Arkansas Unemployment Tax Rate 2020

According to the state Department of Finance and Administration 1099 tax documents from the Department of Workforce Services show that 26 billion in unemployment benefits were paid to. Arkansas Unemployment Rate Decreases to 45 Percent in February.

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

This website is best viewed at 1024x768 or higher resolution.

Arkansas unemployment tax rate 2020. The Arkansas Workforce Services Division has begun informing employers of their new unemployment insurance tax rates. Employees who make more than 79300 will hit the highest tax bracket. To exclude the second quarter 2020 charges in determining the 2021 rates.

DFA instructions and forms have been updated to reflect the unemployment tax change. Starting in 2021 Proposition. The upper range indicates that more payments in unemployment insurance have been made from an employers account than tax has been paid in for unemployment insurance.

For information regarding changes to employers accounts regarding UI benefits and UI tax please read the Employer Newsletters. The rate of Arkansas fund-stabilization surtax which is added to employers basic tax rates is to be 002 in 2020 down from 03 in 2019 the spokeswoman told Bloomberg Tax in an email. According to the finance department 1099 tax documents from the state Department of Workforce Services show that 26 billion in unemployment benefits were paid to 281840 individuals in the 2020.

The taxable wage base for the 2020 rate year will be 7000. The 2020 new employer rate including the additional tax will be 31. Nonprofits and government employing units will be have a different time table for their tax rate calculations.

At this time New York State remains decoupled from the unemployment compensation income exclusion and an adjustment to income for New York is required. Taxable wage base 7000. Unemployment Insurance UI Wage and Tax Filing File and pay Unemployment Insurance taxes.

There are no local taxes so all of your employees will pay the same state income tax no matter where. 2021 RATE STATEMENTS ARE NOW AVAILABLE NEW. The Division of Workforce Services will look at these organizations chargeable regular benefits dating from Jan.

The 2020 tax rates range from 2 on the low end to 66 on the high end. Basic unemployment tax rates are to be unchanged for 2020 but the lower surtax rate is to decrease total tax rates assigned to employers. Click here to view 2021 Tax Alert.

Click here to view the DWS UI Employer Handbook. Unemployment is not taxable for 2020. The Arkansas Department of Workforce Services announced that the total 2020 state unemployment insurance SUI tax rates will range from 03 to 142 including a 02 stabilization tax down 01 from 2019.

Unemployment Insurance Tax Information 2020 State UI Tax Rates In addition to the experience based rates 01 14 or the new employer rate 29 the 2020 rates will include the stabilization tax of 02. This Act excludes from federal gross income a portion of the unemployment compensation received in tax year 2020 for taxpayers with adjusted gross income AGI of less than 150000. LITTLE ROCK The Senate has voted to exempt last years unemployment benefits from state income taxes to help people who lost their jobs because of the economic impact of the Covid-19 pandemic.

1 2020 through March 31 2020 but will exclude the benefits from April 1 through June 30. 45 on 327263 and over of taxable income for married joint filers and 163632 and over for single filers. A business with no previous employment record in Arkansas is taxed at 31 on the first 7000 of each employees earnings until an employment record is established usually within three years.

The rate of the Arkansas unemployment fund-stabilization surtax is to be 02 in 2020 a spokeswoman for the state Division of Workforce Services told Bloomberg Tax in an email Nov. Go to Unemployment Insurance UI Wage and Tax Filing. NameAddress Change Penalty Waiver Request and Request for Copies of Tax Return s Military Personnel and Military Spouse Information.

Arkansas unemployment insurance tax rates currently range from 01 to a maximum rate of 50 plus the stabilization rate in effect for the current year. Senate Bill 236 would apply to benefits paid in 2020 and 2021. The surtax rate which is added to employers basic unemployment tax rates is a revision from the 002 that the department reported Nov.

The unemployment rate in Arkansas had been around four percent until the coronavirus pandemic caused widespread business closures.

