Az Unemployment Tax And Wage Report

Unemployment Tax Wage Report. BE SURE TO USE THE BAR-CODED FORM.

Fillable Online Unemployment Tax And Wage Report Quarterly Tax And Wage Report Fax Email Print Pdffiller

Fillable Online Unemployment Tax And Wage Report Quarterly Tax And Wage Report Fax Email Print Pdffiller

Select Reports then choose Standard then select Payroll.

Az unemployment tax and wage report. The Quarterly Report is used to report wage and tax information. Review the UI Tax Wage Report Schedule and other important information. For example you can select the name of a tax in the report results to see the amount of tax paid per employee by social security number.

Effect on Other Tax Benefits Taxable unemployment benefits include the extra 600 per week that was provided by the federal government in response to the coronavirus pandemic accountant Chip Capelli of. All employers who are liable for unemployment insurance UI must file tax and wage reports for each quarter they are in business. 1099-G Inquiry - Report any issues regarding your 1099-G form.

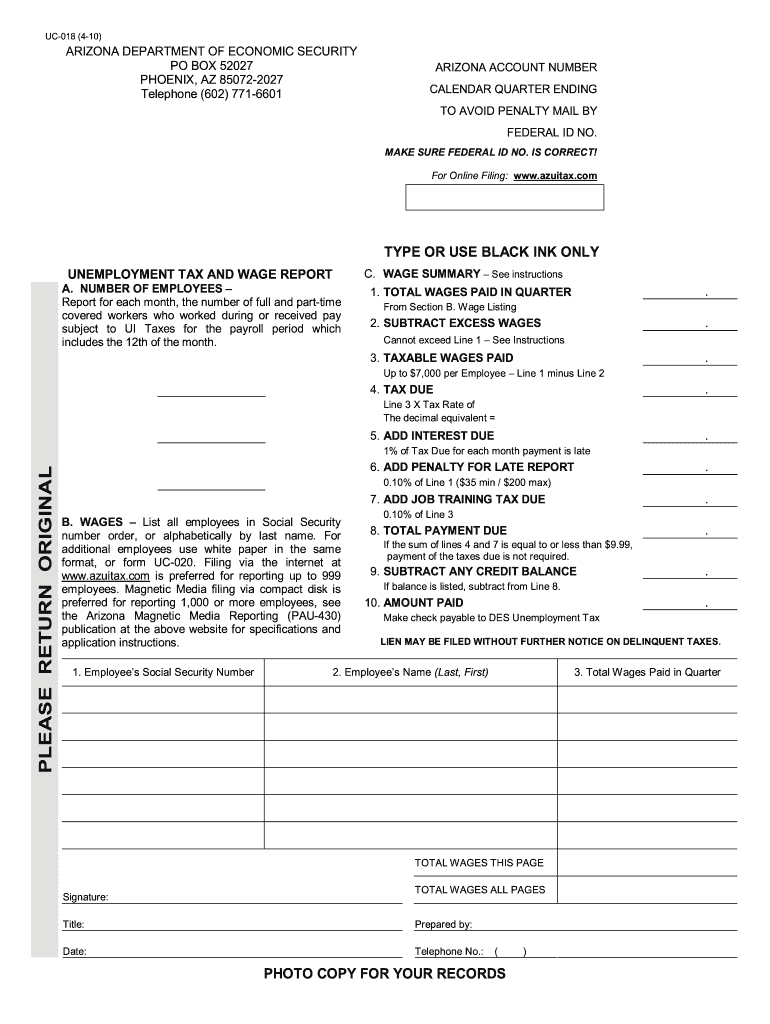

ARIZONA DEPARTMENT OF ECONOMIC SECURITY Employer Engagement Administration. To file on paper use Form UC-018 Unemployment Tax and Wage Report. Use the Internet Unemployment Tax and Wage System TWS to.

Wage Reports and Payments are timely if electronically FILED before midnight Mountain Standard Time on the quarterly due date. DES custom-generates and mails the form to each employer with an active UI tax account every quarter. Submit federal Forms W-2 and W-2c reporting Arizona wages andor Arizona income tax withheld and federal Forms W-2G and 1099 reporting Arizona income tax withheld with Arizona Form A1-APR.

