Does Unemployment Count As Income For Medicaid Nj

Individual gross earned income may not exceed 64596 per year 5383 per month. This federal unemployment compensation is included in income eligibility determinations for ACA marketplace eligibility but not for Medicaid and CHIP eligibility.

Who Can Get Medicaid Find Out If You Re Eligible Healthcare Gov

Who Can Get Medicaid Find Out If You Re Eligible Healthcare Gov

Taxable income may include wages salaries bonuses alimony self-employment income pensions punitive damages IRA distributions jury duty fees unemployment compensation rents royalties severance pay gambling winnings interest tips and estate or trust income.

Does unemployment count as income for medicaid nj. The application will help you make this estimate. If you earned 18240 and received the extra 600 in COVID unemployment benefits for six months 3600 it will be subject to federal income tax but it will not reduce your Social. Some forms of income that are non-taxable or only partially taxable are included in MAGI and affect financial eligibility for premium tax credits and Medicaid.

Both the one-time stimulus check up to 1200 for single adults 2400 for married couples 500 for children under age 17 and the weekly 600 Pandemic Unemployment Compensation checks do not count as income on your Medicaid application. Examples include employment wages alimony payments pension payments Social Security Disability Income Social Security Income IRA withdrawals and stock dividends. The HealthCaregov website says calculating your adjusted gross income gives you a good estimate.

Learn more from the US. The unemployment bump of 600 per week is a different story. Include all unemployment compensation including unemployment compensation as a result of the coronavirus disease 2019 COVID-19 emergency.

Generally speaking for a single senior applicant the income limit in 2020 is. Most states count the full amount of UI but some states are excluding the additional 600 per week of PUC. Unemployment benefits could increase an individuals income to such a degree that aid through these programs is either reduced or eliminated entirely.

When you complete a Marketplace application youll need to predict your income for the coverage year the best you can. If your family income is too much for Medicaid you may still qualify to buy a low-cost policy in the Affordable Care Acts insurance marketplace. States have flexibility for treatment of income under TANF.

The monthly portion of unemployment insurance payments made by the State of NJ shall continue to be counted as appropriate for the. For Medicaid the additional 600 per week of PUC is not countable and should be excluded in determining eligibility but other UI benefits are counted. In New Jersey individuals who qualify for Supplemental Security Income disability payments also qualify for Medicaid.

If you have unearned income for example in addition to your wages you also receive alimony the maximum earned income threshold will vary. If you have no unearned income. Youll need to report your expected unemployment compensation when applying for health coverage through the Marketplace.

Medicaid is financed by Federal and State matching funds but eligibility rules may vary from state to state. Some income that Medicaid. At present vulnerable workers who become unemployed can receive 600 in additional federal income for 16 weeks.

If a person is receiving workers compensation benefits or disability benefits this may also count as income. Pandemic Unemployment Benefit as income on my. Unemployment payments count as income and so do withdrawals from a 401k or IRA account.

To clarify this income can come from any source. If a person receives child. Railroad retirementTier I portion may be taxable.

Workers who qualify for PUC will receive an extra 600 a week in unemployment benefits in addition to their regular unemployment compensation. For long-term care Medicaid eligibility there are income and asset limits. However it will be counted as income in determining eligibility for financial assistance through the Marketplace.

But the 600 a week in extra federal. 16 WEEKS OF FEDERAL ADDITIONAL INCOME INCLUDED IN ELIGIBILITY. This means these payments are NOT taxable and will not be counted as income for Medicaid CHIP or financial assistance in the Marketplace.

The program covers all of the approved charges of the Medicaid patient. Income also includes any unemployment benefits a person receives or any amount of money they earn through self-employment. For individuals qualifying for regular unemployment the CARES act established an additional weekly payment of 600 until July 31 2020.

For Medicaid eligibility purposes any income that a Medicaid applicant receives is counted. You may also be receiving income that is not considered taxable. Does MAGI count any income sources that are not taxed.

The Federal emergency increases in unemployment insurance payments of 600 per week shall be disregarded when determining eligibility for MedicaidCHIP. If youre receiving federal pandemic unemployment compensation include the additional 300 you get each week in your estimate. Does unemployment compensation count as income.

