Ohio Unemployment Tax Rate 2015

Here is a list of the non-construction new employer tax. Reporting their unemployment tax liability as soon as there are one or more employees in covered employmentThis may be done at Ericohiogov or by completing the JFS 20100 Report to Determine Liability and mailing it to PO.

5 Facts About The Minimum Wage Minimum Wage Wage District Of Columbia

5 Facts About The Minimum Wage Minimum Wage Wage District Of Columbia

53 rows To help employers prepare their payroll operations for 2015 the following chart provides.

Ohio unemployment tax rate 2015. Additionally if you live in a traditional tax base school district your unemployment compensation is also subject to school district income tax on your SD 100 return. Contribution Rates For 2011 2012 and 2013 the ranges of Ohio unemployment tax rates also know as contribution rates are as follows. In subsequent years when the loan has not yet been retired the additional tax increases again by 21 so Ohio employers could pay an additional 42.

In order to pay back the loan federal law dictates that an employers federal unemployment tax rate is increased by 50 in the first year which amounts to an additional tax of 21 per employee. The sales and use tax rate for Portage County will be decreasing from 725 to 700 effective January 1 2021 - Map of current sales tax rates. Also used by employers to authorize the Ohio Department of Job and Family.

2021 1 st Quarter Rate Change. Plus localities can add up to an additional. This is a little more complicated but if you had been self-employed or owned your own small business you may.

Box 182404 Columbus Ohio 43218-2404If you report your liability at Ericohiogov you will receive a determination immediately. 2011 2012 2013 Lowest Experience Rate. Because Ohios income tax begins with federal adjusted gross income your unemployment compensation is also taxable to Ohio on your IT 1040 return.

Taxable Wage Base The Taxable Wage Base is the amount of an employees wages upon which the employer is required to pay unemployment taxes each year. JFS-20106 Employers Representative Authorization for Taxes. Typically an employer receives a tax credit of 54 if its state unemployment insurance UI contributions are paid timely.

52 rows SUI tax rate by state. The standard FUTA tax rate is 60 percent on the first 7000 of. If you think you may be liable or if you have questions about whether you are required to pay unemployment taxes please contact the Contribution Section at 614-466-2319 or write to us at ODJFS Contribution Section PO Box 182404 Columbus Ohio 43218-2404.

- The Finder This online tool can help determine the sales tax rate in effect for any address in Ohio. State levy is 485 but mandatory 1 local sales tax and 025 county option sales tax are added to the state tax for a 61 total rate. Employers generally receive a credit of 54 when they file.

The standard FUTA tax rate is 60 on the first 7000 of wages subject to FUTA. Employers with questions can call 614 466-2319. Additionally the Supreme Court of Ohio has endorsed the days-worked method finding that this method comports with due process and ensures that the tax collected is not disproportionate to the income received for work performed.

Effective the first quarter of 2020 Ohio employers will pay state unemployment taxes on the first 9000 in actual not prorated wages paid to each of their covered employees. To submit your quarterly tax report online please visit httpsericohiogov. The FUTA tax levies a federal tax on employers covered by a states Unemployment Insurance UI program.

The taxable wage base may change from year to year. SUTA taxes in a timely manner under an approved state unemployment compensation program can earn a credit of up to 54 percent against the 60 percent resulting in an effective tax rate of 06 percent. Report it by calling toll-free.

A final option is to pay estimated quarterly taxes on your unemployment benefits. Payments for the first quarter of 2020 will be due April 30. The taxable wage base for calendar year 2000 and after is 9000.

Federal Unemployment Tax Act FUTA Tax Forecast for 2015 The FUTA rate is 60 of the first 7000 of each employees wages. Used by employers to authorize someone other than the employer to provide information pertaining to Unemployment Taxes.