The Tax Wage Summary Report gives you a snapshot of your employees taxable wages. Form UC-018 Form UC-020 Unemployment Tax and Wage Report Bar-coded Unemployment Tax and Wage Reports are mailed to liable employers to report their taxes and wages for the specific period indicated. State Income Tax Range.

Arizona taxes unemployment compensation to the same extent as it is taxed under federal law. Renters and landlords impacted by the COVID-19 pandemic in twelve Arizona counties may now apply for rent and utility assistance through the Emergency Rental Assistance Program. On January 28 2021 the Arizona Department of Economic Security DES began mailing 1099-G tax forms to claimants who received unemployment benefits in the state of Arizona in 2020.

It also shows you the taxes withheld from those wages. 259 on up to 54544 of taxable. It is important to provide the.

It also automatically knows whether your account is subject to Job Training Tax and computes it if it is. Unemployment Tax and Wage Report Bar-coded Unemployment Tax and Wage Reports are mailed to liable employers to report their taxes and wages for the specific period indicated on the report. The Unemployment Tax Account Number is an eight-digit number in the following format.

Call the Arizona Department of Economic Security at 602-771-6602. You can use TWS to file reports listing wages for 1 to 34000 employees or file zero-wage reports indicating your business had no employees and paid no wages. The bar-codes contain the Arizona Employer Account Number Calendar Quarter and the Year to be reported.

You must still report your unemployment compensation on your tax return even if you dont receive a Form 1099-G for some reason. Completing and Filing Online Tax and Wage Reports Using the Arizona Tax and Wage System TWS TWS automatically computes your Unemployment Insurance UI Tax at the rate assigned to your account for the filing period being reported. Liable employers will need to file the report online if you have 10 or more employee wage items.

If January 31 falls on a Saturday Sunday or legal holiday the return is considered timely if filed by the next business day. Monday April 1 2019. State Taxes on Unemployment Benefits.

