Can 1099 File For Unemployment In Ohio

Federal employees who wish to file for unemployment insurance are encouraged to file with the state where the job is located not necessarily their resident state. If you use a tax preparer you should provide the 1099-INT along with your other tax information to the preparer.

Tax Season Is Coming With Plenty Of Changes Thanks To Covid 19 S Economic Impact Wsyx

Tax Season Is Coming With Plenty Of Changes Thanks To Covid 19 S Economic Impact Wsyx

Under the American Rescue Plan individuals who received unemployment benefits and earned less than 150000 in adjusted gross income in 2020 can.

Can 1099 file for unemployment in ohio. Box 182830 Columbus Ohio 43218-2830. Normally self-employed and 1099 earners such as sole independent contractors freelancers gig workers and sole proprietors do not qualify for unemployment benefits. Visit the IRS website here for specific information about the IRS adjustment for tax year 2020.

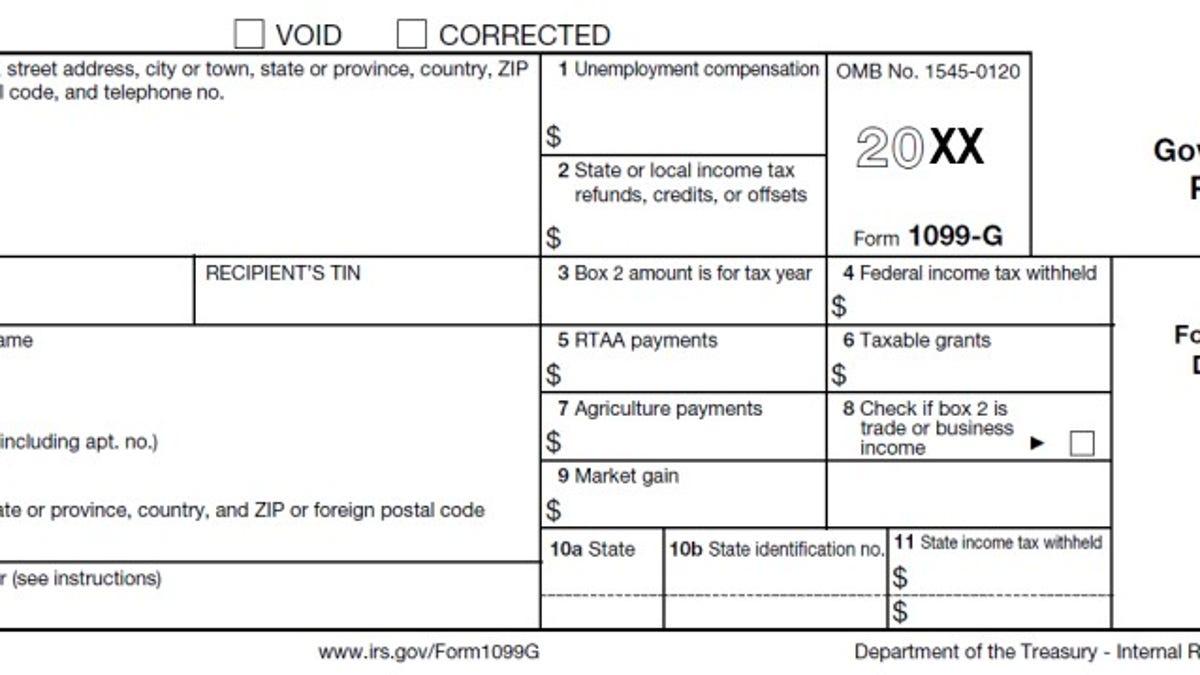

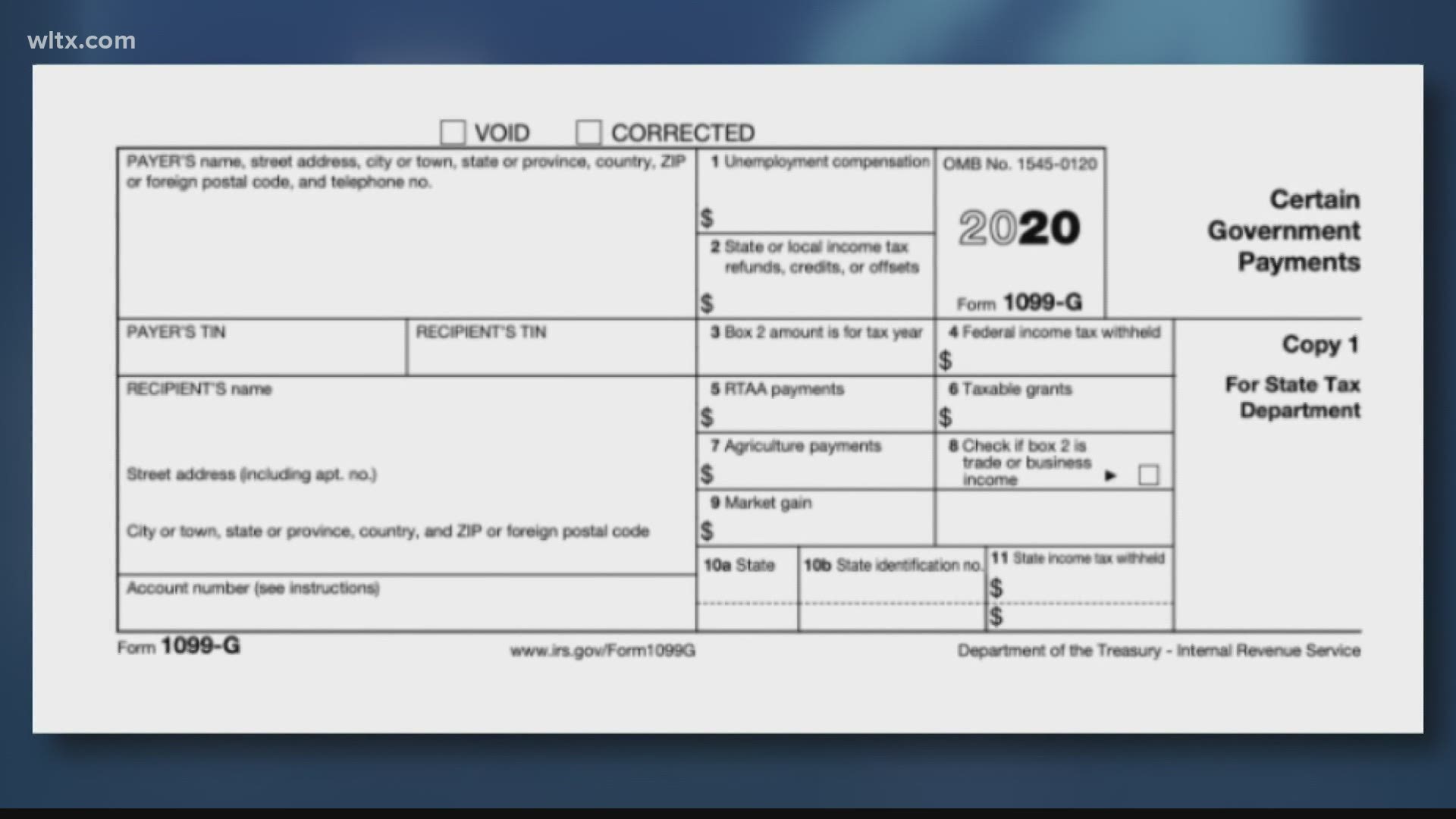

OHIO Self-employed part-time workers and independent contractors filing 1099 forms for taxes will be able to begin the process to apply for unemployment benefits Friday the Ohio Department of. You can elect to be removed from the next years mailing by signing up for email notification. All 1099Gs Issued by the Ohio Department of Taxation will be mailed by January 31st.

Unemployment claimants will receive an Internal Revenue Service 1099 form at the end of January for the previous years benefits. The appeal must be in writing and it must state the reasons the employer believes the determination was incorrect. If you prepare your own taxes you should review the federal return instructions for reporting interest income for more information.

Many Ohioans are also about to receive a 1099-G tax form in the mail stating that they received unemployment benefits in 2020 when in fact they did not. Governor Jon Husted and Dr. Ohio law is in conformity with federal law therefore the provisions applicable under federal.

Unemployment benefits are taxable pursuant to federal and Ohio law. EU chief says AstraZeneca shortfalls slow vaccine campaign If you received unemployment in 2020 you will be receiving a 1099-G tax form in the mail sometime this month which is used to file your. 1099 Upload Frequently Asked Questions Questions regarding the W-21099 Upload Feature can be directed to the Employment Tax Division at.

