What Is A Base Year For Unemployment In Washington State

You cant pick and choose which time periods you want to use to qualify. For the purposes of establishing a benefit year the department shall initially use the first four of the last five completed calendar quarters as the base year.

Https Esdorchardstorage Blob Core Windows Net Esdwa Default Esdwagov Unemployment Webinar Introductiontounemployment Pdf

With respect to benefit year commencing on or after July 11995 if an individual does not have sufficient qualifying weeks or wages in his base year to qualify for benefits the individual shall have the option of designating that his base year shall be the alternative base year which means the last four.

What is a base year for unemployment in washington state. For example if you filed your claim in October of 2019 the base period would be from June 1 2018 through May 31 2019. You must have worked at least 680 hours in your base year. What is a base year.

Find more on eligibility criteria for unemployment benefits at esdwagovunemployment basic-eligibility-requirements. In Washington the maximum weekly benefit amount is 790 and the minimum is 188. For example Washingtons taxable wage base is 56500 for 2021.

Notice to base year employer When a former employee who worked for you in his or her base year files an unemployment-insurance claim you will receive a Benefit Charging Notice. You may qualify for benefits if you worked at least 20 base weeks for claims filed in 2020 these are weeks during which you earned at least 200 or earned at least 10000 in any one-year period over the last 18 months. Typically the base period or base year is the period of employment before losing the job.

Your base year is the first four of the last five completed calendar quarters before the week in which you file your claim. However when there are extenuating circumstances that affect the economy and result in the. You can calculate your estimated benefits here.

For example if you applied for unemployment benefits on January 20 2020 your base year would include wages earned from October 1 2018 through September 30 2019. Whether you worked enough hours in your base year. The base year is the first four of the last five calendar quarters.

The Washington unemployment department also referred to as ESD is your go-to resource when filing unemployment insurance claims in Washington. If you file your unemployment claim in January through March your base period is January through September of the previous year as well as October through December of the year prior to that. In Washington as in most states the base period is the earliest four of the five complete calendar quarters before you filed your benefits claim.

A base year consists of the first four of the last five completed quarters prior to the date the individual applied for benefits. Your base year is October 1 2018 through September 30 2019. An applicants earnings during this four-quarter period helps determine the maximum amount of unemployment benefit the individual can receive.

A specified period of 12 consecutive months or in some states 52 weeks preceding the beginning of a benefit year during which an individual must have the. Most states set a higher taxable wage base for SUTA than the 7000 FUTA tax wage base. How long can people collect unemployment benefits in Washington state.

The four fiscal years preceding the computation date July 1 of each year. During normal economic times an individual may collect regular unemployment benefits for up to 26 weeks. To determine if you are eligible for unemployment benefits we examine.

Washington State requires that you meet eligibility requirements including 680 or more labor hours then calculates the alternate base year by. In the majority of the states the base period is 12 months consisting of the first four of the last five quarters of the calendar year before filing the claim. If a benefit year is not established using the first four of the last five calendar quarters as the base year the department shall use the last four completed calendar quarters as the base year.

For claims filed April through June the base period is. These benefits which are not based on financial need are funded via taxes paid by your previous employer and are designed to stand in for wages to help cover your cost of living while you search for. Note A calendar year is divided into four quarters known as the calendar quarters.

If you worked part time in the last 18 months you must meet the minimum requirement of having worked 680 hours in your base year in order to have an unemployment. At least some wages must have been earned in Washington unless you recently left the military and are currently located in Washington state. You must pay your states unemployment tax rate on each employees wages until they earn above the wage base.

If you file your claim in April May or June 2020 your base year is January 1 2019 through December 31 2019. The amount of benefits you receive depends on your earnings in your reported base year. If you think you are eligible use this checklist.

Read the notice carefully to determine if the information is correct and whether you.

Esdwagov Calculate Your Benefit

Esdwagov Calculate Your Benefit

In Order To Find The Most Livable Cities In America We Looked At Data On Six Metrics We Looked At Unemployment Rates Incom Jersey City City Real Estate News

In Order To Find The Most Livable Cities In America We Looked At Data On Six Metrics We Looked At Unemployment Rates Incom Jersey City City Real Estate News

