Az Unemployment Missing Payment

This a partial list of the most commonly used Unemployment Insurance Tax forms. This video file cannot be played.

You should receive your EPC card by mail within a week after your initial application is processed.

Az unemployment missing payment. Mail your payment to. There you may search for a particular form or sort the list by name or form number by clicking on the heading in. If you printed a payment voucher enclose it with your payment but if you do not have a voucher it is not required.

Please go to the Documents Center to access all documents. Or 4 by US. Provided you are monetarily eligible refer to your Wage Statement UB-107 and you have not previously received an EPC card within the last 3 years for Unemployment Insurance.

The American Rescue Plan a 19 trillion Covid relief bill waived. Select Forms from the dropdown then select Unemployment in the Category and Insurance Tax in the Sub-category drop-down menus. Mail to Labor Department PO.

To check by phone. You must contact the bank that issued your EPCDebit Card or your personal bankcredit union for direct. PHOENIX - Arizonas unemployment agency revealed Monday that its paying out claims to over 300000 residents in addition to the payments.

DES - Unemployment Tax PO Box 52027 Phoenix AZ 85072-2027 Important Information about Additional Payments. Unemployment Insurance claimants who were paid between May 7 and May 11 did not receive the additional 600 weekly Federal Pandemic Unemployment. The maximum amount allowed on a single electronic payment EFT is 2099999999.

2 by e-mail to email protected. 3 by Fax to 602-542-8097. Box 19070 Phoenix AZ 85005-9070.

Arizona jobless claims rose yet again last week far beyond record levels and the Department of Economic Security is having technical problems this week paying people their weekly benefits. Unemployment Insurance UI benefit payments are made through a debit card system. Thirteen states arent offering a tax break on unemployment benefits received last year according to data from HR Block.

For many this is no small chunk of change. You should have a 600 payment for any week that you were eligible for unemployment. View more information about the telephone options available for other various UI claim inquiries.

Anyone who repaid an overpayment of unemployment benefits to the. It is the difference between buying groceries paying bills or making essential purchases. Initial payments were added to the Weekly Benefit Amount starting August 17 and DES began issuing retroactive payments for the benefits weeks ending August 1 and August 8 later that week.

Your unemployment benefits havent landed in your bank account even though the payment should arrive via direct deposit. Call the Telephone Information and Payment System and select Option 2 for the latest payment made to you or information about the last week you filed if you did not receive a payment and the balance remaining on your current claim. Some Arizonans said they are missing upwards of 10000 of unemployment payments due to the issues at the Department of Economic Security.

While many people receive their unemployment check in. The completed Unpaid Wage Claim Form may be submitted 1 Electronically by completing the Sign and Submit Form below. On January 28 2021 the Arizona Department of Economic Security DES began mailing 1099-G tax forms to claimants who received unemployment benefits in the state of Arizona in 2020.

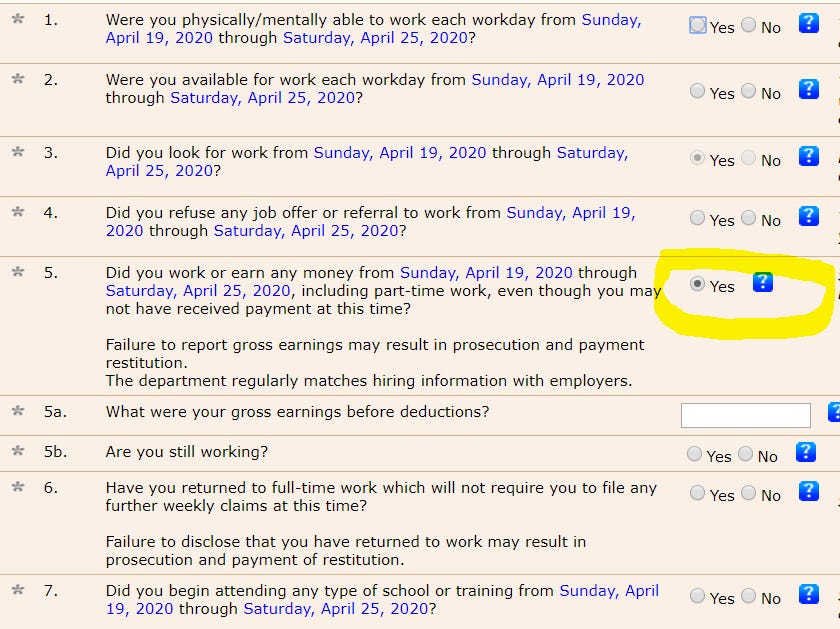

If you have checked your Claim Information and find that a payment was issued and the amount is not showing up on your EPCDebit Card or in your checkingsavings account if youve chosen to receive payments via direct deposit. KOLD News 13 - Many Arizonans who have lost their jobs due to the pandemic received their weekly compensation payments on Monday only to find they were 600 short. Then there were six potential payments of 300 for week endings 08022020-09062020 and again 300 payments from week ending 01032020 and onwards.

