Unemployment Due To Covid Not Taxable

The way the exemption works is the first 10200 of. This income is reported to the IRS.

Top 3 Tax Tips For Unemployment Benefits

Top 3 Tax Tips For Unemployment Benefits

Numerous lawmakers have been pushing the state to change its own laws due to the pandemic saying it is unfair to New Yorkers who lost their jobs when New York went on pause.

Unemployment due to covid not taxable. The Form 1099G reports the total taxable income we issue you in a calendar year. Unemployment compensation is not taxable for Pennsylvania income tax purposes. State Taxes on Unemployment Benefits.

That provision only applies to tax. If you are married each spouse receiving unemployment compensation doesnt have to pay tax on unemployment. Total taxable compensation includes.

Its also important to keep in mind that not everyone will get a federal tax break on 10200 in unemployment income. On Saturday the Senate passed a version of the Covid bill that included a provision to waive taxes on the first 10200 in unemployment insurance. State and federal efforts to expand unemployment benefits aside unemployment compensation is generally still subject to income tax.

You can find information on unemployment benefit changes due to COVID-19 as well as links to each states unemployment programs on the US. To counter that the COVID relief bill includes a tax exemption of 10200 for those with an adjusted gross income less than 150000. Federal law allows any recipient to choose to have a flat 10 withheld from their benefits to cover part or all of their tax liability.

NYS Budget Director says unemployed New Yorkers still have to pay state taxes on the first 10200 in unemployment benefits collected. Some states including Alaska Florida Nevada South Dakota Texas Washington and Wyoming dont have state income taxes so you may get a tax break on your unemployment benefits. The COVID-19 relief bill that passed the Senate on Saturday morning contains a key provision that would come as a big relief to millions of Americans who received unemployment benefits last year.

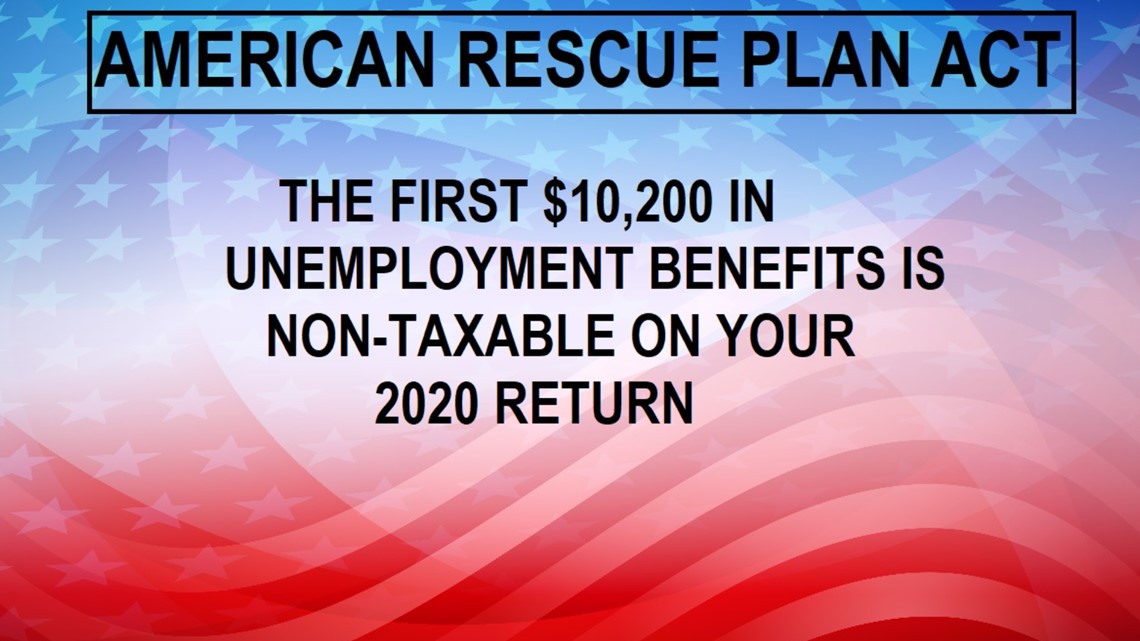

The law includes a provision that makes a taxpayers first 10200 of unemployment benefits non-taxable at. The 2020 tax season is officially underway and the millions of Americans who collected unemployment benefits last year due to the coronavirus pandemic may be. State Income Tax Range.

By Irina Ivanova March 19 2021 708 AM MoneyWatch. Department of Labors CareerOneStop website. Taxable benefits include any of the special unemployment compensation authorized under the Coronavirus Aid Relief and Economic Security CARES Act enacted this spring.

The fact is unemployment compensation doesnt come tax free. Anyone who receives it must pay taxes on that money. Its taxable income even if it doesnt feel like you earned it.

Unemployment Insurance UI benefits. President Biden signed the American Rescue Plan into law on March 11. 10200 in unemployment benefits wont be taxed leading to confusion amid tax-filing season.

