Do You Pay Taxes On Ohio Unemployment

285 on taxable income. Unemployment checks in Ohio normally amount to no more than half the lost weekly income topping out at 480 for a single person or 647 for someone with at least three dependents.

Https Unemployment Ohio Gov Pdf New Workers Self Service User Guide Pdf

Mike DeWine Wednesday brought.

Do you pay taxes on ohio unemployment. The Ohio Department of Taxation will help you find answers to questions about Ohio income taxes including who needs to file a return how and when to file finding the right tax forms and information about Ohios sales tax holiday. You will have to enter a 1099G that is issued by your state. The average weekly wage is determined by dividing your total wages earned during the base period from any employer who pays unemployment contributions by the total number of.

Unemployment benefits including the 600 weekly federal benefit are subject to both federal and state income taxes. Please visit unemploymentohiogov click on the Report Identity Theft button and complete the form so that we can investigate the claim that was filed and take appropriate actionsThis can include correcting the 1099-G form that you were sent. Federal income tax is withheld from unemployment benefits at a flat rate of 10.

The City of Ironton if I recall correctly is the only city in Ohio that taxes unemployment. In some cases you can elect out. With this new law if your household income is less than 150000 the first 10200 of unemployment per taxpayer will be tax free on your federal tax return but any amount you receive above that will be taxed.

5 Depending on the number of dependents you have this might be more or less than what an employer would have withheld from your pay. Who is an Employee. By law unemployment compensation is taxable and must be reported on a 2020 federal income tax return.

Who is a Domestic Employer. Because Ohios income tax begins with federal adjusted gross income your unemployment compensation is also taxable to Ohio on your IT 1040 return. Taxable benefits include any of the special unemployment compensation authorized under the Coronavirus Aid Relief and Economic Security CARES Act enacted this spring.

Unemployment Compensation Tax - Frequently Asked Questions Who is an Employer. To check on your refund pay your taxes or file online visit TaxOhiogov. The IRS considers unemployment benefits taxable income When filing for tax year 2020 your unemployment checks will be counted as.

What is the difference between an E. Highlighted below are two important pieces of information to help you register your business and begin reporting. Unemployment compensation has its own line Line 7 on Schedule 1.

Youll have to pay taxes on the remaining amount if you received more than 10200 in unemployment compensation. Unemployment compensation is taxable on your federal return. The change in a bill signed by Gov.

You can use Form W-4V Voluntary Withholding Request to. The money you receive through state-sponsored unemployment insurance is considered taxable income and must be reported to the federal government. State Income Tax Range.

Under the Ohio Unemployment Law most employers are liable to pay Unemployment taxes and report wages paid to their employees on a quarterly basis. As a result any unemployment compensation received in 2020 up to 10200 exempt from federal income tax is not subject Ohio income tax. Who is an Agricultural Employer.

This is due to the fact that the major industry in Ironton was the coal-fired electrical plant there. Taxation of unemployment benefits in Ohio. The IRS and most states consider unemployment payments as taxable income which means that you have to pay tax on these payments and report them on your return.

Who is a Public Entity Employer. As of December 27 2020 an additional 300 in unemployment benefits will be added to. Additionally if you live in a traditional tax base school district your unemployment compensation is also subject to school district income tax on your SD 100 return.

COLUMBUS Ohioans who received unemployment benefits in 2020 wont have to pay income taxes on the first 10200 they received. Who is a Non-Profit Employer. Your 1099-G will have the information youll need to transfer to your tax return.

If you file your application during 2021 you must have an average weekly wage of at least 280 before taxes or other deductions. Some states will mail out the 1099G.

