claim with your states unemployment office. When applying for the Freelancers Relief Fund youll need the following documentation. IF YOU WERE LAID OFF OR LOST HOURS INCOME DUE TO THE PANDEMIC.

6 2021 at the latest. If the claimant alleges an employeremployee relationship but the employer states that the claimant is self-employed the employer must prove that the claimant is free from control over the performance of the service and customarily engaged in an independently established trade. You can apply for this assistance program directly through the Freelancers Union.

Note that if you can work from home with pay youre not eligible for unemployment. Two consecutive months of financial statements from 2020. Registration of a company with the state or federal employer identification number.

Self-employed contract and gig workers must submit their 2019 IRS 1040 Schedule C F or SE prior to December 26 2020 by fax or mail. Download this checklist for information you need to apply for regular unemployment benefits. 2019 or 2020 tax returns with appropriate attachments Schedule C Schedule C-EZ Schedule F 1065 with K-1 attachment Schedule SE Invoices with your name or your company name including payment for that invoice.

Additionally you will need to have the following information when you file for the CARES benefits. Download the COVID-19 unemployment guide then apply for regular unemployment benefits even though you likely dont qualify for themThis step is required before you can apply for the benefits for self-employed workers. By phone Application help is available on Friday from 800 am.

When you file your claim you will need to provide personal information name address Social Security number and work history for the past 18 to 24 months. The best option for most employees who lost their jobs is to file for unemployment benefits. You can search for a states unemployment website.

To receive unemployment insurance benefits you need to file a claim with the unemployment insurance program in the state that you work. If youre self-employed and seeking unemployment benefits during the pandemic youll need to file a claim with your state unemployment office. The coronavirus relief package passed in December 2020 also.

While the program was originally scheduled to end by December 31 2020 new legislation has extended the program through March 13 2021. Your work history should include any. To use the expanded unemployment benefits as a self-employed individual you will need to self-certify that youre self-employed and seeking part-time employment.

Your 2019 tax files or annual financial statements. Follow the step-by-step instructions on how to apply if you are self-employed. Apply online Available Sunday through Friday from 600 am.

You have to apply for unemployment through your state to get the 300 per week which is now payable until Sept. Youll typically file in the state where you worked. If you are self-employed enter your business name if one exists or your name as the EMPLOYER NAME.

For workers who are not eligible for traditional unemployment benefits program like independent contractors and self-employed people the best option is to apply for the new Pandemic Unemployment. If you were self-employed a gig worker or an independent contractor or otherwise not eligible for regular unemployment no W-2 wages file a Pandemic Unemployment Assistance PUA claim. If you are an independent contractor gig or plaaorm worker and you work for an enHty app website or other online.

A state identification or drivers license number. Keeping documentation about your previous income and wages as a freelancer independent contractor or self-employed worker is important and will help you when filing for unemployment. Depending on the state you may be able to file a claim online by phone or in person.

Non-traditional applicants who are eligible will qualify for a base weekly benefit amount of 207 plus the additional 600 Federal Pandemic Unemployment Compensation FPUC payment per week.

Https Www Louisianaworks Net Hire Admin Gsipub Htmlarea Uploads Pandemic Unemployment Assistance Pua Portal Claimants Guide Pdf

File My Initial Claim Nh Unemployment Benefits

File My Initial Claim Nh Unemployment Benefits

Here Are Key Tax Due Dates If You Are Self Employed Forbes Advisor

Here Are Key Tax Due Dates If You Are Self Employed Forbes Advisor

Labor And Economic Opportunity Can A Person Work Part Time And Still Collect Ui Benefits

Labor And Economic Opportunity Can A Person Work Part Time And Still Collect Ui Benefits