The legislation signed on March 11 allows taxpayers who earned less than 150000 in modified adjusted gross income to exclude unemployment compensation up to 20400 if. If your modified adjusted gross income AGI is less than 150000 the American Rescue Plan enacted on March 11 2021 excludes from income up to 10200 of unemployment compensation paid in 2020 which means you dont have to pay tax on unemployment compensation of up to 10200. If you received unemployment benefits in 2020 or any year you must pay your share of taxes on that money.

As taxable income these payments must be reported on your federal tax return but they are exempt from California state income tax. New York will still tax the unemployment benefits New Yorkers received in 2020 despite changes on the federal level according to State Budget Director Rob Mujica.

Fool Me Once Investing In Unemployment Insurance Systems To Avoid The Mistakes Of The Great Recession During Covid 19 Equitable Growth

Fool Me Once Investing In Unemployment Insurance Systems To Avoid The Mistakes Of The Great Recession During Covid 19 Equitable Growth

The Unemployment Impacts Of Covid 19 Lessons From The Great Recession

The Unemployment Impacts Of Covid 19 Lessons From The Great Recession

Make Sure You Don T Pay Taxes On These Unemployment Benefits Newscentermaine Com

Make Sure You Don T Pay Taxes On These Unemployment Benefits Newscentermaine Com

Here S How To File For Unemployment And Pandemic Unemployment Assistance Michigan Radio

Here S How To File For Unemployment And Pandemic Unemployment Assistance Michigan Radio

Will My Unemployment Benefits Be Taxed Coronavirus Oleantimesherald Com

Will My Unemployment Benefits Be Taxed Coronavirus Oleantimesherald Com

Expert Q A About The Unemployment Provisions Of The American Rescue Plan

Expert Q A About The Unemployment Provisions Of The American Rescue Plan

Taxes On Unemployment Checks May Surprise Some

Taxes On Unemployment Checks May Surprise Some

Enhanced Unemployment Benefits During The Coronavirus Crisis Smartasset

Enhanced Unemployment Benefits During The Coronavirus Crisis Smartasset

Fool Me Once Investing In Unemployment Insurance Systems To Avoid The Mistakes Of The Great Recession During Covid 19 Equitable Growth

Fool Me Once Investing In Unemployment Insurance Systems To Avoid The Mistakes Of The Great Recession During Covid 19 Equitable Growth

Senate Bill Indicates A Portion Of Unemployment Compensation May Not Be Taxable In 2020

Senate Bill Indicates A Portion Of Unemployment Compensation May Not Be Taxable In 2020

Stimulus Checks Won T Be Taxed But Unemployment Benefits Will Be News Wfsb Com

Stimulus Checks Won T Be Taxed But Unemployment Benefits Will Be News Wfsb Com

That Extra 600 A Week In Unemployment Benefits Is Taxable Weareiowa Com

That Extra 600 A Week In Unemployment Benefits Is Taxable Weareiowa Com

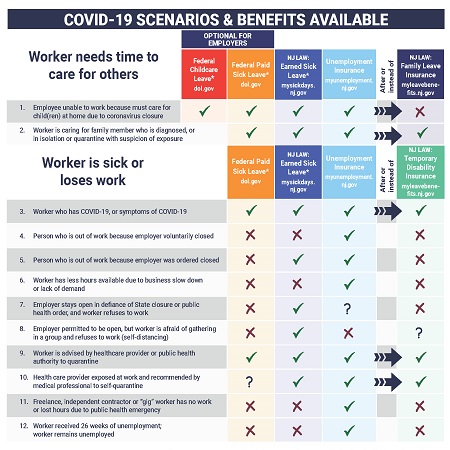

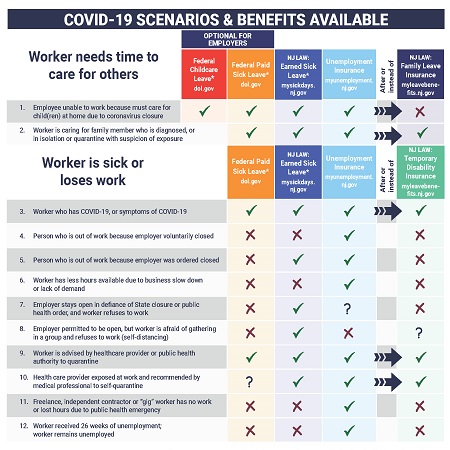

Division Of Unemployment Insurance Nj Workers Frequently Asked Questions During The Coronavirus Emergency

Division Of Unemployment Insurance Nj Workers Frequently Asked Questions During The Coronavirus Emergency

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

Fool Me Once Investing In Unemployment Insurance Systems To Avoid The Mistakes Of The Great Recession During Covid 19 Equitable Growth

Fool Me Once Investing In Unemployment Insurance Systems To Avoid The Mistakes Of The Great Recession During Covid 19 Equitable Growth

Ohio Unemployment Help Wkyc Com

Ohio Unemployment Help Wkyc Com

Post a Comment for "Unemployment Due To Covid Not Taxable"