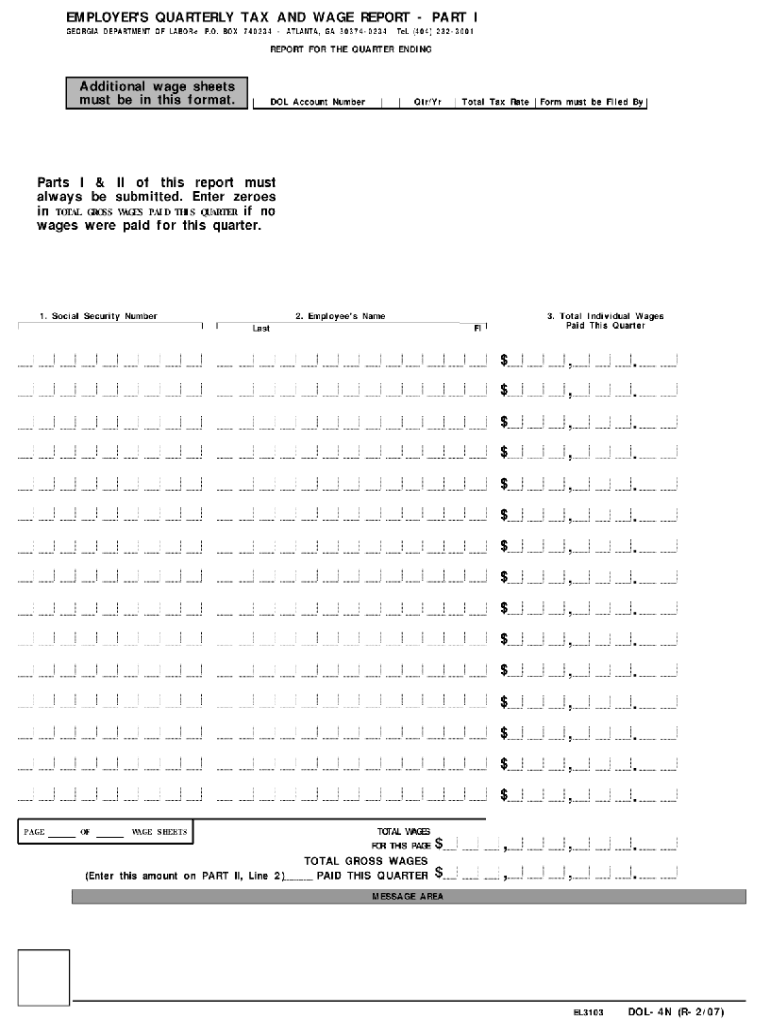

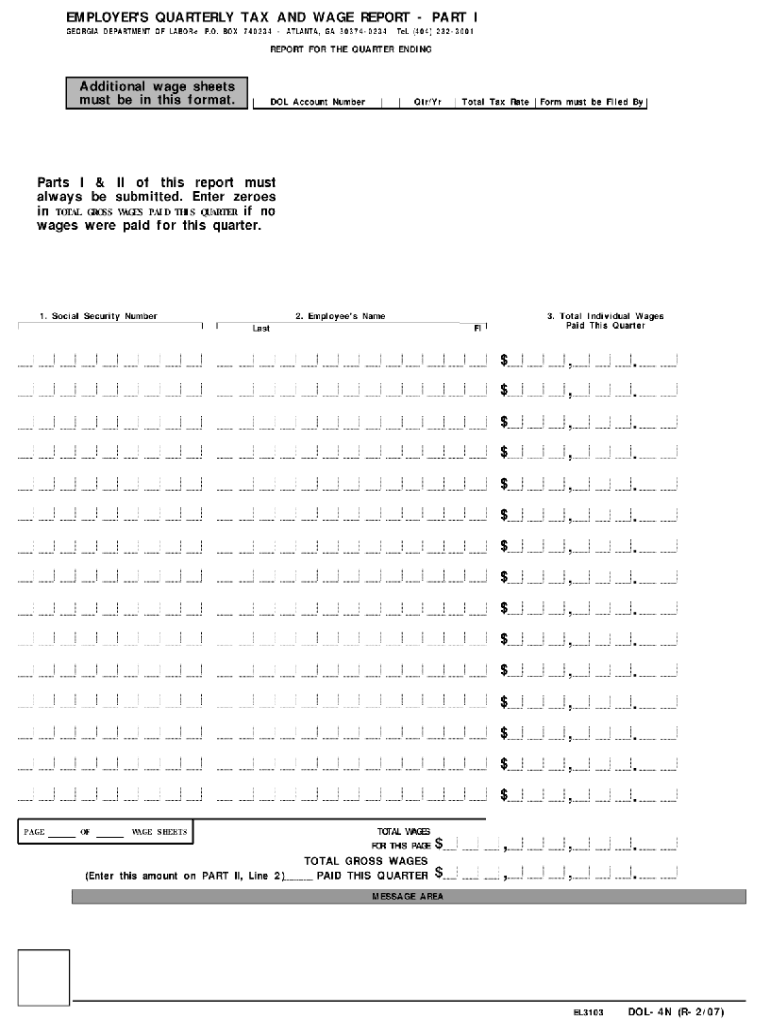

DES Services Related to COVID-19. If you need to file by paper you may download a blank Employers Quarterly Tax and Wage Report from our website or contact the Employer Call Center at 919-707-1150 to request that a blank form be mailed to you. View and print a copy of documents previously filed via the Internet.

FILE ONLINE AT WWWAZUITAXGOV. Unemployment Tax Wage Report. If youve filed state payroll tax returns in the past you can find your Unemployment Tax Account Number on any previously submitted Unemployment Tax and Wage Report UC-018.

To file online use the Arizona Unemployment Tax and Wage System TWS. The reports and any payment due must be filed on or before April 30th July 31st October 31st and January 31st if the due date falls on a weekend or a legal holiday reports are due by the next business day. In the Payroll section select Payroll Tax and Wage.

Please type or clearly print your full address of record in the area above the report title. Get Unemployment Tax And Wage Report UC-018. Form 941 Employers Quarterly Federal Tax Return provides the IRS with a report of each employers total taxable wages paid and payroll tax liability which is then reconciled with the employers record of tax deposits and wage and tax information provided to employees on their W-2 forms.