It is important to note that the additional 600 weekly assistance will not count as income for Medicaid eligibility. An eligible couples gross earned income may not exceed 86988 per year 7249 per month. These increases may be paid retroactively to January 27 2020.

Medicaid Spending And Enrollment Trends Amid The Covid 19 Pandemic Updated For Fy 2021 Looking Ahead To Fy 2022 Kff

Medicaid Spending And Enrollment Trends Amid The Covid 19 Pandemic Updated For Fy 2021 Looking Ahead To Fy 2022 Kff

Https Www Atlantic County Org Documents Public Health Insuranceguidebook2019 Pdf

Lsnjlaw An Overview Of The Unemployment Appeals Process

Lsnjlaw An Overview Of The Unemployment Appeals Process

New Jersey Medicaid Jo Anne Herina Jeffreys

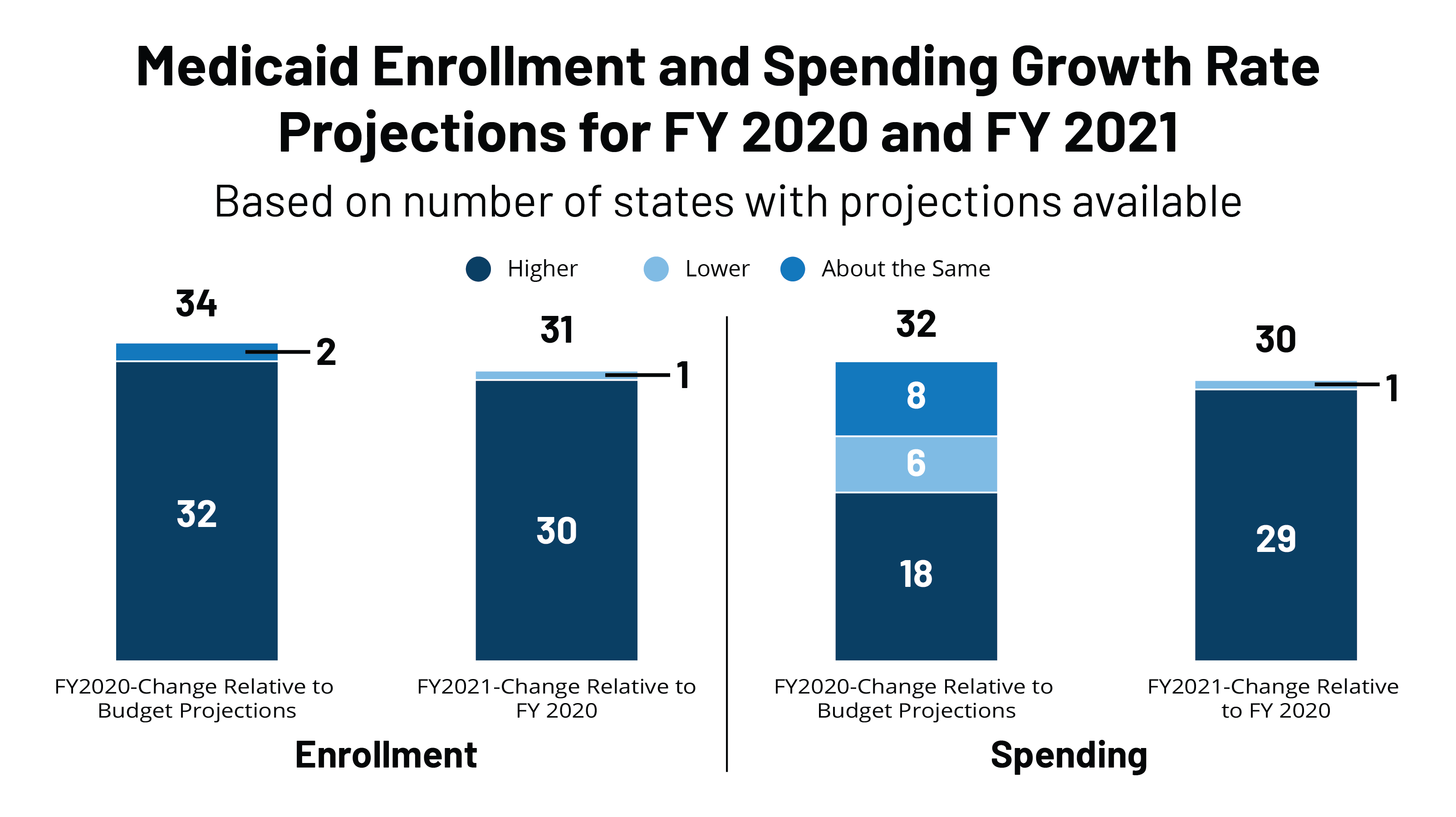

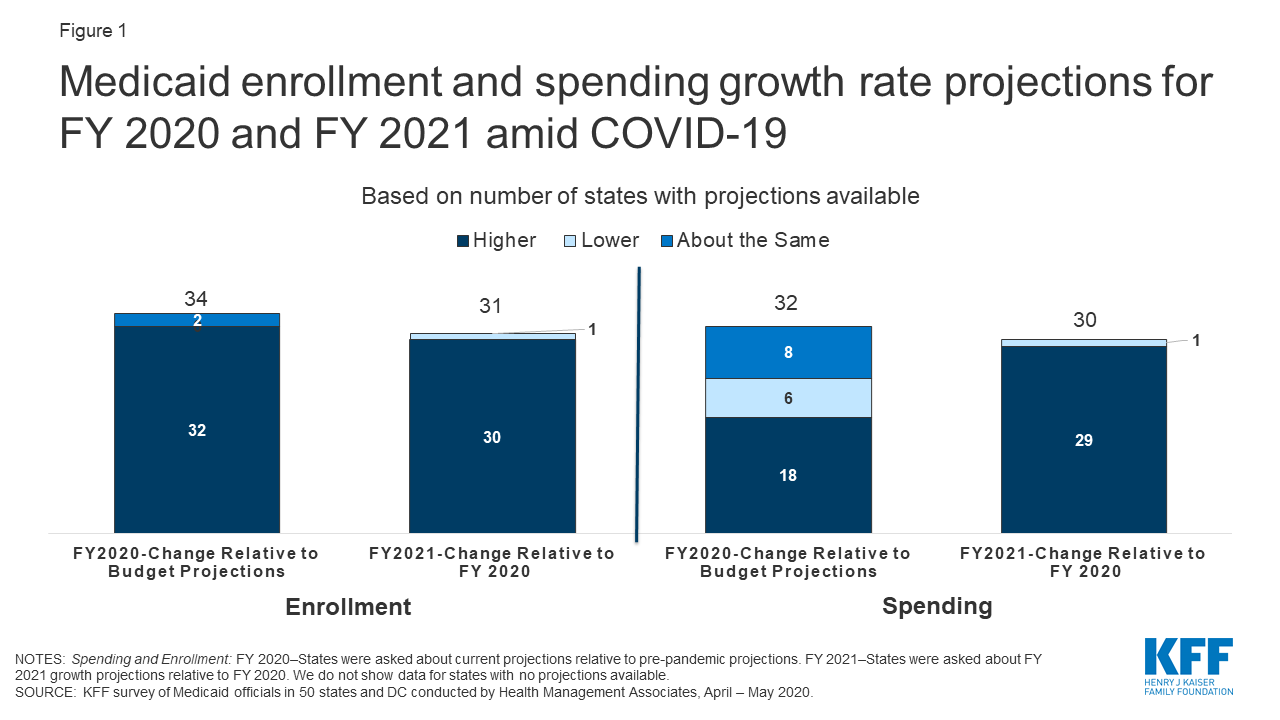

Early Look At Medicaid Spending And Enrollment Trends Amid Covid 19 Kff

Early Look At Medicaid Spending And Enrollment Trends Amid Covid 19 Kff

Health Insurance Marketplace Calculator Kff

