What Percentage Of Unemployment Does Your Employer Pay

If you also pay unemployment insurance tax to your state your federal unemployment tax rate is 8 percent of applicable payroll as of 2011. These taxes fund your states unemployment insurance program.

How Long Can We Expect Temporary Layoffs To Remain Temporary

How Long Can We Expect Temporary Layoffs To Remain Temporary

Employers must pay federal unemployment tax on the first 7000 in wages paid to each employee in a year.

What percentage of unemployment does your employer pay. TWC will request job separation and past wage information related to individuals unemployment claims. If your state collects this tax you will need to register with your state. Do employers pay unemployment.

The amount you receive depends on your weekly earnings prior to being laid off and on the maximum amount of unemployment benefits paid to each worker. You have one or more employees working on a permanent temporary or part-time basis on 1 or more days in each of 13 weeks during a calendar year or. In most states that ranges from the first 10000 to 15000 an employee earns in a calendar year.

Typically youll receive a up to a 54 credit for paying state unemployment taxes. It is 6 on the first 7000 each employee earns in a year meaning you will pay a maximum of 420 per employee per year. Other important employer taxes not covered here include federal UI tax and state and federal withholding taxes.

The UI tax funds unemployment compensation programs for eligible employees. To find out if you as a business owner need to pay state unemployment tax contact your states employment agency. Employers pay unemployment insurance taxes and reimbursements which support unemployment benefit payments.

If employers meet one of two main requirements they must pay unemployment insurance. Employers with the maximum credit only have a rate of 06 6 54 on the first 7000 of each employees wages. The FUTA tax rate for 2021 is 6 on the first 7000 of employee wages a max of 420 per year per employee.

If your company qualifies for the maximum credit your FUTA tax rate would be decreased to 06 reducing your total. No matter what state you are located in youll need to pay set FUTA taxes which amount to 6 of the first 7000 each employee earns per calendar year. Most employers receive a tax credit of up to 54 meaning your FUTA tax rate would be 06.

The State Unemployment Tax Act SUTA tax is much more complex. An Employers Guide To Unemployment Insurance Benefits. State benefits are typically paid for a maximum of 26 weeks.

Federal Unemployment Tax Act FUTA tax is an employer-only tax. However he does not directly write your unemployment check and there is no a direct relationship between the funds in your particular claim and the tax payments he has made. Employers pay a certain tax rate usually between 1 and 8 on the taxable earnings of employees.

In North Carolina state UI tax is just one of several taxes that employers must pay. Many employers pay both federal and state unemployment taxes depending on what state you are doing business in. Different states have different rules and rates for UI taxes.

However companies can qualify for a tax credit of up to 54 based on their timely payment of state unemployment taxes. Most employers are eligible for a federal unemployment tax credit that reduces their FUTA tax rate. The FUTA tax rate is 6 of an employees wages on the first 7000 of wages subject to FUTA in a calendar year.

In this sense your employer does pay for your unemployment benefits because the money comes out of a fund that is made up in part of his unemployment tax payments. This is an employer-only tax that is 6 on the first 7000 each employee earns per calendar year which means the maximum amount youll have to pay per employee is 420 per year. Both Federal Unemployment Taxes FUTA and State Unemployment Taxes SUTA in most cases are paid for by the employer meaning this isnt a tax that comes out of employees paychecks.

Generally if you are a private for-profit employer the Massachusetts unemployment insurance law requires you to contribute to the UI Trust Fund if your business meets the following conditions. Your employer does not directly pay the unemployment benefits that you receive but he will pay a higher unemployment tax rate because you have made a claim against his account. This means the maximum youll pay per employee is 420.

Contributions to the Department of Unemployment Assistance DUA are due 30 days after the end of every quarter. Heres where it gets tricky. The largest credit you can receive is 54.

So for these businesses the rate would be as low as6. If they pay at least 1500 in wages in any quarter within a calendar year or if at least one employee worked one day per week for 20 weeks in a year. Employees do not pay unemployment taxes and employers cannot deduct unemployment taxes from employees paychecks.

In many states you will be compensated for half of your earnings up to a certain maximum. Most businesses pay both Federal Unemployment Tax Act FUTA taxes and State Unemployment Tax Act SUTA taxes. There are several ways to check if your employer is paying unemployment.

Learn about employer contributions and how they are calculated including the Employer Medical Assistance Contribution EMAC and the Workforce Training Fund Program WTFP as well as voluntary contributions and deferrals.