Ohio Eb 5 Regional Center Eb5 Affiliate Network

Ohio Eb 5 Regional Center Eb5 Affiliate Network

Https Jfs Ohio Gov Ofc Cfsp 2015 2019 Stm

Here S How Many Hours You Need To Work To Pay Rent In Every State Minimum Wage Rent Wage

Here S How Many Hours You Need To Work To Pay Rent In Every State Minimum Wage Rent Wage

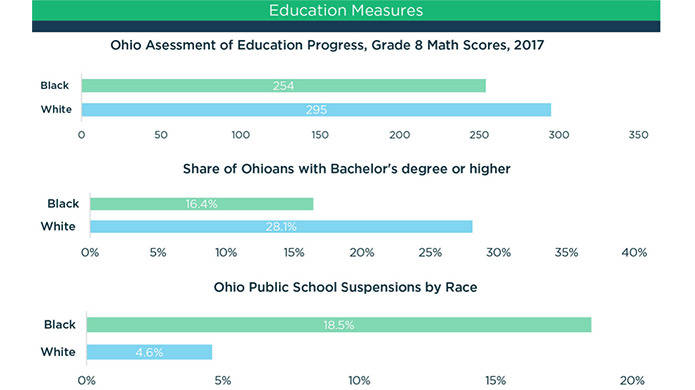

Race Policy And Ohio Policy Matters Ohio November 26 2019

