Ohio Unemployment Tax Rate 2016

Additional information about the Ohio Unemployment Tax can be obtained from our home page or by contacting the Division of Tax and Employer Service at. Computer and Mathematical Occupations.

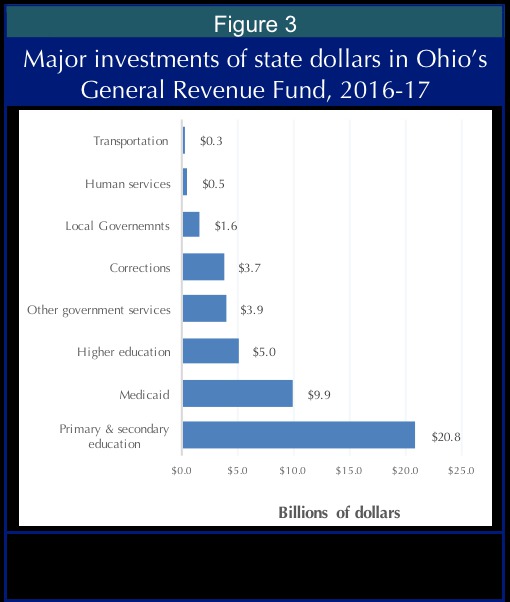

Ohio Budget 101 A Basic Overview

Ohio Budget 101 A Basic Overview

Deposited in UC Trust Fund.

Ohio unemployment tax rate 2016. Also you have the ability to view payments made within the past 61 months. Used by employers to authorize someone other than the employer to provide information pertaining to Unemployment Taxes. JFS-20106 Employers Representative Authorization for Taxes.

Contribution Rates For 2011 2012 and 2013 the ranges of Ohio unemployment tax rates also know as contribution rates are as follows. Office of Communications 30 East Broad Street 32nd Floor Columbus Ohio 43215-3414 Telephone. Unemployment Benefits for Tax Year 2020.

Taxable Wage Base The Taxable Wage Base is the amount of an employees wages upon which the employer is required to pay unemployment taxes each year. This includes extension and estimated payments original and amended return payments billing and assessment payments. Financial Specialists All Other.

OPaid quarterly by employers to the ODJFS Office of Unemployment Compensation UC. Obtain detailed information regarding your 1099-G by clicking here. If the contribution rate assigned to your enterprise is different than the tentative rate we will contact you regarding any necessary adjustments.

In subsequent years when the loan has not yet been retired the additional tax increases again by 21 so Ohio employers could pay an additional 42. - The Finder This online tool can help determine the sales tax rate in effect for any address in Ohio. Thus Ohio employers receive the full FUTA tax credit during times when Ohio does not have outstanding loans.

Ohio income tax forms Fill-in versions of the 2020 IT 1040 and SD 100 are available as well as the 2020 Ohio income tax. 1 day agoOhios unemployment rate in February 2021 was 5 percent and the national rate was 62 percent. ODJFS Issues a Record Amount of 1099 Tax Forms Online Fraud Form and Guidance Available for ID Theft Victims with Unemployment Claims.

Payments for the first quarter of 2020 will be due April 30. To submit your quarterly tax report online please visit httpsericohiogov. Unemployment Rate for January 2021.

2021 1 st Quarter Rate Change. The taxable wage base may change from year to year. In order to pay back the loan federal law dictates that an employers federal unemployment tax rate is increased by 50 in the first year which amounts to an additional tax of 21 per employee.

Pandemic Unemployment Programs Extended. 2016 Taxes paid in 2016. Changes in how unemployment benefits are taxed for tax year 2020 Read More Did you receive a 1099-G.

Employers with questions can call 614 466-2319. Report it by calling toll-free. The taxable wage base for calendar year 2000 and after is 9000.

This is a little more complicated but if you had been self-employed or owned your own small business you may. A final option is to pay estimated quarterly taxes on your unemployment benefits. FUTA tax credit14 Ohio has an approved unemployment compensation system15 and approved experience rating system.

The basic funding mechanism used by all states is to establish for those employers who are subject to the. This month Ohios tax revenues exceeded the monthly estimate by 41 million or 26 percent and remain 43 percent above the estimate for the fiscal year-to-date. Ohio income tax update.

The sales and use tax rate for Portage County will be decreasing from 725 to 700 effective January 1 2021 - Map of current sales tax rates. Electronic filing options Online services is a free secure electronic portal where you can file returns make payments and view additional information regarding your Ohio individual and school district income taxes. Also used by employers to authorize the Ohio Department of Job and Family.