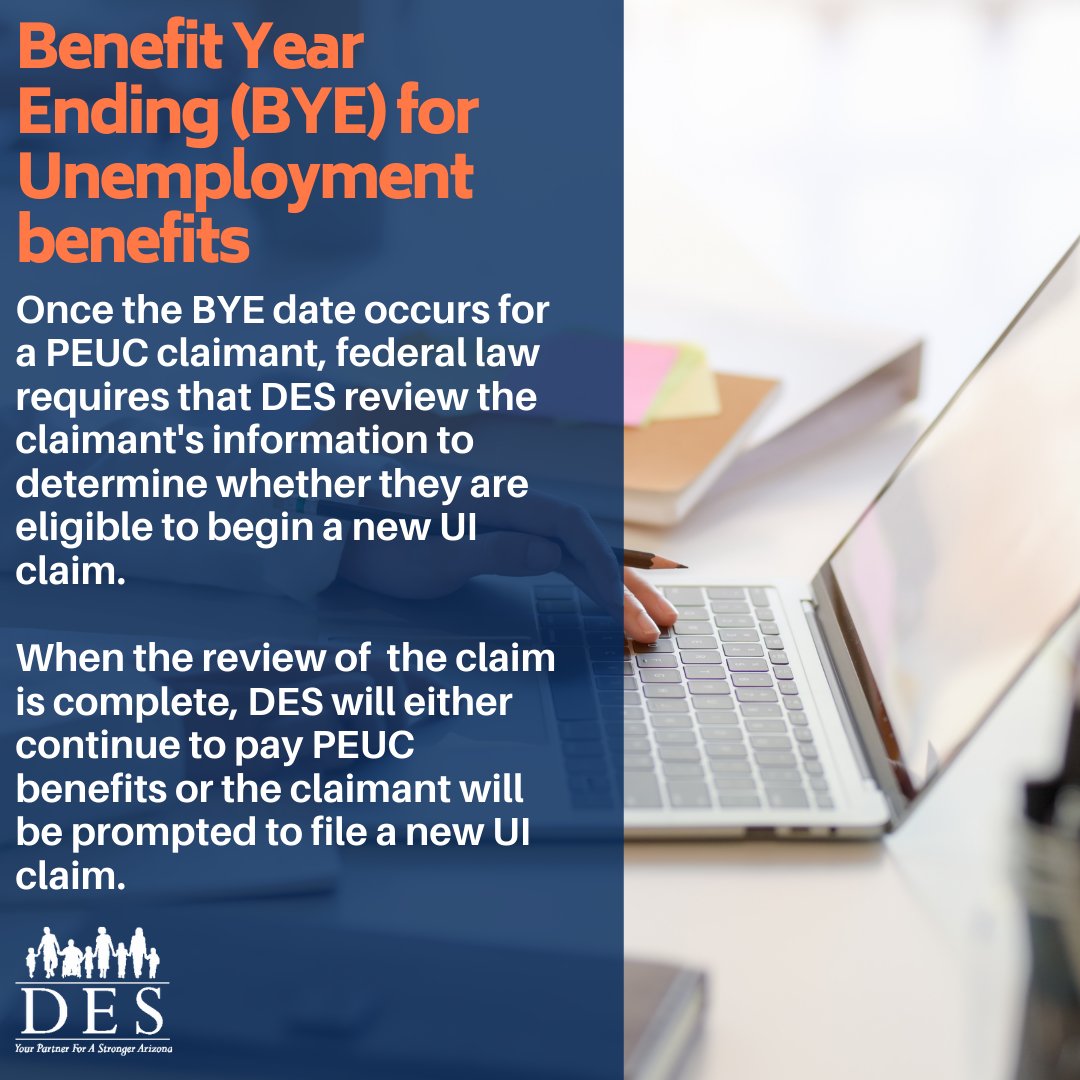

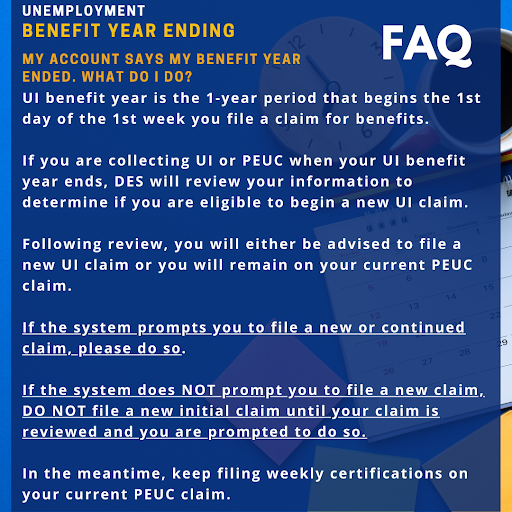

If you qualify for UI benefits you will automatically be enrolled in the Electronic Payment Card EPC program. Start a New UI Application To apply for Unemployment Insurance Benefits or if you already have a benefit year that hasnt expired and want to restart filing for benefits after a break due to employment or some other reason use the same online application that you used to initially apply for benefits. Arizona was the first state in the nation to begin issuing Lost Wages Assistance to eligible claimants.

Lost Wages Assistance LWA Program. Unemployment Insurance Benefits MissingLostStolen Checks Note.

Arizona Az Department Of Economic Security Unemployment Insurance Compensation Pua 300 Fpuc And Peuc 2021 Extensions And Updates Aving To Invest

Arizona Az Department Of Economic Security Unemployment Insurance Compensation Pua 300 Fpuc And Peuc 2021 Extensions And Updates Aving To Invest

Https Des Az Gov Sites Default Files Media Lost Wages Assistance Program Faqs Pdf Time 1599085991465

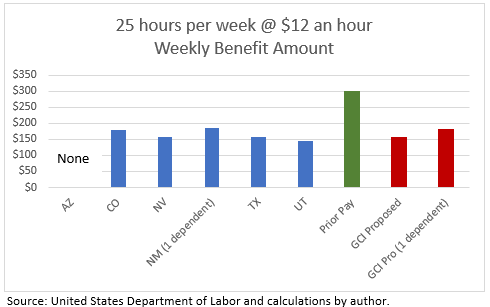

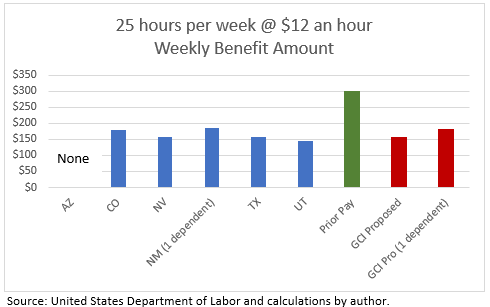

Arizona Needs To Address Unemployment Compensation To Ensure Families Are Protected Before The Next Recession Grand Canyon Institute

Arizona Needs To Address Unemployment Compensation To Ensure Families Are Protected Before The Next Recession Grand Canyon Institute

Arizona Department Of Economic Security Your Partner For A Stronger Arizona

