Can U File For Unemployment If Y O U ' R E Self Employed

Who qualifies Under the relief law people who are self-employed including independent contractors and gig workers and not eligible for regular unemployment insurance can still receive. As with unemployment benefits applicants must be underemployed by no action of their own -- workers who voluntarily reduce their number of hours worked dont qualify -- and must have enough working hours over the prior five or six quarters to meet state eligibility requirements.

Covid 19 Colorado Unemployment Benefits Faqs Livelihood Law Llc

Covid 19 Colorado Unemployment Benefits Faqs Livelihood Law Llc

If you are self-employed or an independent contractor you will need your net income total after taxes.

Can u file for unemployment if y o u ' r e self employed. The reason for your change in employment. The CARES Act expands unemployment insurance benefits through three programs to. Independent contractors are self-employed.

In addition to employees who have traditionally been eligible to collect unemployment insurance compensation the CARES Act extends benefits to workers who have not qualified for unemployment benefits in the past including independent contractors self-employed and gig workers and the long-term unemployed who have exhausted their benefits. In this article we cover the types of self-employment you may identify as along with several available financial support programs for collecting unemployment when youre self-employed. If you are a former federal employee have your Notice to Federal Employees About Unemployment Insurance Standard Form 8 ready.

Self-Employment During the Base Year Services performed in self-employment do not qualify as base year employment and will not be used to establish financial eligibility for benefits. Being self-employed usually means you cant get unemployment benefits when your business income dips or dries up. The federal government has made it possible for states to pay unemployment benefits to self-employed people whove seen their business suffer because of the COVID-19 pandemic.

