File For Unemployment Ohio 1099

Appeal requests may be submitted online at unemploymentohiogov by email to UITaxAppealsjfsohiogov by fax to 614 752-4952 or by mail to Unemployment Tax Appeals P O. If you DID apply andor receive unemployment benefits from ODJFS.

Are Unemployment Insurance Benefits Taxable A Guide On Ui Taxes

Are Unemployment Insurance Benefits Taxable A Guide On Ui Taxes

The Ohio Department of Job and Family Services offers the following resources to help both individuals and employers who have been affected.

File for unemployment ohio 1099. Many Ohioans have become victims and their identities used to file fraudulent unemployment claims in both the traditional unemployment and Pandemic Unemployment Assistance programs. You can reset your PIN online or by calling the PIN reset hotline at 866 962-4064. However the new federal Pandemic Unemployment Assistance PUA program will provide up to 39 weeks of benefits to self-employed workers 1099 tax filers and some other individuals who previously were not eligible for unemployment benefits.

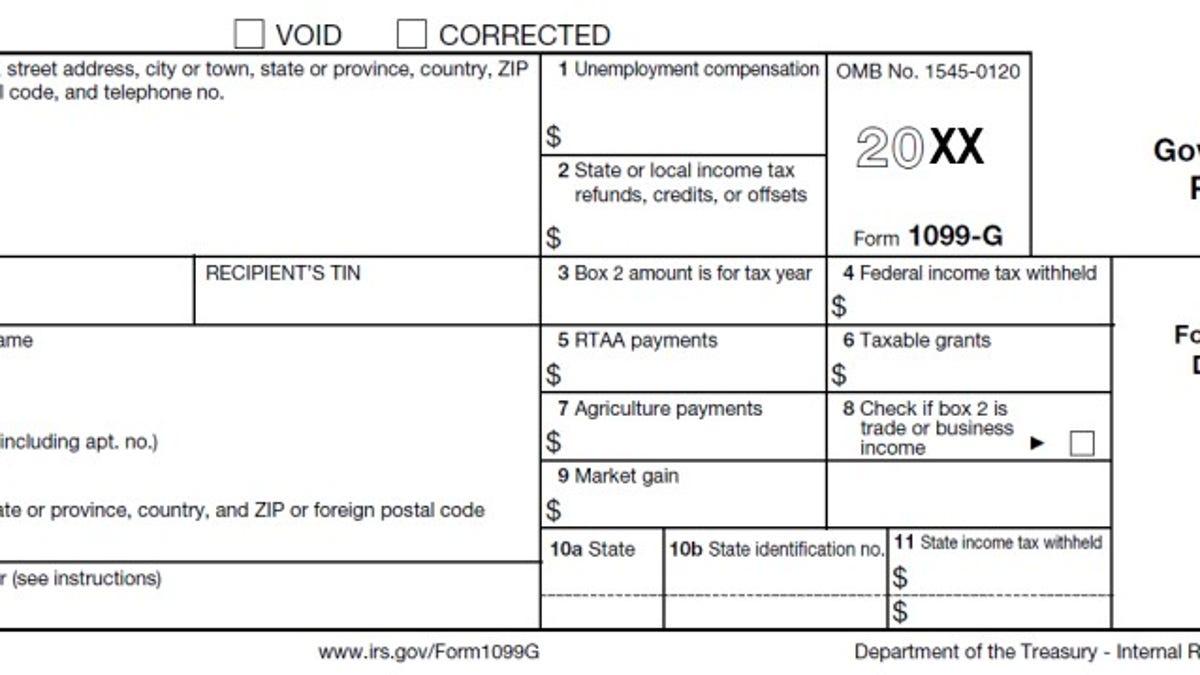

Unemployment claimants will receive an Internal Revenue Service 1099 form at the end of January for the previous years benefits. These income statements are mailed to you. Name full mailing address and phone number.

Ohioans who are self-employed 1099 workers or part-time can now apply for pandemic unemployment assistance The new federal program covers many more categories of workers. If you get one but did not apply for unemployment that is a major red flag that you might be the victim of. The federal Pandemic Unemployment Assistance or PUA program provides benefits for many individuals ineligible for state unemployment benefits including self-employed workers 1099 tax filers and part-time workers.

True Coronavirus and Unemployment Insurance Benefits Resource Hubs Please review our employee and employer resource hubs for more information on unemployment benefits related to COVID-19. IncomeStatementsEWTtaxstateohus or by calling. You can elect to be removed from the next years mailing by signing up for email notification.

The benefit amount will be similar to traditional unemployment benefits plus an additional 600. Unemployment benefits are taxable pursuant to federal and Ohio law. ODJFS issues IRS 1099-G tax forms to recipients of unemployment benefits so they can report this income when filing their annual tax returns.

