What Are The Rules For Partial Unemployment

The CARES Act specifies that PUA benefits cannot be paid for weeks of unemployment ending after December 31 2020. The employer must complete a Notice of Reduced Earnings form and the employee must fill out part of the form.

Who Cares Unemployment Benefits For Reduced Hours And Furloughed Employees Steptoe Johnson Llp

Who Cares Unemployment Benefits For Reduced Hours And Furloughed Employees Steptoe Johnson Llp

This includes tips commissions bonuses show-up time military reserve pay board and lodging.

What are the rules for partial unemployment. For example if your company cut the hours of everyone in. Your WBR and your PBC are added together and then. Under the new rules claimants can work up to 7 days per week without losing full unemployment benefits for that week if they work 30 hours or fewer and earn 504 or less in gross pay excluding earnings from self-employment.

Benefit payments under PUA are retroactive for weeks of unemployment partial employment or inability to work due to COVID-19 reasons starting on or after January 27 2020. Some like Indiana and Wisconsin offer a partial tax break on benefits. You must be able and available for work each week.

Payment amount is determined using your partial benefit credit PBC which is 30 of your weekly benefit rate WBR. These are the same. During any week you earn less than your weekly benefit amount because of a lack of work your employer is required to give you a Statement of Partial Unemployment Form VEC-B.

You must report all wages earned each week even if you wont be paid until later. The law waives federal income taxes on up to 10200 in unemployment insurance benefits for people who earn under 150000 a year potentially. Department of Labor there are two main criteria that must be met in order to qualify.

