Does Tax Come Out Of Unemployment

If you did not receive this form in the mail refer to the Department of Workforce Developments website you may need to enter the Uplink system to print your copy. 10 That extra 600 is also taxable after the first 10200.

Paying Taxes On Unemployment Checks Everything You Need To Know Cnet

Paying Taxes On Unemployment Checks Everything You Need To Know Cnet

Millions of Americans filed their taxes before Congress changed the rules making a big chunk of unemployment.

Does tax come out of unemployment. 1 day agoUnemployment benefits caused a great deal of confusion this tax season. When it comes to federal income taxes the general answer is yes. 5 Depending on the number of dependents you have this might be more or less than what an employer would have withheld from your pay.

Most states do not withhold taxes from unemployment benefits voluntarily but you can request they withhold taxes. If you received unemployment compensation you. JACKSONVILLE Fla Some unemployed Floridians who didnt have taxes deducted from their unemployment benefits may have a hefty payment to the government in the coming months.

It provided an additional 600 per week in unemployment compensation per recipient through July 2020. Federal income tax is withheld from unemployment benefits at a flat rate of 10. Refer to Form W-4V Voluntary Withholding Request and Tax Withholding.

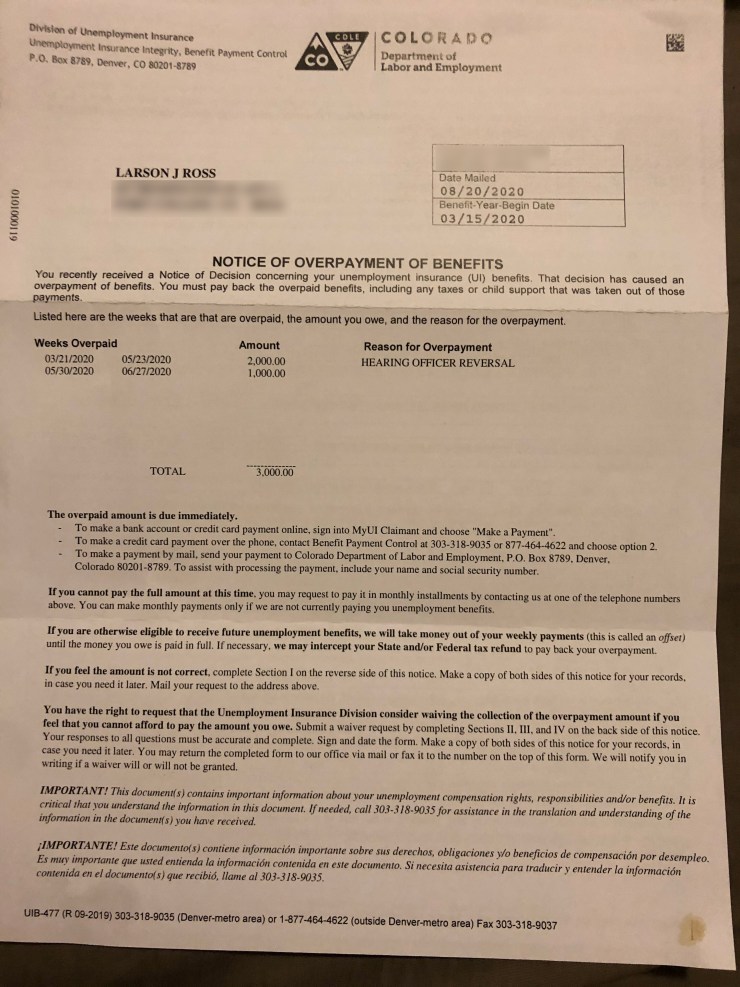

The American Rescue Plan which was signed into law by President Joe Biden on March 11 made the first 10200 of unemployment income tax-free. Be sure to include information from your 1099G. If you repay the benefits in a following year you can take a deduction as long as you paid tax on supplemental unemployment benefit income in the year you received it because you believed you had a right to it.

Your unemployment compensation is taxable on both your federal and state tax returns. Unemployment benefits are usually taxable as income and are still subject to federal income taxes above the exclusion or if you earned more than 150000 in 2020. Taxable benefits include any of the special unemployment compensation authorized under the Coronavirus Aid Relief and Economic Security CARES Act enacted this spring.