On your 1099-G form Box 1 Unemployment Compensation shows the amount you received in unemployment wages. The appeal must be in writing and it must state the reasons the employer believes the determination was incorrect. Report it by calling toll-free.

Get Started Now PUA Application Step-by-Step Guide View FAQs Read All Frequently Asked Questions. Drivers license or state ID number. The Ohio Department of Job and Family Services ODJFS this month is issuing 17 million 1099-G tax forms because of a federal law that requires reporting of unemployment benefits.

How do I reset my unemployment PIN. When you reach the page titled Ohio Unemployment Benefits - Main Menu click on the button for File a New Claim for Unemployment Benefits After you submit the application remember to continue filing weekly claims while you wait for your eligibility determination. Box 182830 Columbus Ohio 43218-2830.

1099 Upload Frequently Asked Questions Questions regarding the W-21099 Upload Feature can be directed to the Employment Tax Division at. 1099Gs are available to view and print online through our Individual Online Services. Enter the amount from Box 1 on Line 19 Unemployment Compensation of your 1040 form.

If this amount if greater than 10 you must report this income to the IRS. False Identity Theft and 1099 Resources If you suspect that your personal information has been stolen andor if you received a 1099-G tax form from the Ohio Department of Job and Family Services ODJFS and did not apply for unemployment benefits in 2020 the agency needs to hear from you immediately. In most states self-employed or 1099 workers will need to provide the following information when applying for unemployment benefits.

However you can elect to receive them. Social Security or Alien Registration number and drivers license number. Tax All 1099Gs Issued by the Ohio Department of Taxation will be mailed by January 31st.

EU chief says AstraZeneca shortfalls slow vaccine campaign If you received unemployment in 2020 you will be receiving a 1099-G tax form in the mail sometime this month which is used to file your. Apply for Unemployment Now Employee 1099 Employee Employer. If you DID NOT apply to receive unemployment benefits.

Generally the 1099-G andor 1099-INT are available by the end of January. Unemployment benefits are taxable pursuant to federal and Ohio law. ODJFS issues IRS 1099-G tax forms to recipients of unemployment benefits so they can report this income when filing their annual tax returns.

How To Apply For Unemployment Benefits Online In Ohio Youtube

How To Apply For Unemployment Benefits Online In Ohio Youtube

1099 G Tax Form Causing Confusion For Some In Kentucky Wkyc Com

1099 G Tax Form Causing Confusion For Some In Kentucky Wkyc Com

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Self Employed Part Time Workers Can Now Get Unemployment In Ohio Wkrc

Self Employed Part Time Workers Can Now Get Unemployment In Ohio Wkrc

File For Unemployment Last Year Documents You Need To File Taxes 10tv Com

File For Unemployment Last Year Documents You Need To File Taxes 10tv Com

Https Unemployment Ohio Gov Pdf New Workers Self Service User Guide Pdf

Https Unemployment Ohio Gov Pdf New Workers Self Service User Guide Pdf

Unemployment Fraud Reports Running Rampant In Central Ohio

Unemployment Fraud Reports Running Rampant In Central Ohio

Unemployment Fraud Reports Running Rampant In Central Ohio

Unemployment Fraud Reports Running Rampant In Central Ohio

Https Jfs Ohio Gov Ouio Pdf Pua Stepbystepapplicationinstructions Pdf

1099 Workers Other Jobless Ohioans Not Previously Eligible Can Pre File For Benefits Friday The Statehouse News Bureau

1099 Workers Other Jobless Ohioans Not Previously Eligible Can Pre File For Benefits Friday The Statehouse News Bureau

Ohio Unemployment Help Wkyc Com

Ohio Unemployment Help Wkyc Com

Pin On 1000 Examples Online Form Templates

Pin On 1000 Examples Online Form Templates

Form 1099 Nec Now Used To Report Non Employee Compensation Ohio Dairy Industry Resources Center

Form 1099 Nec Now Used To Report Non Employee Compensation Ohio Dairy Industry Resources Center

1099 Form Fileunemployment Org

1099 Form Fileunemployment Org

Tax Season Is Coming With Plenty Of Changes Thanks To Covid 19 S Economic Impact Wsyx

Tax Season Is Coming With Plenty Of Changes Thanks To Covid 19 S Economic Impact Wsyx

Unemployment Fraud Chicago Man Receives Ohio Unemployment Tax Form Despite Never Living There Abc7 Chicago

Unemployment Fraud Chicago Man Receives Ohio Unemployment Tax Form Despite Never Living There Abc7 Chicago

Post a Comment for "File For Unemployment Ohio 1099"