Alaska Dept Of Labor Alaskalabor Twitter

Alaska Dept Of Labor Alaskalabor Twitter

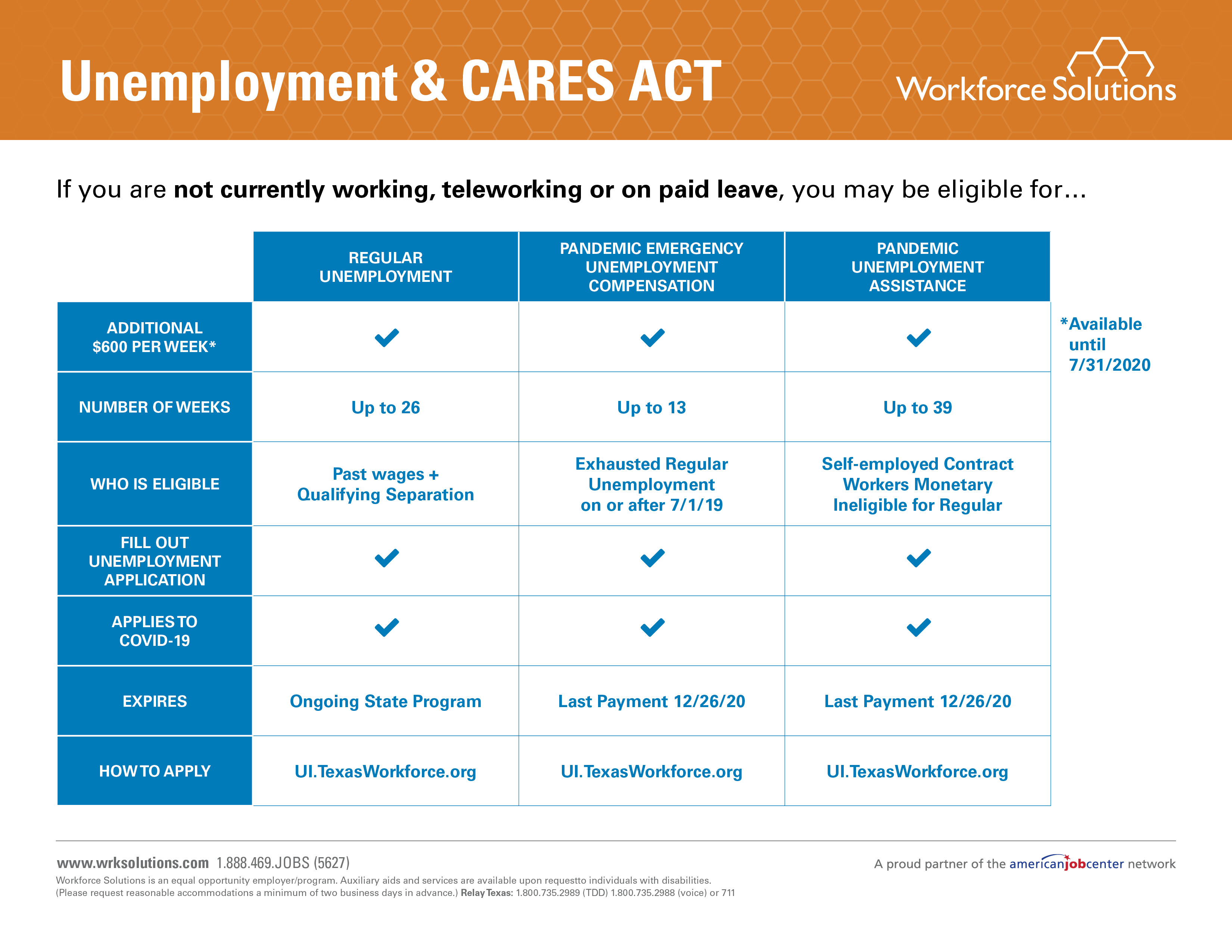

Unemployment Benefits Workforce Solutions

Unemployment Benefits Workforce Solutions

Frequently Asked Questions About Unemployment Benefits For The Self Employed Cares Act Nav

Frequently Asked Questions About Unemployment Benefits For The Self Employed Cares Act Nav

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

Massachusetts Rolls Out New Unemployment System For The Self Employed In Response To Covid 19

Massachusetts Rolls Out New Unemployment System For The Self Employed In Response To Covid 19

Https Www Louisianaworks Net Hire Admin Gsipub Htmlarea Uploads Pandemic Unemployment Assistance Pua Portal Claimants Guide Pdf

