Unemployment Ohio Tax Form

1099Gs are available to view and print online through our Individual Online Services. The toll free number is 1-866-44-UC-TAX 448-2829.

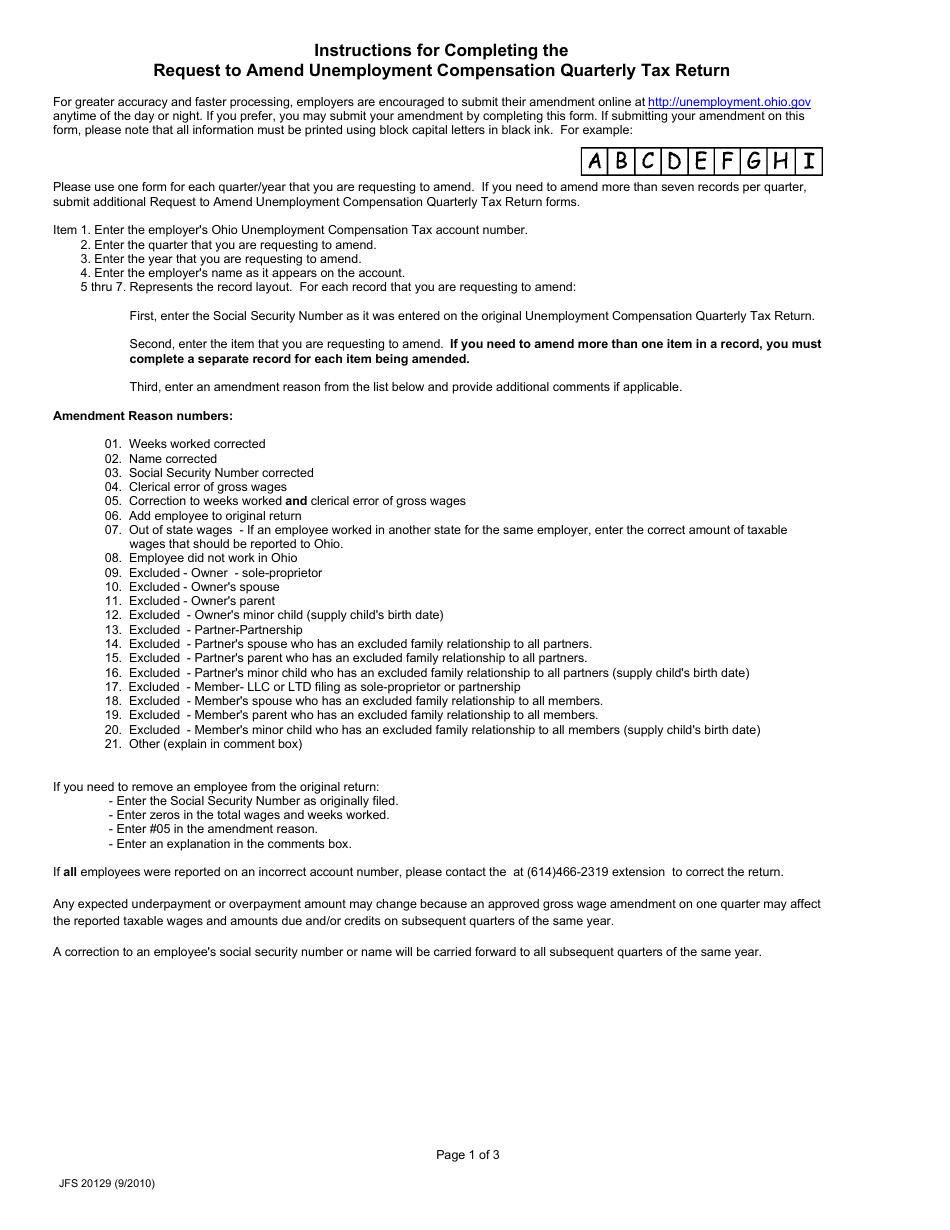

Form Jfs20129 Download Fillable Pdf Or Fill Online Request To Amend Unemployment Compensation Quarterly Tax Return Ohio Templateroller

Form Jfs20129 Download Fillable Pdf Or Fill Online Request To Amend Unemployment Compensation Quarterly Tax Return Ohio Templateroller

According to the IRS taxpayers whose identities may have been used by thieves to steal unemployment benefits should not include those benefits as income on filed tax returns even if they received an incorrect Form 1099-G.

Unemployment ohio tax form. Additionally if you live in a traditional tax base school district your unemployment compensation is. Listed below are several of our most requested forms. Then there were the tax forms from Ohio Michigan Maine and Virginia documenting the unemployment benefits the Martins supposedly received in 2020.

You will need to have both your ODJFS employer number and your federal employer identification number FEIN in order to file your report. Paper Form Exception Filing Information In Ohio employers are required to submit their Quarterly Tax Return electronically. If this amount if greater than 10 you must report this income to the IRS.

Ohio taxes unemployment. 1 day agoUnemployment benefits are usually considered taxable income and the IRS uses them to make sure income is reported correctly. Receive a 1099-G tax form in the mail stating that they received unemployment benefits in 2020 when in fact they did not.