Effective the first quarter of 2020 Ohio employers will pay state unemployment taxes on the first 9000 in actual not prorated wages paid to each of their covered employees. This is a dramatic improvement from one year ago. No staff costs are charged to the state trust fund.

SUTA State Unemployment Tax Act. 2011 2012 2013 Lowest Experience Rate. SUTA taxes in a timely manner under an approved state unemployment compensation program can earn a credit of up to 54 percent against the 60 percent resulting in an effective tax rate of 06 percent.

March 12 2021. OFunds in this state trust fund may be used only to finance Ohio unemployment benefits. Allows you to electronically make Ohio individual income and school district income tax payments.

These resources are for individual taxpayers looking to obtain information on filing and paying Ohio income taxes completing the ID confirmation quiz and other services provided by the Department. 797 rows Tax Examiners and Collectors and Revenue Agents.

Sui Sit Employment Taxes Explained Emptech Com

Sui Sit Employment Taxes Explained Emptech Com

Sage 100 Payroll Users Handy Chart Of Unemployment Wage Bases For All 50 States

Sage 100 Payroll Users Handy Chart Of Unemployment Wage Bases For All 50 States

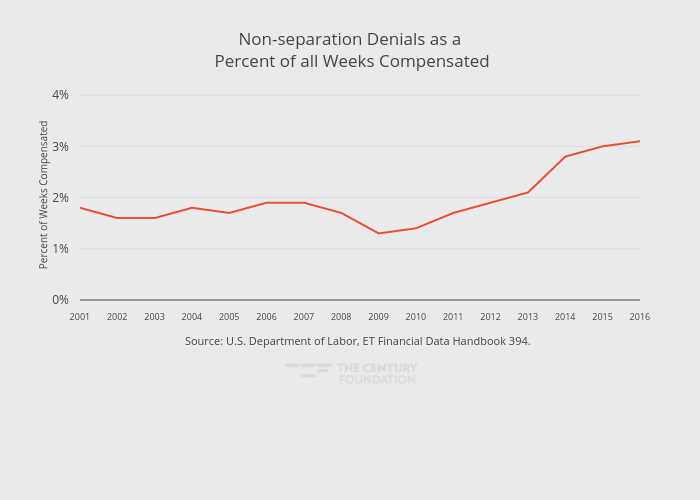

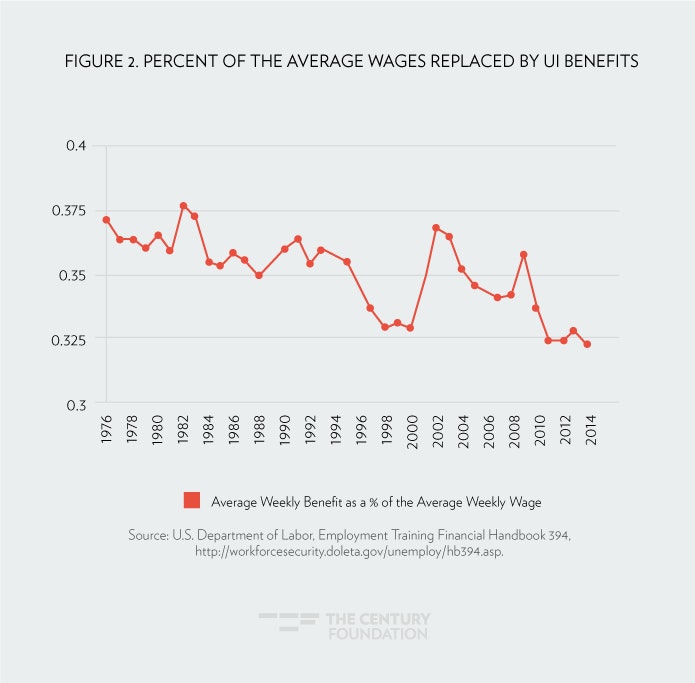

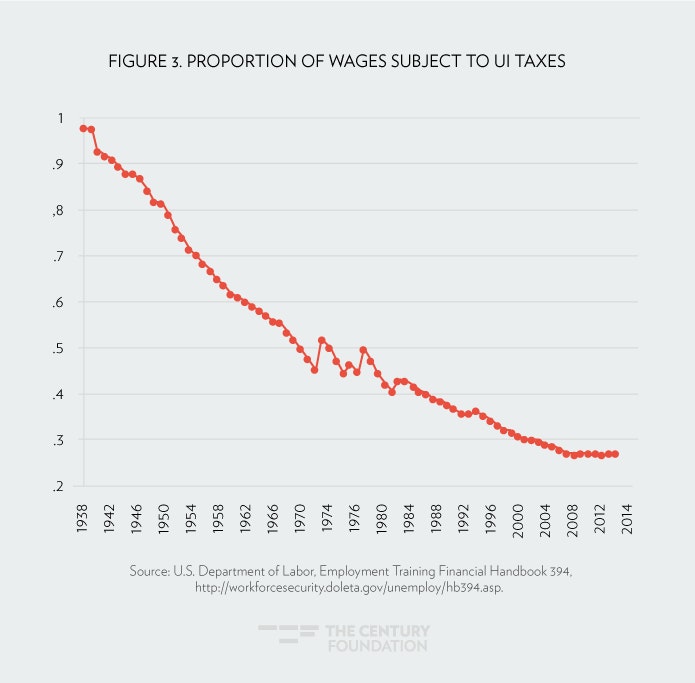

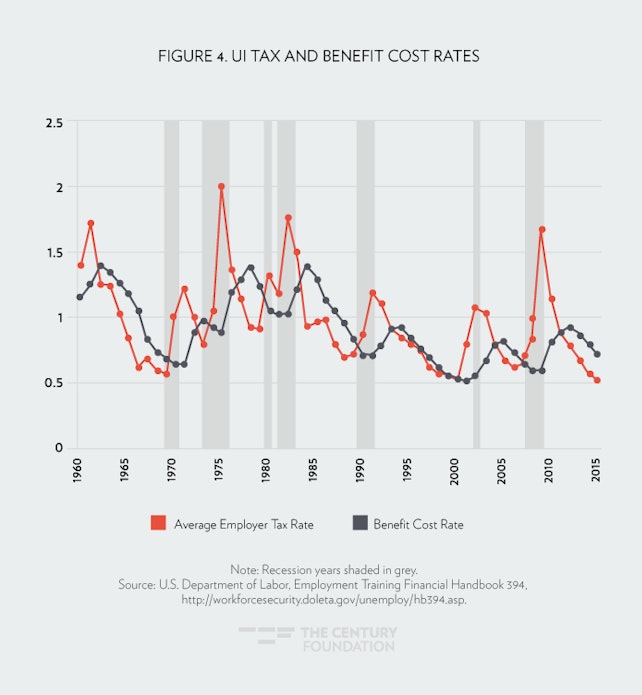

Unemployment Trust Fund Recovery Is Helping Employers Not Workers