Connecticut Tax Forms And Instructions For 2020 Ct 1040

Connecticut Tax Forms And Instructions For 2020 Ct 1040

.jpg?sfvrsn=8ccc851f_0) Employer Tax Rates Employers Kdol

Employer Tax Rates Employers Kdol

States With Highest And Lowest Sales Tax Rates

States With Highest And Lowest Sales Tax Rates

Taxation Of Social Security Benefits Mn House Research

Taxation Of Social Security Benefits Mn House Research

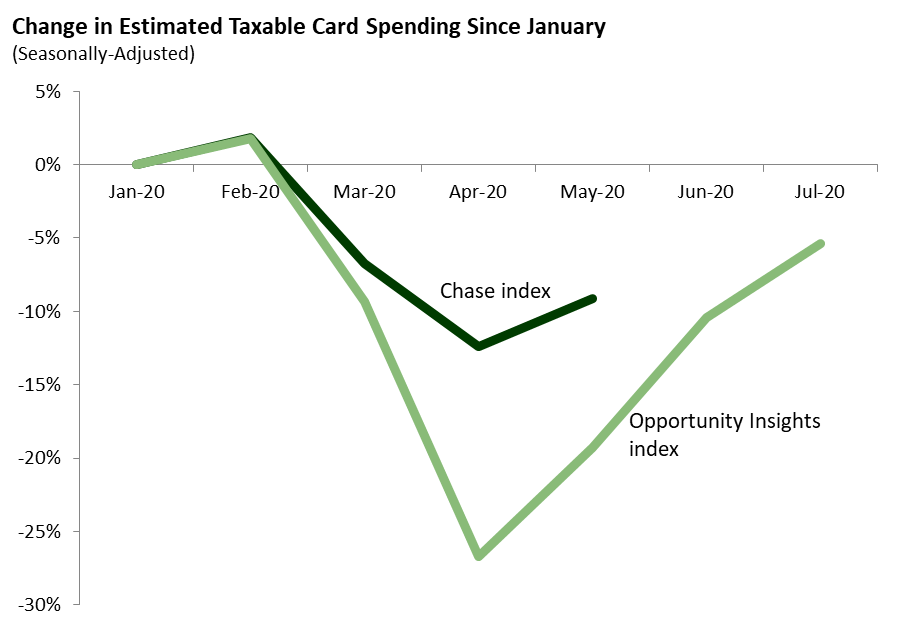

How Severely Will Covid 19 Impact Sui Tax Rates

How Severely Will Covid 19 Impact Sui Tax Rates

2021 Taxes A Comprehensive Guide To Filing Money

2021 Taxes A Comprehensive Guide To Filing Money

How Severely Will Covid 19 Impact Sui Tax Rates

How Severely Will Covid 19 Impact Sui Tax Rates

Did You Collect Unemployment Benefits In 2020 Act Now To Avoid A Tax Day Surprise Dollars And Sense Abc10 Com

Did You Collect Unemployment Benefits In 2020 Act Now To Avoid A Tax Day Surprise Dollars And Sense Abc10 Com

Taxation Of Social Security Benefits Mn House Research

Taxation Of Social Security Benefits Mn House Research

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

How Severely Will Covid 19 Impact Sui Tax Rates

How Severely Will Covid 19 Impact Sui Tax Rates

W 4 Employee S Withholding Certificate And Federal Income Tax Withholding For 2020 Sap Blogs

W 4 Employee S Withholding Certificate And Federal Income Tax Withholding For 2020 Sap Blogs

