Unemployment Tax Refund Nc

SB 114 would put the adjustment on hold for the rest of the tax year keeping the. Locate contact information for state agencies employees hotlines local offices and more.

Use the Wheres My Refund application for an up-to-date report on the status of your refund.

Unemployment tax refund nc. Wheres My Refund. MoreIRS tax refunds to start in May for 10200 unemployment tax break. Unemployment tax payments made by employers are transferred to the Unemployment Insurance Trust Fund in Washington DC.

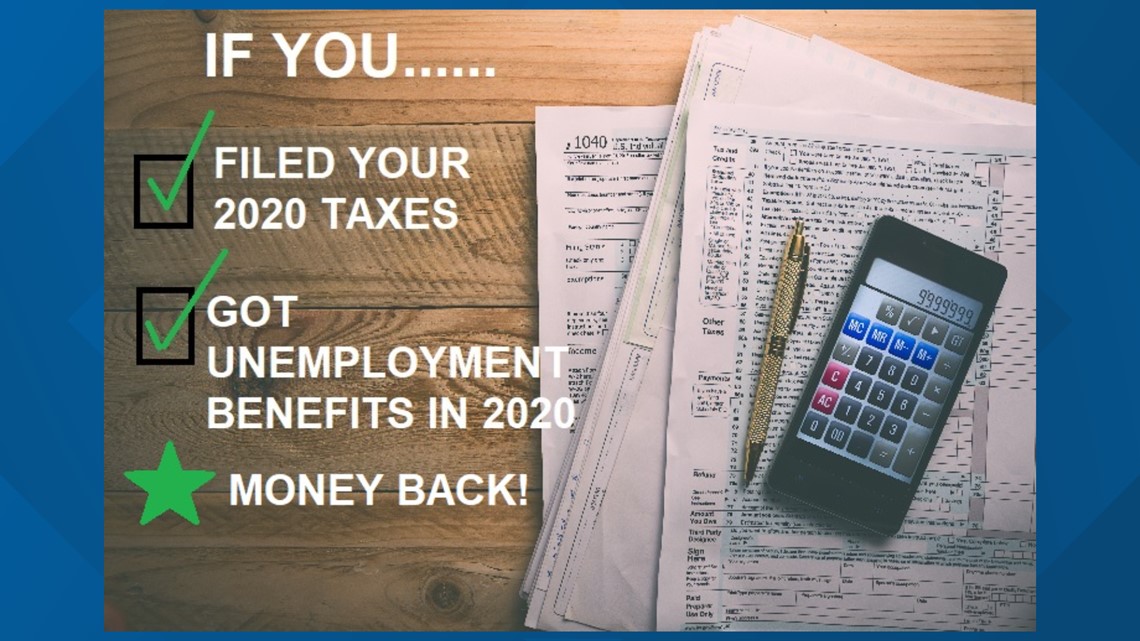

The Governor of North Carolina passed a relief bill that allows all employers who paid their 1Q 2020 North Carolina State Unemployment Insurance tax payment timely on or before April 30 2020 to get a credit equal to their 1Q payment and have it applied towards their 2Q tax payment. 12 hours agoAmericans who collected unemployment insurance in 2020 and filed their taxes before claiming a new tax break on the benefits can expect to receive an automatic refund. 31 2021 all individuals who received unemployment benefits in 2020 will receive an IRS Form 1099-G from the Division of Employment Security.