Arizona Department Of Economic Security Your Partner For A Stronger Arizona

Workers Worry Unemployment Benefits Don T Fit The Covid 19 Economy

Workers Worry Unemployment Benefits Don T Fit The Covid 19 Economy

Unemployment Benefits Arizonan S Checks Say They Re From Pennsylvania

Unemployment Benefits Arizonan S Checks Say They Re From Pennsylvania

Https Des Az Gov Content Arizona One First States Begin Issuing New 300 Covid 19 Relief Unemployment Funds

This Is Not Acceptable Arizonans Continue To Fight Bureaucratic Issues For Unemployment Money 12news Com

This Is Not Acceptable Arizonans Continue To Fight Bureaucratic Issues For Unemployment Money 12news Com

Arizona Unemployment Claims Can Be Faxed If The Online Form Breaks

Arizona Unemployment Claims Can Be Faxed If The Online Form Breaks

300 Federal Unemployment Benefits Available To Arizonans Next Week

300 Federal Unemployment Benefits Available To Arizonans Next Week

Covid 19 And Unemployment Insurance Benefits Questions And Answers Arizona Department Of Economic Security

Covid 19 And Unemployment Insurance Benefits Questions And Answers Arizona Department Of Economic Security

Arizona Unemployment Claims Can Be Faxed If The Online Form Breaks

Arizona Unemployment Claims Can Be Faxed If The Online Form Breaks

Arizona Unemployment Claims Can Be Faxed If The Online Form Breaks

Arizona Unemployment Claims Can Be Faxed If The Online Form Breaks

Post a Comment for "Az Unemployment Missing Payment"