You can file your reports and payments online or on paper. File a Quarterly Wage Report. The report is a great way to find the information you need for state or local taxes.

UNEMPLOYMENT TAX AND WAGE REPORT.

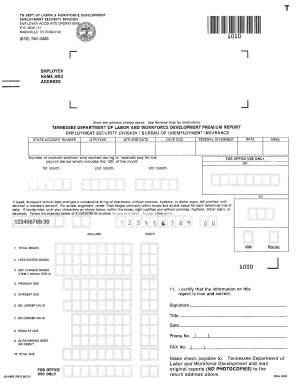

2013 2021 Form Tn Lb 0456 Fill Online Printable Fillable Blank Pdffiller

2013 2021 Form Tn Lb 0456 Fill Online Printable Fillable Blank Pdffiller

Ncui 685 Fill Online Printable Fillable Blank Pdffiller

Ncui 685 Fill Online Printable Fillable Blank Pdffiller

Https Labor Mo Gov Sites Labor Files Pubs Forms M Inf 368 Ai Pdf

Https Des Az Gov Sites Default Files Media Uit Newsleter 3rd Qtr 2019 Pdf

Georgia Dol Fill Online Printable Fillable Blank Pdffiller

Georgia Dol Fill Online Printable Fillable Blank Pdffiller

Https Labor Mo Gov Sites Labor Files Pubs Forms M Inf 368 Ai Pdf

Http Www Obspllc Com Files 2009 20des 20uc 018 Pdf

Https Des Az Gov Sites Default Files Media Employer 2520handbook 2520 28v3 29 5b1 5d Pdf

Fillable Online Uid Dli Mt Montana Employers Unemployment Insurance Ui Quarterly Wage Report Form Ui5 Quarter End Due Date Employer Identification Numbers Ui Account Number Federal Id Fein Ui Contribution Rate Ui

Fillable Online Uid Dli Mt Montana Employers Unemployment Insurance Ui Quarterly Wage Report Form Ui5 Quarter End Due Date Employer Identification Numbers Ui Account Number Federal Id Fein Ui Contribution Rate Ui