Unemployment Trust Fund Recovery Is Helping Employers Not Workers

Sui Sit Employment Taxes Explained Emptech Com

Sui Sit Employment Taxes Explained Emptech Com

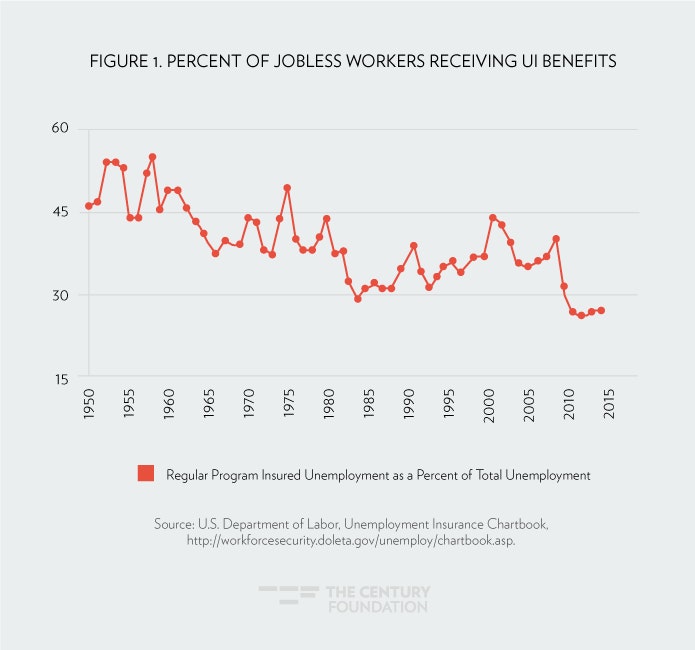

Speeding The Recovery Of Unemployment Insurance

Speeding The Recovery Of Unemployment Insurance

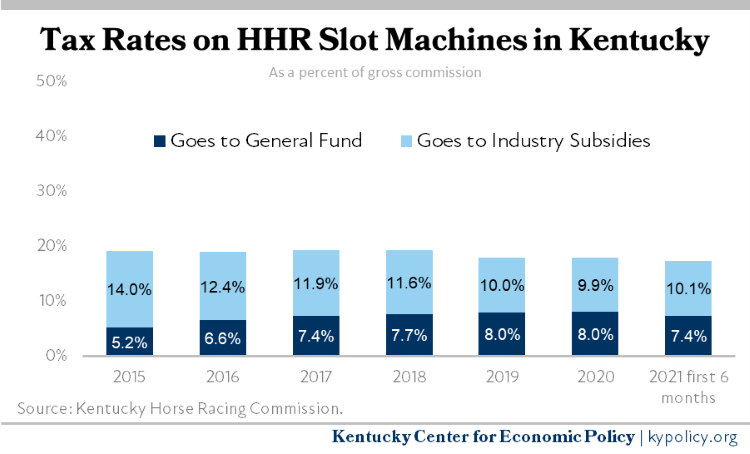

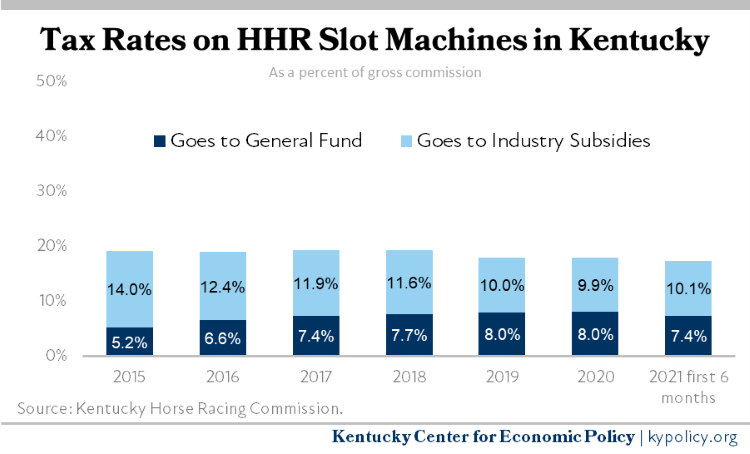

Letter To The Kentucky House Of Representatives On Raising The Inadequate Tax Rate On Hhr Slot Machines Kentucky Center For Economic Policy

Letter To The Kentucky House Of Representatives On Raising The Inadequate Tax Rate On Hhr Slot Machines Kentucky Center For Economic Policy

Https Tax Ohio Gov Static Forms Ohio Individual Individual 2016 Pit It1040 Booklet Pdf

