Unemployment Tax Form Iowa

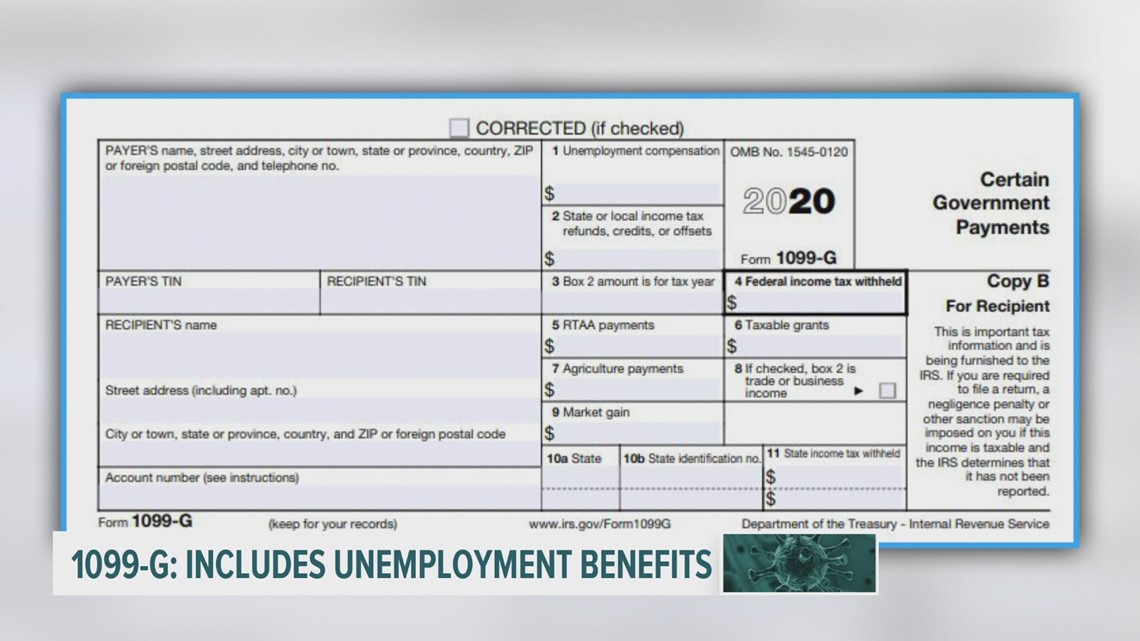

Unemployment insurance benefits are taxable and payments of 1000 or more are reported annually to the Internal Revenue Service IRS and the Iowa Department of Revenue and Finance. The Iowa Department of Revenues ID Number is 42-6004574 The Tax Year shown on the form is the tax year for which you received the refund The Reportable Refund shown is the amount of an Iowa income tax refund you received If you received a refund for more than one tax year you will receive a 1099-G for each year.

Fill Free Fillable Forms State Of Iowa Ocio

Fill Free Fillable Forms State Of Iowa Ocio

State Income Tax Range.

Unemployment tax form iowa. Iowa Department of Revenue. This document will accurately summarize your unemployment compensation and ensure that you are taxed appropriately. If you have already filed your original Iowa tax return.

Iowa Workforce Development announced this week they will be reissuing new 1099-G tax forms to individuals who received unemployment benefits. The 1099-G includes any unemployment insurance benefits issued December 29 2018 through December 30 2019 and any federal andor state taxes that were withheld. An IRS Form 1099-G is mailed by January 31 of each year to individuals who received unemployment insurance benefits during the prior calendar year.

Cindy Axne of Iowa and Sen. Intended for those who would benefit from a more comprehensive set of instructions. If you qualify for the unemployment compensation exclusion enter the unemployment compensation exclusion amount as reported on federal form 1040 Schedule 1 line 8 as a negative amount on your IA 1040 line 14 using a code of M.

The 1099-G tax form includes the amount of benefits paid to you for any the following programs. Unemployment compensation has its own line Line 7 on Schedule 1 which accompanies your 1040 tax return. If you have received unemployment income at any point during the year you will be required to complete and return IRS Form 1099-G.

Iowa Workforce Development will begin mailing form 1099-G on Jan 21 2020. People filing an original 2020 Iowa tax return should report the unemployment compensation exclusion amount on Form IA 1040 Line 14 using a code of M. Thirteen states arent offering a tax break on unemployment benefits received last year according to data from HR Block.

