How To Determine Your Unemployment Benefits

Next you would include the amount of benefits as a negative amount you. We will ask how many hours you worked and how much you earned gross for that week.

Unemployment Appeal Letter Sample Proposal Sample For Proof Of Unemployment Letter Template In 2021 Letter Template Word Letter Templates Letter Sample

Unemployment Appeal Letter Sample Proposal Sample For Proof Of Unemployment Letter Template In 2021 Letter Template Word Letter Templates Letter Sample

36 of the total wages in your base period.

How to determine your unemployment benefits. Your duration of benefitsthe maximum number of weeks you are eligible to receive benefits is determined by dividing your benefit. Report the 25000 the total amount of your unemployment compensation on line 7 and report 15200 on line 8 as a negative amount in parentheses. The following example shows how to determine your maximum benefit credit.

When unemployment checks started pouring in during 2020 many didnt realize that those benefits were taxable. 26 times your weekly benefit amount or. 26 times your weekly benefit amount or.

The total amount of UI benefits you can receive in your benefit year is called your maximum benefit credit. Your state unemployment benefits plus the weekly benefits. It is based on your average weekly wage during your two highest quarters.

Avoid getting scammed and do not give personal information to. First you report the full amount of unemployment benefits on Line 7 of Schedule 1. For example if you worked a 40-hour week you.

The Unemployment Insurance UI benefit calculator will provide you with an estimate of your weekly UI benefit amount which can range from 40 to 450 per week. This is usually a monetary cap which is calculated by multiplying your weekly benefit by 26. Any resulting overpayment of tax will be either refunded or applied to other outstanding taxes owed.

However the only place you can get a definitive answer or file for benefits is on your state unemployment website. This means that if you qualify for partial unemployment you could benefit for more than. Know where unemployment compensation is taxable and where it isnt.

The total amount of benefits potentially payable on your claim is found by taking the smaller of. Some websites say they will figure out your unemployment benefits or file a claim for you. If your weekly benefit amount is 362 multiply this number by.

Unemployment insurance benefits are calculated for hours you work and income you earn in what is known as a base period. The 15200 excluded from income is all of the 5000 unemployment compensation paid to your spouse plus 10200 of the 20000 paid to you. The amount you receive in unemployment benefits is calculated by multiplying the highest amount of wages paid to you in any base period quarter by 41.

The number is in Box 1 on the tax form. Your maximum benefit credit is calculated as the lesser of either. As of October 4 2020 the maximum benefit rate is 855 a week.

To estimate how much you might be eligible to receive add together the gross wages in the two highest quarters during that period divide by 2 and then multiply by 00385 to get your weekly benefit amount. Once you file your claim the EDD will verify your eligibility and wage information to determine your weekly benefit amount WBA. The IRS Finally Made a Decision on How to Tax 2020 Unemployment Income - Contact The W Tax Group and let us help you by clicking through to this page.

Effective date of your claim. Free Tax Relief Consultation. Six dollars will be added for each dependent you claim up to five dependents and that is your maximum benefit.

For those taxpayers who already have filed and figured their tax based on the full amount of unemployment compensation the IRS will determine the correct taxable amount of unemployment compensation and tax. Dont be surprised by an unexpected state tax bill on your unemployment benefits. To be eligible for partial benefits you cannot work more than 80 percent of the hours normally worked in the job.

For married couples each spouse can exclude up to 10200. The majority of states offer 26 weeks worth of unemployment benefits. When you claim your weekly benefit you will let us know if you worked that week.

Individuals should receive a Form 1099-G showing their total unemployment compensation last year. How we calculate partial Unemployment Insurance benefits. Literally defined a base period is information used to base the amount of benefits you will receive.

A benefit ratethe amount of your weekly benefitsis also calculated.

Esdwagov Calculate Your Benefit

Esdwagov Calculate Your Benefit

Esdwagov Calculate Your Benefit

Esdwagov Calculate Your Benefit

Labor And Economic Opportunity Can A Person Work Part Time And Still Collect Ui Benefits

Labor And Economic Opportunity Can A Person Work Part Time And Still Collect Ui Benefits

Des Covid 19 Information For Individuals

Des Covid 19 Information For Individuals

States Are Telling Some People To Pay Back Unemployment Benefits Marketplace

States Are Telling Some People To Pay Back Unemployment Benefits Marketplace

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Extended Unemployment Benefits Set To End This Week

Extended Unemployment Benefits Set To End This Week

Pin By Ncworks Piedmont Triad On Alamance County Nc Insurance Benefits Alamance County Yadkin County

Pin By Ncworks Piedmont Triad On Alamance County Nc Insurance Benefits Alamance County Yadkin County

Ppp Loans Vs Unemployment Benefits How To Choose Bench Accounting

Ppp Loans Vs Unemployment Benefits How To Choose Bench Accounting

How Unemployment Benefits Are Calculated By State Bench Accounting

How Unemployment Benefits Are Calculated By State Bench Accounting

How To Keep A Good Record Of Your Job Search Activities For Unemployment Benefits Purposes Job Search Tips Job Search Education Jobs