What Is Self Employment Tax And What Are The Rates For 2020 Workest

What Is Self Employment Tax And What Are The Rates For 2020 Workest

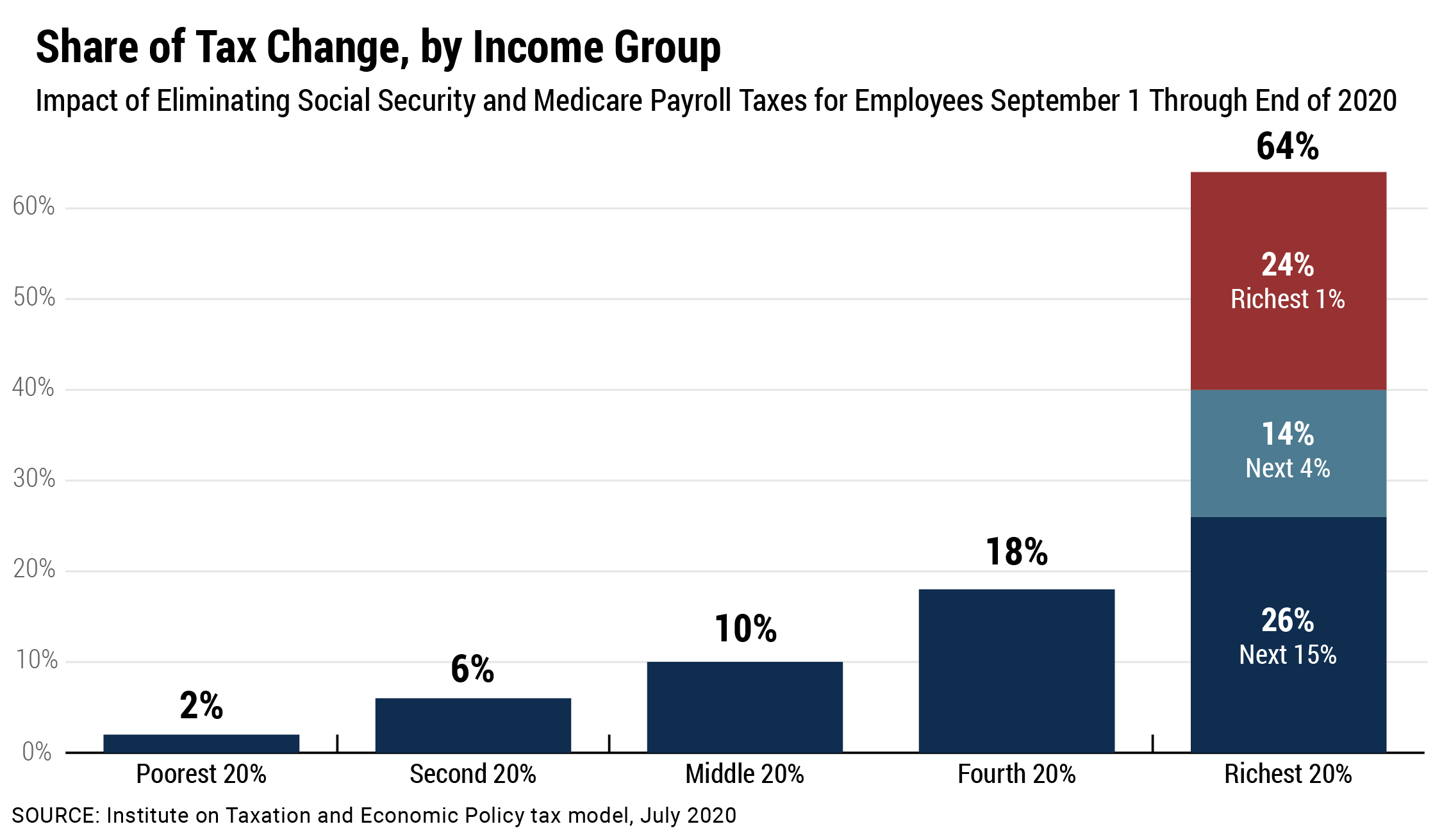

An Updated Analysis Of A Potential Payroll Tax Holiday Itep

An Updated Analysis Of A Potential Payroll Tax Holiday Itep

Why Is My Tax Return So Low 2020 Tax Year Edition Picnic S Blog

Why Is My Tax Return So Low 2020 Tax Year Edition Picnic S Blog

Post a Comment for "Arkansas Unemployment Tax Rate 2020"