If you havent filed taxes yet heres how to account for the change. Its looking like Ohio will be addressing and likely approving in the General Assembly a conformity bill which would align Ohio with all. Thirteen states arent offering a tax break on unemployment benefits received last year according to data from HR Block.

Visit the IRS website here for specific information about the IRS adjustment for tax year 2020. Federal tax changes into Ohio law effective immediately. However any 2020 unemployment benefits excluded for federal tax purposes on Form 1040 Schedule 1 line 8 should be added back to your Idaho income tax return.

Ohio law is in conformity with federal law therefore the provisions applicable under federal. Because Ohios income tax begins with federal adjusted gross income your unemployment compensation is also taxable to Ohio on your IT 1040 return. When appropriate instructions for completing the forms.

Unemployment benefits are taxable pursuant to federal and Ohio law. All 1099Gs Issued by the Ohio Department of Taxation will be mailed by January 31st. Unemployment benefits are not subject to municipal income taxes in Ohio so nothing changes there the Regional Income Tax Agency confirmed.

If you DID apply andor receive unemployment benefits from ODJFS. Report it by calling toll-free. The American Rescue Plan a 19 trillion Covid relief bill waived.

ODJFS has created a new online portal that. Specifically federal tax changes related to unemployment benefits in the federal American Rescue Plan Act ARPA of 2021 will impact some individuals who have already filed or will soon be filing their 2020 Ohio IT 1040 and SD 100 returns due by May 17 2021. Ohio taxes unemployment.

On your 1099-G form Box 1 Unemployment Compensation shows the amount you received in unemployment wages. On the standard federal 1040 form you will list the full amount of unemployment benefits you received on line 7 titled. ODJFS issues IRS 1099-G tax forms to recipients of unemployment benefits so they can report this income when filing their annual.

But unemployment benefits are subject to Ohio income taxes. Enter the amount from Box 1 on Line 19 Unemployment Compensation of your 1040 form. It is included in your federal adjusted gross income FAGI on your federal 1040.

The Michigan tax form showed someone claimed. ODJFS issues IRS 1099-G tax forms to recipients of unemployment benefits so they can report this income when filing their annual tax returns. In Ohio theres discussion in Columbus about whether state lawmakers will follow the federal law and pass legislation next week that would also exempt 10200 in unemployment benefits on state tax returns.

The IRS considers unemployment compensation taxable income. Enter a full or partial form number or description into the Title or Number box optionally select a tax year and type from the drop-downs and then click the Search button. For employers approved by the Office of Unemployment Insurance Operations to submit reports by paper please use the Ohio Unemployment Quarterly Tax Return JFS-20125.

The Ohio Department of Job and Family Services which administers Ohios unemployment program sent out 17 million 1099-G tax forms in January that show how much recipients received in. You can elect to be removed from the next years mailing by signing up for email notification.

Https Tax Ohio Gov Portals 0 Forms Municipal Income Ohiocity Ohiocitytaxform Pdf

Form Jfs20129 Download Fillable Pdf Or Fill Online Request To Amend Unemployment Compensation Quarterly Tax Return Ohio Templateroller

Form Jfs20129 Download Fillable Pdf Or Fill Online Request To Amend Unemployment Compensation Quarterly Tax Return Ohio Templateroller

Are Unemployment Insurance Benefits Taxable A Guide On Ui Taxes

Are Unemployment Insurance Benefits Taxable A Guide On Ui Taxes

Will Ohio S Tax Filing Deadline Be Postponed To May 17 To Match The New Irs Deadline Cleveland Com

Will Ohio S Tax Filing Deadline Be Postponed To May 17 To Match The New Irs Deadline Cleveland Com

Form Jfs20129 Download Fillable Pdf Or Fill Online Request To Amend Unemployment Compensation Quarterly Tax Return Ohio Templateroller

Form Jfs20129 Download Fillable Pdf Or Fill Online Request To Amend Unemployment Compensation Quarterly Tax Return Ohio Templateroller

1099 Tax Forms Available Soon For Pa Unemployment Claimants Erie News Now Wicu And Wsee In Erie Pa

1099 Tax Forms Available Soon For Pa Unemployment Claimants Erie News Now Wicu And Wsee In Erie Pa

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

Unemployment Fraud Chicago Man Receives Ohio Unemployment Tax Form Despite Never Living There Abc7 Chicago

Unemployment Fraud Chicago Man Receives Ohio Unemployment Tax Form Despite Never Living There Abc7 Chicago

Respond To Employer Request For Separation Information Office Of Unemployment Insurance Operations Ohio Department Of Job And Family Services

Respond To Employer Request For Separation Information Office Of Unemployment Insurance Operations Ohio Department Of Job And Family Services

Income 1099 G And 1099 Int From The Department Of Taxation Department Of Taxation

Income 1099 G And 1099 Int From The Department Of Taxation Department Of Taxation

Did You Receive A 1099 G From The Ohio Department Of Taxation Or The Ohio Department Of Job And Family Services Department Of Taxation

Did You Receive A 1099 G From The Ohio Department Of Taxation Or The Ohio Department Of Job And Family Services Department Of Taxation

Https Jfs Ohio Gov Ouio Pdf Pua Stepbystepapplicationinstructions Pdf

Income School District Tax Department Of Taxation

Income School District Tax Department Of Taxation

Post a Comment for "Unemployment Ohio Tax Form"