Race Policy And Ohio Policy Matters Ohio November 26 2019

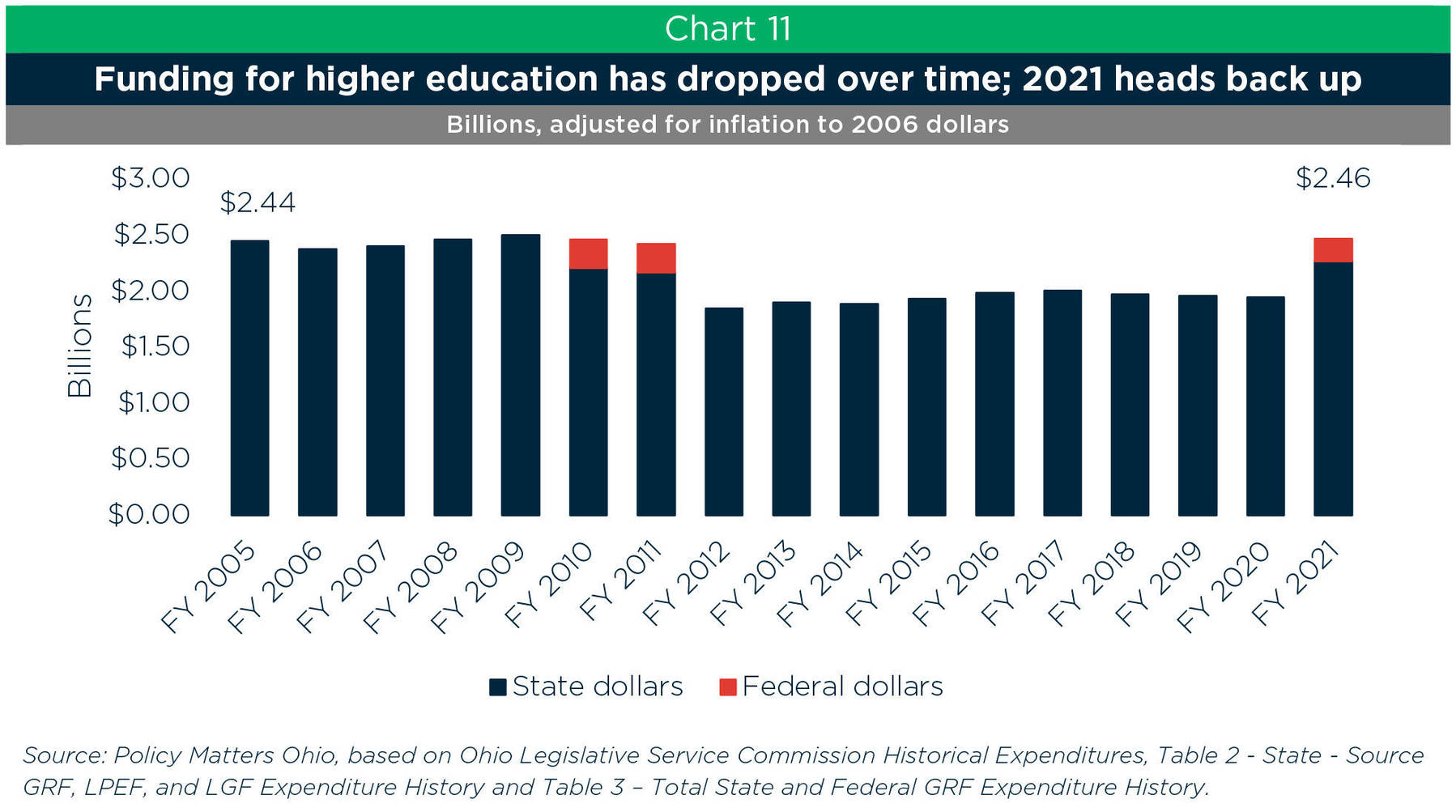

The Ohio 2022 2023 State Budget

The Ohio 2022 2023 State Budget

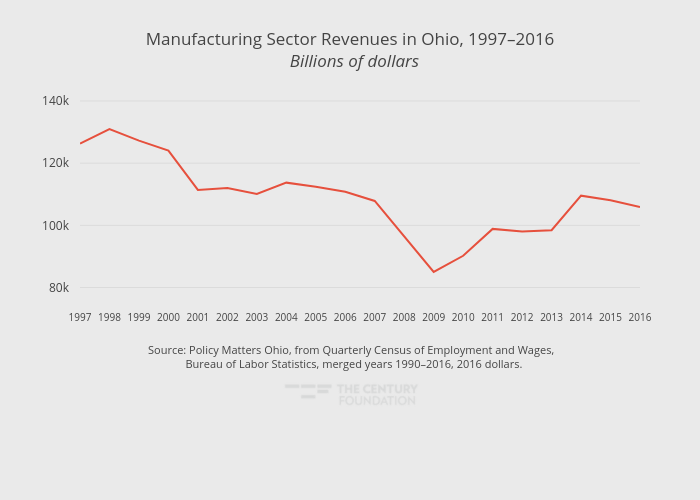

Manufacturing A High Wage Ohio

Manufacturing A High Wage Ohio

Perry County Ohio Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Do Large Corporate Tax Cuts Boost Wages Evidence From Ohio