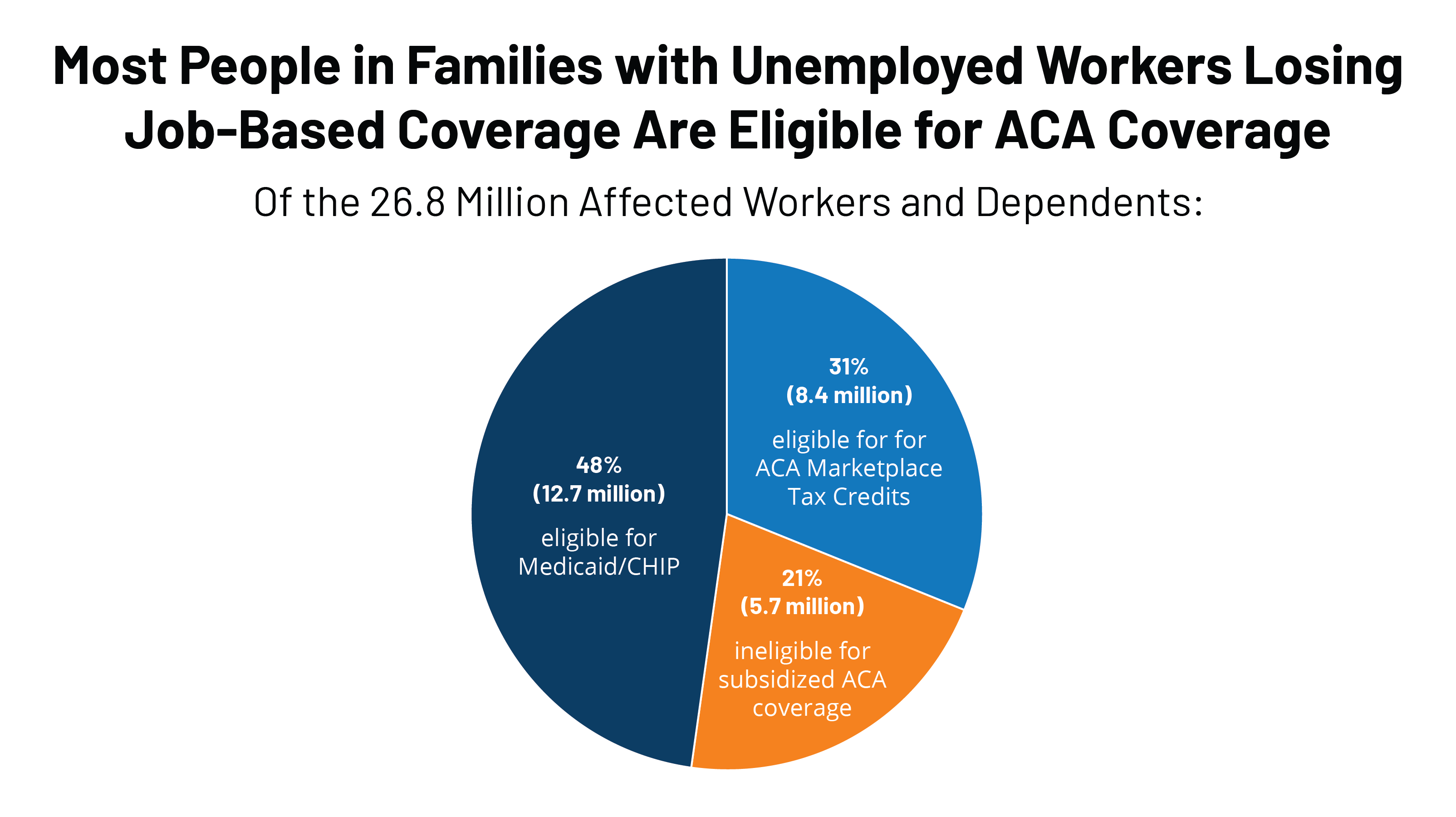

Eligibility For Aca Health Coverage Following Job Loss Kff

Eligibility For Aca Health Coverage Following Job Loss Kff

The Effect Of Covid 19 And Disease Suppression Policies On Labor Markets A Preliminary Analysis Of The Data

The Effect Of Covid 19 And Disease Suppression Policies On Labor Markets A Preliminary Analysis Of The Data

Labor Organizations And Unemployment Insurance A Virtuous Circle Supporting U S Workers Voices And Reducing Disparities In Benefits Equitable Growth

Labor Organizations And Unemployment Insurance A Virtuous Circle Supporting U S Workers Voices And Reducing Disparities In Benefits Equitable Growth