Ui 11 Fill Online Printable Fillable Blank Pdffiller

Ui 11 Fill Online Printable Fillable Blank Pdffiller

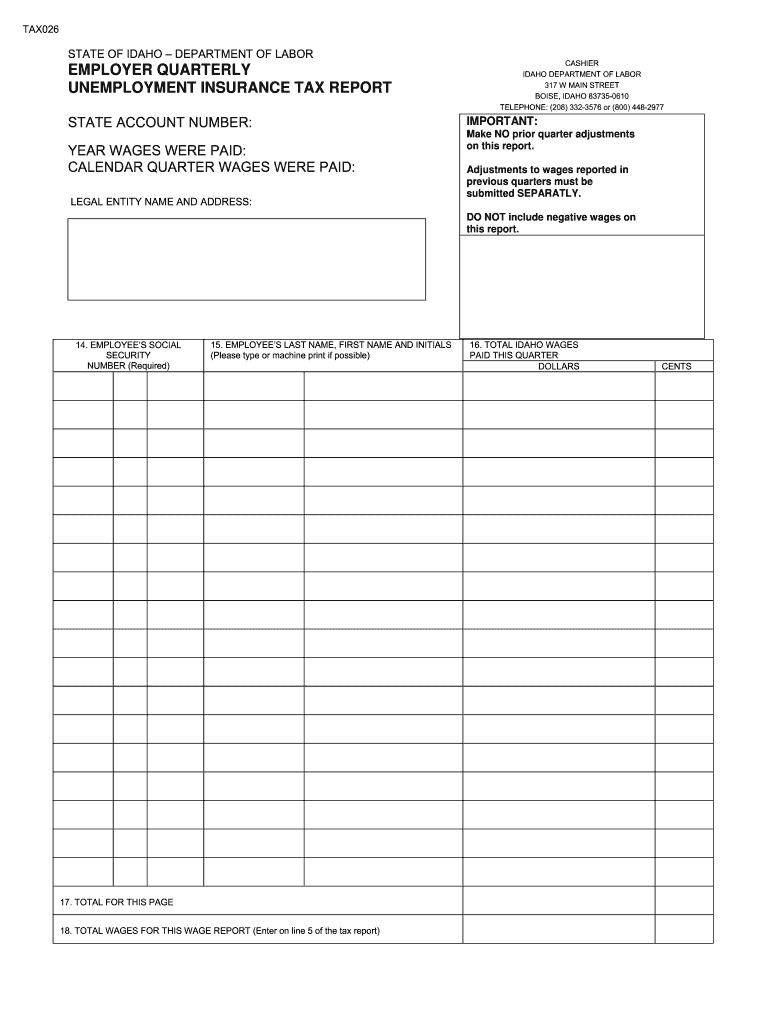

Unemployment Tax Form Fill Online Printable Fillable Blank Pdffiller

Unemployment Tax Form Fill Online Printable Fillable Blank Pdffiller

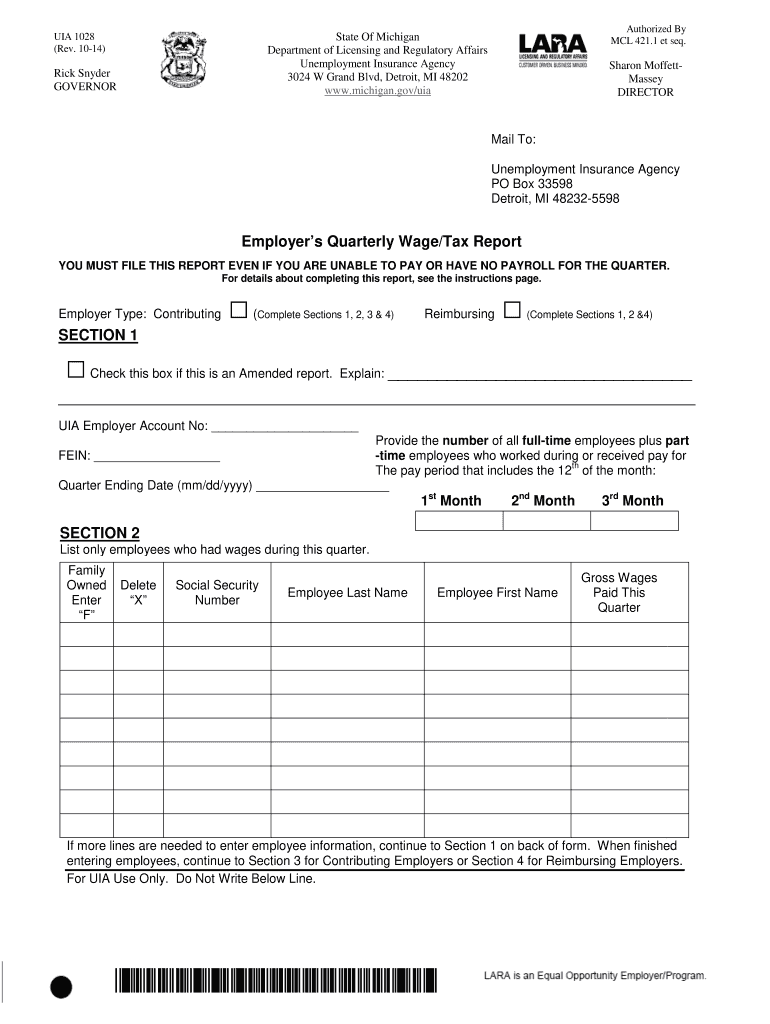

Uia 1028 Fill Online Printable Fillable Blank Pdffiller

Uia 1028 Fill Online Printable Fillable Blank Pdffiller

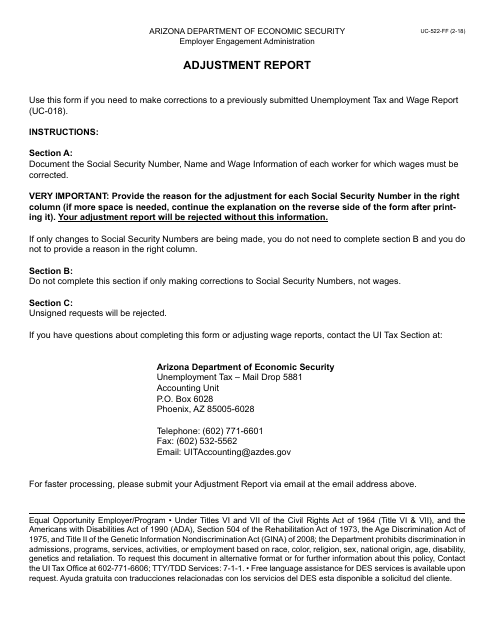

Form Uc 522 Ff Download Fillable Pdf Or Fill Online Adjustment Report Arizona Templateroller

Form Uc 522 Ff Download Fillable Pdf Or Fill Online Adjustment Report Arizona Templateroller

