10000 Of Unemployment Not Taxable

Remove taxes on up to 10200 in unemployment aid for the 2020 tax filing year. Proposed legislation introduced this week would remove taxes on up to 10200 in unemployment aid for the 2020 tax.

Do I Have To Pay Tax On Unemployment Benefits The Motley Fool

Do I Have To Pay Tax On Unemployment Benefits The Motley Fool

State Income Tax Range.

10000 of unemployment not taxable. Certain taxpayers who received unemployment benefits in 2020 can now exclude up to 10200 of compensation from. The federal government considers unemployment benefits to be taxable income although taxes are not automatically withheld from benefits payments the way an employer might take taxes out of your. This relief helps taxpayers who received federal unemployment insurance in 2020 to stop paying taxes on the first 10200 20400 for couples of benefits they received.

Thats why the new COVID bill is a big deal for recipients of unemployment benefits. That could mean up to. This exception applies only to benefits earned in the tax year 2020 not to funding received the next year 2021.

Made the first 10200 of 2020 unemployment benefits tax. Although unemployment benefits are taxable the new law made the first 10200 of benefits tax-free for people with incomes of less than 150000. He filed his taxes a few days before Congress passed the latest COVID-19 relief bill which surprise.

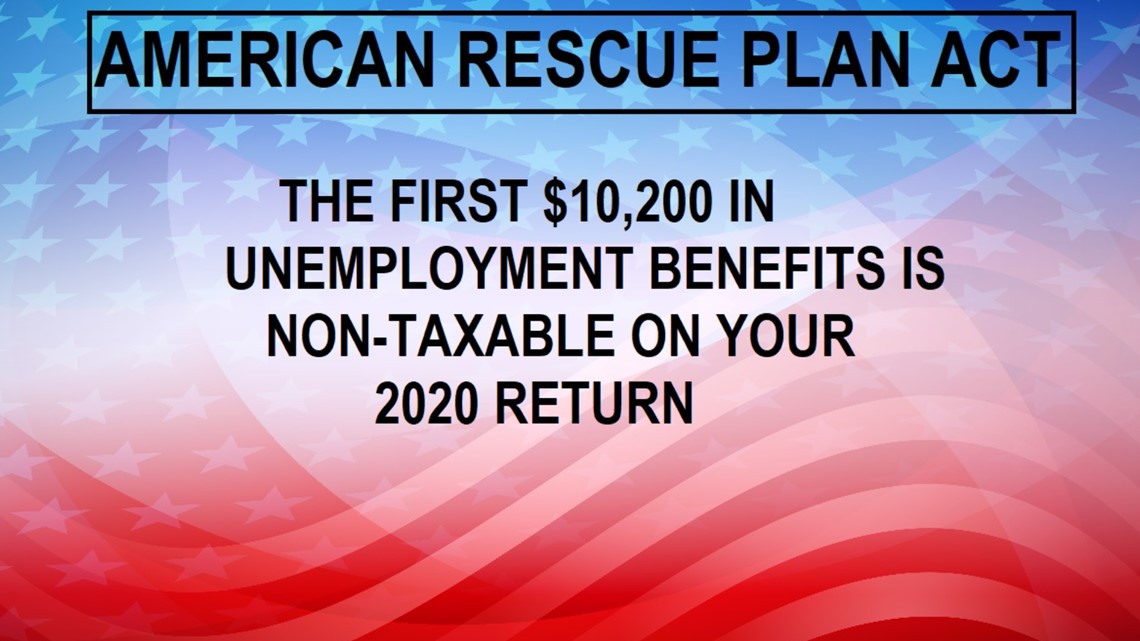

The amendment in the final stimulus bill will make the first 10200 in unemployment benefitscompensation received in 2020 non-taxable ie. Were reviewing the tax provisions of the American Rescue Plan Act of 2021 signed into law on March 11 2021. Thanks to the American Rescue Plan which was passed and signed into law in March 2021 the full amount of unemployment benefits are not taxable.

New Jersey does not tax unemployment compensation. If your modified adjusted gross income AGI is less than 150000 the American Rescue Plan enacted on March 11 2021 excludes from income up to 10200 of unemployment compensation paid in 2020 which means you dont have to pay tax on unemployment compensation of up to 10200. This applies to 2020 only.