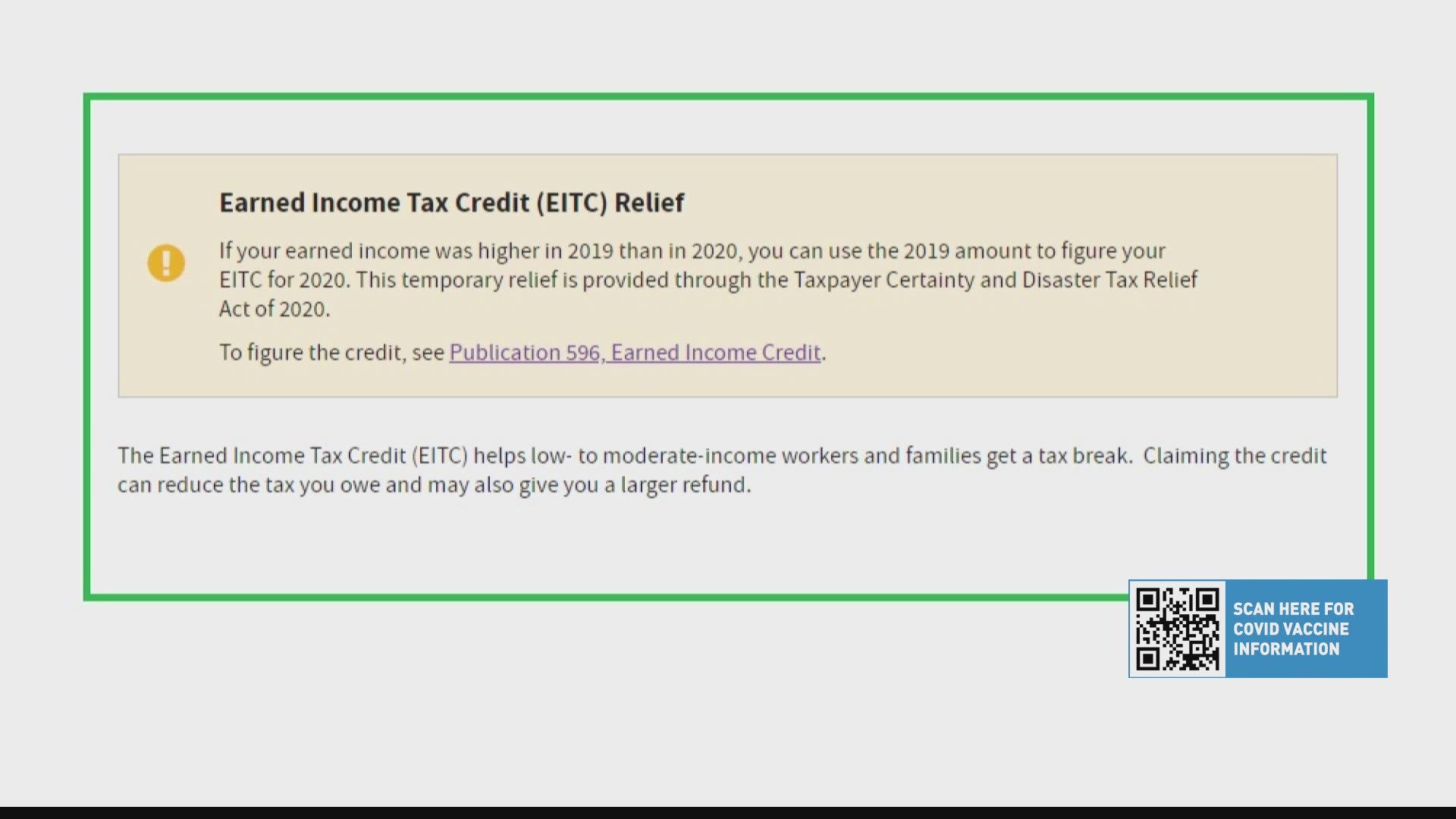

Learn about unemployment tax for employers. The American Rescue Plan passed last month included a tax relief provision that waives taxes on up to 10200 of unemployment benefits meaning more. Fortunately the unemployment tax nightmare that left many with reduced refunds or an unexpected tax.

These statements report the total amount of benefits paid to a claimant in the previous calendar year for tax purposes. State Taxes on Unemployment Benefits. 2 days agoExpecting another refund after the IRS calculates the 10200 unemployment tax break.

Under the American Rescue Plan those who received federal unemployment benefits in 2020 will receive a 10200 tax break when they file a federal income tax return this year. Questions about your 2020 taxesWere here to helpUnemployment is usually taxable income buttaxes are being waived on the first 10200 inunemployment benefits for most peopleThe 2021 tax deadline has been extended toMay 17 meaning you have more time to paywithout incurring penalties or interestThose who were affected by thepandemic and have retirementaccounts could. Employers determined to be liable under the Employment Security Law Chapter 96 of the North Carolina General Statutes are required to prominently display the Certificate of Coverage and Notice to Workersposter in their workplace.

