Unemployment Tax Refund Bill

Fortunately the unemployment tax nightmare that left many with reduced refunds or an unexpected tax bill. Unemployed workers can waive up to 10200 in unemployment benefits received in 2020 from their taxable income.

Stimulus Bill Unemployment Benefits How Much You Could Get And Why You Could Get Tax Relief

Stimulus Bill Unemployment Benefits How Much You Could Get And Why You Could Get Tax Relief

You may use either EAMS or ePay to pay your taxes.

Unemployment tax refund bill. To use EAMS or EAMS for Single Filers you will need to be sure to set up your online account in advance. President Joe Biden signed the American Rescue Plan Act of 2021 on Thursday. The legislation allows taxpayers who earned less than 150000 in adjusted gross income to exclude unemployment compensation up to 20400 if.

You might want to do more than just wait Last Updated. But President Joe Bidens 19 trillion COVID. 12 hours agoAmericans who collected unemployment insurance in 2020 and filed their taxes before claiming a new tax break on the benefits can expect to receive an automatic refund.

Youll transfer the amount in Box 1 of Form 1099-G to Line 7 of Schedule 1 then the withholding amount in Box 4 of the 1099-G if any goes directly onto your 1040 tax return on Line 25b. TaxWatch What to do if you already filed taxes but want to claim the 10200 unemployment tax break Last Updated. 2 days agoExpecting another refund after the IRS calculates the 10200 unemployment tax break.

The recently-signed 19 trillion American Rescue Plan did a lot of things for struggling Americans. If youve already filed. A big tax bill at the end of the year.

Tax refund delays reported some of. Eligible taxpayers who are married filing jointly can exclude up to 20400 in unemployment benefits from their taxable income 10200 for all other taxpayers. Not only did the relief bill put 1400 stimulus checks into millions of peoples pockets but.

Its great that Americans wont have to pay taxes on 10200 of unemployment income. For the millions of Americans who filed for unemployment last year federal support came with a price tag. Those who paid taxes on those benefits already could be in line for a substantial refund.

If you asked to have income tax withheld from your unemployment payments. Use Employer Account Management Services EAMS or EAMS for Single Filers to file your tax reports or tax and wage reports online. For paying unemployment taxes.

March 20 2021 at 941 am. The 19 trillion Covid relief bill gives a federal tax break on up to 10200 of unemployment. If you got unemployment income last year and your state isnt offering a tax break on your first 10200 of benefits you may need to gear up for a tax bill when you file your state income taxes.

10200 tax break President Joe Biden signed a 19 trillion Covid relief bill Thursday that waives federal tax on up to 10200 of unemployment benefits an. 1 day agoUnemployment benefits caused a great deal of confusion this tax season. That tax break will put a lot of extra cash into peoples bank accounts.

For filing tax reports or tax and wage reports online. The IRS will start issuing tax refunds in May to Americans who filed their returns without claiming a new break on unemployment benefits the federal agency said Wednesday. The agency made an update to the unemployment benefits tax exemption in the latest stimulus bill on March 31 saying it will recalculate taxes for people who received unemployment compensation in.

The bill also allows people to get their first 10200 in unemployment benefits free of federal taxes. 1 day agoA good problem to fix. The American Rescue Plan.

Unemployment Stimulus Am I Eligible For The New Unemployment Income Relief The Turbotax Blog

Unemployment Stimulus Am I Eligible For The New Unemployment Income Relief The Turbotax Blog