State Taxes on Unemployment Benefits. The American Rescue Plan which was signed into law by President Joe Biden on March 11 made the first 10200 of unemployment income tax-free for. If you are married each spouse receiving unemployment compensation doesnt have to pay tax on.

Its also important to keep in mind that not everyone will get a federal tax break on 10200 in unemployment income. 14 on up to 20000 of taxable income. That provision only applies to tax.

For the latest updates on coronavirus tax relief related to this page check IRSgovcoronavirus. 2 days agoThere are 12 states that tax unemployment payments that have yet not followed the federal lead to extend a waiver to the first 10200 in unemployment benefits claimed in. Dick Durbin D-Ill and Rep.

1075 on taxable income. Up to 10200 in unemployment payments is tax-free. Key Points Thirteen states arent offering a tax break on unemployment benefits received last year according to data from HR Block.

Cindy Axne D-Iowa introduced a bill on Tuesday that would waive taxes on the first 10200 in unemployment benefits that individuals received last year. As Americans prepare to file their 2020 income taxes a new Democrat-backed bill wants to block federal income taxes on the first 10200 a person received in unemployment. The tax treatment of unemployment benefits you receive depends on the type of program.

USA Today reports under the latest stimulus package you will not be not taxed on the first 10000 of unemployment pay in 2020. 3 If you filed your taxes before the American Rescue Plan was passed you had to pay taxes on the full amount of your unemployment benefits. What are the 10000 non-taxable unemployment benefits for.

For married couples this amount would be 20400.

Paying Taxes On Unemployment Checks Everything You Need To Know Cnet

Paying Taxes On Unemployment Checks Everything You Need To Know Cnet

Taxed For Unemployment You Didn T Receive What The Irs Says You Should Do

Taxed For Unemployment You Didn T Receive What The Irs Says You Should Do

Is Unemployment Taxed H R Block

Is Unemployment Taxed H R Block

Make Sure You Don T Pay Taxes On These Unemployment Benefits Newscentermaine Com

Make Sure You Don T Pay Taxes On These Unemployment Benefits Newscentermaine Com

Frequently Asked Questions About Unemployment Benefits For The Self Employed Cares Act Nav

Frequently Asked Questions About Unemployment Benefits For The Self Employed Cares Act Nav

Stimulus Bill Unemployment Benefits How A New Tax Break Could Save You Money Cnet

Stimulus Bill Unemployment Benefits How A New Tax Break Could Save You Money Cnet

Unemployment Stimulus Am I Eligible For The New Unemployment Income Relief The Turbotax Blog

Unemployment Stimulus Am I Eligible For The New Unemployment Income Relief The Turbotax Blog

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Senate Bill Indicates A Portion Of Unemployment Compensation May Not Be Taxable In 2020

Senate Bill Indicates A Portion Of Unemployment Compensation May Not Be Taxable In 2020

A Detailed Guide To Unemployment Insurance Compliance Emptech Com

A Detailed Guide To Unemployment Insurance Compliance Emptech Com

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

Here S Information On Why Unemployment Is Taxable In Colorado 9news Com

Here S Information On Why Unemployment Is Taxable In Colorado 9news Com

Covid Bill Provides Tax Waiver On Up To 10 200 Of Unemployment Benefits

Covid Bill Provides Tax Waiver On Up To 10 200 Of Unemployment Benefits

Stimulus Checks Won T Be Taxed But Unemployment Benefits Will Be News Wfsb Com

Stimulus Checks Won T Be Taxed But Unemployment Benefits Will Be News Wfsb Com

New Bill Aims To Eliminate Taxes On Up To 10 200 Of 2020 Unemployment Benefits

New Bill Aims To Eliminate Taxes On Up To 10 200 Of 2020 Unemployment Benefits

Taxed For Unemployment You Didn T Receive What The Irs Says You Should Do

Taxed For Unemployment You Didn T Receive What The Irs Says You Should Do

Post a Comment for "10000 Of Unemployment Not Taxable"