Cares Act Unemployment Not Taxable

Thirteen states arent offering a tax break on unemployment benefits received last year according to data from HR Block. Refer to Form W-4V Voluntary Withholding Request and Tax Withholding.

Increased Unemployment Benefits Under The Cares Act Covid 19 Relief Act Association Of Flight Attendants Cwa

Increased Unemployment Benefits Under The Cares Act Covid 19 Relief Act Association Of Flight Attendants Cwa

However based on the CARES Act rules that wont apply to forgiven PPP loans.

Cares act unemployment not taxable. The 10200 exemption amount is intended to cover 17 weeks of the extra 600 federal unemployment benefit that was passed as part of the Cares Act and ran from March to. Several provisions in the CARES Act added new elements to unemployment but it did not change the way the IRS classifies unemployment benefits. The new stimulus package called the American Rescue Plan Act of 2021 makes tax-free a big chunk of unemployment benefits people received last.

Up to 10200 in unemployment payments is tax-free. President Joe Biden signed a 19 trillion Covid relief bill Thursday that waives federal tax on up to 10200 of unemployment benefits an individual received in 2020. If your modified adjusted gross income AGI is less than 150000 the American Rescue Plan enacted on March 11 2021 excludes from income up to 10200 of unemployment compensation paid in 2020 which means you dont have to pay tax on unemployment compensation of up to 10200.

The federal government considers unemployment benefits to be taxable income although taxes are not automatically withheld from benefits payments the way an employer might take taxes out of your. The break applies this. Other deductions may include court ordered or voluntary child support or repayment of an UI overpayment one-half of your 300 FPUC payment will be deducted and applied to your outstanding overpayment.

New York State follows the federal treatment of RMDs. The change will allow more taxpayers to qualify. Prior to Tuesday the IRS instructed taxpayers to include the unemployment income in modified AGI but now they can exclude unemployment benefits from modified AGI.

How unemployment insurance affects your taxes Because unemployment benefits are considered income youll need to report them on your 2020 federal and state as applicable taxes when you file your return in early 2021. All unemployment compensation is considered taxable income by the IRS. Another stipulation discussed is a tax break for unemployed workers.

Thanks to the American Rescue Plan which was passed and signed into law in March 2021 the full amount of unemployment benefits are not taxable. The American Rescue Plan Act which President Biden signed into law this month allows taxpayers who earned under 150000 in 2020 to qualify for the 10200 exclusion. To counter that the COVID relief bill includes a tax exemption of 10200 for those with an adjusted gross income less than 150000.

Unemployment benefits Under the CARES Act eligible Americans who are out of work entirely or underemployed because of reasons related to. Normally a forgiven loan will be counted as cancelled debt which is considered taxable income. The American Rescue Plan a 19 trillion Covid relief bill waived.

In the event your PPP loan is not forgiven its treated like a normal loan and its not considered taxable. This includes the employment benefits a. 3 If you filed your taxes before the American Rescue Plan was passed you had to pay taxes on the full amount of your unemployment benefits.

For federal tax purposes a forgiven PPP loan is not taxable. This includes the waiver of RMDs for tax year 2020 and the extended rollover period. 2 days agoNew York State will continue to fully tax unemployment benefits despite a federal exemption on the first 10200 received by some workers who lost their jobs last year due to the pandemic.

Unemployment benefits are taxable income. Federal taxes are deducted at 10 and state taxes at 6. May be required to make quarterly estimated tax payments or Can choose to have federal income tax withheld from your unemployment compensation.

Mixed Earners Unemployment Compensation MEUC. Unemployment checks count as taxable income but some states didnt withhold federal taxes according to a. The federal government will issue Form 1099.

The federal CARES Act allows coronavirus-related distributions from an eligible retirement plan to be included in income over a three-year period. The way the exemption works is the first 10200 of. If you received unemployment compensation you.