How To Keep A Good Record Of Your Job Search Activities For Unemployment Benefits Purposes Job Search Tips Job Search Education Jobs

My Unemployment Says I Have A Break In My Claim What Does That Mean In 2020 Meant To Be Serious Problem Sayings

My Unemployment Says I Have A Break In My Claim What Does That Mean In 2020 Meant To Be Serious Problem Sayings

What To Do When An Employer Lies To Unemployment So They Do Not Have To Pay Out Benefits In 2020 Unemployment Employment Agency Employment

What To Do When An Employer Lies To Unemployment So They Do Not Have To Pay Out Benefits In 2020 Unemployment Employment Agency Employment

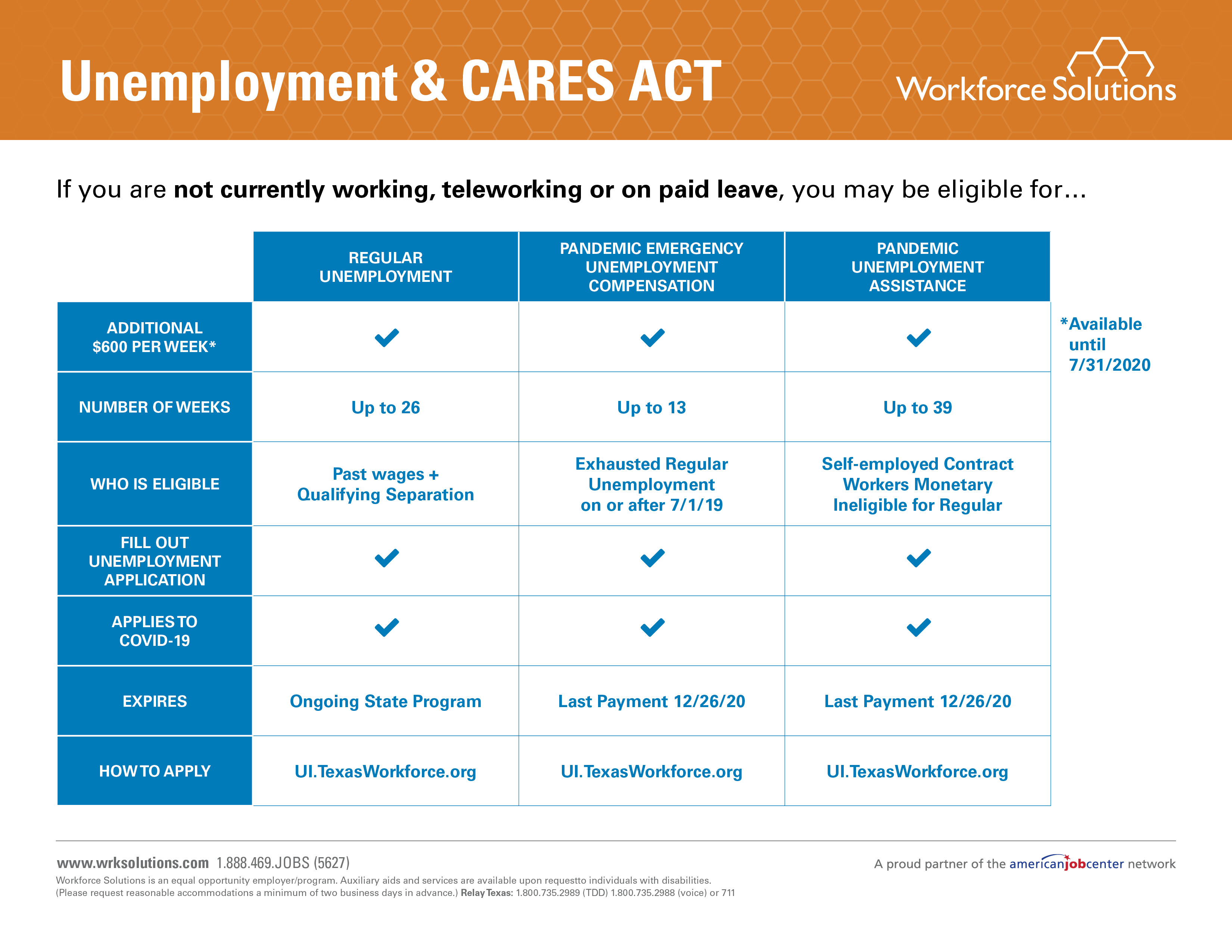

Unemployment Benefits Workforce Solutions

Unemployment Benefits Workforce Solutions

Veterans Group Life Insurance Helps Applicants Switch Coverage To A Renewable Term Policy Of Insuran In 2020 Group Life Insurance Life Insurance Policy Life Insurance

Veterans Group Life Insurance Helps Applicants Switch Coverage To A Renewable Term Policy Of Insuran In 2020 Group Life Insurance Life Insurance Policy Life Insurance

Post a Comment for "How To Determine Your Unemployment Benefits"