Health Insurance Marketplace Calculator Kff

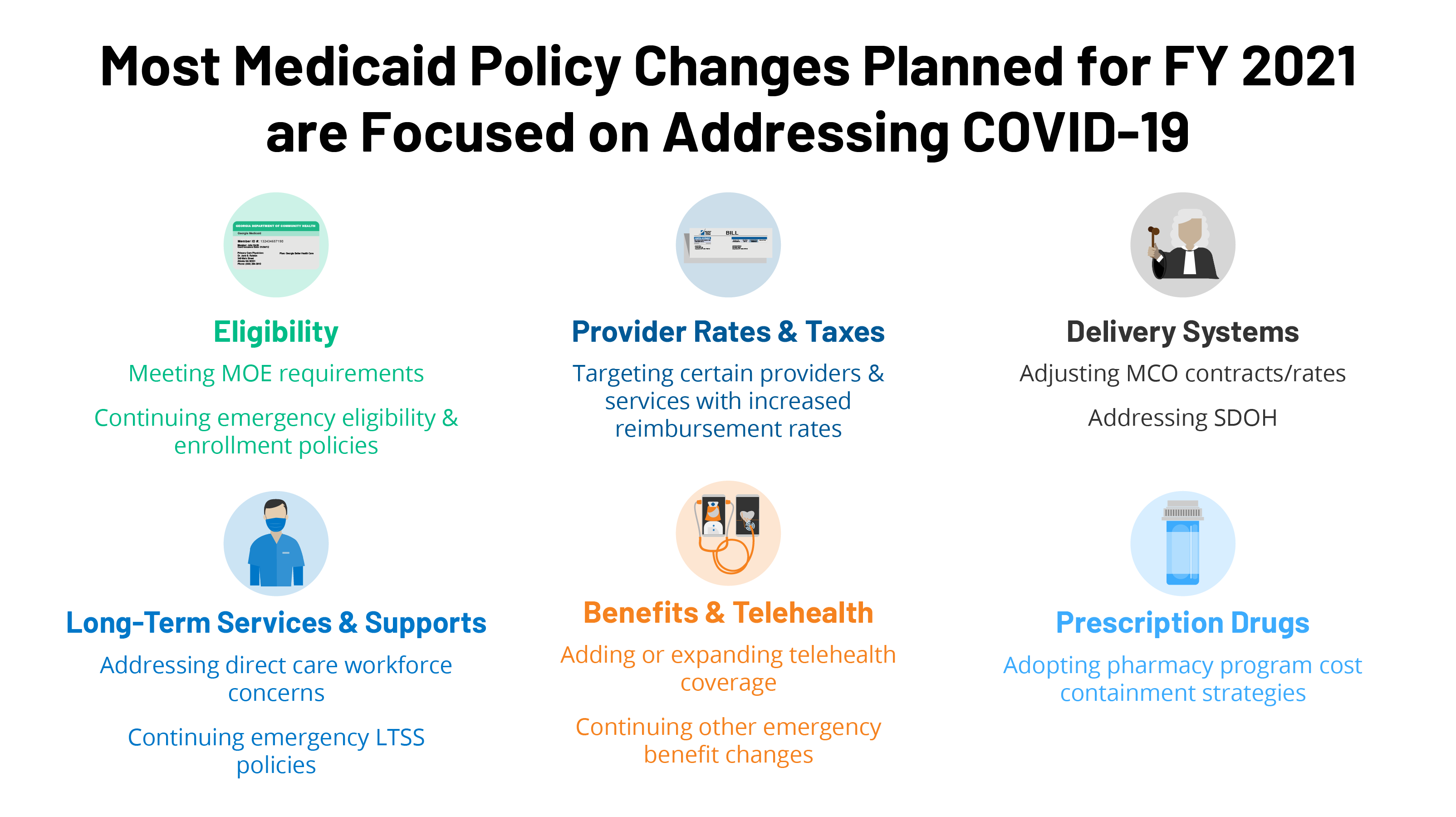

State Medicaid Programs Respond To Meet Covid 19 Challenges Eligibility And Enrollment 9554 Kff

State Medicaid Programs Respond To Meet Covid 19 Challenges Eligibility And Enrollment 9554 Kff

Https Www Njhcqi Org Wp Content Uploads 2020 07 Mpc Issue Brief Projections For New Jersey Medicaid Eligibility Trends During Covid 19 July 2020 Pdf Utm Source Newsletter Utm Medium Mailchimp Utm Campaign Mpc 20issue 20brief 20pdf 20july 202020

