Unemployment Tax Break Married Couple

Unemployment compensation benefits are considered taxable income. For married couples filing jointly with AGI below 150k where BOTH received unemployment income each can deduct the 10200 for a total of 20400 against their 2020 taxes.

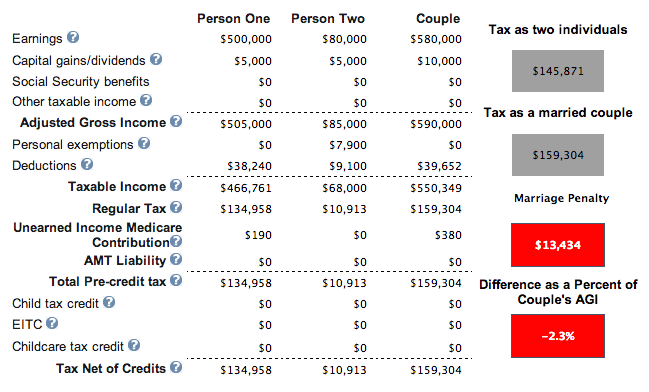

At What Income Level Does The Marriage Penalty Tax Kick In

At What Income Level Does The Marriage Penalty Tax Kick In

To qualify individuals and married couples must have filed for unemployment and have an adjusted gross income AGI thats less than 150000 in 2020.

Unemployment tax break married couple. The average person received 14000 in benefits. The American Rescue Plan waived federal tax on up to 10200 of jobless aid per person collected in 2020. So its possible that if both lost work in 2020 a married couple filing a joint return might not have to pay.

It will then proceed to calculate the new refund for married couples who are eligible for the 20400 exclusion. However the American Rescue Plan Act of 2021 contained a one-time exclusion of 10200 20400 for married couple for individuals and families with modified adjusted gross income of 150000 or less. About 40 million people collected jobless aid last year according to The Century Foundation.

HERES HOW THE 10200 UNEMPLOYMENT TAX BREAK IN BIDENS COVID RELIEF PLAN WORKS. The American Rescue Plan Act of 2021 which President Joe Biden signed Thursday waives federal tax on up to 10200 of unemployment benefits for single adults who earned less than 150000 a year. All filers need to have modified adjusted gross income below 150000 to qualify.

What to Know A new law will bring relief to millions this tax season after they get over the headache of figuring it out. An Unexpected 10200 Unemployment Tax Break. The 19 trillion Covid relief measure limits that break to individuals and couples.

Localities can add as. That unemployment tax break doubles for married couples who file taxes jointly. The American Rescue Plan approved by Congress and signed into law by President Joe Biden in March exempts the first 10200 in unemployment benefits 20400 for married couples filing jointly.

Amounts above 10200 20400 for a married couple should still be included as taxable income. The legislation allows taxpayers who earned less than 150000 in adjusted gross income to exclude unemployment compensation up to 20400 if. The exclusion is up to 10200 of jobless benefits for each spouse for married couples.

684 on taxable income over 31750 for single filers and 63500 for married couples filing jointly. If you file Form 1040-NR for non-residents trusts and deceased individuals you cant.

Covid Bill Provides Tax Waiver On Up To 10 200 Of Unemployment Benefits

Covid Bill Provides Tax Waiver On Up To 10 200 Of Unemployment Benefits

Donate Your Wedding Dress For Tax Deduction The Turbotax Blog

Donate Your Wedding Dress For Tax Deduction The Turbotax Blog

5 End Of The Year Tax Tips For Newly Married Couples The Turbotax Blog

5 End Of The Year Tax Tips For Newly Married Couples The Turbotax Blog

101 Tax Write Offs For Business What To Claim On Taxes Business Tax Deductions Small Business Tax Deductions Business Tax

101 Tax Write Offs For Business What To Claim On Taxes Business Tax Deductions Small Business Tax Deductions Business Tax

For The Vast Majority Of Americans No Action On Their Part Will Be Required In Order To Receive A Rebate Check Which Will Be 1 200 For Most Adults Or 2 40

For The Vast Majority Of Americans No Action On Their Part Will Be Required In Order To Receive A Rebate Check Which Will Be 1 200 For Most Adults Or 2 40

When Married Filing Separately Will Save You Taxes Turbotax Tax Tips Videos

When Married Filing Separately Will Save You Taxes Turbotax Tax Tips Videos

Married Filing Jointly Or Separate What Status Is Best Taxslayer Pro S Blog For Professional Tax Preparers

Married Filing Jointly Or Separate What Status Is Best Taxslayer Pro S Blog For Professional Tax Preparers

For Better Or Worse How Marriage Affects Your Tax Status

For Better Or Worse How Marriage Affects Your Tax Status

Your Tax Questions Answered Marketplace

Your Tax Questions Answered Marketplace

Follow The Rules And You Ll Walk Away Scot Free Taxtip Taxplanning Play Your Cards Right Tips Tax Free

Follow The Rules And You Ll Walk Away Scot Free Taxtip Taxplanning Play Your Cards Right Tips Tax Free

Retirees Might Need To File Taxes In Certain Situations Star Advertiser Filing Taxes Tax Tax Return

Retirees Might Need To File Taxes In Certain Situations Star Advertiser Filing Taxes Tax Tax Return

Still Need To Do Your Taxes Here S A List Of Items Most Taxpayers Need To File Their Tax Return Taxes Taxpreparation Tax Refund Tax Preparation Tax Return

Still Need To Do Your Taxes Here S A List Of Items Most Taxpayers Need To File Their Tax Return Taxes Taxpreparation Tax Refund Tax Preparation Tax Return

/marriedfilingjointly-5e145143734a4d3cb0181f45d5bc64dd.jpg) Married Vs Single Tax Filing Statuses

Married Vs Single Tax Filing Statuses

How To Fill Out Irs Form W 4 2020 Married Filing Jointly Youtube

How To Fill Out Irs Form W 4 2020 Married Filing Jointly Youtube

Wife S Share Of Couples Income By Race Ethnicity 1980 2017 Women Married To Men Ages 25 54 Source Philip Cohen Curr Wife Sharing Married Woman Married

Wife S Share Of Couples Income By Race Ethnicity 1980 2017 Women Married To Men Ages 25 54 Source Philip Cohen Curr Wife Sharing Married Woman Married

Five Tax Tips For Community Property States Turbotax Tax Tips Videos

Five Tax Tips For Community Property States Turbotax Tax Tips Videos

Married Filing Jointly Or Separate Irs Tax Return Filing Status

Married Filing Jointly Or Separate Irs Tax Return Filing Status

Getting Married What Newlyweds Need To Know Turbotax Tax Tips Videos

Getting Married What Newlyweds Need To Know Turbotax Tax Tips Videos

Post a Comment for "Unemployment Tax Break Married Couple"