Sui Sit Employment Taxes Explained Emptech Com

Sui Sit Employment Taxes Explained Emptech Com

The Ohio 2022 2023 State Budget

The Ohio 2022 2023 State Budget

How To Calculate Amount Of Unemployment In Ohio 9 Steps

How To Calculate Amount Of Unemployment In Ohio 9 Steps

Futa Federal Unemployment Tax Act San Francisco California

Futa Federal Unemployment Tax Act San Francisco California

Speeding The Recovery Of Unemployment Insurance

Speeding The Recovery Of Unemployment Insurance

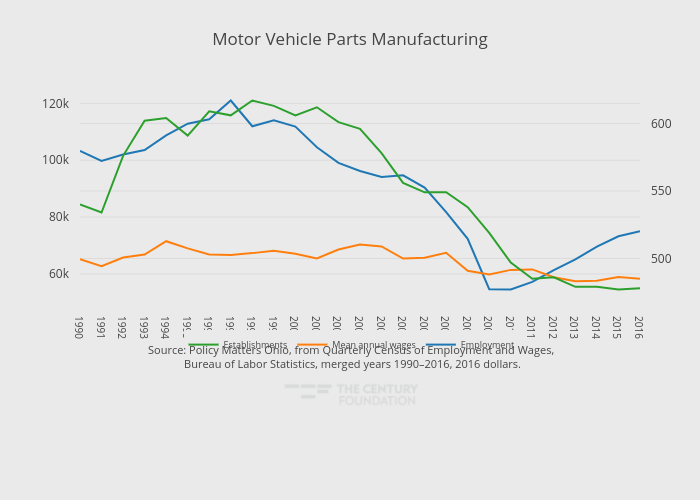

Manufacturing A High Wage Ohio

Manufacturing A High Wage Ohio

Ohio Eb 5 Regional Center Eb5 Affiliate Network

Ohio Eb 5 Regional Center Eb5 Affiliate Network

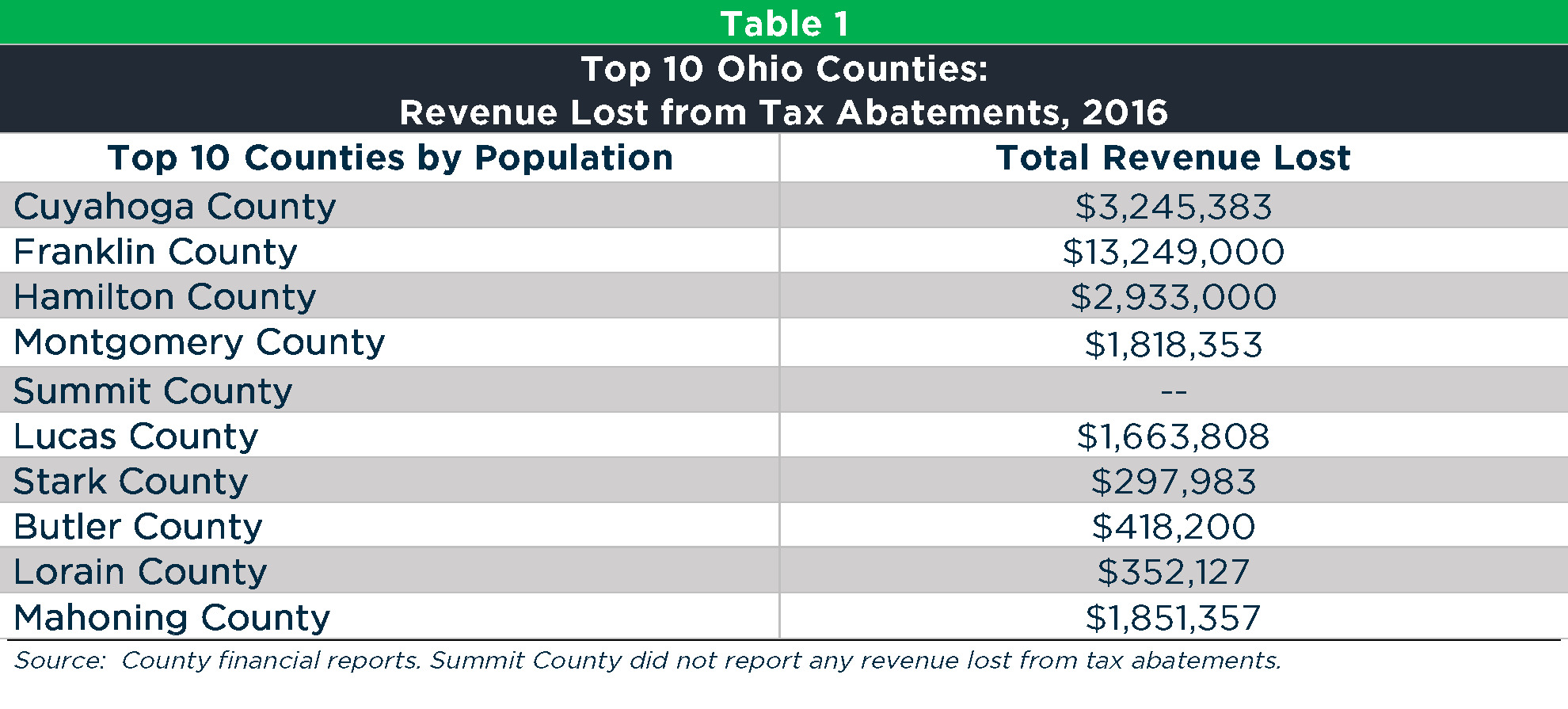

Local Tax Abatement In Ohio A Flash Of Transparency

Local Tax Abatement In Ohio A Flash Of Transparency

Speeding The Recovery Of Unemployment Insurance

Speeding The Recovery Of Unemployment Insurance

Speeding The Recovery Of Unemployment Insurance

Speeding The Recovery Of Unemployment Insurance

Post a Comment for "Ohio Unemployment Tax Rate 2016"