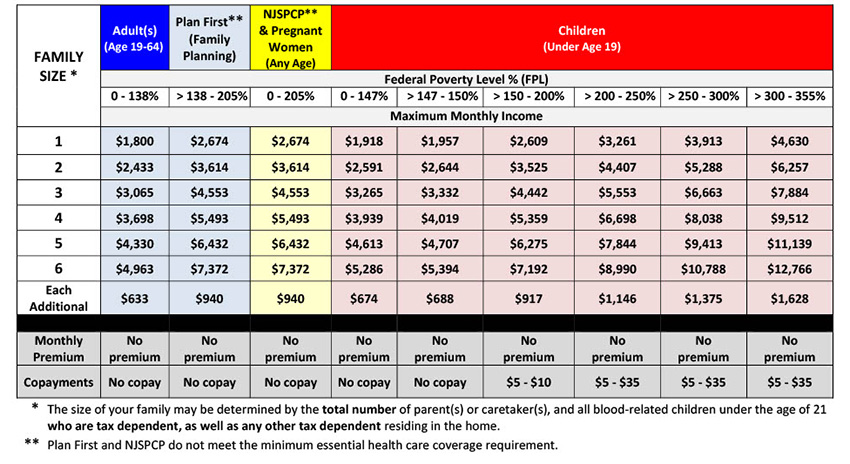

Nj Familycare Income Eligibility And Cost

Early Look At Medicaid Spending And Enrollment Trends Amid Covid 19 Kff

Early Look At Medicaid Spending And Enrollment Trends Amid Covid 19 Kff

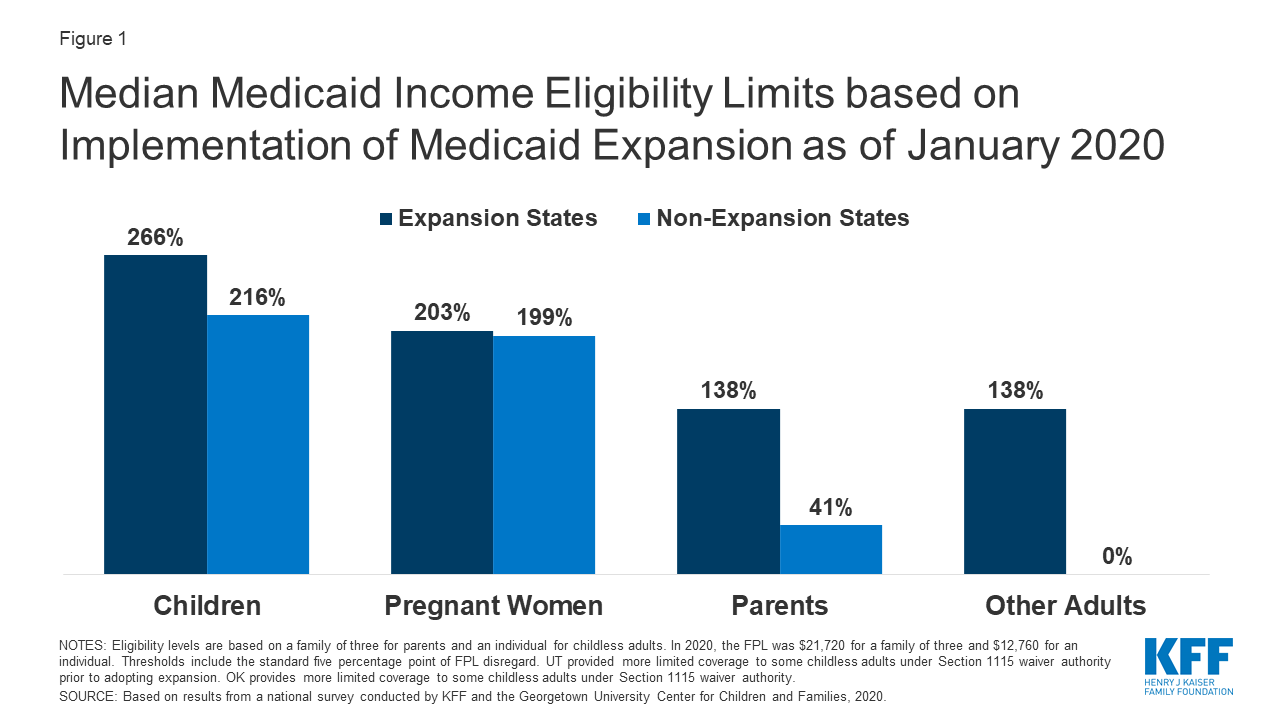

Medicaid And Chip Eligibility Enrollment And Cost Sharing Policies As Of January 2020 Findings From A 50 State Survey Kff