Nucs 4072 Fill Online Printable Fillable Blank Pdffiller

Nucs 4072 Fill Online Printable Fillable Blank Pdffiller

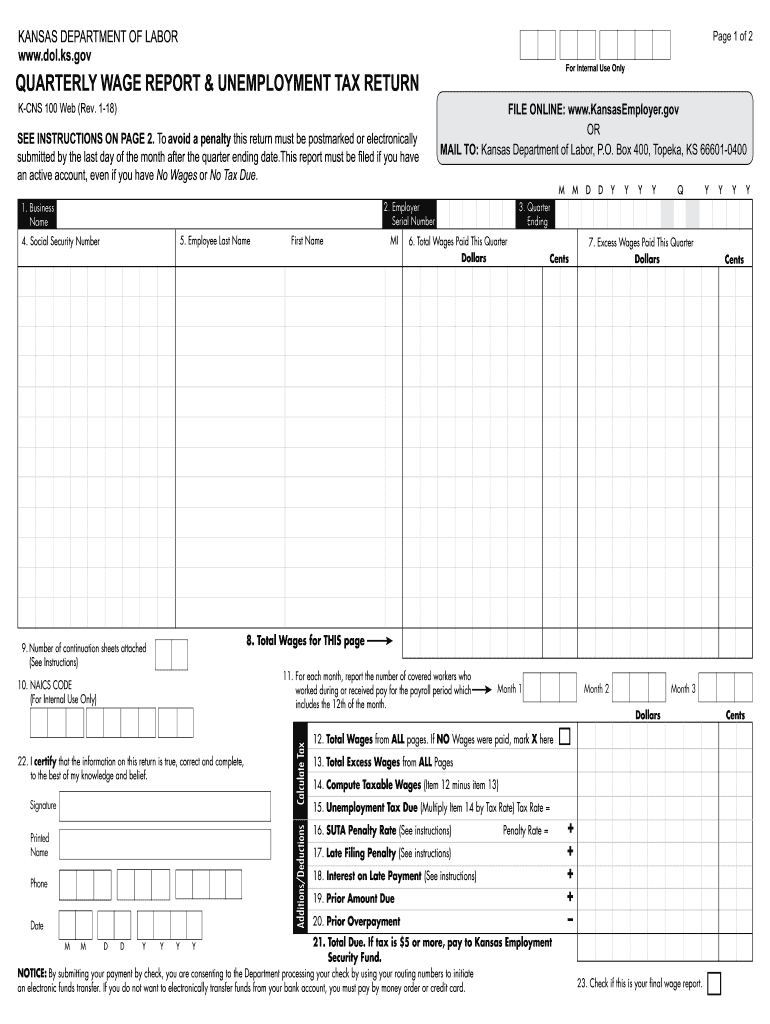

2018 2021 Form Ks K Cns 100 Fill Online Printable Fillable Blank Pdffiller

2018 2021 Form Ks K Cns 100 Fill Online Printable Fillable Blank Pdffiller

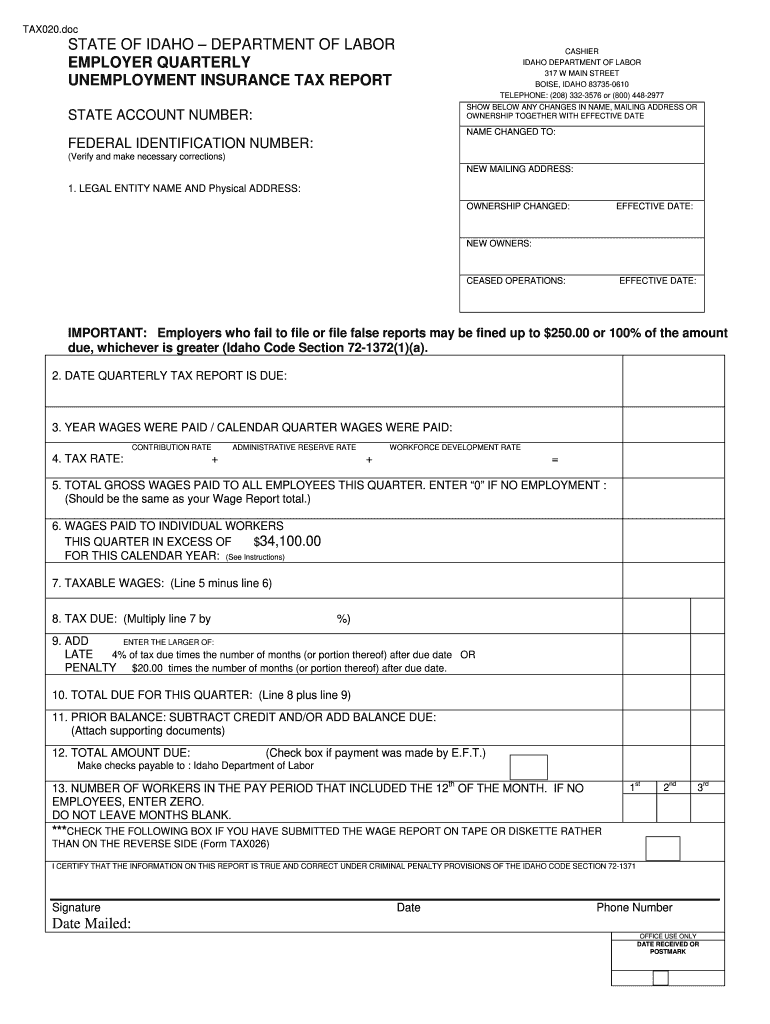

