Unemployment Tax Break Legislation

The federal tax break went into effect in President Joe Bidens 19 trillion American Rescue Plan. Thanks to the American Rescue Plan which was passed and signed into law in March 2021 the full amount of unemployment benefits are not taxable.

Serino Supermajority Fails New Yorkers By Declining To Offer Tax Break On Unemployment Benefits Ny State Senate

Serino Supermajority Fails New Yorkers By Declining To Offer Tax Break On Unemployment Benefits Ny State Senate

However only 13 states are excluding 10200 of federal unemployment benefits from their residents tax liability for 2020.

Unemployment tax break legislation. 7 hours agoFederal COVID relief includes tax break on unemployment but NC SC law doesnt comply. Time-sensitive legislation aimed at stabilizing the states unemployment system providing targeted tax relief to employers and workers and creating a. 3 If you filed your taxes before the American Rescue Plan was passed you had to pay taxes on the full amount of your unemployment benefits.

The recent stimulus bill includes a tax break on unemployment income. If you got unemployment income last year and your state isnt offering a tax break on your first 10200 of benefits you may need to gear up for a. The measure waived taxes on up to 10200 unemployment benefits received in.

Up to 10200 in unemployment payments is tax-free. The American Rescue Plan a 19 trillion Covid relief bill waived. The tax exemption for 10200 in unemployment benefits currently only applies to unemployment income you collected in 2020 even though the.

Under the legislation known as the American Rescue Plan households do not have to pay federal income taxes on up to 10200 in 2020 unemployment insurance benefits. Along with the tax break Bidens bill also extended the 300 a week in federal unemployment benefits until September 6. State Taxes on Unemployment Benefits.

As a result any unemployment compensation received in 2020. Although many of the provisions in the American Rescue plan have been criticized the tax break is less hotly contested for example than the direct payments. The American Rescue Plan which was signed into law by President Joe Biden on March 11 made the first 10200 of unemployment income tax.