Medicaid And Chip Eligibility Enrollment And Cost Sharing Policies As Of January 2020 Findings From A 50 State Survey Kff

What Do I Do If I Lose My Job Based Health Insurance

What Do I Do If I Lose My Job Based Health Insurance

The New Jersey Hospital Association

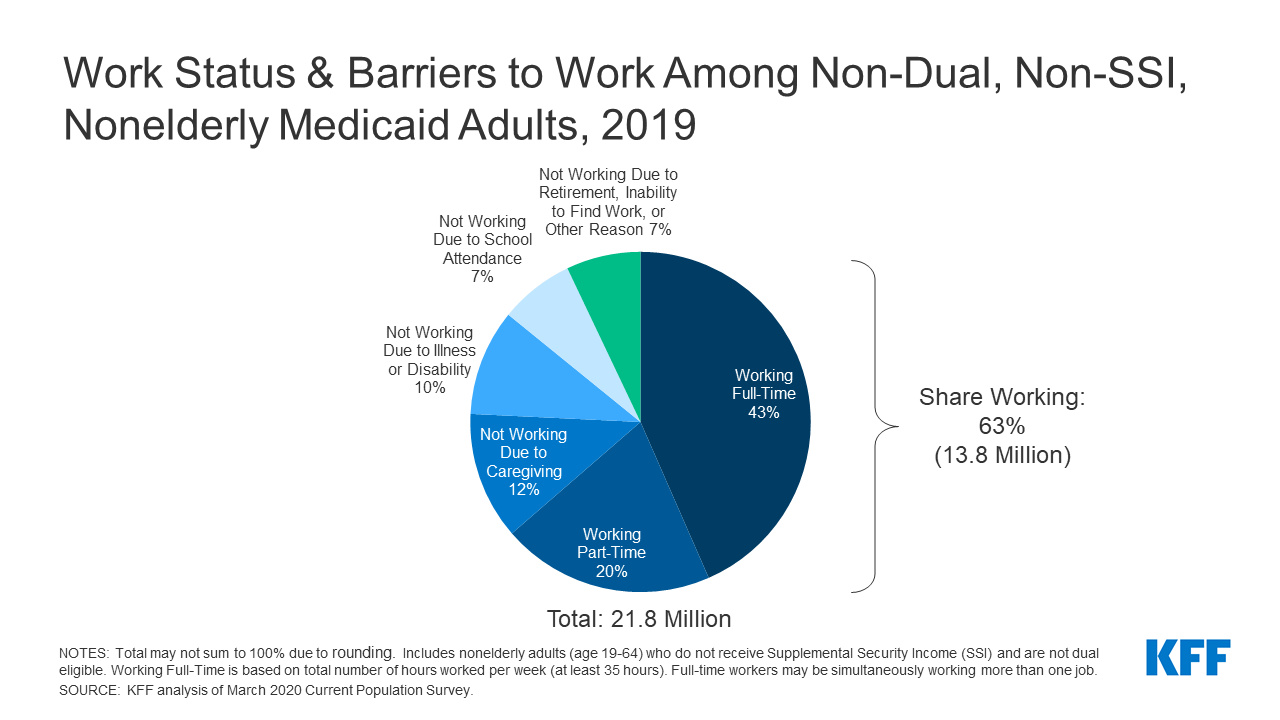

Work Among Medicaid Adults Implications Of Economic Downturn And Work Requirements Kff

Work Among Medicaid Adults Implications Of Economic Downturn And Work Requirements Kff