Labor Organizations And Unemployment Insurance A Virtuous Circle Supporting U S Workers Voices And Reducing Disparities In Benefits Equitable Growth

Labor Organizations And Unemployment Insurance A Virtuous Circle Supporting U S Workers Voices And Reducing Disparities In Benefits Equitable Growth

Employer Costs For Employee Compensation For The Regions December 2020 Southwest Information Office U S Bureau Of Labor Statistics

Employer Costs For Employee Compensation For The Regions December 2020 Southwest Information Office U S Bureau Of Labor Statistics

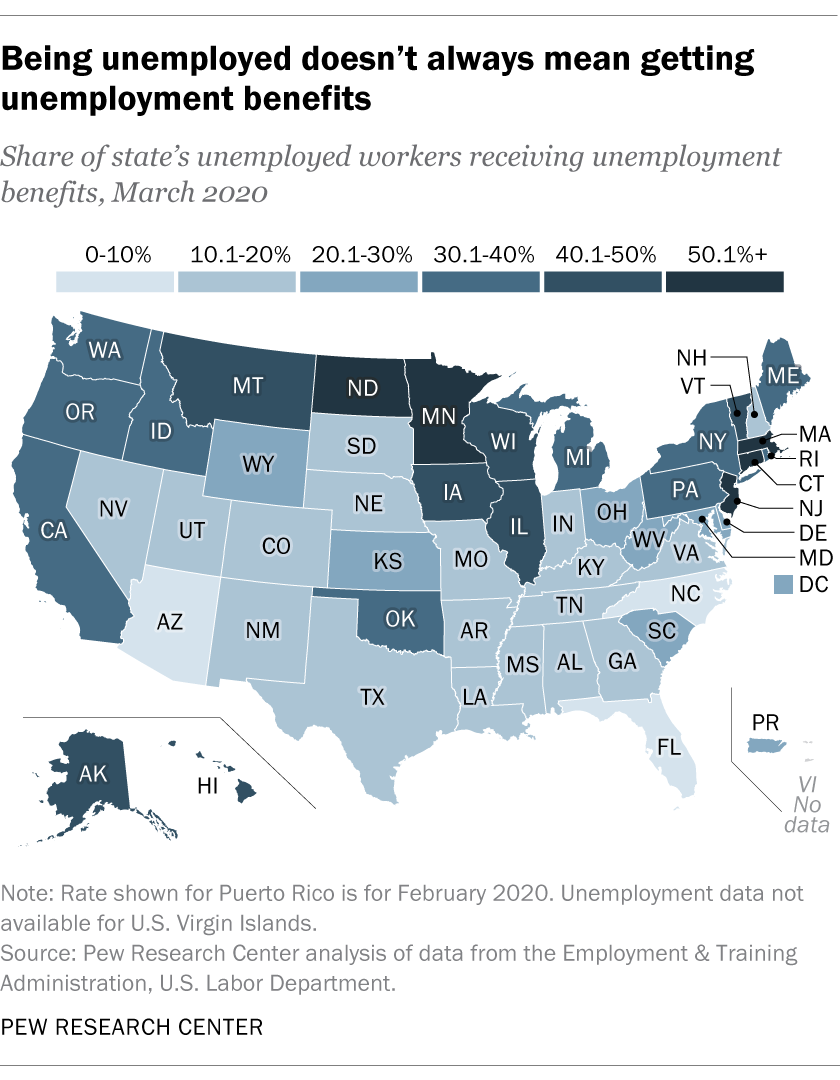

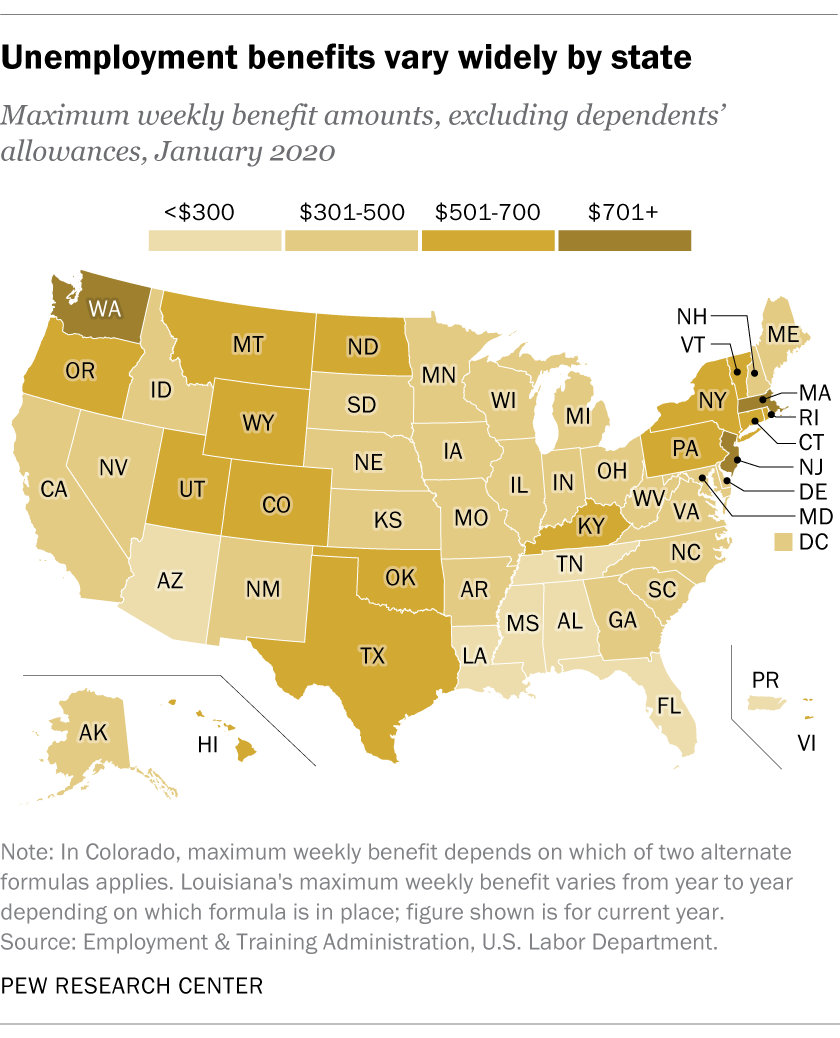

In Some States Very Few Unemployed People Get Unemployment Benefits Pew Research Center

In Some States Very Few Unemployed People Get Unemployment Benefits Pew Research Center

Official Jobless Figures Will Miss The Economic Pain Of The Pandemic

Official Jobless Figures Will Miss The Economic Pain Of The Pandemic

/UnemploymentandGDP2008-80ffa8c6bee640208888f8cc26cb38e2.jpg) Unemployment And Recession What S The Relation

Unemployment And Recession What S The Relation

The Downside Of Low Unemployment

How Inflation And Unemployment Are Related

Esdwagov Calculate Your Benefit

Esdwagov Calculate Your Benefit

In Some States Very Few Unemployed People Get Unemployment Benefits Pew Research Center