Paying Taxes On Unemployment Checks Everything You Need To Know Cnet

Paying Taxes On Unemployment Checks Everything You Need To Know Cnet

Jobless Workers May Face A Surprise Tax Bill Or Smaller Refund

Jobless Workers May Face A Surprise Tax Bill Or Smaller Refund

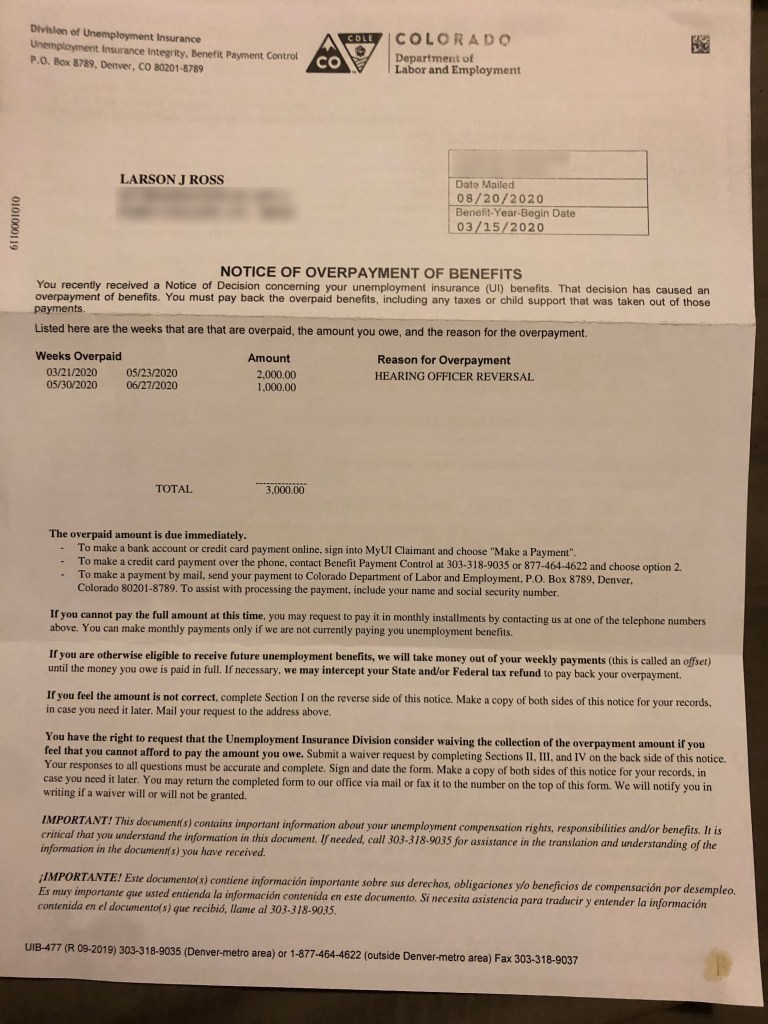

States Are Telling Some People To Pay Back Unemployment Benefits Marketplace

States Are Telling Some People To Pay Back Unemployment Benefits Marketplace

Stimulus Bill Unemployment Benefits How A New Tax Break Could Save You Money Cnet

Stimulus Bill Unemployment Benefits How A New Tax Break Could Save You Money Cnet

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Taxes 2021 Everything New Including Deadline Stimulus Payments And Unemployment Cnet

Taxes 2021 Everything New Including Deadline Stimulus Payments And Unemployment Cnet

New Stimulus Bill Offers Tax Break On Unemployment Payments Whec Com

New Stimulus Bill Offers Tax Break On Unemployment Payments Whec Com

Senate Bill Indicates A Portion Of Unemployment Compensation May Not Be Taxable In 2020

Senate Bill Indicates A Portion Of Unemployment Compensation May Not Be Taxable In 2020

Unemployment Benefits 2020 How To Claim The New Tax Reduction As Com

Unemployment Benefits 2020 How To Claim The New Tax Reduction As Com

Covid Bill Provides Tax Waiver On Up To 10 200 Of Unemployment Benefits

Covid Bill Provides Tax Waiver On Up To 10 200 Of Unemployment Benefits

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Stimulus Bill Unemployment Benefits How Much You Could Get And Why You Could Get Tax Relief

Stimulus Bill Unemployment Benefits How Much You Could Get And Why You Could Get Tax Relief

Jobless Workers May Face A Surprise Tax Bill Or Smaller Refund

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

Stimulus Bill Unemployment Benefits How A New Tax Break Could Save You Money Cnet

Stimulus Bill Unemployment Benefits How A New Tax Break Could Save You Money Cnet

Unemployment 10 200 Tax Credit Irs Begins Refund In May If You Filed

Unemployment 10 200 Tax Credit Irs Begins Refund In May If You Filed

Collecting Unemployment Take These Steps To Avoid A Tax Bill Next Year

Collecting Unemployment Take These Steps To Avoid A Tax Bill Next Year

Post a Comment for "Unemployment Tax Refund Bill"