The American Rescue Plan a 19 trillion Covid relief bill waived. Unemployment Insurance Tax Rate Tables. Iowa Professional Licensing Bureau Iowa Secretary of State.

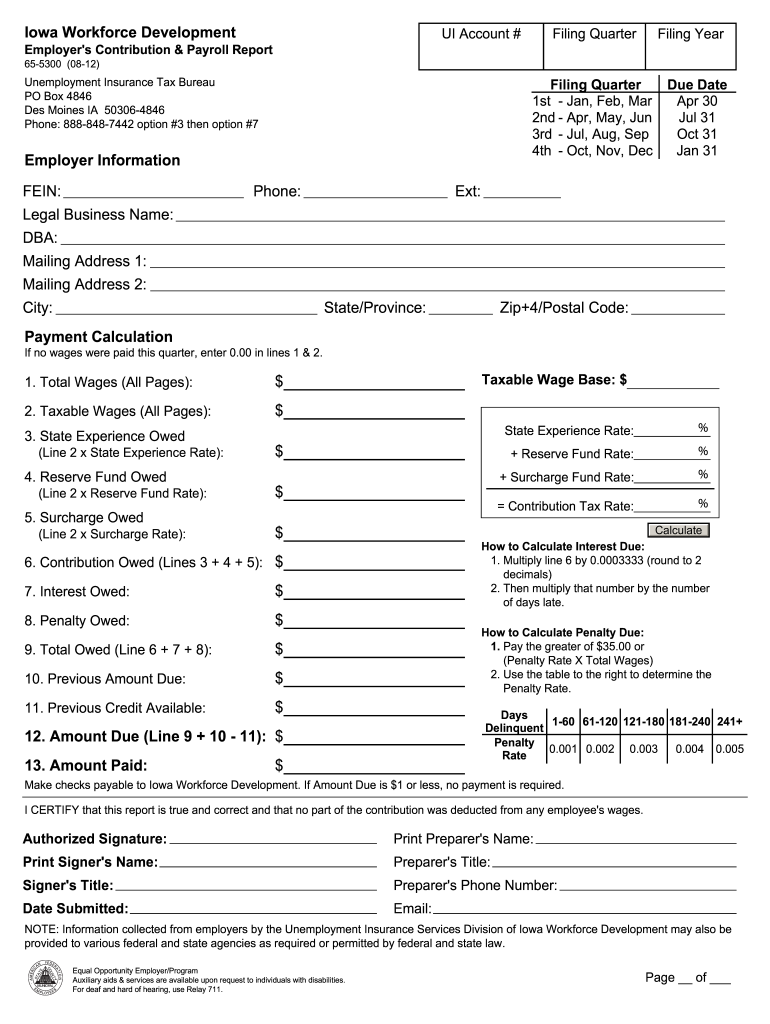

Most private employers covered by the Iowa UI Program are subject to the Federal Unemployment Tax Act FUTA you can receive a maximum credit equal to 54 percent against this tax if you are participating in a state UI program that meets federal requirements. All Forms and Publications Forms for Individuals Forms for Employers Iowa Workforce Development Administration Documents Labor Market Information Documents. Federal Unemployment Tax Act.

Does not tax unemployment benefits while other state income tax policies mirror the federal. You can collected Form 1099-G by calling your local unemployment office or contacting the IRS directly. Small Business Administration - Iowa Iowa.

Unemployment Insurance UI Pandemic Unemployment Assistance PUA Pandemic Emergency Unemployment Compensation PEUC Extended Benefits EB Federal Pandemic Unemployment Compensation FPUC and Lost Wages Assistance LWA. Find a line-by-line breakdown of the IA 1040 tax form here. Youll transfer the amount in Box 1 of Form 1099-G to Line 7 of Schedule 1 then the withholding amount in Box 4 of the 1099-G if any goes directly onto your 1040 tax return on Line 25b.

Thats accomplished with the Form 1040-X. Refund Processing and Assistance. All publicly distributed Iowa tax forms can be found on the Iowa Department of Revenues tax form index site.

Iowa Department of Labor Iowa Workforce Development Iowa Workforce Development - Unemployment Insurance Tax System Unemployment Insurance - Employers and Agents New Hire Reporting. Taxpayers filing an original 2020 individual income tax return should report the unemployment compensation exclusion amount on Form IA 1040 line 14 using a code of M. The Department currently is processing state income tax refunds in 28 days slightly under the Departments goal of 30 days.