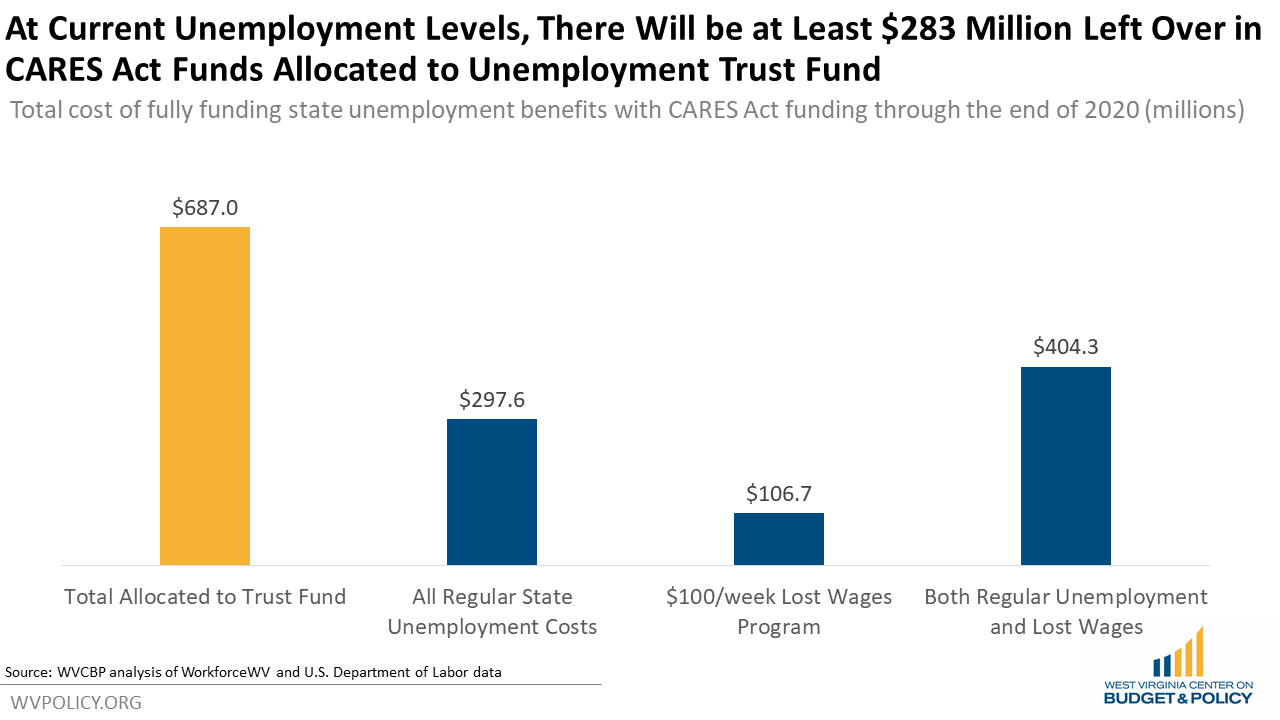

West Virginia Must Target Remaining Cares Act Aid To Those Most In Need West Virginia Center On Budget Policy

West Virginia Must Target Remaining Cares Act Aid To Those Most In Need West Virginia Center On Budget Policy