Get Away From Growth Delusion Right To Education Business Pages Delusional

Get Away From Growth Delusion Right To Education Business Pages Delusional

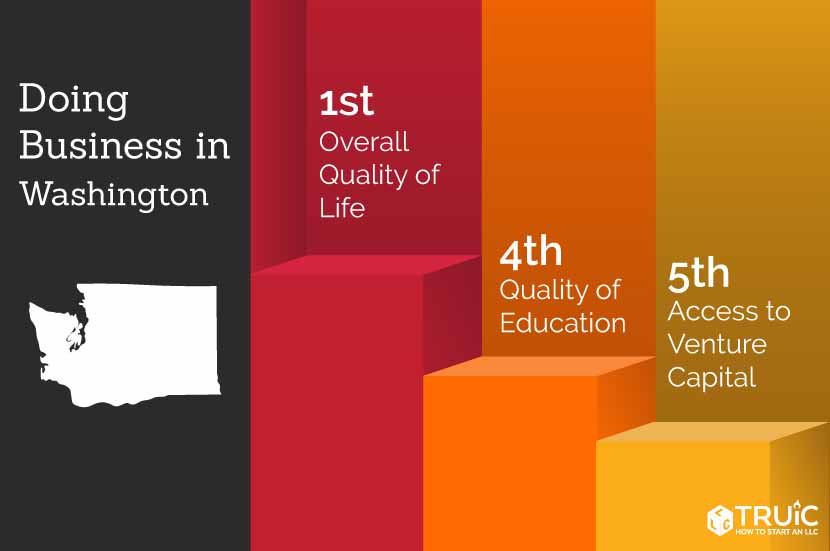

How To Start A Business In Washington A Truic Small Business Guide

How To Start A Business In Washington A Truic Small Business Guide

Daily Update September 24 2020 In 2020 Dow Jones Index Global Economy Mining Company

Daily Update September 24 2020 In 2020 Dow Jones Index Global Economy Mining Company

Esdwagov Calculate Your Benefit

Esdwagov Calculate Your Benefit

Washington State S Total Unemployment Claims Climb To Nearly 600 000 As Coronavirus Pushes Nationwide Tally Toward Depression Territory The Seattle Times

Washington State S Total Unemployment Claims Climb To Nearly 600 000 As Coronavirus Pushes Nationwide Tally Toward Depression Territory The Seattle Times

Exponential Curves Feel Gradual And Then Sudden Quot How Did You Go Bankrupt Quot Quot Two Ways Gradually Recruitment Software Pc For Sale Mobile Data

Exponential Curves Feel Gradual And Then Sudden Quot How Did You Go Bankrupt Quot Quot Two Ways Gradually Recruitment Software Pc For Sale Mobile Data

U S Air Force Major Bases And Installations Air Force Air Force Reserve Air Force Bases

U S Air Force Major Bases And Installations Air Force Air Force Reserve Air Force Bases

Brain Hub Cities Attract Jobs Job Great Place To Work City

Brain Hub Cities Attract Jobs Job Great Place To Work City

Esdwagov Calculate Your Benefit

Esdwagov Calculate Your Benefit

Esdwagov Calculate Your Benefit

Esdwagov Calculate Your Benefit

Uncle Sam S Teaser Rate Budgeting Interest Rates Debt

Uncle Sam S Teaser Rate Budgeting Interest Rates Debt

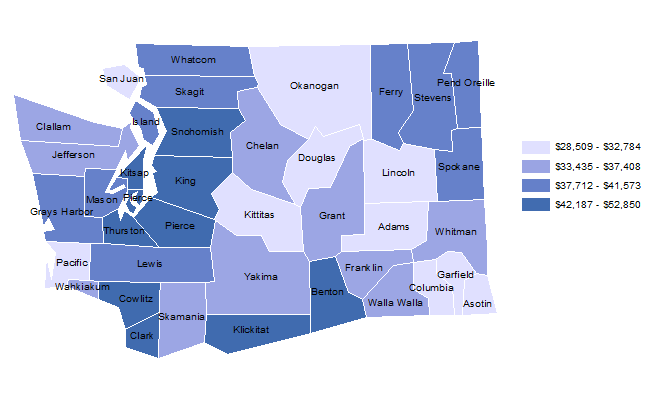

Average Wages By County Map Office Of Financial Management

Average Wages By County Map Office Of Financial Management

Esdwagov Calculate Your Benefit

Esdwagov Calculate Your Benefit

Pin By Usar P3o On Job Fairs And Ongoing Opportunities Job Fair Job Opportunities Job

Pin By Usar P3o On Job Fairs And Ongoing Opportunities Job Fair Job Opportunities Job

The Economy Of Morocco Is Considered A Relatively Liberal Economy Governed By The Law Of Supply And Demand Morocco Is Ranked 7t Aluminum Can Morocco Aluminium

The Economy Of Morocco Is Considered A Relatively Liberal Economy Governed By The Law Of Supply And Demand Morocco Is Ranked 7t Aluminum Can Morocco Aluminium

Fool Me Once Investing In Unemployment Insurance Systems To Avoid The Mistakes Of The Great Recession During Covid 19 Equitable Growth

Fool Me Once Investing In Unemployment Insurance Systems To Avoid The Mistakes Of The Great Recession During Covid 19 Equitable Growth

Esdwagov Calculate Your Benefit

Esdwagov Calculate Your Benefit

Post a Comment for "What Is A Base Year For Unemployment In Washington State"