Covid 19 Unemployment Benefits Hamilton Ryker

Covid 19 Unemployment Benefits Hamilton Ryker

Unemployment Fraud Chicago Man Receives Ohio Unemployment Tax Form Despite Never Living There Abc7 Chicago

Unemployment Fraud Chicago Man Receives Ohio Unemployment Tax Form Despite Never Living There Abc7 Chicago

Https Jfs Ohio Gov Ouio Pdf Pua Stepbystepapplicationinstructions Pdf

Did You Receive A 1099 G From The Ohio Department Of Taxation Or The Ohio Department Of Job And Family Services Department Of Taxation

Did You Receive A 1099 G From The Ohio Department Of Taxation Or The Ohio Department Of Job And Family Services Department Of Taxation

Ohio Unemployment Help Wkyc Com

Ohio Unemployment Help Wkyc Com

How To Apply For Unemployment Benefits Online In Ohio Youtube

How To Apply For Unemployment Benefits Online In Ohio Youtube

Answers To Qualifying For Unemployment The 300 Payments And Disputed Ohio Claims That S Rich Q A Cleveland Com

Answers To Qualifying For Unemployment The 300 Payments And Disputed Ohio Claims That S Rich Q A Cleveland Com

Http Www Policymattersohio Org Wp Content Uploads 2014 11 Uc Es Pdf

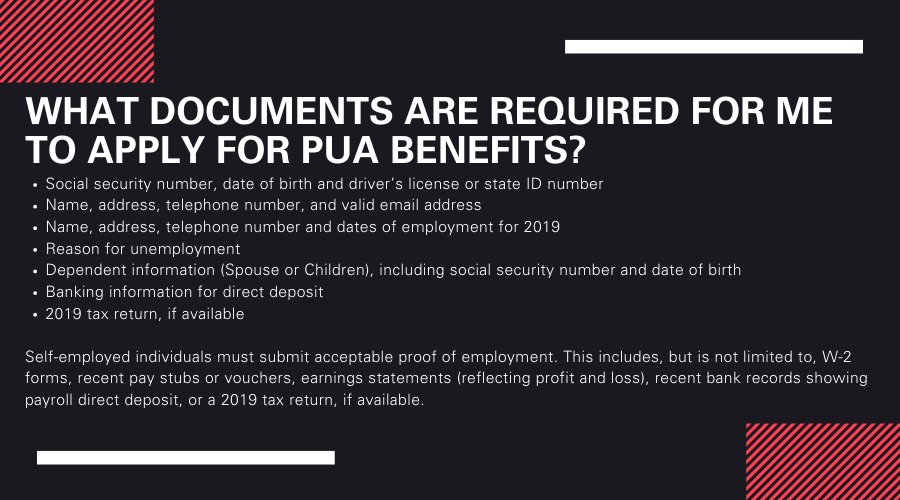

Ohiojfs On Twitter What Documents Are Required For Me To Apply For Pua Benefits For Answers To More Faq S Visit Https T Co Eummtiixu4 Inthistogetherohio Everyclaimisimportant Covid19 Https T Co 6okwzpzqdr

Ohiojfs On Twitter What Documents Are Required For Me To Apply For Pua Benefits For Answers To More Faq S Visit Https T Co Eummtiixu4 Inthistogetherohio Everyclaimisimportant Covid19 Https T Co 6okwzpzqdr

Odjfs Wants Businesses To Report Employees Who Refuse To Return To Work

Odjfs Wants Businesses To Report Employees Who Refuse To Return To Work

Https Unemployment Ohio Gov Pdf New Workers Self Service User Guide Pdf

Ohio Postpones Tax Filing Deadline To May 17 Matching The Irs Revised Deadline For Federal Taxes Cleveland Com

Ohio Postpones Tax Filing Deadline To May 17 Matching The Irs Revised Deadline For Federal Taxes Cleveland Com

Https Unemployment Ohio Gov Pdf New Workers Self Service User Guide Pdf

Respond To Employer Request For Separation Information Office Of Unemployment Insurance Operations Ohio Department Of Job And Family Services

Respond To Employer Request For Separation Information Office Of Unemployment Insurance Operations Ohio Department Of Job And Family Services

Tens Of Thousands Of Ohioans Told To Repay Unemployment Benefits

Tens Of Thousands Of Ohioans Told To Repay Unemployment Benefits

Https Unemployment Ohio Gov Pdf New Workers Self Service User Guide Pdf

Ohio Hospital Association Ohio Hospital Association

Ohio Hospital Association Ohio Hospital Association

Post a Comment for "Do You Pay Taxes On Ohio Unemployment"