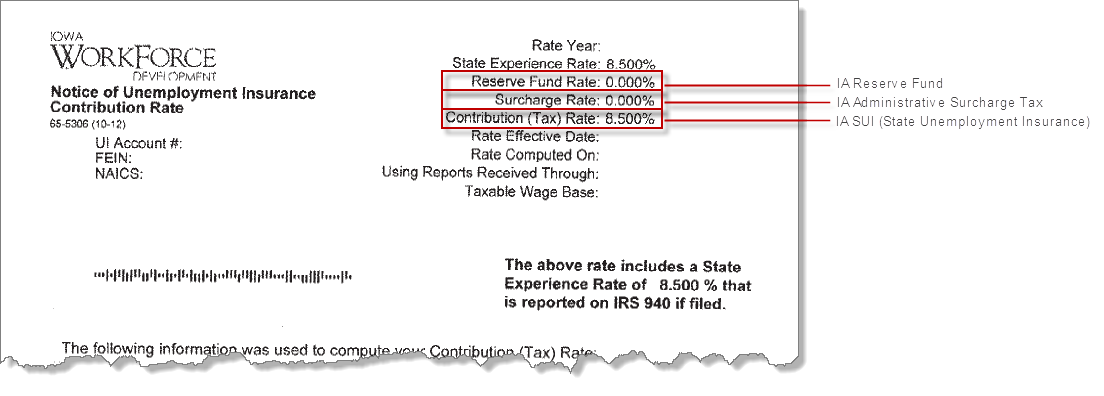

Enter the amount of unemployment compensation benefits reported on federal 1040 Schedule 1 line 7. Browse them all here. Rates vary from 0000 to 9000 on table 1 and from 0000 to 7000 on table 8.

The Iowa law stipulates that UI taxes may be collected from employers under eight different tax rate tables and each tax rate table has 21 rate brackets or ranks. 033 on up.

Fill Free Fillable Forms State Of Iowa Ocio

Fill Free Fillable Forms State Of Iowa Ocio

What You Need To Know About Unemployment Benefits And Taxes Weareiowa Com

What You Need To Know About Unemployment Benefits And Taxes Weareiowa Com

Iowa Extends Deadline For Individual Income Taxes The Gazette

Iowa Extends Deadline For Individual Income Taxes The Gazette

Fill Free Fillable Forms State Of Iowa Ocio

Fill Free Fillable Forms State Of Iowa Ocio

Iowa Unemployment 1099 G Online Fill Online Printable Fillable Blank Pdffiller

Iowa Unemployment 1099 G Online Fill Online Printable Fillable Blank Pdffiller

Https Www Iowaworkforcedevelopment Gov Sites Search Iowaworkforcedevelopment Gov Files Documents 68 0061 20employers 20wage 20adjustment 20report Pdf

Iowa Rep Cindy Axne Introduces Covid Unemployment Tax Relief Bill Kgan

Iowa Rep Cindy Axne Introduces Covid Unemployment Tax Relief Bill Kgan

Fill Free Fillable Forms State Of Iowa Ocio

Fill Free Fillable Forms State Of Iowa Ocio

Iowa Form 65 5300 Fill Online Printable Fillable Blank Pdffiller

Iowa Form 65 5300 Fill Online Printable Fillable Blank Pdffiller

Fill Free Fillable Forms State Of Iowa Ocio

Fill Free Fillable Forms State Of Iowa Ocio

W 2 1099 Electronic Filing Iowa Department Of Revenue

W 2 1099 Electronic Filing Iowa Department Of Revenue

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back Tax Credits For People Who Work

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back Tax Credits For People Who Work

Fill Free Fillable Forms State Of Iowa Ocio

Fill Free Fillable Forms State Of Iowa Ocio

Fill Free Fillable Forms State Of Iowa Ocio

Fill Free Fillable Forms State Of Iowa Ocio

Https Www Iowaworkforcedevelopment Gov Sites Search Iowaworkforcedevelopment Gov Files Newsfiles 1 20 2021 20iwd 20will 20reissue 201099 20forms Pdf

Fill Free Fillable Forms State Of Iowa Ocio

Fill Free Fillable Forms State Of Iowa Ocio

W 2 And 1099 File Upload Instructions Iowa Dept Of Revenue

W 2 And 1099 File Upload Instructions Iowa Dept Of Revenue

Fill Free Fillable Forms State Of Iowa Ocio

Fill Free Fillable Forms State Of Iowa Ocio

Post a Comment for "Unemployment Tax Form Iowa"