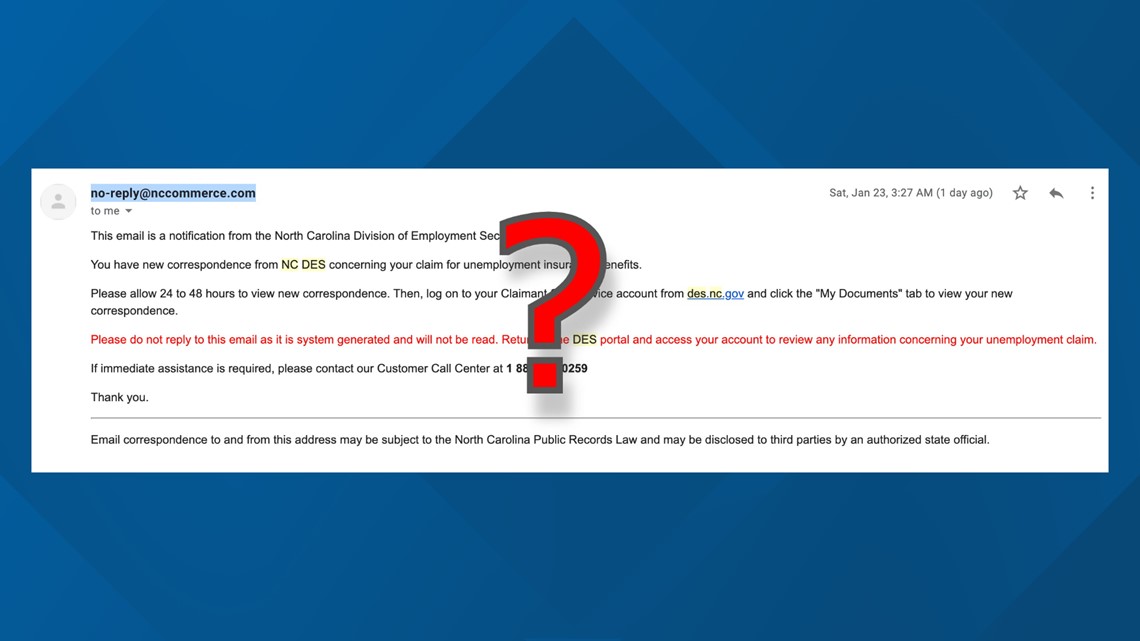

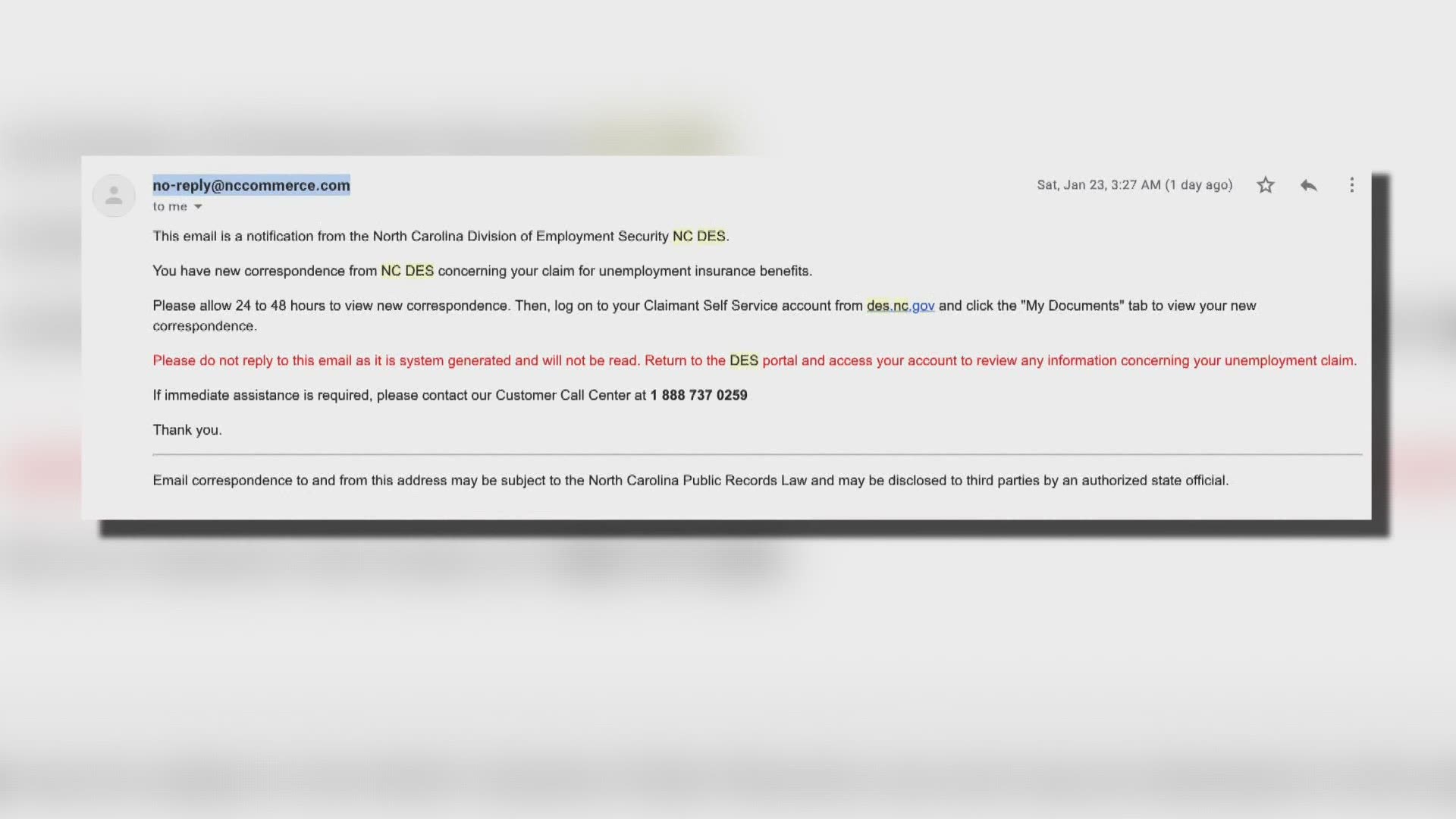

1099-G forms are delivered by email or mail and are also available through a claimants DES online account. 8 hours agoCHARLOTTE NC. TaxWatch What to do if you already filed taxes but want to claim the 10200 unemployment tax break Last Updated.

