Unemployment Tax Refund Offset

Penney list Get answers Free gardening kits COVID vaccine perk. It will also give the agencys contact information.

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

What Kind of Bills Can Be Offset.

Unemployment tax refund offset. The notice will identify the agency or creditor that will receive your refund instead. Tax refund offsets are authorized reductions to tax refunds youd otherwise be entitled to but which are not paid to you because you owe certain debts. Unemployment benefits are tax-free up to 10200.

Here are the details so far. Your tax refund may have been offset by the Treasury Offset Program. Fortunately the unemployment tax nightmare that left many with reduced refunds or an unexpected tax.

The notice will list the original refund and offset amount. However a recent law change allows some recipients to not pay tax on some 2020 unemployment compensation. For filing tax reports or tax and wage reports online.

It will also include the agency that received the offset payment. For paying unemployment taxes. To use EAMS or EAMS for Single Filers you will need to be sure to set up your online account in advance.

Certain unemployment compensation debts owed to a state. A 10200 tax exemption was added into the details of. Any portion of your remaining refund after offset is issued in a check or direct deposited as originally requested on the return.

6402 to authorize tax refund offset to collect an additional type of unemployment insurance compensation debts owed to the states that were incurred as a result of fraud and that were not outstanding for more than ten years. The BFS will mail you a notice if it offsets any part of your refund to pay your debt. You may use either EAMS or ePay to pay your taxes.

Use Employer Account Management Services EAMS or EAMS for Single Filers to file your tax reports or tax and wage reports online. 1 day agoThe IRS will automatically refund filers who are entitled to an unemployment tax break but that money wont come for a while. Up to 100 percent of your tax refund can be taken and you can still be subject to an offset even if your wages are being garnished as well.

12 hours agoAmericans who collected unemployment insurance in 2020 and filed their taxes before claiming a new tax break on the benefits can expect to receive an automatic refund. On September 30 2008 the President signed the SSI Extension for Elderly and Disabled Refugees Act Public Law 110-328 which amended 26 USC. It will tell you how much of a refund you would otherwise have received as well as the amount of the debt.

The notice will reflect the original refund amount your offset amount the agency receiving the. Bird served as a paralegal on. If your debt meets submission criteria for offset BFS will reduce your refund as needed to pay off the debt you owe to the agency.

COVID Tax Tip 2021-46 April 8 2021 Normally any unemployment compensation someone receives is taxable. Funds can be taken without your permission but you will receive information regarding the amount and date of your offset. Someone who received 10200 or more in unemployment benefits and is in the 10 tax bracket could save 1200 on federal income taxes assuming.

2 days agoExpecting another refund after the IRS calculates the 10200 unemployment tax break. Unemployment benefits caused a great deal of confusion this tax season. Beverly Bird a paralegal with over two decades of experience has been the tax expert for The Balance since 2015 crafting digestible personal finance legal and tax content for readers.

Fortunately the unemployment tax nightmare that left many with reduced refunds or an unexpected tax. You might want to do more than just wait Last Updated. Some who receive unemployment could expect a second refund check in May.

BFS will send you a notice if an offset occurs. The Internal Revenue Service will automatically issue tax refunds next month to Americans who already filed their returns but are eligible to take advantage of a new break on unemployment benefits. Not every late bill is potentially subject to a tax refund offset.

You should receive a Notice of Intent to Offset letting you know that you wont be receiving some or all of your tax refund this year. The IRS will automatically refund money to eligible people who filed their tax return reporting unemployment compensation before the recent changes made by the American. 1 day agoUnemployment benefits caused a great deal of confusion this tax season.

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Esdwagov For Taxable Employers Offsetting Benefit Charges

Esdwagov For Taxable Employers Offsetting Benefit Charges

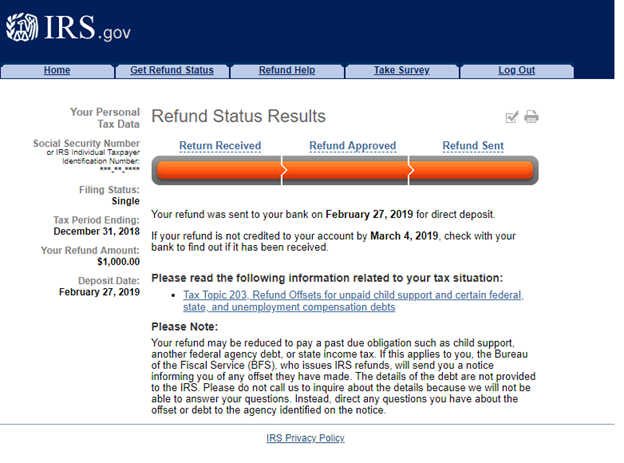

Why Was The Refund Amount Deposited To My Account Different From The Irs Where S My Refund Link Support

Why Was The Refund Amount Deposited To My Account Different From The Irs Where S My Refund Link Support

If You Were On Unemployment Last Year You Ll Probably Get A Tax Break Marketplace

If You Were On Unemployment Last Year You Ll Probably Get A Tax Break Marketplace

/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

:max_bytes(150000):strip_icc()/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

Can A Debt Management Program Help You Consolidated Credit Debt Management Debt Management Plan Debt Solutions

Can A Debt Management Program Help You Consolidated Credit Debt Management Debt Management Plan Debt Solutions

What Do You Think About Soda Taxes Soda Tax Link Building Thinking Of You

What Do You Think About Soda Taxes Soda Tax Link Building Thinking Of You

Get Away From Growth Delusion Right To Education Business Pages Delusional

Get Away From Growth Delusion Right To Education Business Pages Delusional

The Transitional Living Program Provides Homeless Youth With Stable Safe Housing And Support Services Determine You Homeless Youth Support Services Homeless

The Transitional Living Program Provides Homeless Youth With Stable Safe Housing And Support Services Determine You Homeless Youth Support Services Homeless

If Smbs Were Paid On Time They Could Hire An Additional 2 1 Million Employees And Reduce U S Une Small Business Trends Business Infographic Small Business

If Smbs Were Paid On Time They Could Hire An Additional 2 1 Million Employees And Reduce U S Une Small Business Trends Business Infographic Small Business

Four Reasons Why You Might Never See That Hefty Tax Refund

Four Reasons Why You Might Never See That Hefty Tax Refund

Pin By Bingi Sahana On Income Tax Login Tax Return Income Tax Income Tax Return

Pin By Bingi Sahana On Income Tax Login Tax Return Income Tax Income Tax Return

2020 Tax Changes For 1099 Independent Contractors Updated For 2020

2020 Tax Changes For 1099 Independent Contractors Updated For 2020

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

404 Not Found Internal Revenue Service Debt Relief Programs Irs Taxes

404 Not Found Internal Revenue Service Debt Relief Programs Irs Taxes

Post a Comment for "Unemployment Tax Refund Offset"