Appeal requests may be submitted online at unemploymentohiogov by email to UITaxAppealsjfsohiogov by fax to 614 752-4952 or by mail to Unemployment Tax Appeals P O. 1099Gs are available to view and print online through our Individual Online Services. Amy Acton MD MPH provided the following updates on Ohios response to the COVID-19 pandemic.

The Ohio Department of Job and Family Services ODJFS this month is issuing 17 million 1099-G tax forms because of a federal law that requires reporting of unemployment benefits. Ohioans who are self-employed 1099 workers or part-time can now apply for pandemic unemployment assistance The new federal program covers many more categories of workers than the traditional. Do not include the 1099-INT with any Ohio tax return.

ODJFS issues IRS 1099-G tax forms to recipients of unemployment benefits so they can report this income when filing their annual tax returns. ODJFS issues IRS 1099-G tax forms to recipients of unemployment benefits so they can report this income when filing their annual tax returns. Federal employees affected by the federal government shutdown can file for Ohio Unemployment Insurance UI benefits if they are partially or totally unemployed due to the federal shutdown.

IncomeStatementsEWTtaxstateohus or by calling. Deferred Elective Procedures CARES Act Payments 1099 Unemployment Claims First Responder PPE Testing Partnership Prison Update Census 2020 COLUMBUS OhioOhio Governor Mike DeWine Lt. However the federal government created new provisions that allow 1099 earners to tap into unemployment benefits during the ongoing COVID-19 pandemic.

Get Started Now PUA Application Step-by-Step Guide View FAQs Read All Frequently Asked Questions. The federal Pandemic Unemployment Assistance or PUA program provides benefits for many individuals ineligible for state unemployment benefits including self-employed workers 1099 tax filers and part-time workers. Report it by calling toll-free.

Unemployment benefits are taxable pursuant to federal and Ohio law. If you DID NOT apply to receive unemployment.

1099 G Tax Form Causing Confusion For Some In Kentucky Wkyc Com

1099 G Tax Form Causing Confusion For Some In Kentucky Wkyc Com

Unemployment Fraud Reports Running Rampant In Central Ohio

Unemployment Fraud Reports Running Rampant In Central Ohio

Unemployment Fraud Reports Running Rampant In Central Ohio

Unemployment Fraud Reports Running Rampant In Central Ohio

Ohio Unemployment Help Wkyc Com

Ohio Unemployment Help Wkyc Com

Are Unemployment Insurance Benefits Taxable A Guide On Ui Taxes

Are Unemployment Insurance Benefits Taxable A Guide On Ui Taxes

1099 Workers Other Jobless Ohioans Not Previously Eligible Can Pre File For Benefits Friday The Statehouse News Bureau

1099 Workers Other Jobless Ohioans Not Previously Eligible Can Pre File For Benefits Friday The Statehouse News Bureau

Self Employed Part Time Workers Can Now Get Unemployment In Ohio Wkrc

Self Employed Part Time Workers Can Now Get Unemployment In Ohio Wkrc

Pin On 1000 Examples Online Form Templates

Pin On 1000 Examples Online Form Templates

Q A Your Most Common Unemployment Questions The Lima News

Q A Your Most Common Unemployment Questions The Lima News

File For Unemployment Last Year Documents You Need To File Taxes 10tv Com

File For Unemployment Last Year Documents You Need To File Taxes 10tv Com

How To Apply For Unemployment Benefits Online In Ohio Youtube

How To Apply For Unemployment Benefits Online In Ohio Youtube

Unemployment Fraud Chicago Man Receives Ohio Unemployment Tax Form Despite Never Living There Abc7 Chicago

Unemployment Fraud Chicago Man Receives Ohio Unemployment Tax Form Despite Never Living There Abc7 Chicago

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Https Unemployment Ohio Gov Pdf New Workers Self Service User Guide Pdf

Unemployment Benefits Are Taxable Look For A 1099 G Form Wkyc Com

Unemployment Benefits Are Taxable Look For A 1099 G Form Wkyc Com

Ohio Lawmakers Grill Unemployment Chief Over System Inefficiencies Wosu Radio

Ohio Lawmakers Grill Unemployment Chief Over System Inefficiencies Wosu Radio

Unemployment Fraud In Ohio What To Do If Somebody Steals My Info Wcnc Com

Unemployment Fraud In Ohio What To Do If Somebody Steals My Info Wcnc Com

How To File For Unemployment Benefits If You Re Self Employed Youtube

How To File For Unemployment Benefits If You Re Self Employed Youtube

Post a Comment for "Can 1099 File For Unemployment In Ohio"