In Some States Very Few Unemployed People Get Unemployment Benefits Pew Research Center

Labor And Economic Opportunity Can A Person Work Part Time And Still Collect Ui Benefits

Labor And Economic Opportunity Can A Person Work Part Time And Still Collect Ui Benefits

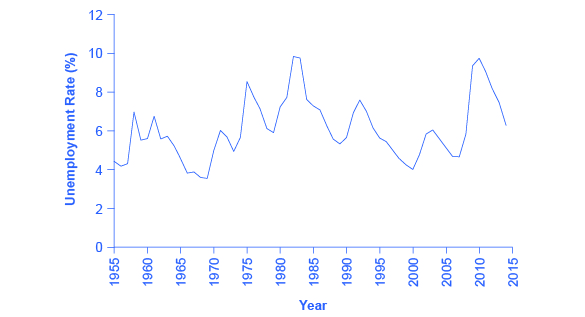

21 2 Patterns Of Unemployment Principles Of Economics

21 2 Patterns Of Unemployment Principles Of Economics

The Post Recession Labor Market An Incomplete Recovery Institute For Research On Labor And Employment

Labor Organizations And Unemployment Insurance A Virtuous Circle Supporting U S Workers Voices And Reducing Disparities In Benefits Equitable Growth

Labor Organizations And Unemployment Insurance A Virtuous Circle Supporting U S Workers Voices And Reducing Disparities In Benefits Equitable Growth

Enhanced Unemployment Benefits During The Coronavirus Crisis Smartasset

Enhanced Unemployment Benefits During The Coronavirus Crisis Smartasset

Official Jobless Figures Will Miss The Economic Pain Of The Pandemic

Official Jobless Figures Will Miss The Economic Pain Of The Pandemic

Uk Unemployment Rate 2021 By Age Group Statista

Uk Unemployment Rate 2021 By Age Group Statista

Post a Comment for "What Percentage Of Unemployment Does Your Employer Pay"