By law unemployment compensation is taxable and must be reported on a 2020 federal income tax return. However jobless workers wont pay Social Security and Medicare taxes like they would on their paychecks. Claim this deduction by reporting your supplemental unemployment benefits as income.

Unemployment benefits are generally taxable. The IRS and most states consider unemployment payments as taxable income which means that you have to pay tax on these payments and report them on your return. You have multiple options for paying your taxes when youre unemployed.

You might be alright if you arranged to have income tax withheld from your benefits but federal law caps withholding on benefits at 10. Sometimes it doesnt pay to be an early bird. You can use Form W-4V Voluntary Withholding Request to.

May be required to make quarterly estimated tax payments or Can choose to have federal income tax withheld from your unemployment compensation. Uncle Sam taxes unemployment benefits as if they were wages although up to 10200 of unemployment compensation received in 2020. You must take the deduction in the year you repaid.

Paying taxes when you are unemployed Unless the federal andor state governments act to change the law youll likely have to pay federal income tax and possibly state income tax on the unemployment compensation you receive while out of work because of COVID-19. The federal government considers unemployment benefits to be taxable income although taxes are not automatically withheld from benefits payments the way an employer might take taxes out of your. Unemployment benefits are taxable Long ago unemployment benefits were exempt from income tax.

Unemployment compensation is taxable. You dont have to pay Social Security and Medicare taxes on your unemployment benefits but you do have to report them on your tax return as income. Unfortunately thats no longer true.

Unemployment benefits are taxed like other income sources experts said. The American Rescue Plan makes the first 10200 of unemployment payments per taxpayer tax-free on your federal tax return for households with an annual income under 150000. Fortunately the unemployment tax nightmare that left many with reduced refunds or an unexpected tax bill is coming.

If you are receiving unemployment benefits check with your state about voluntary withholding to help.

Frequently Asked Questions About Unemployment Benefits For The Self Employed Cares Act Nav

Frequently Asked Questions About Unemployment Benefits For The Self Employed Cares Act Nav

Enhanced Unemployment Benefits During The Coronavirus Crisis Smartasset

Enhanced Unemployment Benefits During The Coronavirus Crisis Smartasset

How Unemployment Can Affect Your Tax Return

How Unemployment Can Affect Your Tax Return

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Taxes 2021 Everything New Including Deadline Stimulus Payments And Unemployment Cnet

Taxes 2021 Everything New Including Deadline Stimulus Payments And Unemployment Cnet

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

How Unemployment Affects Your Taxes Taxact Blog

How Unemployment Affects Your Taxes Taxact Blog

States Are Telling Some People To Pay Back Unemployment Benefits Marketplace

States Are Telling Some People To Pay Back Unemployment Benefits Marketplace

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

New Bill Aims To Eliminate Taxes On Up To 10 200 Of 2020 Unemployment Benefits

New Bill Aims To Eliminate Taxes On Up To 10 200 Of 2020 Unemployment Benefits

What Are Employee And Employer Payroll Taxes Ask Gusto

What Are Employee And Employer Payroll Taxes Ask Gusto

2020 Unemployment Tax Break H R Block

2020 Unemployment Tax Break H R Block

How Will Unemployment Benefits Impact Your 2020 Taxes Legalzoom Com

How Will Unemployment Benefits Impact Your 2020 Taxes Legalzoom Com

People Now Receiving Tax Form Tied To Fake Unemployment Claims

People Now Receiving Tax Form Tied To Fake Unemployment Claims

Is Unemployment Taxed H R Block

Is Unemployment Taxed H R Block

If You Were On Unemployment Last Year You Ll Probably Get A Tax Break Marketplace

If You Were On Unemployment Last Year You Ll Probably Get A Tax Break Marketplace

Accessing Your 1099 G Sc Department Of Employment And Workforce

Accessing Your 1099 G Sc Department Of Employment And Workforce

The Irs Just Made More People Eligible For An Unemployment Benefit Tax Break

The Irs Just Made More People Eligible For An Unemployment Benefit Tax Break

Post a Comment for "Does Tax Come Out Of Unemployment"