Cares Act Unemployment Benefits From The Stimulus Bill Youtube

Cares Act Unemployment Benefits From The Stimulus Bill Youtube

Cares Act 2021 Tax Incentives Aopa

Cares Act 2021 Tax Incentives Aopa

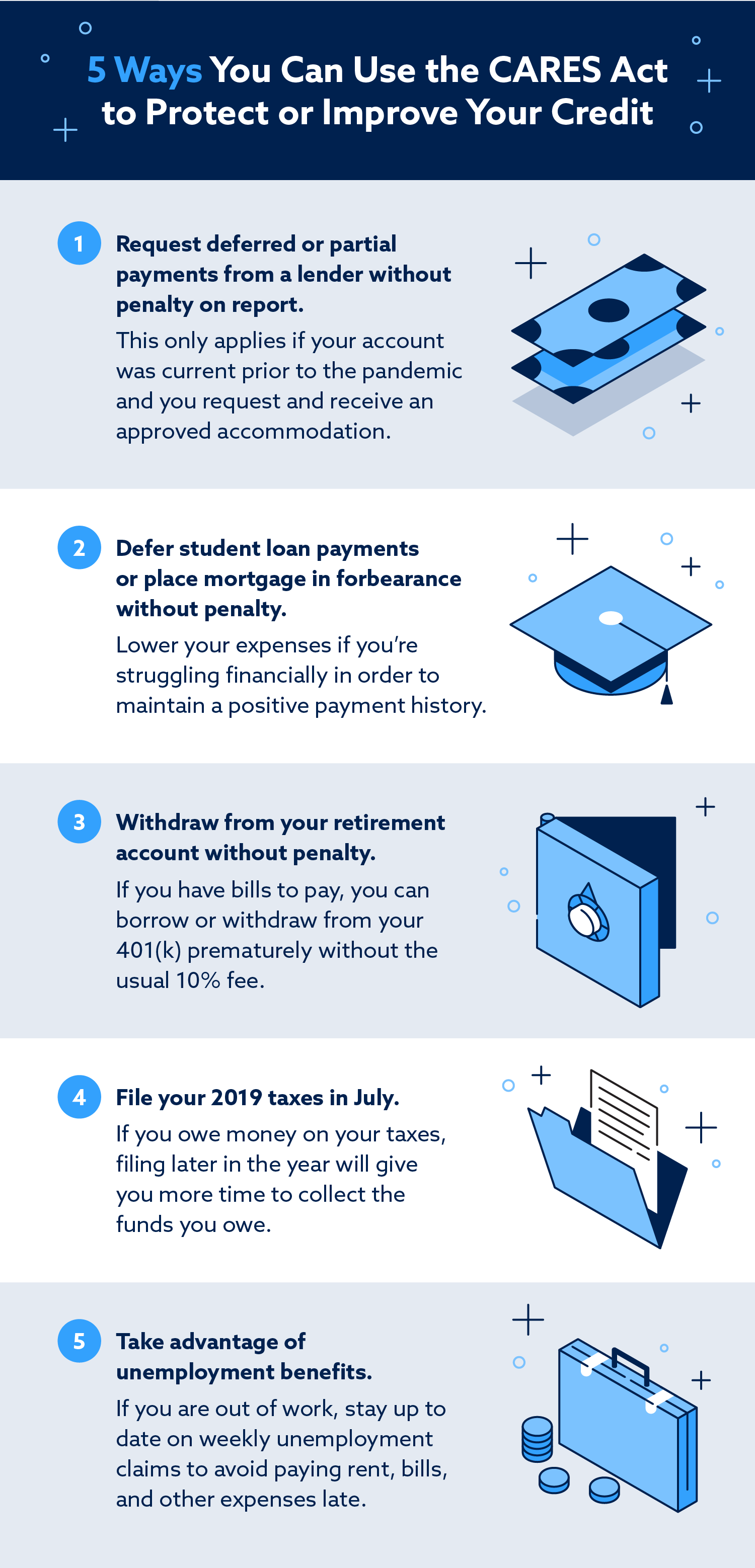

How To Take Advantage Of The Coronavirus Relief Act Lexington Law

How To Take Advantage Of The Coronavirus Relief Act Lexington Law

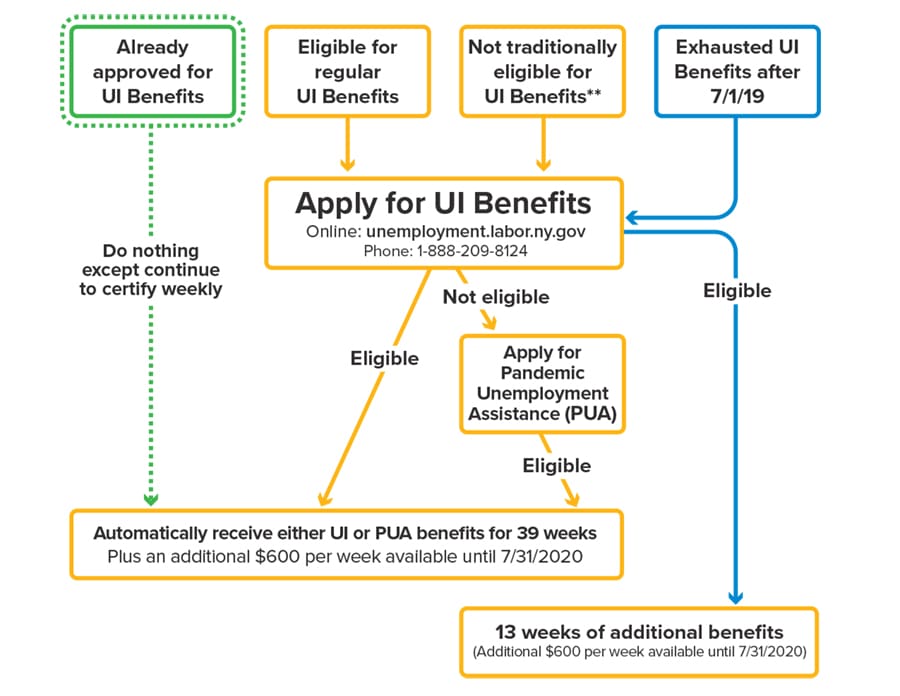

Covid 19 Faq Federal Stimulus Checks Cares Act Empire Justice Center

Covid 19 Faq Federal Stimulus Checks Cares Act Empire Justice Center

Employer Provisions In The Senate Cares Act

Employer Provisions In The Senate Cares Act

Cares Act Provisions For Financial Advisors And Their Clients

Cares Act Provisions For Financial Advisors And Their Clients

An Employer S Guide To The Cares Act Ppp Erc More

An Employer S Guide To The Cares Act Ppp Erc More

The Cares Act A Simple Summary Bench Accounting

The Cares Act A Simple Summary Bench Accounting

How To Take Advantage Of The Coronavirus Relief Act Lexington Law

How To Take Advantage Of The Coronavirus Relief Act Lexington Law

Cares Act What You Need To Know Neighborhood Trust Financial Partners

Cares Act What You Need To Know Neighborhood Trust Financial Partners