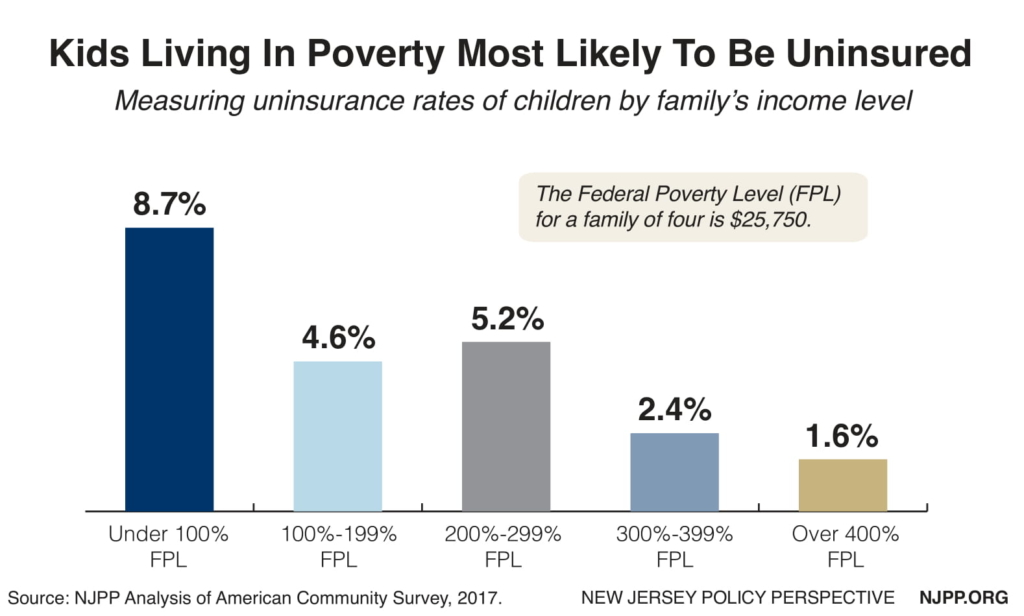

It S Time For All Kids Health Coverage New Jersey Policy Perspective

It S Time For All Kids Health Coverage New Jersey Policy Perspective

Https Www Njhcqi Org Wp Content Uploads 2020 07 Mpc Issue Brief Projections For New Jersey Medicaid Eligibility Trends During Covid 19 July 2020 Pdf Utm Source Newsletter Utm Medium Mailchimp Utm Campaign Mpc 20issue 20brief 20pdf 20july 202020