Id Dol Tax020 Fill Out Tax Template Online Us Legal Forms

Id Dol Tax020 Fill Out Tax Template Online Us Legal Forms

Nj Wr 30 Fill Out Tax Template Online Us Legal Forms

Nj Wr 30 Fill Out Tax Template Online Us Legal Forms

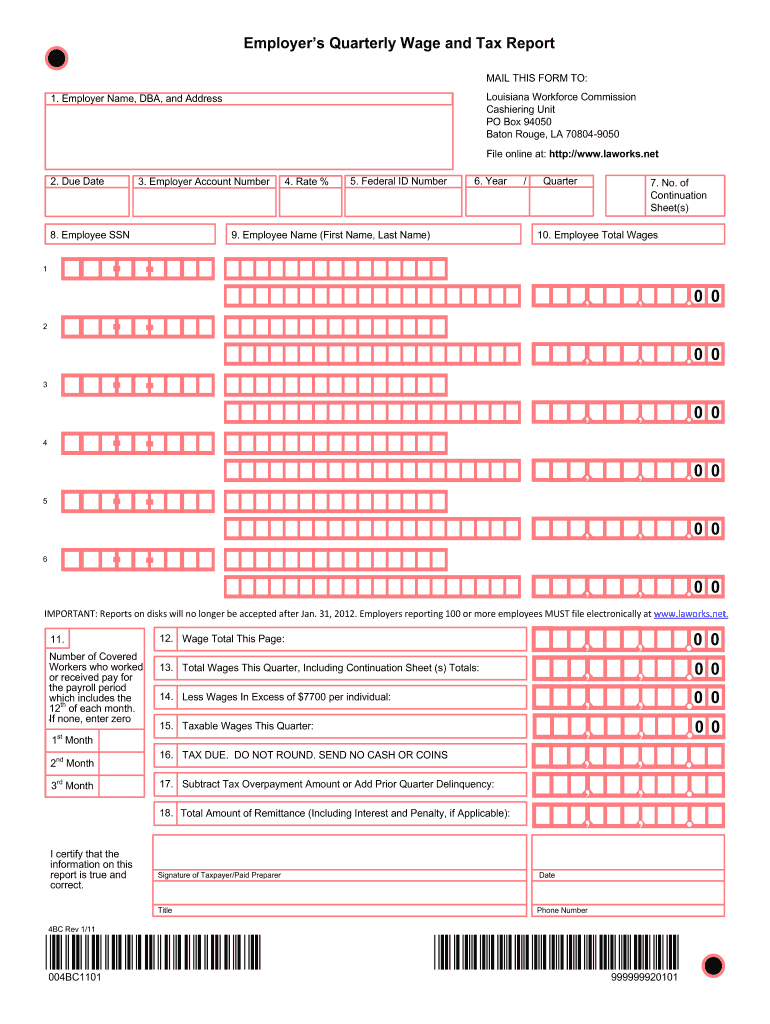

La Wage Reporting Fill Online Printable Fillable Blank Pdffiller