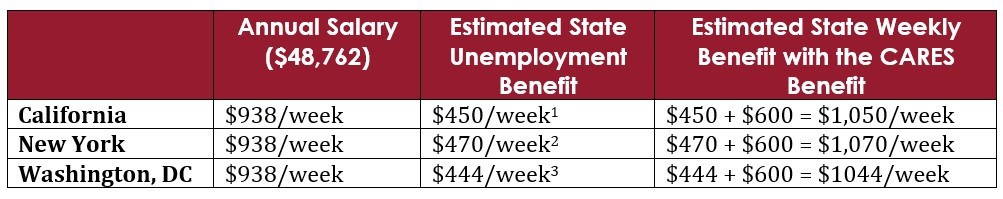

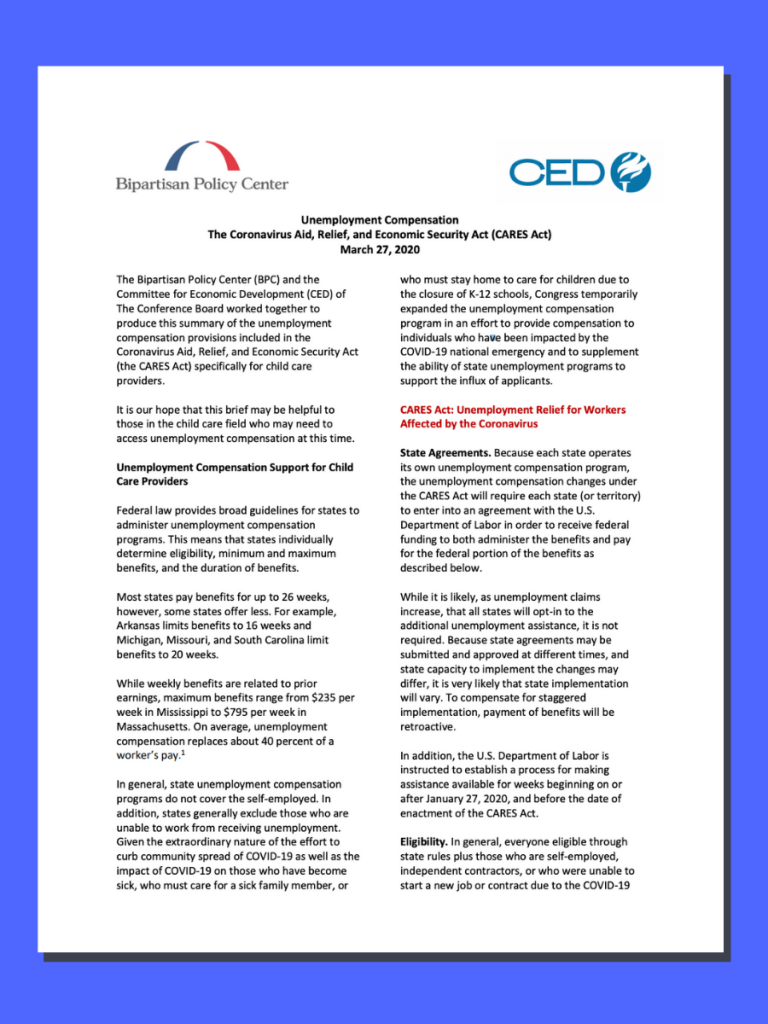

File Partial Unemployment Insurance Claims Partial unemployment insurance claims may be filed by employers for full-time employees who work less than full-time during a pay period due to lack of work only. FPUC is a flat amount given to people who received unemployment insurance including those with a partial unemployment benefit check. Eligibility for Partial Unemployment Benefits.

To be eligible for Pandemic Unemployment Assistance PUA you must provide self-certification that you are able to work and available for work and that you are unemployed partially employed or. NYS DOLs new partial unemployment system uses an hours-based approach. Theres been a recent change in the partial benefits system.

Others specifically exclude unemployment income from state tax. You must be unemployed through no fault of your own. 51 rows For each 1 earned WBA reduced by 50 cents benefits and earnings cannot exceed 15 WBA.

If you are on temporary layoff or work reduction you may be eligible for benefits under Californias partial benefit program. The employees must still be attached to the employer and must have earned wages that do not exceed the weekly benefit amount plus 5000. If your hours were reduced you may also be eligible for partial unemployment benefits.

Prior to that day weekly benefits were calculated based on the number of days you work. 18 announcement by Gov. Part-time workers can now base their unemployment claims on the hours they work in a week and not the days according to a Jan.

The original amount of 600 was reduced to 300 per week after. Work less than 32 hours per week Earnings less than your weekly benefit amount 50 percent of your earnings will be deducted from benefit amount. You may work part-time and possibly receive an unemployment benefit for the week.

Eligibility requirements to qualify for unemployment compensation vary from state to state. This program is for employees whose employers want to retain them despite a current lack of work. You meet your states minimum earnings or minimum hours worked requirements.

However according to the US. For every week of partial UI benefits claimed total weeks of benefits payable are reduced by one full week. You are underemployed meaning that you are working part time through no fault of your own.

Georgia Dol Implements Two Emergency Rules Affecting Partial Unemployment Claims Ogletree Deakins

Georgia Dol Implements Two Emergency Rules Affecting Partial Unemployment Claims Ogletree Deakins

Rules Roundup Supplemental Unemployment Benefits And Their Impact On Public Assistance Programs Making Justice Real

Rules Roundup Supplemental Unemployment Benefits And Their Impact On Public Assistance Programs Making Justice Real

New York Ny Dol Unemployment Insurance Compensation Enhanced Benefits Pua Peuc And 300 Fpuc Payment Eligibility And September 2021 Stimulus Funded Extension Aving To Invest

New York Ny Dol Unemployment Insurance Compensation Enhanced Benefits Pua Peuc And 300 Fpuc Payment Eligibility And September 2021 Stimulus Funded Extension Aving To Invest

Eligibility For Unemployment Benefits Missouri Labor

Eligibility For Unemployment Benefits Missouri Labor

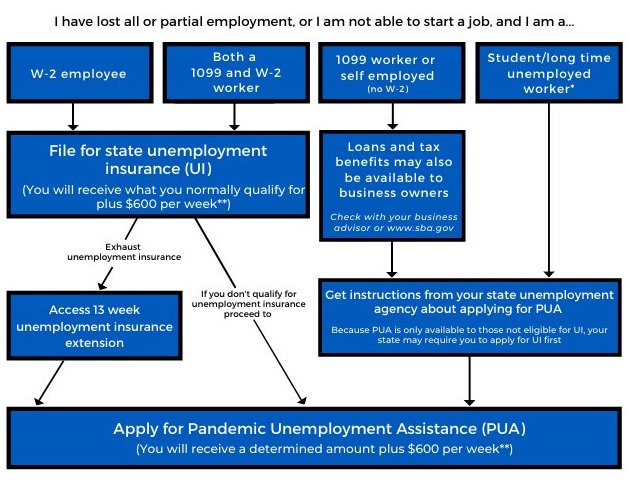

Understanding New Unemployment Benefits Included In The Cares Act Passed By Congress First Five Years Fund

