Unemployment Taxes Columbus Ohio

Employers with questions can call 614 466-2319. If you worked in a City other than Columbus you can take credit for any city tax withheld and paid to that city.

1890 The United Mine Workers Of America Is Founded In Columbus Ohio The United Mine Workers Of America Coal Mining Union Logo Labor Union

1890 The United Mine Workers Of America Is Founded In Columbus Ohio The United Mine Workers Of America Coal Mining Union Logo Labor Union

Payments for the first quarter of 2020 will be due April 30.

Unemployment taxes columbus ohio. Front Street building to drop off tax documents. Highlighted below are two important pieces of information to help you register your business and begin reporting. Effective the first quarter of 2020 Ohio employers will pay state unemployment taxes on the first 9000 in actual not prorated wages paid to each of their covered employees.

Due to the ARPA the IRS is allowing certain taxpayers to deduct up to 10200 in unemployment benefits. Due to the COVID-19 pandemic the Division is currently closed to the public. Changes in how unemployment benefits are taxed for tax year 2020 Read More Did you receive a 1099-G.

Because Ohios income tax begins with federal adjusted gross income your unemployment compensation is also taxable to Ohio on your IT 1040 return. Report it by calling toll-free. Ohio income tax update.

Reporting their unemployment tax liability as soon as there are one or more employees in covered employment. Specifically federal tax changes related. 614 645-7193 Customer Service Hours.

Box 182404 Columbus Ohio 43218-2404. In Ohio theres discussion in Columbus about whether state lawmakers will follow the federal law and pass legislation next week that would also exempt 10200 in unemployment benefits on state tax returns. In regards to taxes unemployment benefits are generally treated as income.

Ohio Income Tax Update. On March 31 2021 Governor DeWine signed into law Sub. Check your W-2s to make sure a total of 25 was withheld by your employer.

Certain married taxpayers who both received unemployment benefits can each deduct up. What the American Rescue Plan does is exempt the first 10200 of federal unemployment. Additionally if you live in a traditional tax base school district your unemployment compensation is also subject to school district income tax.

The change in a bill signed by Gov. Obtain detailed information regarding your. 2011 2012 2013 Lowest Experience Rate.

The IRS considers unemployment compensation taxable income. Taxpayers may use the secure drop box located in the lobby of the 77 N. Under the Ohio Unemployment Law most employers are liable to pay Unemployment taxes and report wages paid to their employees on a quarterly basis.

This may be done at Ericohiogov or by completing the JFS 20100 Report to Determine Liability and mailing it to PO. Contribution Rates For 2011 2012 and 2013 the ranges of Ohio unemployment tax rates also know as contribution rates are as follows. Unemployment benefits are not subject to municipal income taxes in Ohio so nothing changes there the Regional Income Tax Agency confirmed.

Income of religious fraternal charitable scientific literary or educational institutions to the extent that such income is derived from tax-exempt real estate tax-exempt tangible or intangible property or tax-exempt activities. Also used by employers to authorize the Ohio Department of Job and Family Services to furnish information directly to a representative. If you worked in a city with a tax of 1 and only 1 was withheld you must pay an additional 15 to Columbus.

Its looking like Ohio will be addressing and likely approving in the General Assembly a conformity bill which would align Ohio with all of the tax changes said Gary Gudmundson. Changes in how Unemployment Benefits are taxed for Tax Year 2020. Used by employers to authorize someone other than the employer to provide information pertaining to Unemployment Taxes.

For a total of 25 tax paid. 18 which incorporates recent federal tax changes into Ohio law effective immediately. Mike DeWine Wednesday brought.

A record number of tax forms will be going out this month to Ohioans who must pay taxes on unemployment benefits they received in 2020. COLUMBUS Ohioans who received unemployment benefits in 2020 wont have to pay income taxes on the first 10200 they received. Monday through Friday 900 am.

It is included in your federal adjusted gross income FAGI on your federal 1040. To receive your Unemployment tax account number and contribution rate. Insurance benefits - unless your employer paid the premiums.

With the Ohio Society of CPAs supported tax conformity legislation Senate Bill 18 being signed into law by Governor DeWine on March 31 the Ohio Department of Taxation has now issued guidance on Ohio tax filings related to the retroactive 10200 income tax exemption for unemployment. How to Obtain an Employer Account Number. Ohio taxes unemployment benefits to the extent they are included in federal adjusted gross income AGI.

JFS-20106 Employers Representative Authorization for Taxes.