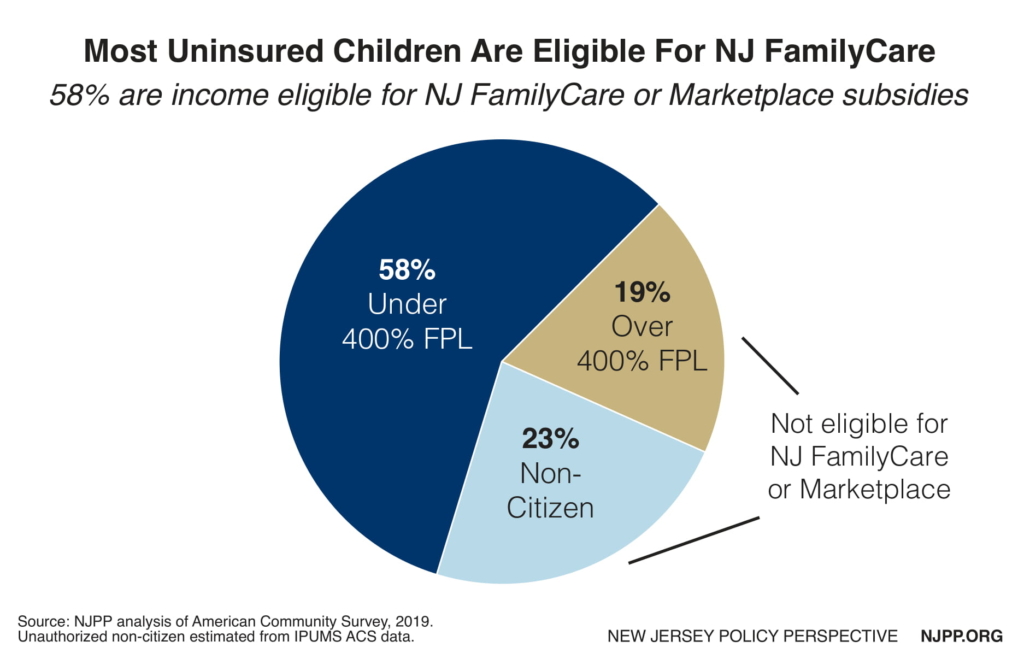

It S Time For All Kids Health Coverage New Jersey Policy Perspective

It S Time For All Kids Health Coverage New Jersey Policy Perspective

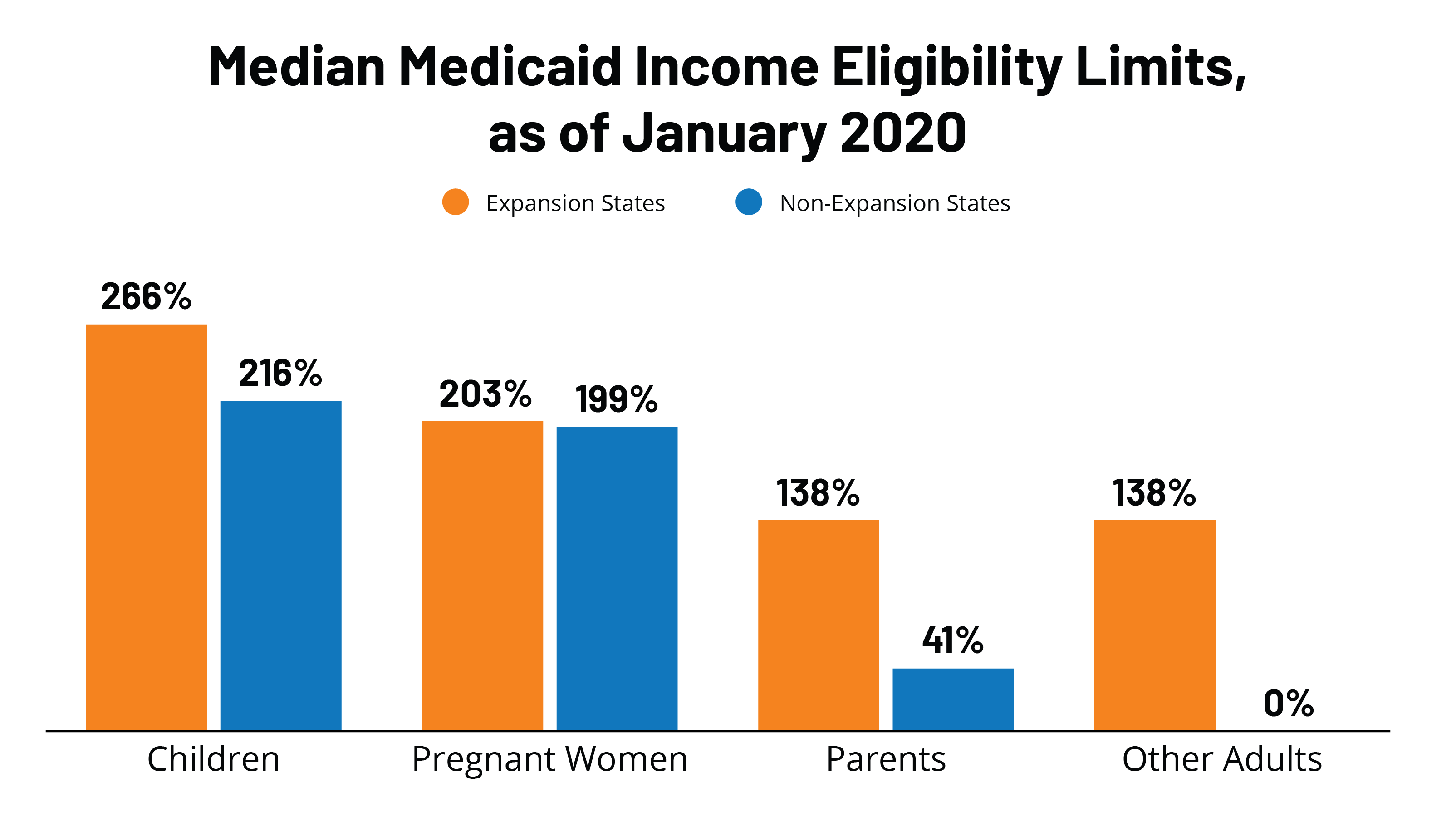

Medicaid And Chip Eligibility Enrollment And Cost Sharing Policies As Of January 2020 Findings From A 50 State Survey Kff

Medicaid And Chip Eligibility Enrollment And Cost Sharing Policies As Of January 2020 Findings From A 50 State Survey Kff

Post a Comment for "Does Unemployment Count As Income For Medicaid Nj"