Do Large Corporate Tax Cuts Boost Wages Evidence From Ohio

Oh How To Prepare Jfs 20127 And 20128 Wage Reports For E Filing Cwu2014

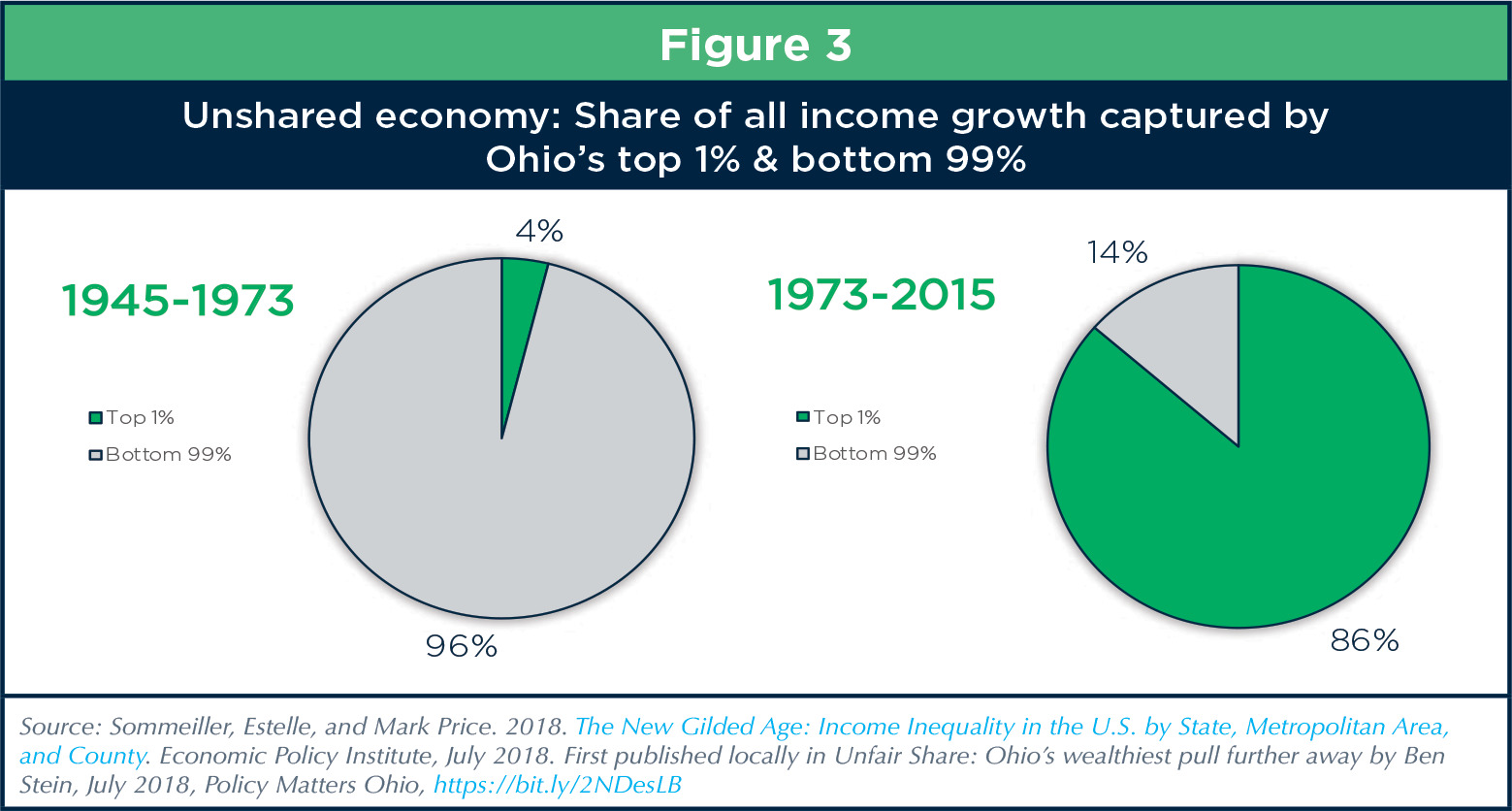

State Of Working Ohio 2018 Inequality Amid Job Growth

State Of Working Ohio 2018 Inequality Amid Job Growth

The 10 Best States To Make A Living In 2015 Places Of Interest Cincinnati Favorite Places

The 10 Best States To Make A Living In 2015 Places Of Interest Cincinnati Favorite Places

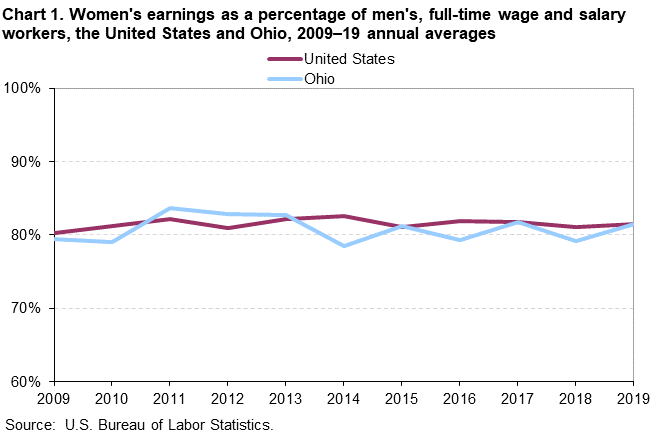

Women S Earnings In Ohio 2019 Midwest Information Office U S Bureau Of Labor Statistics

Women S Earnings In Ohio 2019 Midwest Information Office U S Bureau Of Labor Statistics