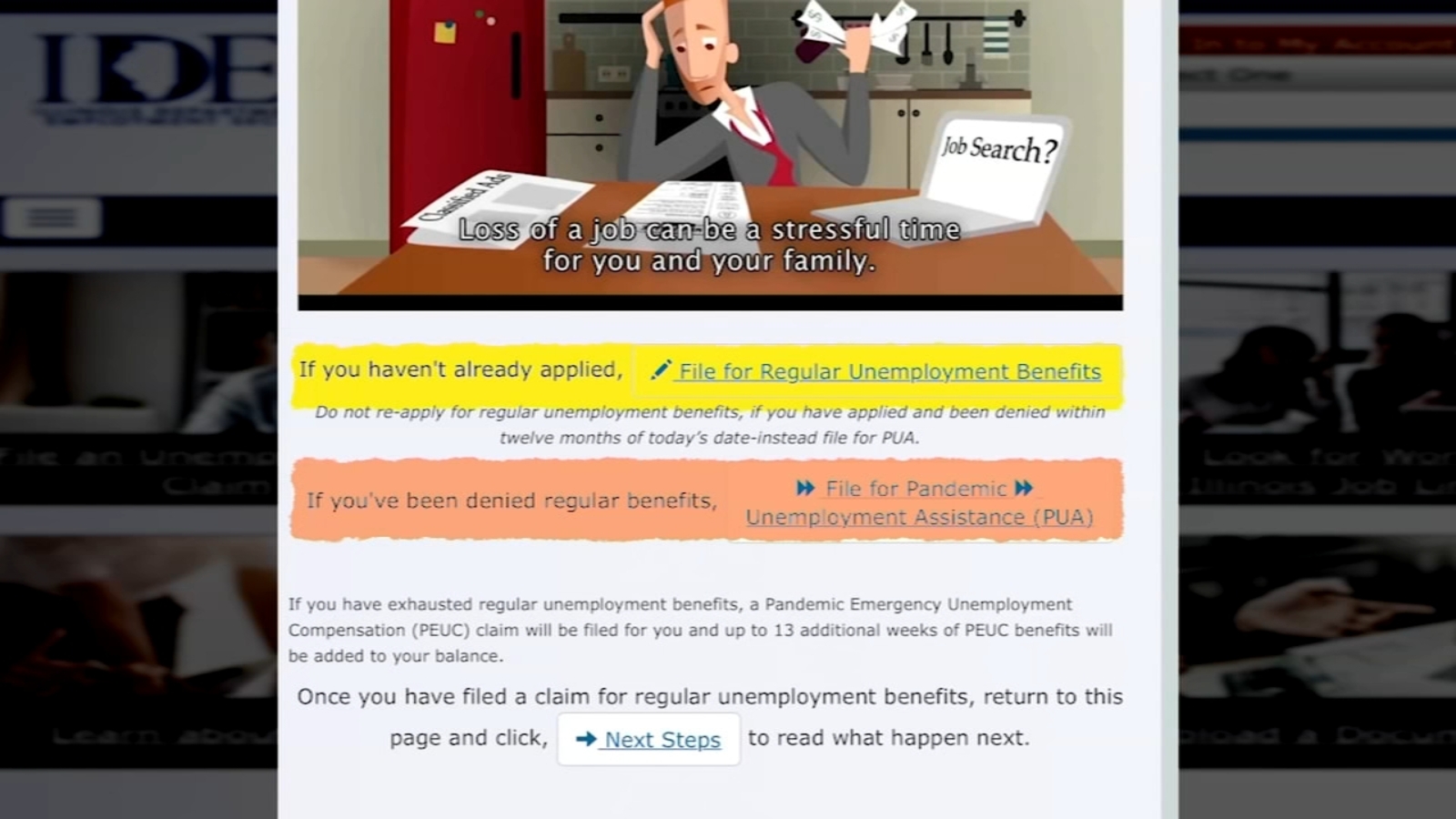

If you were self-employed a gig worker or an independent contractor or otherwise not eligible for regular unemployment no W-2 wages file a Pandemic Unemployment Assistance PUA claim. Unemployment Insurance is temporary income for eligible workers who lose their jobs through no fault of their own. File your claim the first week that you lose your job.

Under normal circumstances you cant collect unemployment benefits if you quit your job or if youre self-employed. The following two factors must exist for a claimant to be considered self-employed. How self-employed can file for unemployment insurance benefits This video tutorial shows how self-employed individuals can apply for unemployment insurance benefits under the CARES Act COVID-19.

Federal and Military Documents. Note that if you can work from home with pay youre not eligible for unemployment. But coronavirus legislation has changed that at least temporarily.

While the program was originally scheduled to end by December 31 2020 new legislation has extended the program through March 13 2021. To use the expanded unemployment benefits as a self-employed individual you will need to self-certify that youre self-employed and seeking part-time employment. Generally speaking you cant collect unemployment if you were fired due to serious misconduct like stealing from your employer lying about your.

With new unemployment and relief benefits for self-employed professionals under the CARES Act you may be eligible to apply for unemployment benefits. Who qualifies Under the relief law people who are self-employed including independent contractors and gig workers and not eligible for regular unemployment insurance can still receive unemployment benefits if they are unable to work or are working reduced hours due to the coronavirus.

Stimulus 2020 Unemployment Insurance For Self Employed Individuals Turbotax Tax Tips Videos

Stimulus 2020 Unemployment Insurance For Self Employed Individuals Turbotax Tax Tips Videos

Https Www Iowaworkforcedevelopment Gov Sites Search Iowaworkforcedevelopment Gov Files Content Files Webinar 20q 26a 20 20april 2016 Pdf

Illinois Unemployment Ides Pua Benefits Payments Now Available For Self Employed Workers To Apply Problems Reported Abc7 Chicago

Illinois Unemployment Ides Pua Benefits Payments Now Available For Self Employed Workers To Apply Problems Reported Abc7 Chicago

/employment_form-5bfc379946e0fb00511ce26e.jpg) How To Apply For Unemployment Insurance Now

