Ohio Tax Rate On Unemployment

For joint filers income up to 19750 is taxed. Nearly every Ohioan who received unemployment benefits about 94 made less.

Did You Receive A 1099 G From The Ohio Department Of Taxation Or The Ohio Department Of Job And Family Services Department Of Taxation

Did You Receive A 1099 G From The Ohio Department Of Taxation Or The Ohio Department Of Job And Family Services Department Of Taxation

Additionally if you live in a traditional tax base school district your unemployment compensation is also subject to school district income tax on your SD 100 return.

/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg)

Ohio tax rate on unemployment. The taxable wage base for calendar years 2018 and 2019 is 9500. Ohio taxes unemployment benefits to the extent they are included in federal adjusted gross income AGI. The exclusion is 10200 per person so spouses filing a joint return can avoid paying taxes on up to 20400.

The taxable wage base for calendar year 2020 and subsequent years is 9000. A final option is to pay estimated quarterly taxes on your unemployment benefits. After deductions income for individuals is taxed at 10 up to 9875 then 12 from there to 40124 and then at 22.

Unemployment taxes contributions must be paid on the first 9000 of an employees wages per year. The taxable wage base may change from year to year. Ohio taxes unemployment compensation to the same extent it is taxed under federal law.

As a result any unemployment compensation received in. In recent years however it has been stable at 27. SUI tax rate by state.

But dont file your tax returns just yet local accountants and state officials say. Certain married taxpayers who both received unemployment benefits can each deduct up. The state UI tax rate for new employers also known as the standard beginning tax rate can change from one year to the next.

Here is a list of the non-construction new employer tax rates for each state and Washington DC. The Ohio 2020 state unemployment insurance SUI tax rates will range from 03 to 94 up from the 2019 range of 03 to 92. The new-employer tax rate is to be 270 for 2021 unchanged from 2020.

Ohio income tax update. And if you already filed the IRS is still working on a way to get you. Certain married taxpayers who both received unemployment benefits can each deduct up to 10200.

New employers except for those in the construction industry will continue to pay at 27. The 17 million Ohioans who collected unemployment in 2020 will get a nice chunk of the taxes they paid on it back. State Taxes on Unemployment Benefits.

Changes in how unemployment benefits are taxed for tax year 2020 Read More. Certain married taxpayers who both received unemployment benefits can each deduct up. The 2020 SUI taxable wage base reverts to 9000 down from 9500 for 2018 and 2019.

Due to the ARPA the IRS is allowing certain taxpayers to deduct up to 10200 in unemployment benefits. Ohio taxes unemployment benefits to the extent they are included in federal adjusted gross income AGI. Note that some states require employees to contribute state unemployment tax.

Except for new employers in the construction industry who are subject to a significantly higher beginning rate. Due to the ARPA the IRS is allowing certain taxpayers to deduct up to 10200 in unemployment benefits. The primary purpose of the mutualized account is to maintain the Unemployment Insurance Trust Fund at a safe level and recover the costs of unemployment benefits that are not chargeable to individual employers.

Unemployment Benefits for Tax Year 2020. Ohios unemployment rate hit a record 164 last April. Ohio taxes unemployment benefits to the extent they are included in federal adjusted gross income AGI.

In some cases all of it. Ohios unemployment taxable wage base will remain at 9000 for 2021. New employers in the construction industry are to be assessed a rate of 580 in 2021 also unchanged from 2020.

Due to the ARPA the IRS is allowing certain taxpayers to deduct up to 10200 in unemployment benefits. This is a little more complicated but if you had been self-employed or owned your own small business you may. For calendar year 2021 the mutualized tax rate will be 05.

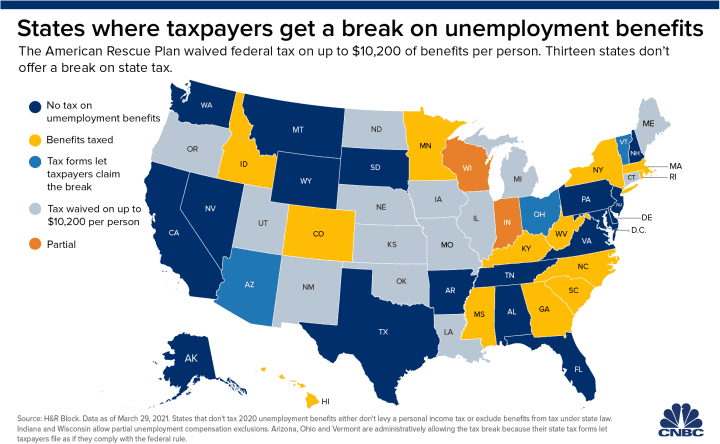

The American Rescue Plan a 19 trillion Covid relief bill waived. Thirteen states arent offering a tax break on unemployment benefits received last year according to data from HR Block. The Ohio Department of Job and Family Services which administers Ohios unemployment program sent out.

Because Ohios income tax begins with federal adjusted gross income your unemployment compensation is also taxable to Ohio on your IT 1040 return.

Unemployment Fraud Reports Running Rampant In Central Ohio

Unemployment Fraud Reports Running Rampant In Central Ohio

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Explaining Taxes On Unemployment And Stimulus Checks And Answers To Other Personal Finance Questions That S Rich Recap Cleveland Com

Explaining Taxes On Unemployment And Stimulus Checks And Answers To Other Personal Finance Questions That S Rich Recap Cleveland Com

A Detailed Guide To Unemployment Insurance Compliance Emptech Com

A Detailed Guide To Unemployment Insurance Compliance Emptech Com

Paying Taxes On Unemployment Checks Everything You Need To Know Cnet

Paying Taxes On Unemployment Checks Everything You Need To Know Cnet

Income School District Tax Department Of Taxation

Income School District Tax Department Of Taxation

Sui Sit Employment Taxes Explained Emptech Com

Sui Sit Employment Taxes Explained Emptech Com

Sui Sit Employment Taxes Explained Emptech Com

Sui Sit Employment Taxes Explained Emptech Com

/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

Ohio Hospital Association Ohio Hospital Association

Ohio Hospital Association Ohio Hospital Association

Are Unemployment Insurance Benefits Taxable A Guide On Ui Taxes

Are Unemployment Insurance Benefits Taxable A Guide On Ui Taxes

10 200 Unemployment Tax Break 13 States Aren T Giving The Waiver

10 200 Unemployment Tax Break 13 States Aren T Giving The Waiver

Unemployment Fraud Chicago Man Receives Ohio Unemployment Tax Form Despite Never Living There Abc7 Chicago

Unemployment Fraud Chicago Man Receives Ohio Unemployment Tax Form Despite Never Living There Abc7 Chicago

No 10 200 Unemployment Tax Break In 13 States Could Mean Higher Taxes

No 10 200 Unemployment Tax Break In 13 States Could Mean Higher Taxes

What To Watch For When Filing 2020 Tax Returns The Blade

What To Watch For When Filing 2020 Tax Returns The Blade

10 200 Unemployment Tax Break 13 States Aren T Giving The Waiver

10 200 Unemployment Tax Break 13 States Aren T Giving The Waiver

Ohio Unemployment Help Wkyc Com

Ohio Unemployment Help Wkyc Com

State By State Coronavirus Guidelines Tax Unemployment Resources

State By State Coronavirus Guidelines Tax Unemployment Resources

Post a Comment for "Ohio Tax Rate On Unemployment"