How To Calculate Amount Of Unemployment In Ohio 9 Steps

How To Calculate Amount Of Unemployment In Ohio 9 Steps

State Of Working Ohio 2018 Inequality Amid Job Growth

State Of Working Ohio 2018 Inequality Amid Job Growth

10 Tips To Save On Your Ohio Income Tax

10 Tips To Save On Your Ohio Income Tax

Evictions In Ohio Cities Down In 2020 Uncertainty Ahead

Evictions In Ohio Cities Down In 2020 Uncertainty Ahead

Group S Annual Report On Working Ohio Shows Low Worker Participation High Income Inequality The Statehouse News Bureau

Group S Annual Report On Working Ohio Shows Low Worker Participation High Income Inequality The Statehouse News Bureau

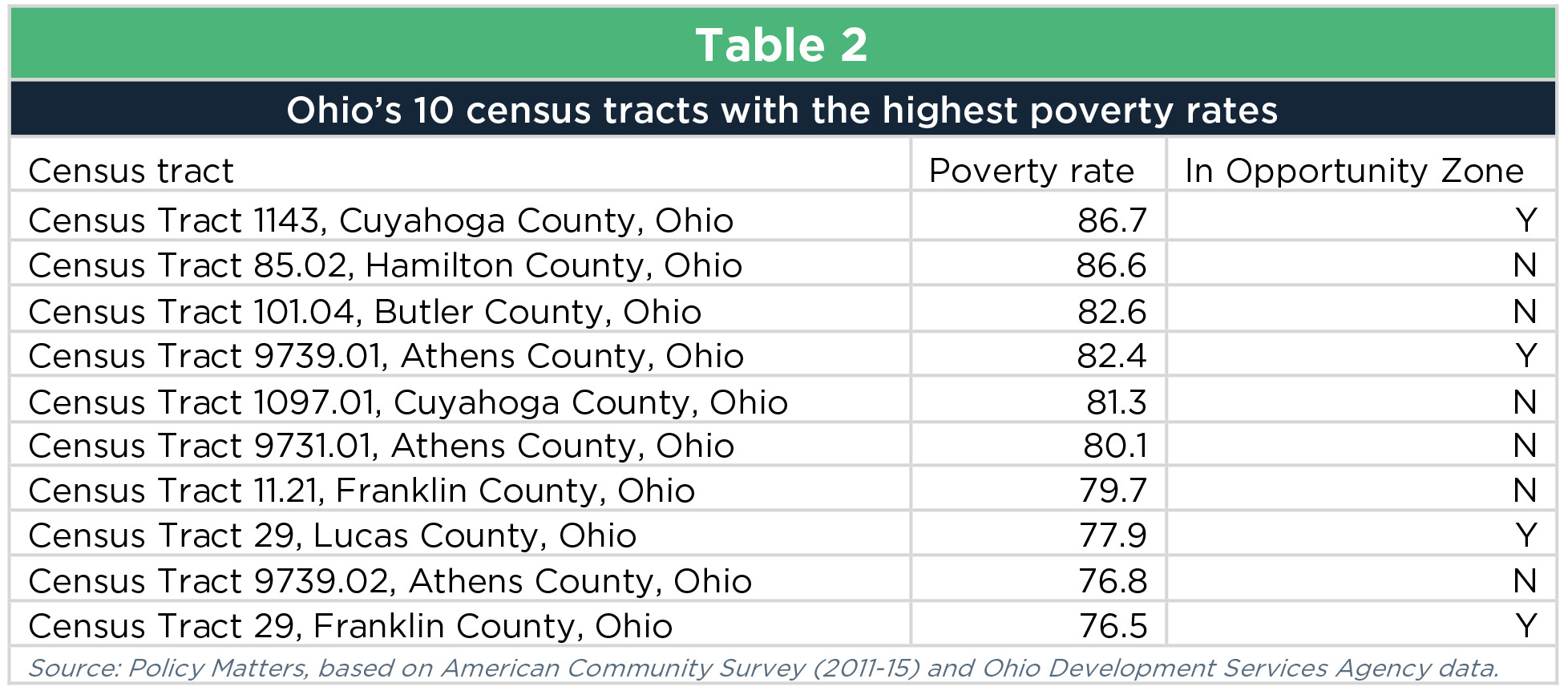

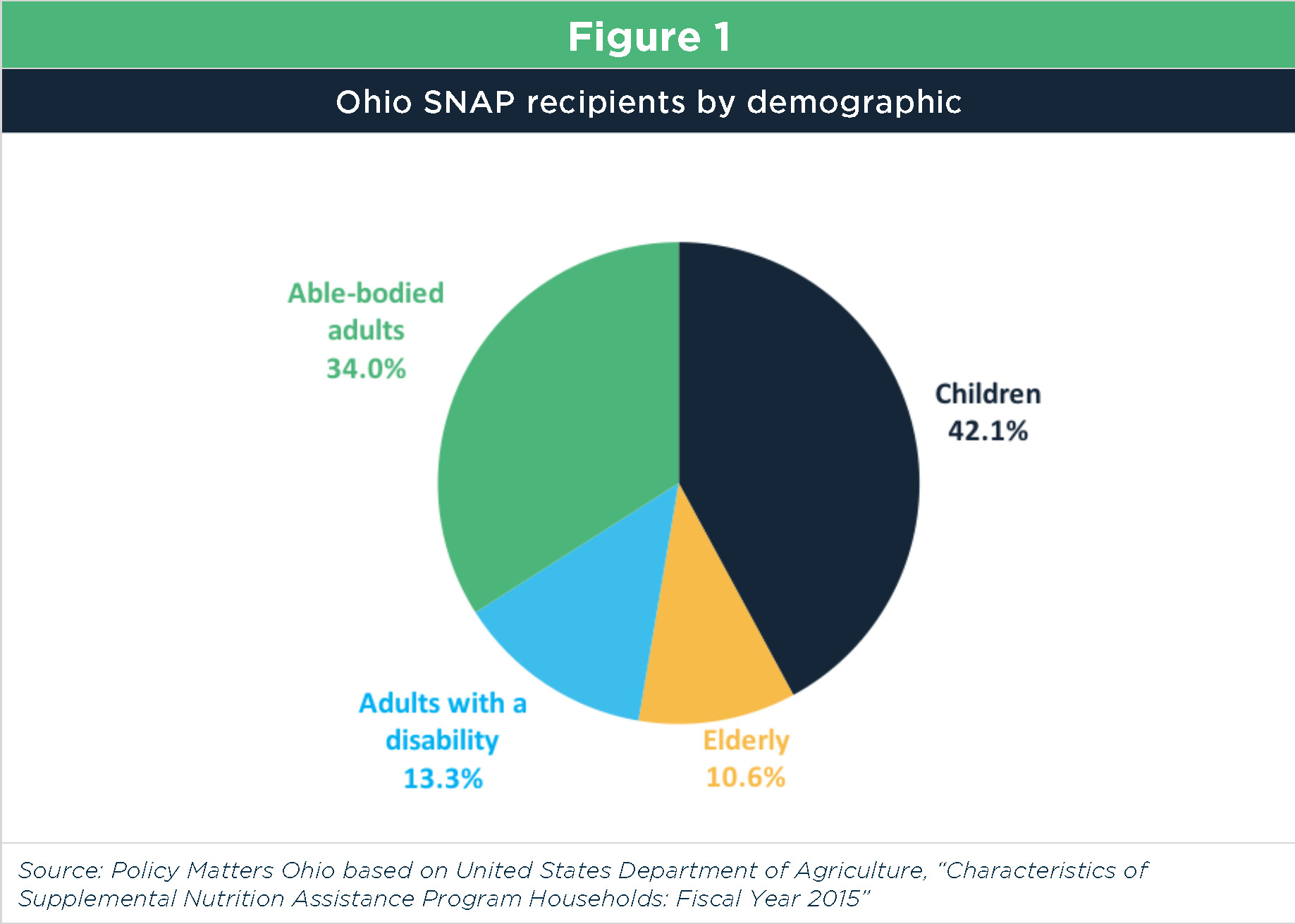

Assessing Opportunity Zones In Ohio

Assessing Opportunity Zones In Ohio

Post a Comment for "Ohio Unemployment Tax Rate 2015"