How To Apply For Unemployment Insurance Now

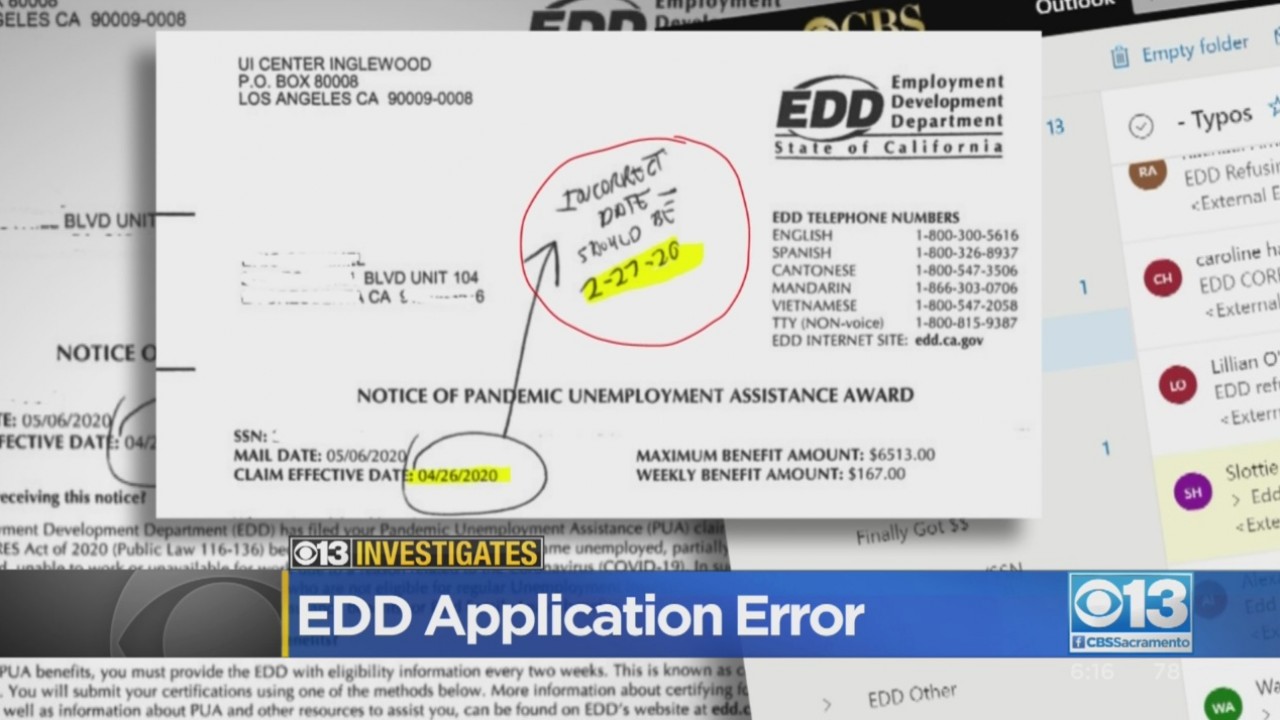

Coronavirus Unemployment Edd Date Errors Keeping Self Employed Filers From Their Back Pay Cbs Sacramento

Coronavirus Unemployment Edd Date Errors Keeping Self Employed Filers From Their Back Pay Cbs Sacramento