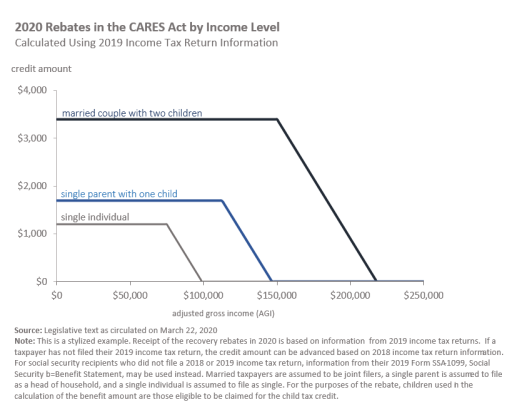

Covid 19 And Direct Payments To Individuals Summary Of The 2020 Recovery Rebates In The Cares Act As Circulated March 22 Everycrsreport Com

Covid 19 And Direct Payments To Individuals Summary Of The 2020 Recovery Rebates In The Cares Act As Circulated March 22 Everycrsreport Com

Cares Act Assistance For Employers And Employees The Paycheck Protection Program Employee Retention Tax Credit And Unemployment Insurance Benefits Assessment Of Alternatives Part 2 Everycrsreport Com

Cares Act Assistance For Employers And Employees The Paycheck Protection Program Employee Retention Tax Credit And Unemployment Insurance Benefits Assessment Of Alternatives Part 2 Everycrsreport Com

Cares Act Unemployment Insurance Benefits

Cares Act Unemployment Insurance Benefits

Unemployment Benefits And The Cares Act Bench Accounting

Unemployment Benefits And The Cares Act Bench Accounting

That Extra 600 A Week In Unemployment Benefits Is Taxable Weareiowa Com

That Extra 600 A Week In Unemployment Benefits Is Taxable Weareiowa Com

Tax Season Is Not Over Until You File Tackk Tax Season Tax Services Tax

Tax Season Is Not Over Until You File Tackk Tax Season Tax Services Tax

Post a Comment for "Cares Act Unemployment Not Taxable"