Des Covid 19 Information For Individuals

Des Covid 19 Information For Individuals

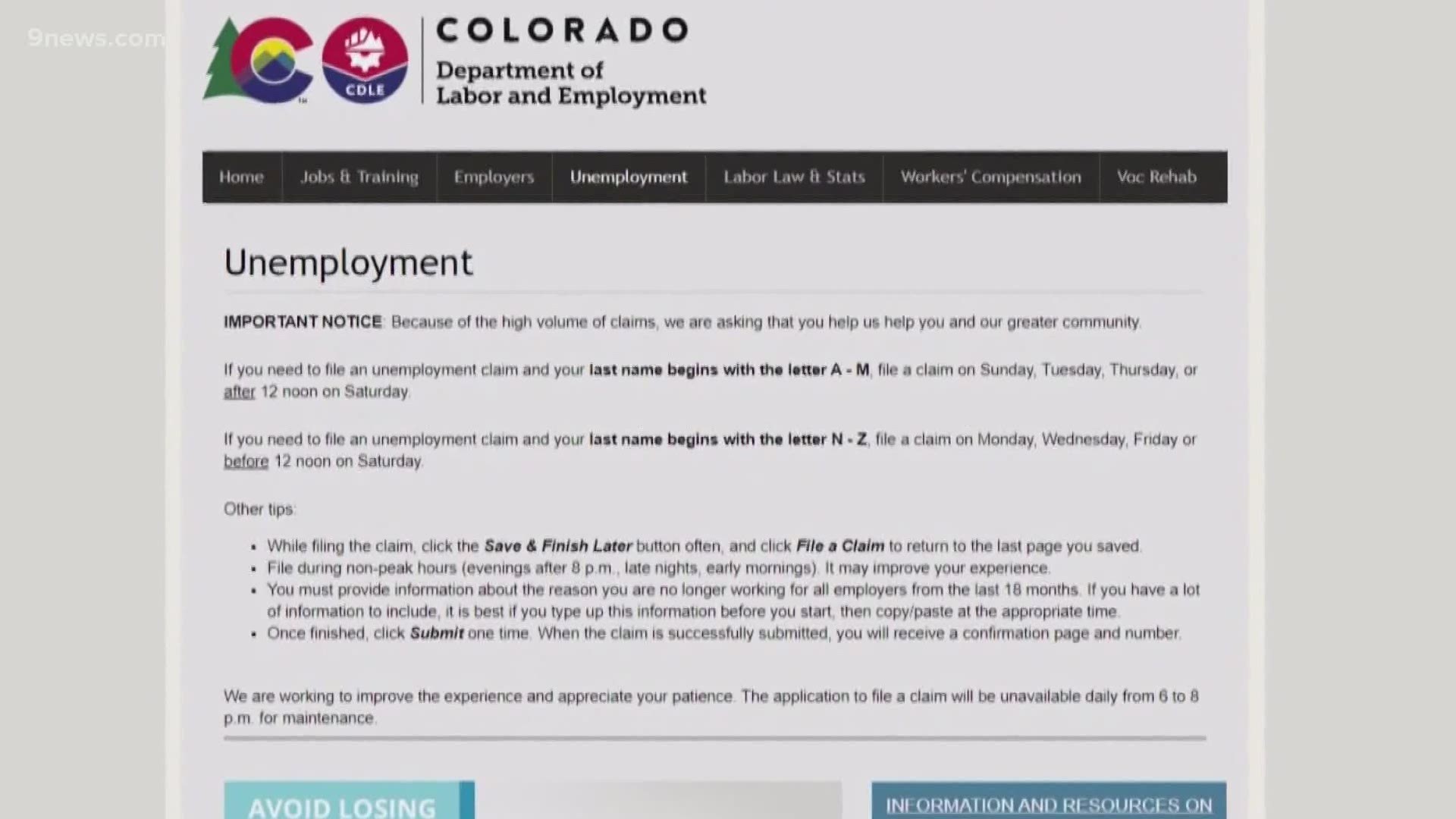

Here S How Colorado Self Employed Can Apply For Unemployment 9news Com

Here S How Colorado Self Employed Can Apply For Unemployment 9news Com

Unemployment Benefits Workforce Solutions

Unemployment Benefits Workforce Solutions

Https Www Oregon Gov Employ Documents Pua Online Form Howtofileaninitialclaim Pdf

Filing For Coronavirus Unemployment If You Re Self Employed Nerdwallet

Filing For Coronavirus Unemployment If You Re Self Employed Nerdwallet

Filing For Coronavirus Unemployment If You Re Self Employed Nerdwallet

Filing For Coronavirus Unemployment If You Re Self Employed Nerdwallet

Enhanced Unemployment Benefits During The Coronavirus Crisis Smartasset

Enhanced Unemployment Benefits During The Coronavirus Crisis Smartasset

Http Www Ctdol State Ct Us Ui Online Guide 20for 20filing 20ct 20unemployment 20claims Pdf

Post a Comment for "How To File For Unemployment If You Were Self Employed"