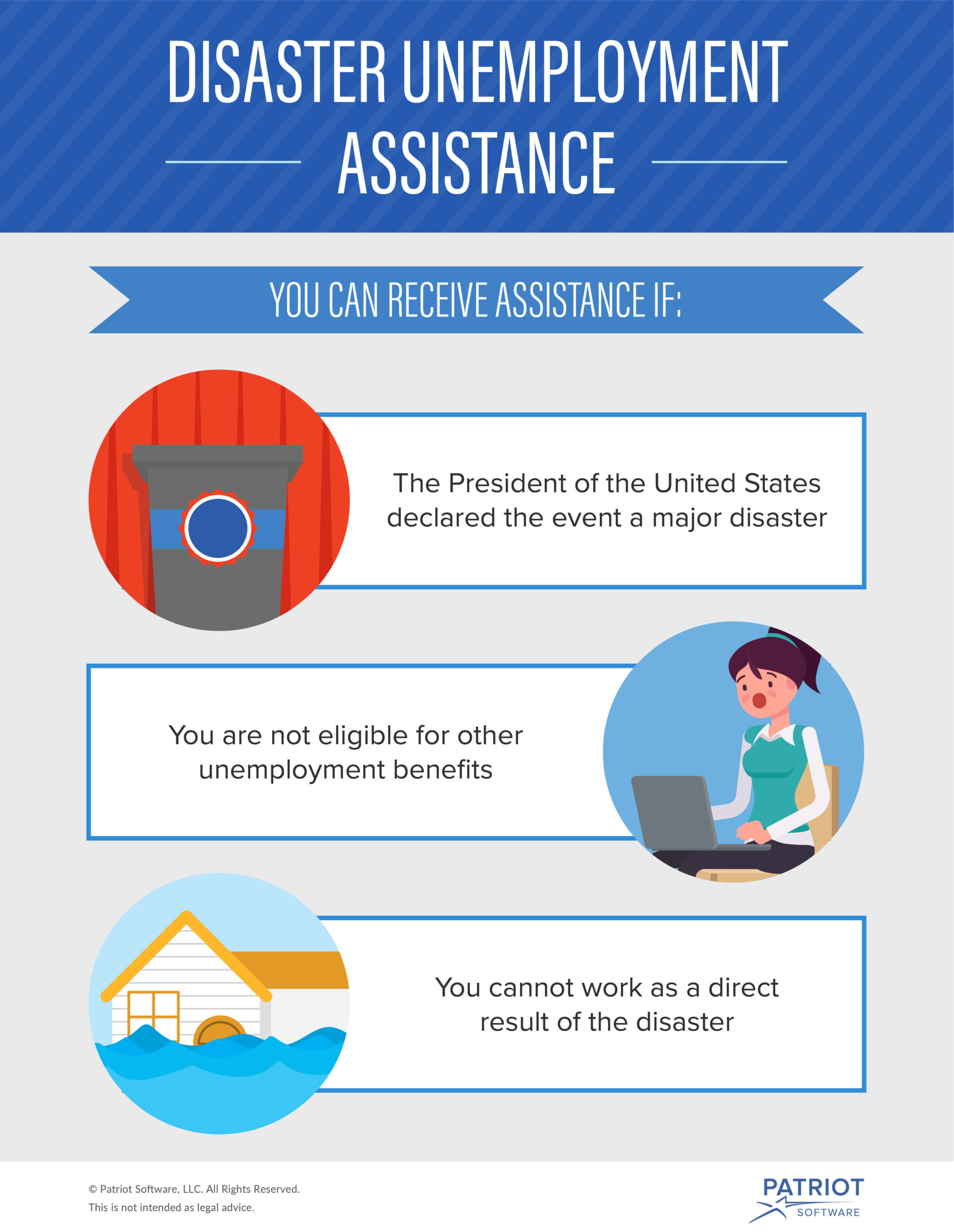

Self Employed Unemployment Insurance Can Business Owners File

Self Employed Unemployment Insurance Can Business Owners File

Pandemic Unemployment Assistance Now Available To Self Employed Gig Workers And Independent Contractors Kreis Enderle

Pandemic Unemployment Assistance Now Available To Self Employed Gig Workers And Independent Contractors Kreis Enderle

Https Unemployment Ohio Gov Pdf New Workers Self Service User Guide Pdf

Frequently Asked Questions About Unemployment Benefits For The Self Employed Cares Act Nav

Frequently Asked Questions About Unemployment Benefits For The Self Employed Cares Act Nav

Help For Self Employed Coronavirus Relief For Self Employed Individuals

Help For Self Employed Coronavirus Relief For Self Employed Individuals

Frequently Asked Questions About Unemployment Benefits For The Self Employed Cares Act Nav

Frequently Asked Questions About Unemployment Benefits For The Self Employed Cares Act Nav

Filing For Coronavirus Unemployment If You Re Self Employed Nerdwallet

Filing For Coronavirus Unemployment If You Re Self Employed Nerdwallet

How To File For Unemployment Benefits If You Re Self Employed Youtube

How To File For Unemployment Benefits If You Re Self Employed Youtube

Can I Get Unemployment If I M Self Employed Credit Karma

Can I Get Unemployment If I M Self Employed Credit Karma

How To File For Unemployment In 10 Steps Cnn Underscored

How To File For Unemployment In 10 Steps Cnn Underscored

Self Employed And Taxes Deductions For Health Retirement

Self Employed And Taxes Deductions For Health Retirement

Filing For Coronavirus Unemployment If You Re Self Employed Nerdwallet

Filing For Coronavirus Unemployment If You Re Self Employed Nerdwallet

Self Employed Workers Will Be Able To File Unemployment Claims By Week S End L I Says The Morning Call

Self Employed Workers Will Be Able To File Unemployment Claims By Week S End L I Says The Morning Call

Unemployment Benefits And The Cares Act Bench Accounting

Unemployment Benefits And The Cares Act Bench Accounting

Post a Comment for "Can U File For Unemployment If Y O U ' R E Self Employed"