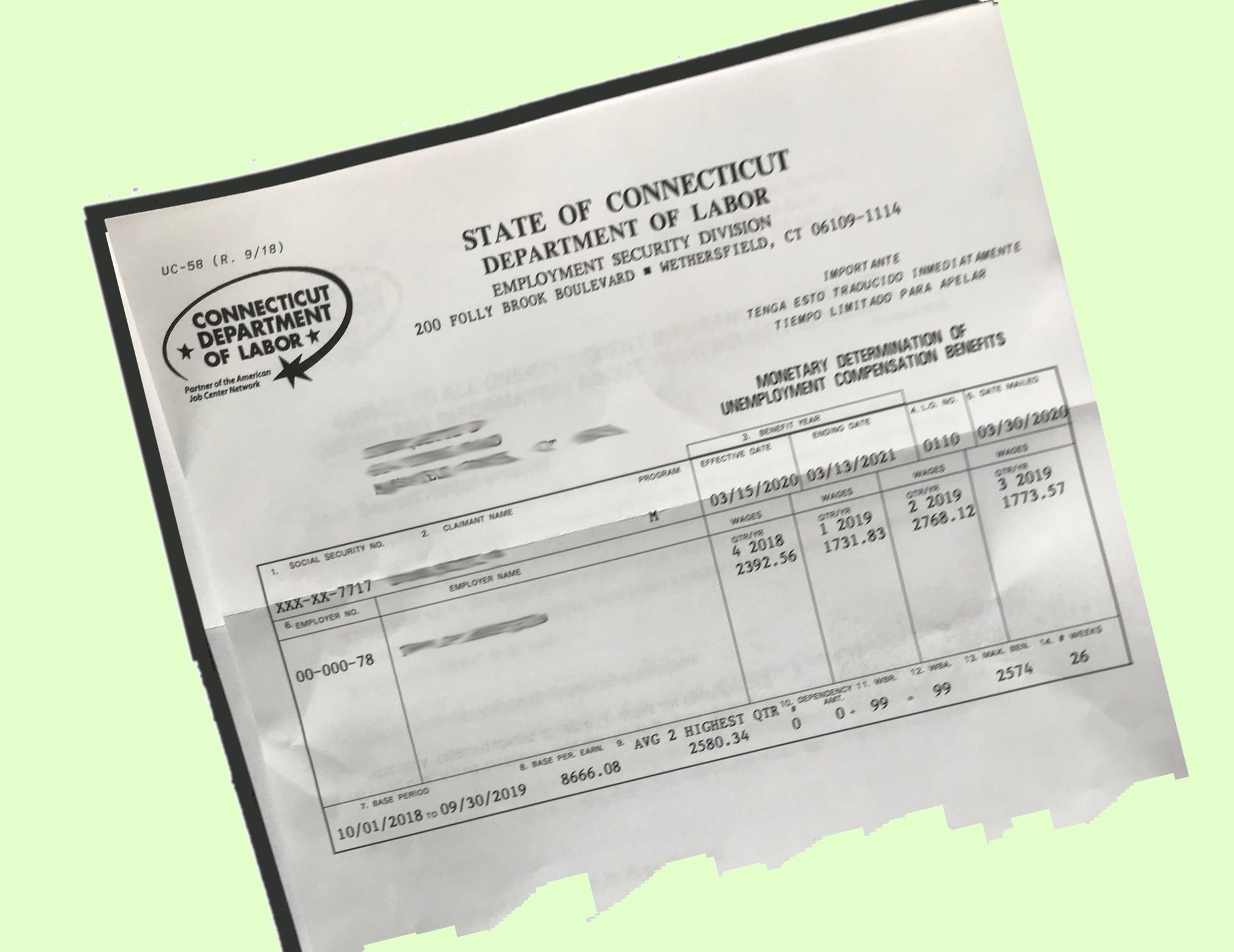

The IRS will send refunds for that tax break but you may need to wait for the money. There have been proposals in both states to change the law to conform to the federal break. Connecticut taxes unemployment compensation to the same extent as it is taxed under federal law.

That will be the case if a new tax break on up to 10200 of unemployment benefits makes them newly eligible for income-dependent tax credits and deductions like the earned income tax. 1 day agoA good problem to fix. Thirteen states arent offering a tax break on unemployment benefits received last year according to data from HR Block.

Its great that Americans wont have to pay taxes on 10200 of unemployment income. Galle notes that most states will fall in line with the federal tax law but he says there are about 12 states that may charge taxes on unemployment benefits even with federal exemptions. That tax break will put a lot of extra.

Collecting Unemployment Take These Steps To Avoid A Tax Bill Next Year

Collecting Unemployment Take These Steps To Avoid A Tax Bill Next Year

Tomorrow House Lawmakers Are Moving Forward 300 Billion In Corporate Tax Breaks Yet They Claim That We Can T Afford To Extend Tax Breaks Business Tax Moving

Tomorrow House Lawmakers Are Moving Forward 300 Billion In Corporate Tax Breaks Yet They Claim That We Can T Afford To Extend Tax Breaks Business Tax Moving

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Covid Bill Provides Tax Waiver On Up To 10 200 Of Unemployment Benefits

Covid Bill Provides Tax Waiver On Up To 10 200 Of Unemployment Benefits

Xcelhr S Payroll Payroll Tax Services Payroll Taxes Payroll Hr Infographic

Xcelhr S Payroll Payroll Tax Services Payroll Taxes Payroll Hr Infographic

New Stimulus Bill Offers Tax Break On Unemployment Payments Whec Com

New Stimulus Bill Offers Tax Break On Unemployment Payments Whec Com

How To Avoid Tax On Up To 10 200 Of Unemployment Benefits Smart Change Personal Finance Tucson Com

How To Avoid Tax On Up To 10 200 Of Unemployment Benefits Smart Change Personal Finance Tucson Com

Tax Waiver For Unemployment Benefits Leads To Questions Kake

Tax Waiver For Unemployment Benefits Leads To Questions Kake

Congress Wants To Waive Taxes On Unemployment Some States May Not

Congress Wants To Waive Taxes On Unemployment Some States May Not

Taxes 2021 Everything New Including Deadline Stimulus Payments And Unemployment Cnet

Taxes 2021 Everything New Including Deadline Stimulus Payments And Unemployment Cnet

Senate Bill Indicates A Portion Of Unemployment Compensation May Not Be Taxable In 2020

Senate Bill Indicates A Portion Of Unemployment Compensation May Not Be Taxable In 2020

Did You Collect Unemployment Benefits In 2020 Act Now To Avoid A Tax Day Surprise Dollars And Sense Abc10 Com

Did You Collect Unemployment Benefits In 2020 Act Now To Avoid A Tax Day Surprise Dollars And Sense Abc10 Com

Wayne County Treasurer Eric Sabree Forfeits The Public Trust Wayne County County Wayne

Wayne County Treasurer Eric Sabree Forfeits The Public Trust Wayne County County Wayne

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Ct Struggling To Pay Unemployment Claims Feds Holding Back Billions Pending New Rules

Ct Struggling To Pay Unemployment Claims Feds Holding Back Billions Pending New Rules

Unemployment Stimulus Am I Eligible For The New Unemployment Income Relief The Turbotax Blog

Unemployment Stimulus Am I Eligible For The New Unemployment Income Relief The Turbotax Blog

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

Post a Comment for "Unemployment Tax Break Legislation"