Understanding New Unemployment Benefits Included In The Cares Act Passed By Congress First Five Years Fund

Unemployed Worker Benefits Pine Tree Legal Assistance

Unemployed Worker Benefits Pine Tree Legal Assistance

Who Cares Unemployment Benefits For Reduced Hours And Furloughed Employees Steptoe Johnson Llp

Who Cares Unemployment Benefits For Reduced Hours And Furloughed Employees Steptoe Johnson Llp

Partial Unemployment Benefits For Hour And Pay Cuts

Partial Unemployment Benefits For Hour And Pay Cuts

![]() Employer S Guide To The Coronavirus

Employer S Guide To The Coronavirus

Total And Partial Unemployment Tpu 460 55 Pension Or Retirement Pay

Total And Partial Unemployment Tpu 460 55 Pension Or Retirement Pay

Labor And Economic Opportunity Can A Person Work Part Time And Still Collect Ui Benefits

Labor And Economic Opportunity Can A Person Work Part Time And Still Collect Ui Benefits

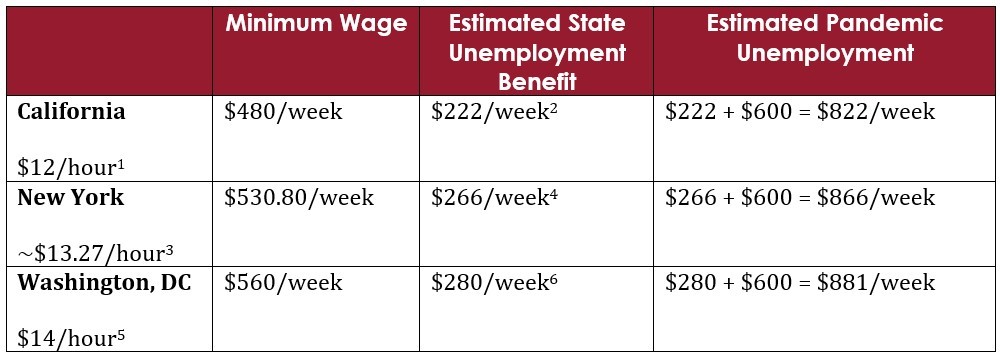

Enhanced Unemployment Benefits During The Coronavirus Crisis Smartasset

Enhanced Unemployment Benefits During The Coronavirus Crisis Smartasset

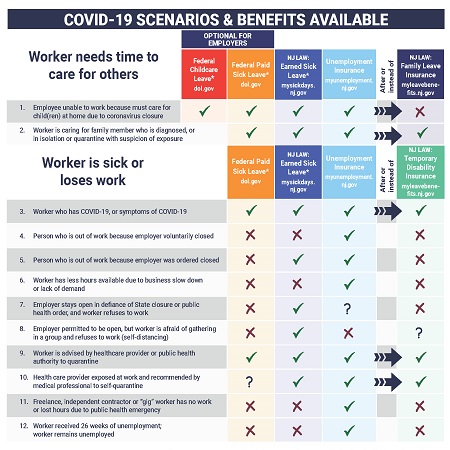

Division Of Unemployment Insurance Nj Workers Frequently Asked Questions During The Coronavirus Emergency

Division Of Unemployment Insurance Nj Workers Frequently Asked Questions During The Coronavirus Emergency

Covid 19 Unemployment Benefits Hamilton Ryker

Covid 19 Unemployment Benefits Hamilton Ryker

Who Cares Unemployment Benefits For Reduced Hours And Furloughed Employees Steptoe Johnson Llp

Who Cares Unemployment Benefits For Reduced Hours And Furloughed Employees Steptoe Johnson Llp

Covid 19 Unemployment Benefits Unemployment Law Project

Covid 19 Unemployment Benefits Unemployment Law Project

Covid 19 Resources American Federation Of Musicians

Covid 19 Resources American Federation Of Musicians

What Are Partial Unemployment Benefits Bench Accounting

What Are Partial Unemployment Benefits Bench Accounting

Post a Comment for "What Are The Rules For Partial Unemployment"