La Wage Reporting Fill Online Printable Fillable Blank Pdffiller

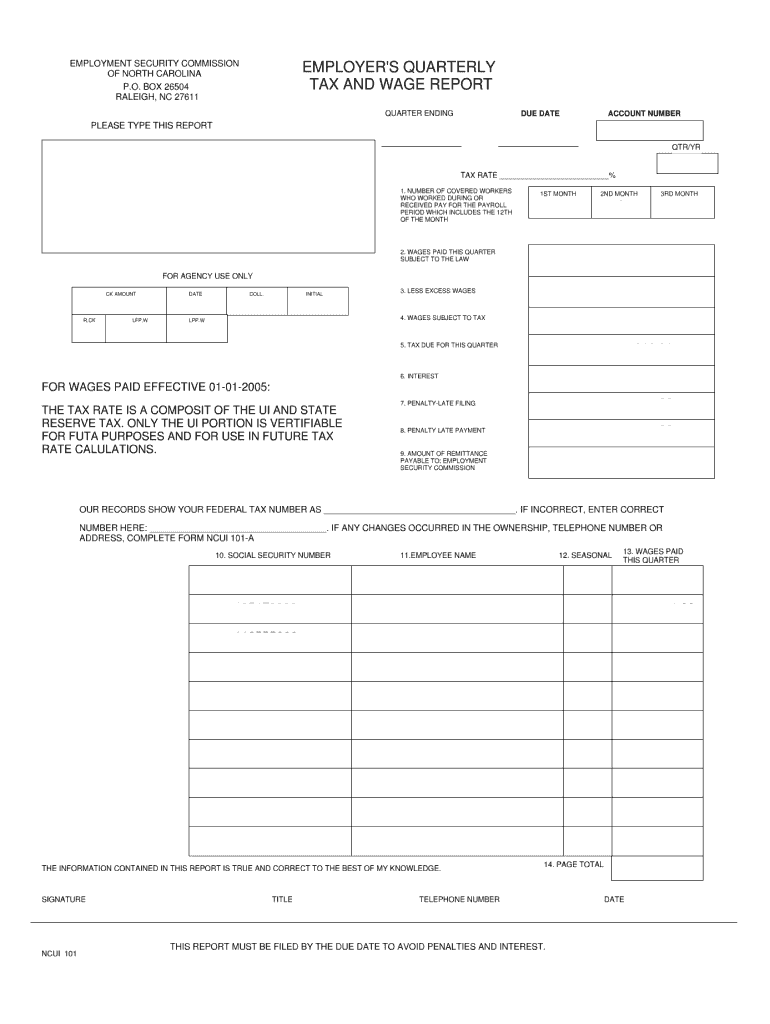

Employers Quarterly Tax And Wage Report Nc Fill Online Printable Fillable Blank Pdffiller

Employers Quarterly Tax And Wage Report Nc Fill Online Printable Fillable Blank Pdffiller

Post a Comment for "Az Unemployment Tax And Wage Report"