Ohio Unemployment Help Wkyc Com

Ohio Unemployment Help Wkyc Com

Oh893 Herrick Memorial Library Old Cars Wellington Ohio Real Photo Postcard House Styles Ohio Photo Postcards

Oh893 Herrick Memorial Library Old Cars Wellington Ohio Real Photo Postcard House Styles Ohio Photo Postcards

Ohio Postpones Tax Filing Deadline To May 17 Matching The Irs Revised Deadline For Federal Taxes Cleveland Com

Ohio Postpones Tax Filing Deadline To May 17 Matching The Irs Revised Deadline For Federal Taxes Cleveland Com

Cincinnati S Oldest Park Is Still One Of The Most Beautiful Spots In The City Downtown Cincinnati Ohio Photography Ohio Travel

Cincinnati S Oldest Park Is Still One Of The Most Beautiful Spots In The City Downtown Cincinnati Ohio Photography Ohio Travel

Https Jfs Ohio Gov Ocomm Pdf 031221 Revised Stimulus Bill Update News Release Stm

Fraud Wreaks Havoc On Ohio Unemployment System Wtol Com

Fraud Wreaks Havoc On Ohio Unemployment System Wtol Com

Downtown Cincinnati Ohio Taken By Jhouston Ohio Photography Cincinnati Ohio Downtown Cincinnati

Downtown Cincinnati Ohio Taken By Jhouston Ohio Photography Cincinnati Ohio Downtown Cincinnati

Ohio Unemployment Claims Flagged For Fraud

Ohio Unemployment Claims Flagged For Fraud

Unemployment Fraud Reports Running Rampant In Central Ohio

Unemployment Fraud Reports Running Rampant In Central Ohio

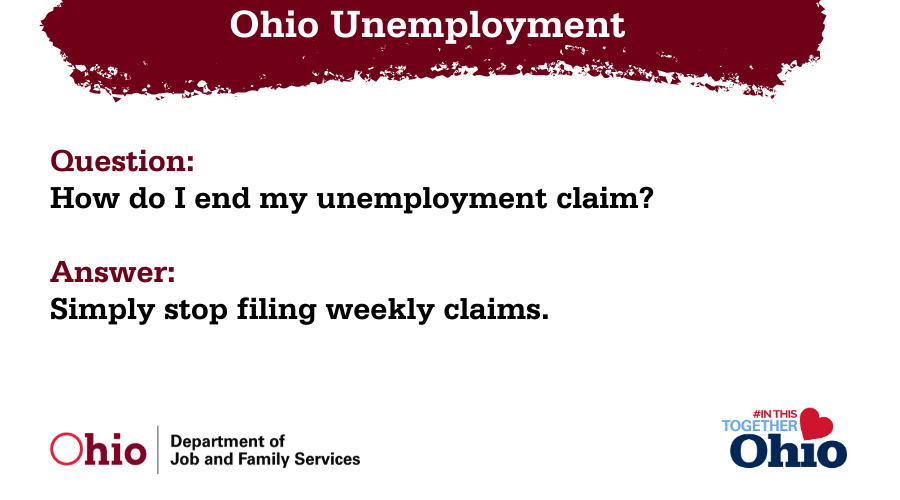

Ohiojfs On Twitter Unemployment Faq How Do I End My Unemployment That S Simple Stop Filing Weekly Claims And Your Claim Will Close Automatically To Find A Full List Of Frequently Asked Questions

Ohiojfs On Twitter Unemployment Faq How Do I End My Unemployment That S Simple Stop Filing Weekly Claims And Your Claim Will Close Automatically To Find A Full List Of Frequently Asked Questions

Cinncinati Row Houses Row House Cincinnati Ohio City View

Cinncinati Row Houses Row House Cincinnati Ohio City View

Pin By Brian J Boskovitch On Unoy Tetri In 2020 Activities Day Ohio

Pin By Brian J Boskovitch On Unoy Tetri In 2020 Activities Day Ohio

As Ohio Economy Reopens State Has No Answers For Many Of The Working Poor Health Planning Ohio Service Jobs

As Ohio Economy Reopens State Has No Answers For Many Of The Working Poor Health Planning Ohio Service Jobs

Rideshare Rodeo Podcast 12 Uber Global Monopoly Tax Filing Tips For Gig Workers Rideshare Podcasts Filing Taxes

Rideshare Rodeo Podcast 12 Uber Global Monopoly Tax Filing Tips For Gig Workers Rideshare Podcasts Filing Taxes

What You Need More Than An Assistant Sales Coaching Sales And Marketing Assistant

What You Need More Than An Assistant Sales Coaching Sales And Marketing Assistant

50 000 Unemployment Claims Filed In Ohio During The Past Week 5 000 Flagged For Possible Fraud Nbc4 Wcmh Tv

50 000 Unemployment Claims Filed In Ohio During The Past Week 5 000 Flagged For Possible Fraud Nbc4 Wcmh Tv

Pin By Brian J Boskovitch On Unoy Tetri In 2020 Activities Day Ohio

Pin By Brian J Boskovitch On Unoy Tetri In 2020 Activities Day Ohio

Standard Deduction Vs Itemized Tax Deduction What S Better Standard Deduction Deduction Tax Deductions

Standard Deduction Vs Itemized Tax Deduction What S Better Standard Deduction Deduction Tax Deductions

Post a Comment for "Unemployment Taxes Columbus Ohio"