Arizona taxes unemployment compensation to the same extent as it is taxed under federal law. Each year a prorated share of the interest earned on this trust fund is added back to the account of each North Carolina employer having a credit experience rating balance. March 20 2021 at 941 am.

1 day agoUnemployment benefits caused a great deal of confusion this tax season. Under North Carolina law state unemployment tax has three possible base rates which adjust each year based on the states unemployment trusts solvency. The lowest base rate was applied in 2019 and the middle base rate was supposed to be activated Thursday.

WECT - According to the North Carolina Department of Commerce Employment Security since March 15 more than 13 million people in the state have applied for unemployment. MoreHow to avoid tax. Heres what you need to know.

The public needs to prepare for tax liability from unemployment benefits By John Smist October 8 2020 at 1029 PM EDT - Updated October 8 at 1156 PM WILMINGTON NC. This was passed on May 4 2020. You cannot check the status of extra credit grant awards using the Wheres My Refund application.

1 day agoAs such many missed out on claiming that unemployment tax break. You can find additional information about the Extra Credit Grant Program here. You might want to do more than just wait Last Updated.

Unemployment tax is not deducted from employee wages.

Des Covid 19 Information For Employers

Income Tax Season 2021 What To Know Before Filing In Nc Charlotte Nc Patch

Income Tax Season 2021 What To Know Before Filing In Nc Charlotte Nc Patch

Time Is Almost Up To Apply For 335 Extra Credit Grant For North Carolina Families With Children Abc11 Raleigh Durham

Time Is Almost Up To Apply For 335 Extra Credit Grant For North Carolina Families With Children Abc11 Raleigh Durham

Get Answers About Stimulus Payments And Taxes Wcnc Com

Get Answers About Stimulus Payments And Taxes Wcnc Com

Des North Carolina Makes First Lost Wages Assistance Payments

Des North Carolina Makes First Lost Wages Assistance Payments

North Carolina Des Email Is About Your Tax Form For Unemployment Wcnc Com

North Carolina Des Email Is About Your Tax Form For Unemployment Wcnc Com

State Employees Credit Union Tax Refund Information

State Employees Credit Union Tax Refund Information

Nc Separation Agreement Template Lovely Nc Divorce Forms Courselist Separation Agreement Template Social Security Benefits Contract Template

Nc Separation Agreement Template Lovely Nc Divorce Forms Courselist Separation Agreement Template Social Security Benefits Contract Template

How Refund Checks Unemployment Affect Taxes In North Carolina

How Refund Checks Unemployment Affect Taxes In North Carolina

North Carolina Des Email Is About Your Tax Form For Unemployment Wcnc Com

North Carolina Des Email Is About Your Tax Form For Unemployment Wcnc Com

Nc S Tax Day Is Still April 15 But That Could Change Wfmynews2 Com

Nc S Tax Day Is Still April 15 But That Could Change Wfmynews2 Com

Time Is Running Out People Still Desperate For Unemployment Benefits As Nc Plows Through Backlog Wral Com

Time Is Running Out People Still Desperate For Unemployment Benefits As Nc Plows Through Backlog Wral Com

Get A Bigger Refund With The Earned Income Tax Credit Eitc 11alive Com

Get A Bigger Refund With The Earned Income Tax Credit Eitc 11alive Com

Regdavies Tax Checklist Financial Services Checklist

Regdavies Tax Checklist Financial Services Checklist

New Analysis A Third Of Nc Taxpayers Won T Benefit From Proposed Tax Refund Plan The Progressive Pulse

North Carolina Nc Des Unemployment Benefits With Extra 300 Fpuc Pua And Peuc Latest 2021 Extension News And Updates Aving To Invest

North Carolina Nc Des Unemployment Benefits With Extra 300 Fpuc Pua And Peuc Latest 2021 Extension News And Updates Aving To Invest

More Irs Refunds Are On The Way How Unemployment Figures In Wcnc Com

More Irs Refunds Are On The Way How Unemployment Figures In Wcnc Com

Post a Comment for "Unemployment Tax Refund Nc"